Grundlæggende statistik

| Institutionelle ejere | 269 total, 266 long only, 0 short only, 3 long/short - change of 5,49% MRQ |

| Gennemsnitlig porteføljeallokering | 0.3223 % - change of -8,57% MRQ |

| Institutionelle aktier (lange) | 52.151.765 (ex 13D/G) - change of 1,09MM shares 2,13% MRQ |

| Institutionel værdi (lang) | $ 1.203.095 USD ($1000) |

Institutionelt ejerskab og aktionærer

Sixth Street Specialty Lending, Inc. (US:TSLX) har 269 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 52,151,765 aktier. Største aktionærer omfatter Strs Ohio, Sixth Street Partners Management Company, L.P., Progeny 3, Inc., Sound Income Strategies, LLC, Burgundy Asset Management Ltd., Van Eck Associates Corp, BIZD - VanEck Vectors BDC Income ETF, Morgan Stanley, Allen Investment Management LLC, and Ares Management Llc .

Sixth Street Specialty Lending, Inc. (NYSE:TSLX) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 8, 2025 is 24,68 / share. Previously, on September 9, 2024, the share price was 21,14 / share. This represents an increase of 16,75% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

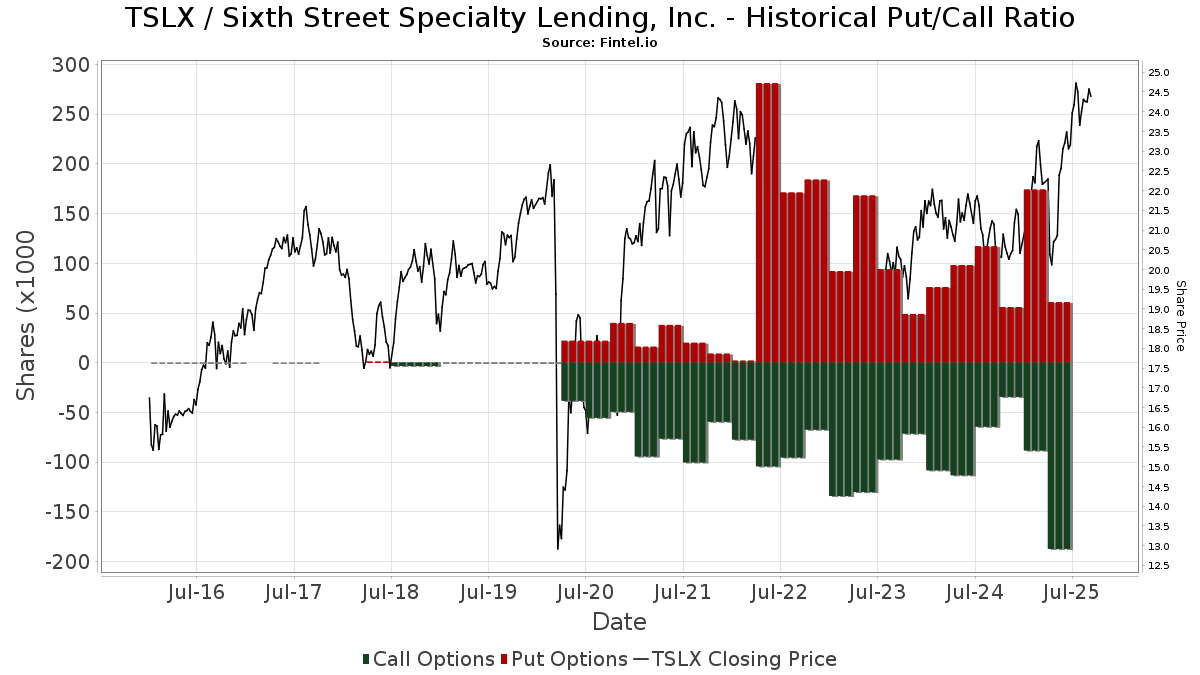

Institutionel Put/Call-forhold

Ud over at indberette standardaktie- og gældsudstedelser skal institutter med mere end 100 mill. aktiver under forvaltning også oplyse deres put- og call-optionsbeholdninger. Da salgsoptioner generelt indikerer negativ stemning, og købsoptioner indikerer positiv stemning, kan vi få en fornemmelse af den overordnede institutionelle stemning ved at plotte forholdet mellem put og kald. Diagrammet til højre viser det historiske put/call-forhold for dette instrument.

