Grundlæggende statistik

| Institutionelle aktier (lange) | 20.682.203 - 18,73% (ex 13D/G) - change of -8,60MM shares -29,37% MRQ |

| Institutionel værdi (lang) | $ 609.241 USD ($1000) |

Institutionelt ejerskab og aktionærer

AllianceBernstein Holding L.P. - Limited Partnership (US:AB) har 311 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 20,682,203 aktier. Største aktionærer omfatter Kingstone Capital Partners Texas, LLC, Fmr Llc, FCPVX - Fidelity Small Cap Value Fund, American Century Companies Inc, Bank Of America Corp /de/, TWEIX - Equity Income Fund Investor Class, PGOAX - PGIM JENNISON SMALL COMPANY FUND Class A, Morgan Stanley, Wells Fargo & Company/mn, and FDMLX - Fidelity Series Intrinsic Opportunities Fund .

AllianceBernstein Holding L.P. - Limited Partnership (NYSE:AB) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 11, 2025 is 38,36 / share. Previously, on September 12, 2024, the share price was 34,21 / share. This represents an increase of 12,13% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

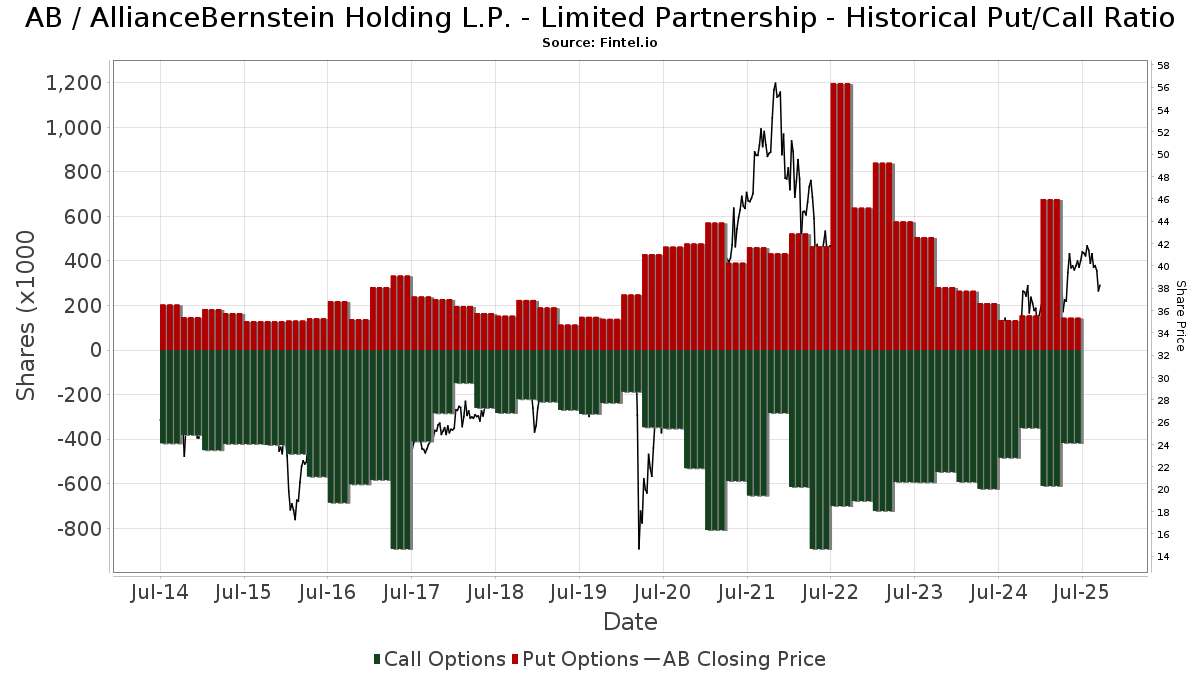

Institutionel Put/Call-forhold

Ud over at indberette standardaktie- og gældsudstedelser skal institutter med mere end 100 mill. aktiver under forvaltning også oplyse deres put- og call-optionsbeholdninger. Da salgsoptioner generelt indikerer negativ stemning, og købsoptioner indikerer positiv stemning, kan vi få en fornemmelse af den overordnede institutionelle stemning ved at plotte forholdet mellem put og kald. Diagrammet til højre viser det historiske put/call-forhold for dette instrument.

Brug af Put/Call Ratio som en indikator for investorernes stemning overvinder en af de vigtigste mangler ved at bruge totalt institutionelt ejerskab, som er, at en betydelig mængde af aktiver under forvaltning investeres passivt for at spore indekser. Passivt forvaltede fonde køber typisk ikke optioner, så indikatoren for put/call-forholdet følger mere nøje følelsen af aktivt forvaltede fonde.

13D/G-arkivering

Vi præsenterer 13D/G ansøgninger separat fra 13F ansøgninger på grund af den forskellige behandling af SEC. 13D/G-ansøgninger kan indgives af grupper af investorer (med én ledende), hvorimod 13F-ansøgninger ikke kan. Dette resulterer i situationer, hvor en investor kan indsende en 13D/G, der rapporterer én værdi for de samlede aktier (der repræsenterer alle de aktier, der ejes af investorgruppen), men derefter indsender en 13F, der rapporterer en anden værdi for de samlede aktier (der udelukkende repræsenterer deres egne) ejendomsret). Det betyder, at aktieejerskab af 13D/G-arkiver og 13F-arkiveringer ofte ikke er direkte sammenlignelige, så vi præsenterer dem separat.