Brug af Put/Call Ratio som en indikator for investorernes stemning overvinder en af de vigtigste mangler ved at bruge totalt institutionelt ejerskab, som er, at en betydelig mængde af aktiver under forvaltning investeres passivt for at spore indekser. Passivt forvaltede fonde køber typisk ikke optioner, så indikatoren for put/call-forholdet følger mere nøje følelsen af aktivt forvaltede fonde.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-11 | 13F | EMC Capital Management | 6.120 | -9,29 | 0 | |||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 2.983 | 0,10 | 71 | 14,52 | ||||

| 2025-08-28 | NP | SVOAX - Simt Us Managed Volatility Fund Class F | 38.650 | -38,99 | 920 | -35,07 | ||||

| 2025-05-05 | 13F | Transce3nd, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Muzinich & Co., Inc. | 608.616 | 35,21 | 14.491 | 43,85 | ||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 512.747 | 17,61 | 12.209 | 25,13 | ||||

| 2025-08-15 | 13F | Northeast Financial Consultants Inc | 26.000 | 0,00 | 619 | 6,54 | ||||

| 2025-08-07 | 13F | ProShare Advisors LLC | 19.159 | -3,69 | 456 | 2,47 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 98.843 | 0,00 | 2.353 | 6,37 | ||||

| 2025-08-05 | 13F | Huntington National Bank | 1.001 | 0,00 | 24 | 4,55 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 84.292 | 52,37 | 2.007 | 62,04 | ||||

| 2025-07-17 | 13F | HB Wealth Management, LLC | 76.206 | -4,27 | 1.814 | 1,85 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 16.052 | 24,86 | 382 | 33,10 | ||||

| 2025-08-08 | 13F | Foundations Investment Advisors, LLC | 42.122 | 1.003 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 1.186.011 | 35,43 | 28.239 | 44,09 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 4.659 | -8,70 | 111 | -3,51 | ||||

| 2025-05-01 | 13F | Country Club Bank /gfn | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Virtus ETF Advisers LLC | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Hager Investment Management Services, Llc | 55 | 1,85 | 1 | 0,00 | ||||

| 2025-08-06 | 13F | Round Rock Advisors, LLC | 281.184 | 2,44 | 6.695 | 8,99 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Ellsworth Advisors, LLC | 29.815 | 710 | ||||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 1.770 | -31,37 | 42 | -26,32 | ||||

| 2025-06-18 | NP | Putnam ETF Trust - Putnam BDC ETF - | 479.138 | 21,72 | 9.947 | 12,91 | ||||

| 2025-07-01 | 13F | Confluence Investment Management Llc | 288.066 | 14,58 | 6.859 | 21,90 | ||||

| 2025-07-18 | 13F | Trust Co Of Vermont | 1.584 | -13,63 | 38 | -9,76 | ||||

| 2025-08-13 | 13F | 1832 Asset Management L.P. | 395.347 | 12,96 | 9.413 | 20,17 | ||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 189.491 | 4.512 | ||||||

| 2025-08-14 | 13F | Mariner, LLC | 38.629 | 13,16 | 920 | 20,45 | ||||

| 2025-08-14 | 13F | FJ Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | NP | SVYAX - SIIT U.S. Managed Volatility Fund - Class A | 104.200 | 0,00 | 2.427 | -0,94 | ||||

| 2025-08-07 | 13F | Allworth Financial LP | 334 | 1.570,00 | 8 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 1.672 | 0,00 | 40 | 5,41 | ||||

| 2025-08-11 | 13F | Annis Gardner Whiting Capital Advisors, LLC | 5.235 | 0,00 | 125 | 5,98 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 1.872.708 | 0,15 | 44.589 | 6,55 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 17.300 | -24,78 | 412 | -20,04 | |||

| 2025-08-14 | 13F | Wetherby Asset Management Inc | 11.514 | 274 | ||||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 667 | 0,00 | 16 | 7,14 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 50.774 | -76,82 | 1.209 | -75,36 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 46.900 | 838,00 | 1.117 | 905,41 | |||

| 2025-07-10 | 13F | Security National Bank | 3.361 | 5,96 | 80 | 14,29 | ||||

| 2025-07-22 | 13F | Romano Brothers And Company | 25.200 | 46,51 | 601 | 56,51 | ||||

| 2025-08-11 | 13F | Greykasell Wealth Strategies, Inc. | 497 | -39,76 | 12 | -38,89 | ||||

| 2025-07-28 | NP | FXED - Sound Enhanced Fixed Income ETF | 52.635 | 1,12 | 1.226 | 0,16 | ||||

| 2025-07-29 | 13F | Private Trust Co Na | 600 | 0,00 | 14 | 7,69 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 74.279 | 176,23 | 1.769 | 194,18 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Register Financial Advisors LLC | 7.665 | 0,24 | 183 | 6,43 | ||||

| 2025-08-08 | 13F | Pnc Financial Services Group, Inc. | 7.341 | 0,00 | 175 | 6,10 | ||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 595.029 | -1,60 | 14.168 | 4,68 | ||||

| 2025-07-28 | 13F | Melia Wealth LLC | 614.916 | 3,56 | 14.641 | 10,18 | ||||

| 2025-08-13 | 13F | Lansforsakringar Fondforvaltning AB (publ) | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Pasadena Private Wealth, LLC | 10.090 | -9,66 | 240 | -3,61 | ||||

| 2025-05-14 | 13F | Campbell & CO Investment Adviser LLC | 0 | -100,00 | 0 | |||||

| 2025-07-24 | 13F | Standard Life Aberdeen plc | 123.237 | -5,70 | 2.936 | 0,75 | ||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 8.570 | 204 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 75.811 | 186,63 | 1.805 | 205,41 | ||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 17.540 | 418 | ||||||

| 2025-08-11 | 13F | Lsv Asset Management | 1.055.562 | -10,33 | 25 | -3,85 | ||||

| 2025-08-12 | 13F | Franklin Resources Inc | 485.418 | 9,97 | 11.558 | 17,00 | ||||

| 2025-08-14 | 13F | Benjamin Edwards Inc | 211.976 | 3,40 | 5.047 | 10,00 | ||||

| 2025-08-20 | NP | LSPAX - LoCorr Spectrum Income Fund Class A | 29.829 | -48,40 | 710 | -45,09 | ||||

| 2025-08-14 | 13F | London & Capital Asset Management Ltd | 19.400 | 0,00 | 462 | 6,22 | ||||

| 2025-07-15 | 13F | Family Wealth Partners, Llc | 16.297 | 81,54 | 388 | 94,00 | ||||

| 2025-07-21 | 13F | Future Financial Wealth Managment LLC | 4.200 | 0,00 | 100 | 7,53 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 30.628 | 7,98 | 729 | 14,98 | ||||

| 2025-04-22 | 13F | Synergy Financial Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 37 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | DRW Securities, LLC | 25.122 | 598 | ||||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 53.219 | 2,24 | 1.267 | 8,85 | ||||

| 2025-08-13 | 13F | Legacy Capital Wealth Partners, LLC | 61.987 | -3,10 | 1.476 | 3,07 | ||||

| 2025-08-13 | 13F | Texas Capital Bank Wealth Management Services Inc | 148.017 | 5,87 | 3.524 | 12,66 | ||||

| 2025-08-14 | 13F | Mercer Global Advisors Inc /adv | 8.733 | 208 | ||||||

| 2025-07-29 | 13F | Stableford Capital Ii Llc | 8.500 | 208 | ||||||

| 2025-08-04 | 13F | IFG Advisory, LLC | 20.608 | 14,31 | 491 | 21,59 | ||||

| 2025-08-13 | 13F | Advisory Research Inc | 10.564 | -1,55 | 252 | 4,58 | ||||

| 2025-08-13 | 13F | Wambolt & Associates, LLC | 146.586 | -8,68 | 3.487 | -3,14 | ||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 24.084 | 4,50 | 573 | 11,26 | ||||

| 2025-07-25 | NP | First Trust Specialty Finance & Financial Opportunities Fund This fund is a listed as child fund of First Trust Advisors Lp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 222.000 | 12,69 | 5.170 | 11,64 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 1.297 | -9,55 | 0 | |||||