Bemærk: Fra den 16. maj 2021 viser vi ikke længere ejere, der ikke har indsendt en 13D/G inden for det seneste år. Tidligere viste vi den fulde historie af 13D/G-arkiver. Generelt skal enheder, der er forpligtet til at indgive 13D/G-ansøgninger, indgive mindst årligt, før de indsender en afsluttende ansøgning. Dog forlader fonde nogle gange positioner uden at indsende en afsluttende ansøgning (dvs. de afvikler), så visning af den fulde historie resulterede nogle gange i forvirring om det nuværende ejerskab. For at undgå forvirring viser vi nu kun 'aktuelle' ejere - det vil sige - ejere, der har anmeldt inden for det seneste år.

Upgrade to unlock premium data.

| Fil dato | Form | Investor | Forrige Aktier |

Seneste Aktier |

Δ Aktier (Procent) |

Ejendomsret (Procent) |

Δ Ejerskab (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-14 | Equitable Holdings, Inc. | 184,336,885 | 199,231,025 | 8.08 | 68.17 | 8.02 |

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 12.700 | -11,19 | 1 | ||||

| 2025-05-13 | 13F | Cresset Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-03-21 | NP | AAARX - Strategic Allocation: Aggressive Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 5.572 | 9,75 | 223 | 18,62 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 911 | 0 | ||||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 12.500 | -63,45 | 1 | -100,00 | |||

| 2025-08-13 | 13F | Gabelli Funds Llc | 60.000 | -69,23 | 2.450 | -67,22 | ||||

| 2025-08-13 | 13F | Cary Street Partners Financial Llc | 7.860 | 0,87 | 321 | 7,38 | ||||

| 2025-07-14 | 13F | Armstrong Advisory Group, Inc | 503 | 0,00 | 21 | 11,11 | ||||

| 2025-08-14 | 13F | Ursa Fund Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 3.520 | -2,36 | 144 | 3,62 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Sheaff Brock Investment Advisors, LLC | 6.680 | 0,00 | 256 | 3,24 | ||||

| 2025-08-14 | 13F | RBF Capital, LLC | 30.000 | 0,00 | 1.225 | 6,53 | ||||

| 2025-08-14 | 13F | RMB Capital Management, LLC | 7.575 | 309 | ||||||

| 2025-08-11 | 13F | FSA Wealth Management LLC | 604 | 0,00 | 25 | 4,35 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 27.115 | 1.255,75 | 1.107 | 1.356,58 | ||||

| 2025-05-12 | 13F | Sandy Spring Bank | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Regal Investment Advisors LLC | 7.290 | -10,10 | 298 | -4,19 | ||||

| 2025-08-19 | 13F | State of Wyoming | 8.599 | -3,03 | 351 | 3,54 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 6.615 | 1.102,73 | 270 | 1.250,00 | ||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 34.100 | 3.000,00 | 1.392 | 3.214,29 | |||

| 2025-05-29 | NP | DSMC - Distillate Small/Mid Cash Flow ETF | 13.155 | -6,28 | 504 | 2,86 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 20.445 | 4,42 | 835 | 11,20 | ||||

| 2025-08-12 | 13F | J.w. Cole Advisors, Inc. | 12.323 | 62,68 | 503 | 73,45 | ||||

| 2025-08-11 | 13F | Western Wealth Management, LLC | 9.599 | 0,05 | 392 | 6,54 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 255 | -16,67 | 10 | -9,09 | ||||

| 2025-08-05 | 13F | Fourth Dimension Wealth, LLC | 240 | 0,00 | 10 | 0,00 | ||||

| 2025-08-11 | 13F | Nicola Wealth Management Ltd. | 114.000 | -26,45 | 4.655 | -21,62 | ||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 13.430 | -8,14 | 548 | -2,14 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-06 | 13F | Equitec Proprietary Markets, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Equitable Holdings, Inc. | 19.973 | 79,87 | 815 | 91,76 | ||||

| 2025-08-06 | 13F | Equitec Proprietary Markets, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-07-29 | 13F | Chevy Chase Trust Holdings, Inc. | 9.000 | 0,00 | 367 | 6,69 | ||||

| 2025-07-08 | 13F/A | Salem Investment Counselors Inc | 450 | 0,00 | 18 | 5,88 | ||||

| 2025-08-08 | 13F | TD Capital Management LLC | 226 | 0,00 | 9 | 12,50 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 444 | -10,12 | 18 | 0,00 | ||||

| 2025-07-17 | 13F/A | Capital Investment Advisors, LLC | 5.185 | -1,33 | 212 | 4,98 | ||||

| 2025-08-14 | 13F | Nomura Holdings Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 300 | 0,00 | 12 | 9,09 | ||||

| 2025-08-06 | 13F | Equitec Proprietary Markets, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-07-17 | 13F | Sonora Investment Management Group, LLC | 8.927 | 0,89 | 364 | 7,69 | ||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-06-30 | NP | RIVSX - River Oak Discovery Fund | 21.518 | 0,00 | 848 | -1,74 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-07 | 13F | Americana Partners, LLC | 5.062 | 207 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 3.298 | 0,58 | 135 | 7,20 | ||||

| 2025-05-30 | NP | GABCX - The Gabelli Abc Fund Class Aaa | 120.000 | 207,69 | 4.597 | 217,91 | ||||

| 2025-05-27 | NP | Advanced Series Trust - Ast Prudential Growth Allocation Portfolio | 12.056 | -11,43 | 462 | -8,53 | ||||