| 2025-06-30 | NP | PSP - Invesco Global Listed Private Equity ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 26.905 | -22,31 | 559 | -28,00 | ||||

| 2025-07-25 | 13F | Community Bank, N.A. | 1.000 | 0,00 | 24 | 4,55 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1.241.039 | 3,07 | 29.549 | 9,66 | ||||

| 2025-08-26 | NP | NORTHERN FUNDS - NORTHERN SMALL CAP CORE FUND Class K | 10.068 | -5,54 | 240 | 0,42 | ||||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 150.543 | 0,00 | 3.584 | 6,41 | ||||

| 2025-07-15 | 13F | SJS Investment Consulting Inc. | 43 | 1 | ||||||

| 2025-08-13 | 13F | Brown Advisory Inc | 38.999 | -14,98 | 929 | -9,55 | ||||

| 2025-07-16 | 13F | Essex Financial Services, Inc. | 41.047 | 4,57 | 977 | 11,28 | ||||

| 2025-07-29 | NP | PPADX - GMO U.S. Opportunistic Value Fund Class III | 21.838 | 509 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 18.012 | -13,02 | 429 | -7,56 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 538.400 | 8,83 | 12.819 | 15,79 | ||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 11.138 | 265 | ||||||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 15.050 | 66,87 | 358 | 78,11 | ||||

| 2025-08-08 | 13F | Tortoise Investment Management, LLC | Call | 500 | 0 | |||||

| 2025-07-28 | 13F | Frazier Financial Advisors, LLC | 4.814 | 0,00 | 115 | 6,54 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 663.112 | -4,02 | 15.789 | 2,11 | ||||

| 2025-05-30 | NP | ERNZ - TrueShares Active Yield ETF | 13.535 | -93,77 | 303 | -93,47 | ||||

| 2025-08-13 | 13F | Delphi Financial Group, Inc. | 20.041 | -55,57 | 477 | -52,73 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 14.825 | 353 | ||||||

| 2025-06-26 | NP | LSVQX - LSV Small Cap Value Fund Institutional Class Shares | 90.000 | 0,00 | 1.868 | -7,25 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 4.000 | 0,00 | 95 | 6,74 | ||||

| 2025-08-14 | 13F | BI Asset Management Fondsmaeglerselskab A/S | 1.919 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Advisors Asset Management, Inc. | 206.077 | 16,24 | 4.907 | 23,67 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 678.886 | -7,62 | 16.164 | -1,71 | ||||

| 2025-08-05 | 13F | Bank Of Montreal /can/ | 324.196 | 7.719 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 94 | -57,27 | 2 | -50,00 | ||||

| 2025-08-14 | 13F | Clayton Partners LLC | 137.140 | -9,62 | 3.265 | -3,83 | ||||

| 2025-07-01 | 13F | Harbor Investment Advisory, Llc | 219 | 2,34 | 5 | 25,00 | ||||

| 2025-05-15 | 13F | Centiva Capital, LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-25 | NP | VPC - Virtus Private Credit Strategy ETF | 36.498 | -16,64 | 758 | -22,68 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 828.529 | -0,33 | 19.727 | 6,04 | ||||

| 2025-08-14 | 13F | Barnett & Company, Inc. | 36.750 | 22,30 | 875 | 30,21 | ||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 21.868 | 1,38 | 521 | 7,88 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-07-17 | 13F | LexAurum Advisors, LLC | 8.454 | 201 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 14.150 | 0,00 | 337 | 6,33 | ||||

| 2025-07-11 | 13F | Mallini Complete Financial Planning LLC | 15.226 | 16,87 | 362 | 24,40 | ||||

| 2025-08-04 | 13F | Savvy Advisors, Inc. | 35.138 | 15,92 | 837 | 23,30 | ||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 178 | 0,00 | 4 | 33,33 | ||||

| 2025-07-16 | 13F | Magnus Financial Group LLC | 12.526 | -13,05 | 298 | -7,45 | ||||

| 2025-07-18 | 13F | Union Bancaire Privee, UBP SA | 19.319 | 5,09 | 65.559 | 15.851,09 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 14.726 | -60,82 | 351 | -58,38 | ||||

| 2025-08-12 | 13F | Argent Trust Co | 144.734 | 36,10 | 3.446 | 44,85 | ||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 2.144 | 0,00 | 51 | 24,39 | ||||

| 2025-08-14 | 13F | AllSquare Wealth Management LLC | 500 | 0,00 | 12 | 0,00 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 100 | 0,00 | 0 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 107.300 | 29,75 | 2.555 | 38,05 | |||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 9.300 | 3.000,00 | 0 | ||||

| 2025-08-14 | 13F | FIL Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 44.000 | -64,80 | 1.048 | -62,57 | |||

| 2025-08-14 | 13F | Hrt Financial Lp | 190.316 | 185,61 | 5 | 300,00 | ||||

| 2025-07-30 | 13F | Principle Wealth Partners Llc | 11.701 | -11,02 | 279 | -5,44 | ||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 6.588 | 157 | ||||||

| 2025-08-11 | 13F | Delta Asset Management Llc/tn | 250 | 0,00 | 6 | 0,00 | ||||

| 2025-07-29 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-04-28 | 13F | Redmont Wealth Advisors Llc | 4.341 | 97 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bramshill Investments, LLC | 32.652 | -47,47 | 777 | -44,14 | ||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 19.502 | 1,22 | 464 | 7,66 | ||||

| 2025-05-15 | 13F | Nebula Research & Development LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Trexquant Investment LP | 168.058 | 11,57 | 4.001 | 18,69 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 696.005 | 16,84 | 16.572 | 24,30 | ||||

| 2025-08-07 | 13F | Allen Investment Management LLC | 1.557.126 | 8,52 | 37.075 | 15,45 | ||||

| 2025-08-14 | 13F | Parkwood LLC | 184.819 | 0,00 | 4 | 0,00 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 11.100 | 264 | |||||

| 2025-08-06 | 13F | AE Wealth Management LLC | 9.361 | -13,84 | 223 | -8,64 | ||||

| 2025-06-26 | NP | LSVMX - LSV U.S. MANAGED VOLATILITY FUND Institutional Class Shares | 4.700 | 0,00 | 98 | -7,62 | ||||

| 2025-07-30 | NP | BIGTX - The Texas Fund Class I | 5.220 | 89,82 | 122 | 105,08 | ||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 2.825 | -80,22 | 67 | -77,96 | ||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 142.414 | 12,01 | 3 | 50,00 | ||||

| 2025-04-29 | 13F | Riggs Asset Managment Co. Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Van Eck Associates Corp | 2.143.789 | -3,78 | 51 | 4,08 | ||||

| 2025-08-01 | 13F | First National Trust Co | 214.770 | 0,00 | 5.114 | 6,39 | ||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 67.700 | -7,02 | 1.612 | -1,10 | ||||

| 2025-07-18 | 13F | Bartlett & Co. Wealth Management Llc | 700 | 0,00 | 17 | 6,67 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 575.432 | -8,50 | 13.701 | -2,66 | ||||

| 2025-08-14 | 13F | Glenview Trust Co | 9.700 | 231 | ||||||

| 2025-07-24 | 13F | Wealthstar Advisors, Llc | 129.482 | -0,40 | 3.083 | 5,95 | ||||

| 2025-08-13 | 13F | Callodine Capital Management, LP | 1.064.824 | -0,02 | 25.353 | 6,36 | ||||

| 2025-07-29 | NP | GBFFX - GMO Benchmark-Free Fund Class III | 2.970 | 69 | ||||||

| 2025-08-13 | 13F | Lido Advisors, LLC | 52.996 | -23,25 | 1.262 | -18,38 | ||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 32.519 | 787 | ||||||

| 2025-08-15 | 13F | Provenance Wealth Advisors, LLC | 100 | 0,00 | 2 | 0,00 | ||||

| 2025-07-21 | 13F | Ameriflex Group, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | We Are One Seven, LLC | 427.840 | 3,05 | 10.187 | 9,63 | ||||

| 2025-08-14 | 13F | Glen Eagle Advisors, LLC | 100 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Sargent Investment Group, LLC | 28.400 | 0,00 | 682 | 7,24 | ||||