| 2025-08-04 | 13F | Assetmark, Inc | 1 | -97,67 | 0 | -100,00 | ||||

| 2025-07-10 | 13F | Atticus Wealth Management, Llc | 2.345 | 0,00 | 96 | 6,74 | ||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 15.267 | -0,01 | 623 | 6,68 | ||||

| 2025-08-13 | 13F | Four Tree Island Advisory LLC | 208.083 | 0,00 | 8.496 | 6,59 | ||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 126 | -94,50 | 0 | |||||

| 2025-08-29 | NP | GCAEX - The Gabelli Equity Income Fund Class A | 20.000 | 0,00 | 817 | 6,53 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 187 | 0,00 | 8 | 0,00 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-07-22 | 13F | Iron Horse Wealth Management, LLC | 286 | 12 | ||||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 6.995 | 0,00 | 286 | 6,74 | ||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 16.201 | 13,34 | 661 | 20,84 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 124 | -87,44 | 5 | -86,49 | ||||

| 2025-04-14 | 13F | IMC-Chicago, LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-13 | 13F | MONECO Advisors, LLC | 10.495 | -8,05 | 429 | -2,06 | ||||

| 2025-07-24 | 13F | Baldwin Brothers Inc/ma | 17.525 | 0,00 | 716 | 6,56 | ||||

| 2025-07-09 | 13F | Bank of New Hampshire | 300 | 12 | ||||||

| 2025-07-25 | NP | TEMGX - Templeton Global Smaller Companies Fund Class A | 375.765 | -1,67 | 15.012 | 4,30 | ||||

| 2025-08-14 | 13F | Beck Mack & Oliver Llc | 7.658 | -13,55 | 313 | -7,96 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 479 | -24,21 | 20 | -17,39 | ||||

| 2025-04-22 | 13F | Duncker Streett & Co Inc | 0 | -100,00 | 0 | |||||

| 2025-06-09 | NP | Bmc Fund Inc | 1.312 | 0,00 | 52 | -1,92 | ||||

| 2025-08-01 | 13F | Vision Financial Markets Llc | 5.800 | 0,00 | 237 | 6,31 | ||||

| 2025-08-14 | 13F | Kovitz Investment Group Partners, LLC | 5.214 | 213 | ||||||

| 2025-07-17 | 13F | Oakworth Capital, Inc. | 0 | -100,00 | 0 | |||||

| 2025-03-21 | NP | AACRX - Strategic Allocation: Conservative Fund R Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1.530 | 27,39 | 61 | 38,64 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 4.001 | 0 | ||||||

| 2025-08-14 | 13F | 10Elms LLP | 15.460 | 0,00 | 631 | 6,59 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 4.135 | 0,00 | 169 | 6,33 | ||||

| 2025-05-30 | NP | Gabelli Global Utility & Income Trust | 5.000 | -28,57 | 192 | -26,25 | ||||

| 2025-05-02 | 13F | Fortis Group Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Compass Wealth Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Formidable Asset Management, LLC | 22.320 | 0,00 | 855 | 0,00 | ||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 27.882 | -2,64 | 1.138 | 3,74 | ||||

| 2025-08-08 | 13F | Sittner & Nelson, Llc | 8.100 | 0,00 | 331 | 6,45 | ||||

| 2025-08-15 | 13F | Resources Management Corp /ct/ /adv | 15.550 | -1,11 | 1 | |||||

| 2025-07-21 | 13F | DHJJ Financial Advisors, Ltd. | 16 | 0,00 | 1 | |||||

| 2025-08-05 | 13F | GPS Wealth Strategies Group, LLC | 1.435 | 0,00 | 59 | 7,41 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 126.153 | -3,20 | 5.151 | 3,17 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 35.384 | 349,43 | 1.445 | 379,73 | ||||

| 2025-07-31 | 13F | Oppenheimer & Co Inc | 17.876 | -10,49 | 730 | -4,71 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 15.644 | -4,95 | 639 | 1,27 | ||||

| 2025-08-14 | 13F | American Trust Investment Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 11.550 | 0,00 | 472 | 6,56 | ||||

| 2025-07-16 | 13F | Cadent Capital Advisors, LLC | 10.080 | 0,00 | 412 | 6,48 | ||||

| 2025-08-15 | NP | Guardian Variable Products Trust - Guardian Select Mid Cap Core VIP Fund | 20.934 | -1,91 | 855 | 4,53 | ||||

| 2025-06-26 | NP | FAFDX - Fidelity Advisor Financial Services Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 138.700 | -42,64 | 5.465 | -43,59 | ||||

| 2025-05-15 | 13F | Manufacturers Life Insurance Company, The | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 5.150 | 0,00 | 210 | 6,60 | ||||

| 2025-08-12 | 13F | Horizon Kinetics Asset Management Llc | 164.892 | 42,17 | 6.733 | 51,52 | ||||

| 2025-04-24 | NP | PFSAX - PGIM Jennison Financial Services Fund Class A | 27.126 | -53,91 | 1.022 | -52,16 | ||||

| 2025-08-15 | 13F | 44 Wealth Management Llc | 5.000 | 204 | ||||||

| 2025-07-31 | 13F | Richards, Merrill & Peterson, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-29 | NP | BPSIX - Boston Partners Small Cap Value Fund II INSTITUTIONAL | 36.797 | -3,62 | 1.470 | 2,30 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | 683 Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Morgan Stanley | 644.042 | -86,31 | 26.296 | -85,41 | ||||

| 2025-07-24 | 13F | Trust Co Of Toledo Na /oh/ | 500 | 20 | ||||||

| 2025-08-12 | 13F | Oak Associates Ltd /oh/ | 23.711 | 3,00 | 968 | 9,88 | ||||

| 2025-08-13 | 13F | Blue Fin Capital, Inc. | 26.717 | -33,45 | 1.091 | -26,80 | ||||

| 2025-08-04 | 13F | Pensionmark Financial Group, Llc | 8.717 | 0,00 | 356 | 6,61 | ||||

| 2025-07-11 | 13F | Grove Bank & Trust | 500 | 20 | ||||||

| 2025-08-12 | 13F | Franklin Resources Inc | 384.740 | -1,14 | 15.709 | 5,37 | ||||

| 2025-08-13 | 13F | JBR Co Financial Management Inc | 13.605 | 13,06 | 555 | 20,65 | ||||

| 2025-04-03 | 13F | Central Pacific Bank - Trust Division | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | Disciplined Equity Management, Inc. | 60.293 | 12,06 | 2.462 | 19,41 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 12.291 | -73,81 | 502 | -72,14 | ||||

| 2025-04-22 | 13F | Brown, Lisle/cummings, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 27.344 | 76,47 | 1.116 | 88,20 | ||||

| 2025-05-23 | NP | PGOAX - PGIM JENNISON SMALL COMPANY FUND Class A | 872.376 | 0,00 | 33.421 | 3,29 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 1.500 | 0,00 | 61 | 7,02 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 5.618 | -4,47 | 229 | 1,78 | ||||

| 2025-08-12 | 13F | Bokf, Na | 800 | 0,00 | 33 | 6,67 | ||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 100 | 0,00 | 4 | 33,33 | ||||

| 2025-05-15 | 13F | Talon Private Wealth, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-19 | 13F | Advisory Services Network, LLC | 7.525 | 0,56 | 307 | 6,99 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 1.000 | 0,00 | 41 | 5,26 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 1 | 0,00 | 0 | |||||

| 2025-07-24 | NP | FMCDX - Fidelity Advisor Stock Selector Mid Cap Fund Class A This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 245.809 | -28,90 | 9.820 | -24,57 | ||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 6.200 | 0,00 | 253 | 6,75 | ||||

| 2025-06-26 | NP | FCPVX - Fidelity Small Cap Value Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 1.606.357 | 4,43 | 63.290 | 2,71 | ||||

| 2025-07-15 | 13F | Northside Capital Management, LLC | 13.625 | 556 | ||||||

| 2025-08-13 | 13F | Haverford Trust Co | 7.906 | 0,00 | 323 | 6,62 | ||||

| 2025-04-25 | NP | CFMCX - Column Mid Cap Fund | 17.395 | 0,68 | 655 | 4,63 | ||||

| 2025-08-11 | 13F | Rothschild Investment Llc | 7.500 | 0,00 | 306 | 6,62 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Sit Investment Associates Inc | 40.200 | 0,00 | 2 | 0,00 | ||||

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 22.079 | -2,65 | 901 | 3,92 | ||||

| 2025-08-14 | 13F | Alpine Global Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 12.901 | -2,61 | 527 | 3,75 | ||||

| 2025-08-14 | 13F | Williams Jones Wealth Management, LLC. | 81.600 | -2,04 | 3.332 | 4,39 | ||||

| 2025-04-22 | 13F | Center for Financial Planning, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 108.143 | 438,08 | 4 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 456.156 | 1,67 | 18.625 | 8,35 | ||||

| 2025-07-15 | 13F | Tepp RIA, LLC | 7.683 | 0,00 | 314 | 6,46 | ||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 149.922 | 1,44 | 6.121 | 8,13 | ||||

| 2025-08-14 | 13F | Ausdal Financial Partners, Inc. | 5.133 | 210 | ||||||

| 2025-08-14 | 13F | CoreFirst Bank & Trust | 600 | 24 | ||||||

| 2025-07-31 | 13F | Glass Jacobson Investment Advisors llc | 1.129 | 4,93 | 46 | 17,95 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | CFC Planning Co LLC | 5.633 | 230 | ||||||

| 2025-07-31 | 13F | Orion Capital Management LLC | 4 | 0,00 | 0 | |||||

| 2025-07-25 | 13F | Joel Adams & Associates, Inc. | 5.000 | 204 | ||||||

| 2025-05-02 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Second Line Capital, LLC | 9.295 | 13,98 | 379 | 21,47 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 32.568 | 3,60 | 1.330 | 10,38 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 1.083.131 | -19,54 | 44.224 | -14,25 | ||||

| 2025-08-08 | 13F | WASHINGTON TRUST Co | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Scarborough Advisors, LLC | 279 | 11 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 8.973 | -4,33 | 366 | 1,95 | ||||

| 2025-07-23 | 13F | Tyche Wealth Partners LLC | 5.000 | 204 | ||||||

| 2025-07-18 | 13F | Consolidated Planning Corp | 7.051 | 0,00 | 288 | 6,30 | ||||

| 2025-08-14 | 13F | IPG Investment Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Merrion Investment Management Co, LLC | 6.500 | 0,00 | 265 | 6,43 | ||||

| 2025-08-13 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-05-13 | 13F | State of Tennessee, Treasury Department | 0 | -100,00 | 0 | |||||

| 2025-08-26 | NP | AZBAX - AllianzGI Small-Cap Fund Class A | 7.513 | -51,88 | 307 | -48,83 | ||||