| 2025-08-14 | 13F | Comerica Bank | 9.280 | 12,42 | 221 | 19,57 | ||||

| 2025-08-07 | 13F | Hennion & Walsh Asset Management, Inc. | 63.911 | -38,55 | 1.522 | -34,64 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 113.162 | 181,73 | 2.694 | 200,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 40.339 | -4,92 | 961 | 1,16 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 2.406.296 | 1,91 | 57.294 | 8,42 | ||||

| 2025-07-14 | 13F | AdvisorNet Financial, Inc | 2.000 | 11,11 | 48 | 17,50 | ||||

| 2025-07-25 | 13F | Cwm, Llc | 64.376 | 7.857,48 | 2 | |||||

| 2025-07-07 | 13F | First Community Trust Na | 1.040 | 0,00 | 25 | 4,35 | ||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 500 | 0 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 70.817 | -42,45 | 1.686 | -38,76 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 47.667 | 9,70 | 1.135 | 16,67 | ||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Quarry LP | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 527.107 | 21,01 | 12.550 | 28,74 | ||||

| 2025-07-10 | 13F | Worth Asset Management, LLC | 14.322 | 0,10 | 341 | 6,56 | ||||

| 2025-08-14 | 13F | Principal Street Partners, LLC | 14.570 | -4,65 | 347 | 1,47 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 93.065 | 16,48 | 2.216 | 23,88 | ||||

| 2025-07-28 | NP | PEX - ProShares Global Listed Private Equity ETF | 20.431 | 1,50 | 476 | 0,42 | ||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 12.595 | 5,85 | 300 | 12,41 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 39.024 | -17,62 | 929 | -12,36 | ||||

| 2025-08-12 | 13F | Heritage Trust Co | 15.580 | 371 | ||||||

| 2025-08-12 | 13F | Waterloo Capital, L.P. | 103.773 | 7,64 | 2.471 | 14,51 | ||||

| 2025-07-29 | NP | SLPAX - Siit Small Cap Fund - Class A | 12.300 | 0,00 | 286 | -1,04 | ||||

| 2025-08-06 | 13F | Ethos Financial Group, LLC | 29.811 | -26,19 | 710 | -21,48 | ||||

| 2025-07-28 | 13F | Naviter Wealth, LLC | 137.708 | 19,01 | 3.279 | 24,31 | ||||

| 2025-08-11 | 13F | Platform Technology Partners | 27.945 | -4,90 | 665 | 1,22 | ||||

| 2025-08-14 | 13F | Evergreen Capital Management Llc | 16.513 | -4,37 | 393 | 1,81 | ||||

| 2025-08-08 | 13F | MTM Investment Management, LLC | 2.040 | 49 | ||||||

| 2025-07-17 | 13F | Beacon Capital Management, LLC | 1.204 | 2,29 | 29 | 7,69 | ||||

| 2025-08-18 | 13F | Geneos Wealth Management Inc. | 1.746 | 0,00 | 42 | 5,13 | ||||

| 2025-08-11 | 13F | Brown Brothers Harriman & Co | 100 | 2 | ||||||

| 2025-08-05 | 13F | Westside Investment Management, Inc. | 286 | 7 | ||||||

| 2025-08-12 | 13F | Legal & General Group Plc | 622.774 | 0,14 | 14.822 | 6,57 | ||||

| 2025-07-09 | 13F | Inspirion Wealth Advisors, Llc | 15.426 | 0,00 | 367 | 6,38 | ||||

| 2025-07-11 | 13F | SILVER OAK SECURITIES, Inc | 19.955 | 145,57 | 475 | 162,43 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 225 | -43,47 | 5 | -37,50 | ||||

| 2025-08-11 | 13F | Nations Financial Group Inc, /ia/ /adv | 35.508 | -2,42 | 845 | 3,81 | ||||

| 2025-08-14 | 13F | Fmr Llc | 34 | 0,00 | 1 | |||||

| 2025-08-12 | 13F | Cornerstone Wealth Management, LLC | 46.666 | -0,14 | 1.111 | 6,32 | ||||

| 2025-08-13 | 13F | Burgundy Asset Management Ltd. | 2.378.968 | 1,36 | 56.643 | 7,84 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 161 | 1,90 | 4 | 0,00 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 83 | -82,23 | 2 | -90,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 52.974 | 1.261 | ||||||