| 2025-07-22 | 13F | Belpointe Asset Management LLC | 19.311 | -12,02 | 788 | -6,19 | ||||

| 2025-08-13 | 13F | Transce3nd, LLC | 670 | -0,74 | 27 | 8,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 17.654 | 0,87 | 721 | 7,46 | ||||

| 2025-07-25 | 13F | Johnson Investment Counsel Inc | 10.434 | 0,00 | 426 | 6,77 | ||||

| 2025-07-18 | 13F | CHURCHILL MANAGEMENT Corp | 314.844 | -2,01 | 12.855 | 4,44 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 9.563 | -48,27 | 390 | -44,92 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 350 | 0,57 | 14 | 7,69 | ||||

| 2025-08-01 | 13F | Chilton Capital Management Llc | 31.190 | 0,00 | 1.273 | 6,62 | ||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 310 | 0,00 | 13 | 9,09 | ||||

| 2025-05-07 | 13F | Bastion Asset Management Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-15 | 13F | Virtus Investment Advisers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | LRI Investments, LLC | 197 | 0,00 | 8 | 14,29 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Summit Trail Advisors, Llc | 8.755 | 0,00 | 357 | 6,57 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1.992 | 1,17 | 81 | 8,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 56.800 | -51,54 | 2.319 | -48,34 | |||

| 2025-08-14 | 13F | Citadel Advisors Llc | 10.805 | -98,04 | 441 | -97,91 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 72.200 | -33,09 | 2.948 | -28,70 | |||

| 2025-08-18 | 13F | Old North State Trust, LLC | 6.035 | 0,00 | 0 | |||||

| 2025-07-18 | 13F | Chelsea Counsel Co | 95.330 | 807,90 | 3.892 | 868,16 | ||||

| 2025-08-14 | 13F | Herold Advisors, Inc. | 15.700 | 0,00 | 641 | 6,66 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 939 | 2,07 | 38 | 8,57 | ||||

| 2025-03-21 | NP | TWSMX - Strategic Allocation: Moderate Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 4.866 | 9,87 | 195 | 18,29 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 61.215 | 0,20 | 2.499 | 6,79 | ||||

| 2025-08-13 | 13F | M&t Bank Corp | 42.540 | 0,00 | 1.737 | 6,57 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 675 | 0,00 | 28 | 8,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 95.627 | 8,20 | 3.904 | 15,30 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 78.690 | -0,06 | 3.213 | 6,50 | ||||

| 2025-07-28 | 13F | Private Wealth Asset Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Infrastructure Capital Advisors, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-07 | 13F | Walnut Private Equity Partners, Llc | 25.949 | 0,00 | 1.059 | 6,54 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 7.821 | -4,62 | 319 | 1,59 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 7.152 | 104,28 | 289 | 115,67 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 1.829 | 0,00 | 75 | 5,71 | ||||

| 2025-04-21 | 13F | Ronald Blue Trust, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-29 | 13F | Hm Payson & Co | 1.000 | 0,00 | 38 | 2,70 | ||||

| 2025-08-01 | 13F | Gwn Securities Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 14.669 | 19,50 | 599 | 27,23 | ||||

| 2025-08-15 | 13F | Prevail Innovative Wealth Advisors, Llc | 21.822 | 98,04 | 891 | 110,90 | ||||

| 2025-08-01 | 13F | Jennison Associates Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Epoch Investment Partners, Inc. | 25.038 | -83,32 | 1.022 | -82,23 | ||||

| 2025-08-14 | 13F | Harvest Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hurley Capital, LLC | 186 | 2,20 | 8 | 16,67 | ||||

| 2025-05-14 | 13F | Basswood Capital Management, L.l.c. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Van Cleef Asset Management,Inc | 6.525 | -1,88 | 266 | 4,72 | ||||

| 2025-04-25 | 13F | Stonebridge Financial Group, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | PSI Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | BluePath Capital Management, LLC | 28.437 | 22,14 | 1.161 | 30,30 | ||||

| 2025-07-16 | 13F | PFS Partners, LLC | 190 | 0,00 | 8 | 0,00 | ||||

| 2025-04-14 | 13F | Beach Investment Counsel Inc/pa | 12.125 | 0,00 | 0 | |||||

| 2025-05-13 | 13F | Beacon Pointe Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Prospera Financial Services Inc | 14.376 | 10,30 | 587 | 17,43 | ||||

| 2025-08-19 | 13F | Anchor Investment Management, LLC | 3.375 | 0,00 | 138 | 6,20 | ||||

| 2025-08-12 | 13F/A | Boston Partners | 37.264 | -0,95 | 1.521 | 5,55 | ||||

| 2025-04-29 | 13F | Lee Danner & Bass Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 17.256 | 2,77 | 705 | 9,49 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 100 | 0,00 | 4 | 33,33 | ||||

| 2025-08-07 | 13F | Proficio Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Perigon Wealth Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Mather Group, Llc. | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Highland Capital Management, Llc | 34.915 | 112,47 | 1.426 | 126,55 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 2.616 | 0,08 | 107 | 6,00 | ||||

| 2025-07-16 | 13F | FCG Investment Co | 8.873 | 362 | ||||||

| 2025-08-05 | 13F | Mission Wealth Management, Lp | 29.235 | 0,00 | 1.194 | 6,61 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 421.866 | 10,77 | 17.225 | 18,06 | ||||

| 2025-08-05 | 13F | Freestone Capital Holdings, LLC | 8.801 | 0,00 | 359 | 6,53 | ||||

| 2025-08-06 | 13F | Zevin Asset Management Llc | 6.863 | -33,42 | 0 | |||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 33.319 | 0,00 | 1.360 | 6,58 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 150 | -40,00 | 6 | -33,33 | ||||

| 2025-07-28 | 13F | Nadler Financial Group, Inc. | 10.840 | 0,00 | 443 | 6,51 | ||||

| 2025-07-11 | 13F/A | Umb Bank N A/mo | 1.300 | 0,00 | 53 | 8,16 | ||||

| 2025-08-06 | 13F | Moors & Cabot, Inc. | 60.134 | -2,92 | 2.455 | 3,50 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 363.158 | -67,94 | 14.828 | -65,84 | ||||

| 2025-08-04 | 13F | Moody Aldrich Partners Llc | 59.294 | 0,00 | 2.421 | 6,56 | ||||

| 2025-08-12 | 13F | Change Path, LLC | 5.427 | 1,04 | 222 | 7,80 | ||||

| 2025-05-09 | 13F | Blair William & Co/il | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-23 | 13F | Sax Wealth Advisors, Llc | 6.117 | 0,00 | 250 | 6,41 | ||||

| 2025-05-15 | 13F | Barclays Plc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Peddock Capital Advisors, Llc | 5.780 | 0,00 | 236 | 6,33 | ||||

| 2025-07-24 | 13F | Costello Asset Management, INC | 1.900 | 0,00 | 78 | 6,94 | ||||

| 2025-08-14 | 13F | Lombard Odier Asset Management (Europe) Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-29 | NP | EMAAX - Enterprise Mergers and Acquisitions Fund Class A | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-05 | 13F | Crestwood Advisors Group LLC | 26.424 | 0,00 | 1.079 | 6,52 | ||||

| 2025-08-01 | 13F | GoalVest Advisory LLC | 783 | 0,00 | 32 | 6,90 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 221.278 | 4,28 | 9.035 | 11,15 | ||||

| 2025-08-12 | 13F | Segall Bryant & Hamill, Llc | 14.100 | 0,00 | 576 | 6,48 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 70.819 | -85,71 | 2.892 | -84,77 | ||||

| 2025-08-12 | 13F | American Century Companies Inc | 1.171.246 | -32,48 | 47.822 | -28,04 | ||||

| 2025-05-01 | 13F | Gateway Wealth Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 62.182 | -14,62 | 2.539 | -9,03 | ||||

| 2025-08-13 | 13F | F/M Investments LLC | 13.465 | 0,00 | 550 | 6,60 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 70.492 | -78,42 | 2.878 | -77,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 38.100 | -79,63 | 1.556 | -78,29 | |||

| 2025-08-14 | 13F | DRW Securities, LLC | 17.467 | 713 | ||||||

| 2025-07-01 | 13F | Cacti Asset Management Llc | 44.850 | 0,00 | 1.815 | 5,47 | ||||

| 2025-07-09 | 13F | New England Research & Management, Inc. | 9.900 | -14,66 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 207.300 | -12,83 | 8.464 | -7,09 | |||

| 2025-08-07 | 13F | BOK Financial Private Wealth, Inc. | 300 | 0,00 | 12 | 9,09 | ||||

| 2025-08-07 | 13F | Roberts Glore & Co Inc /il/ | 5.485 | 0,00 | 224 | 6,19 | ||||

| 2025-08-12 | 13F | Jaffetilchin Investment Partners, LLC | 15.571 | 0,74 | 636 | 7,26 | ||||

| 2025-08-13 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Natixis | 0 | -100,00 | 0 | |||||

| 2025-05-19 | 13F/A | Jane Street Group, Llc | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-17 | 13F | Tritonpoint Wealth, Llc | 17.466 | 0,00 | 713 | 6,58 | ||||

| 2025-08-13 | 13F | Formula Growth Ltd | 43.090 | 1.759 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 71 | 115,15 | 0 | |||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 11.512 | 66,53 | 470 | 77,36 | ||||

| 2025-07-10 | 13F | Capital Advisory Group Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Thompson Investment Management, Inc. | 600 | 24 | ||||||

| 2025-08-11 | 13F | Independent Advisor Alliance | 9.136 | 9,28 | 373 | 16,56 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-07-18 | 13F | Truist Financial Corp | 16.760 | 0,28 | 684 | 6,88 | ||||

| 2025-07-17 | 13F | Vermillion Wealth Management, Inc. | 300 | 0,00 | 12 | 9,09 | ||||

| 2025-07-11 | 13F | Mallini Complete Financial Planning LLC | 381 | 7,34 | ||||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 21.187 | -0,27 | 865 | 6,40 | ||||

| 2025-05-06 | 13F | Kovack Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Moody National Bank Trust Division | 8.406 | 0,91 | 343 | 7,52 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 33 | 1 | ||||||

| 2025-08-13 | 13F | Aristides Capital LLC | 40.920 | 0,00 | 1.671 | 6,57 | ||||

| 2025-08-14 | 13F | Sandia Investment Management LP | 0 | -100,00 | 0 | |||||

| 2025-04-21 | 13F | Beacon Capital Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-02 | 13F | Retirement Planning Co of New England, Inc. | 0 | -100,00 | 0 | |||||

| 2025-04-21 | 13F | Luken Investment Analytics, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Twin Lakes Capital Management, LLC | 2.529 | 2,02 | 103 | 9,57 | ||||

| 2025-08-12 | 13F | Bahl & Gaynor Inc | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | SCAP - InfraCap Small Cap Income ETF | 3.770 | -53,31 | 151 | -50,66 | ||||

| 2025-07-21 | 13F | Vaughan Nelson Investment Management, L.p. | 2.600 | 0,00 | 106 | |||||

| 2025-05-16 | 13F | McIlrath & Eck, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Mml Investors Services, Llc | 12.020 | 12,49 | 0 | |||||

| 2025-08-13 | 13F | Hudson Portfolio Management LLC | 9.450 | 0,00 | 386 | 6,35 | ||||

| 2025-07-18 | 13F | PFG Investments, LLC | 9.923 | 66,55 | 405 | 77,63 | ||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 5.168.578 | 194 | ||||||

| 2025-08-14 | 13F | Horizon Investments, LLC | 219 | 9 | ||||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 6.405 | 55,39 | 262 | 66,24 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 66.310 | -92,77 | 2.707 | -92,29 | ||||

| 2025-07-31 | 13F | FSM Wealth Advisors, LLC | 7.720 | 320 | ||||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 46.409 | 0,00 | 1.895 | 6,58 | ||||

| 2025-06-26 | NP | FDMLX - Fidelity Series Intrinsic Opportunities Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 434.800 | 8,16 | 17.131 | 6,38 | ||||

| 2025-08-13 | 13F | Nicolet Advisory Services, Llc | 8.598 | 0,00 | 349 | 13,68 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 10.380 | -29,00 | 424 | -24,46 | ||||

| 2025-07-28 | NP | KBWD - Invesco KBW High Dividend Yield Financial ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 319.804 | 40,61 | 12.776 | 49,17 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 39.120 | 2,25 | 1.597 | 9,01 | ||||

| 2025-07-25 | 13F | Sequoia Financial Advisors, LLC | 20.308 | 0,79 | 829 | 7,52 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 1.200 | -4,00 | 49 | 2,13 | ||||

| 2025-08-14 | 13F | Css Llc/il | Put | 0 | -100,00 | 0 | ||||

| 2025-08-19 | 13F | Cape Investment Advisory, Inc. | 567 | -23,38 | 23 | -17,86 | ||||

| 2025-08-13 | 13F | Gamco Investors, Inc. Et Al | 33.198 | -53,89 | 1.355 | -50,87 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 11.400 | 58,33 | 465 | 69,09 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 1.500 | -96,16 | 61 | -95,93 | |||

| 2025-05-14 | 13F | Van Hulzen Asset Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 8.391 | 343 | ||||||

| 2025-05-22 | NP | MANNING & NAPIER FUND, INC. - Callodine Equity Income Series Class I | 174.060 | -3,30 | 6.668 | -0,12 | ||||

| 2025-08-11 | 13F | One Capital Management, LLC | 8.029 | 0,00 | 328 | 6,51 | ||||

| 2025-07-22 | 13F | Kessler Investment Group, LLC | 70 | 0,00 | 3 | 0,00 | ||||

| 2025-08-06 | 13F | Wedbush Securities Inc | 8.680 | -10,79 | 0 | |||||

| 2025-08-11 | 13F | Knott David M Jr | 48.000 | 0,00 | 1.960 | 6,58 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 1 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Wealth Preservation Advisors, LLC | 15.061 | 0,00 | 615 | 6,60 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 174.553 | -46,29 | 7.127 | -42,77 | ||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 27.000 | 25,73 | 1 | |||||

| 2025-08-14 | 13F | Css Llc/il | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | HFG Advisors, Inc. | 6.560 | -4,89 | 268 | 1,14 | ||||

| 2025-08-08 | 13F | Schwarz Dygos Wheeler Investment Advisors Llc | 6.095 | 0,00 | 249 | 6,44 | ||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 183.021 | 0,16 | 7.522 | 7,46 | ||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | Integrated Advisors Network LLC | 10.449 | -2,25 | 427 | 4,16 | ||||

| 2025-08-29 | NP | GATAX - The Gabelli Asset Fund Class A | 40.000 | 0,00 | 1.633 | 6,59 | ||||

| 2025-07-15 | 13F | Shulman DeMeo Asset Management LLC | 14.115 | 0,35 | 576 | 7,06 | ||||

| 2025-07-28 | 13F | Mutual Advisors, LLC | 14.405 | 0,88 | 618 | 14,90 | ||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 59.829 | 0,72 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Fmr Llc | 2.445.741 | -26,23 | 99.860 | -21,37 | ||||

| 2025-08-28 | NP | TWEIX - Equity Income Fund Investor Class This fund is a listed as child fund of American Century Companies Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 982.139 | -33,00 | 40.101 | -28,59 | ||||

| 2025-07-14 | 13F | Opal Wealth Advisors, LLC | 7.111 | 0,00 | 290 | 6,62 | ||||

| 2025-08-14 | 13F | Wiley Bros.-aintree Capital, Llc | 38.236 | 3,54 | 1.561 | 10,24 | ||||

| 2025-08-20 | NP | AAIIX - Ancora Income Fund Class I | 4.200 | 0,00 | 171 | 6,88 | ||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | Put | 11.300 | 461 | |||||

| 2025-08-22 | NP | VARIABLE INSURANCE PRODUCTS FUND IV - Financial Services Portfolio Initial Class | 62.800 | -48,18 | 2.564 | -44,78 | ||||

| 2025-04-28 | 13F | Redmont Wealth Advisors Llc | 11.373 | 0,00 | 436 | 3,33 | ||||

| 2025-07-10 | 13F | Kozak & Associates, Inc. | 1.125 | 1,63 | 46 | 12,20 | ||||

| 2025-08-05 | 13F | Mountain Hill Investment Partners Corp. | 0 | -100,00 | 0 | |||||

| 2025-07-24 | NP | FIDSX - Financial Services Portfolio This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 215.000 | -56,09 | 8.589 | -53,42 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 159 | 0,00 | 6 | 0,00 | ||||

| 2025-08-12 | 13F | Manchester Capital Management LLC | 407 | 0,00 | 15 | 0,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 12.619 | -4,61 | 515 | 1,78 | ||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 76.786 | 14,98 | 3.135 | 26,58 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 103.869 | -3,58 | 4 | 0,00 | ||||

| 2025-05-08 | 13F | HHM Wealth Advisors, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 1.000 | 0,00 | 41 | 5,26 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 72.357 | 16,73 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 58.353 | -31,26 | 2.383 | -26,75 | ||||

| 2025-04-25 | 13F | K.J. Harrison & Partners Inc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 1.154 | 2,03 | 47 | 9,30 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 208.278 | -2,01 | 8.504 | 4,45 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | First National Trust Co | 26.824 | 0,00 | 1.095 | 6,62 | ||||

| 2025-08-13 | 13F | Manning & Napier Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 37.889 | -0,33 | 1.547 | 6,25 | ||||

| 2025-08-14 | 13F | First Foundation Advisors | 24.500 | 0,00 | 1.000 | 6,61 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 19.399 | 0,00 | 792 | 6,59 | ||||

| 2025-08-13 | 13F | Keystone Financial Group | 19.169 | 4,87 | 774 | 6,62 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 17.679 | 722 | ||||||

| 2025-04-22 | 13F | Mendota Financial Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 6.833 | 0,00 | 285 | 1,79 | ||||

| 2025-08-06 | 13F | Golden State Wealth Management, LLC | 2.575 | 0,00 | 105 | 7,14 | ||||

| 2025-08-13 | 13F | Fiduciary Group LLC | 6.565 | -5,74 | 268 | 0,75 | ||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 25.635 | 24,88 | 1.047 | 33,08 | ||||

| 2025-08-07 | 13F | Zions Bancorporation, National Association /ut/ | 2.000 | 0,00 | 82 | 6,58 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 159.673 | -3,86 | 6.520 | 2,47 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 388 | 0,00 | 16 | 7,14 | ||||

| 2025-07-23 | 13F | Birinyi Associates Inc | 10.261 | -8,64 | 0 | |||||

| 2025-08-07 | 13F | Future Fund LLC | 13.044 | 10,22 | 533 | 17,44 | ||||

| 2025-08-04 | 13F | Flagship Harbor Advisors, Llc | 9.185 | -1,24 | 375 | 5,34 | ||||

| 2025-07-14 | 13F | CHICAGO TRUST Co NA | 6.000 | 245 | ||||||

| 2025-08-12 | 13F | Skopos Labs, Inc. | 13 | 0,00 | 0 | |||||

| 2025-04-29 | NP | ICAP - InfraCap Equity Income Fund ETF | 40.806 | 8,12 | 1.537 | 12,28 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 90 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 173.692 | -2,91 | 7.092 | 3,47 | ||||

| 2025-08-14 | 13F/A | Zazove Associates Llc | Call | 67.400 | 0,00 | 88 | -81,99 | |||

| 2025-08-12 | 13F | Clear Street Markets Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-08-12 | 13F | Laurel Wealth Advisors LLC | 205 | 4.000,00 | 0 | |||||

| 2025-08-12 | 13F | Clear Street Markets Llc | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | DAVENPORT & Co LLC | 37.022 | 0,82 | 1.512 | 7,47 | ||||

| 2025-03-31 | NP | FIDAX - Financial Industries Fund Class A | 183.168 | 3,89 | 7.338 | 12,32 | ||||

| 2025-08-14 | 13F | Colony Group, LLC | 26.829 | -1,99 | 1.095 | 4,48 | ||||

| 2025-08-11 | 13F | Aptus Capital Advisors, LLC | 9.525 | 13,65 | 389 | 20,87 | ||||

| 2025-07-29 | NP | FFND - The Future Fund Active ETF | 12.672 | 18,20 | 506 | 25,56 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 37.800 | -16,56 | 1.543 | -11,07 | |||

| 2025-07-15 | 13F | North Star Investment Management Corp. | 2.341 | 0,00 | 96 | 6,74 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 78.323 | -46,51 | 3.198 | -43,01 | ||||

| 2025-08-14 | 13F | UBS Group AG | 292.235 | -77,33 | 11.932 | -75,84 | ||||

| 2025-07-28 | 13F | Davidson Trust Co | 7.000 | 0,00 | 286 | 6,34 | ||||

| 2025-07-23 | 13F | Joel Isaacson & Co., LLC | 10.177 | 0,00 | 416 | 6,68 | ||||

| 2025-07-31 | 13F/A | Avion Wealth | 584 | 5,04 | 0 | |||||

| 2025-07-29 | 13F | Koshinski Asset Management, Inc. | 6.165 | 12,81 | 252 | 20,10 | ||||

| 2025-06-24 | NP | NLSAX - Neuberger Berman Long Short Fund Class A | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-16 | 13F | Fortitude Family Office, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Summit Asset Management, LLC | 5.450 | 0,00 | 223 | 6,73 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 420 | 0,00 | 17 | 6,25 |