| 2025-08-08 | 13F | Creative Planning | 38.717 | -3,54 | 922 | 2,56 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 12.200 | 290 | |||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 260 | 61,49 | 6 | 66,67 | ||||

| 2025-08-14 | 13F | Dearborn Partners Llc | 63.576 | 0,27 | 1.514 | 6,62 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Whalerock Point Partners, Llc | 13.200 | 24,24 | 314 | 32,49 | ||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 48.778 | -9,64 | 1.161 | -3,89 | ||||

| 2025-07-30 | 13F | Denali Advisors Llc | 198.685 | -2,34 | 4.731 | 3,91 | ||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 494.410 | 10,14 | 11.772 | 17,17 | ||||

| 2025-08-13 | 13F | SCS Capital Management LLC | 622.522 | 2,86 | 14.822 | 9,43 | ||||

| 2025-08-21 | NP | BIZD - VanEck Vectors BDC Income ETF | 1.873.346 | -9,19 | 44.604 | -3,39 | ||||

| 2025-06-27 | NP | LBO - WHITEWOLF Publicly Listed Private Equity ETF | 6.624 | 14,29 | 138 | 6,20 | ||||

| 2025-08-04 | 13F | Strs Ohio | 3.176.606 | -10,80 | 75.635 | -5,10 | ||||

| 2025-08-08 | 13F | Marble Harbor Investment Counsel, LLC | 10.210 | -10,00 | 243 | -3,95 | ||||

| 2025-07-21 | 13F | Vaughan Nelson Investment Management, L.p. | 5.350 | 0,00 | 127 | |||||

| 2025-08-08 | 13F | Advisors Capital Management, LLC | 718.338 | 1,95 | 17.104 | 8,46 | ||||

| 2025-08-29 | NP | John Hancock Financial Opportunities Fund | 228.214 | 0,00 | 5.434 | 6,38 | ||||

| 2025-07-09 | 13F | Westmount Partners, LLC | 13.030 | 0,00 | 310 | 6,53 | ||||

| 2025-08-06 | 13F | Baillie Gifford & Co | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-23 | 13F | PARK CIRCLE Co | 62.000 | 0,00 | 1.476 | 6,42 | ||||

| 2025-08-12 | 13F | MAI Capital Management | 4.264 | 83,48 | 102 | 94,23 | ||||

| 2025-08-13 | 13F | Virtus Investment Advisers, Inc. | 29.302 | -26,67 | 698 | -22,04 | ||||

| 2025-07-29 | 13F | Chicago Partners Investment Group LLC | 22.864 | 1,33 | 560 | 19,15 | ||||

| 2025-08-08 | 13F | Alberta Investment Management Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 141.477 | 13,87 | 3.369 | 21,19 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 609.227 | 0,94 | 14.506 | 7,39 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 604 | 0,00 | 14 | 7,69 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | Dakota Wealth Management | 39.220 | 8,27 | 934 | 15,19 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1.061 | 0,00 | 25 | 8,70 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-30 | 13F | D.a. Davidson & Co. | 179.702 | 3,56 | 4.279 | 10,17 | ||||

| 2025-05-15 | 13F | Brevan Howard Capital Management LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Beacon Pointe Advisors, LLC | 49.612 | 58,49 | 1.181 | 68,71 | ||||

| 2025-07-24 | 13F | Robertson Stephens Wealth Management, LLC | 9.700 | 0,00 | 231 | 5,99 | ||||

| 2025-08-13 | 13F | Cerity Partners LLC | 422.634 | -4,82 | 10.063 | 1,26 | ||||

| 2025-08-13 | 13F | Guggenheim Capital Llc | 26.971 | 5,81 | 642 | 12,63 | ||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 230.586 | -0,88 | 5.490 | 5,46 | ||||

| 2025-08-13 | 13F | OMERS ADMINISTRATION Corp | 178.214 | 4.243 | ||||||

| 2025-07-09 | 13F | Mirador Capital Partners LP | 21.920 | 4,38 | 522 | 10,85 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Buckingham Strategic Partners | 16.296 | 81,55 | 388 | 94,00 | ||||

| 2025-07-30 | 13F | Whittier Trust Co Of Nevada Inc | 9.575 | 0,00 | 228 | 6,07 | ||||

| 2025-08-11 | 13F | Core Wealth Partners LLC | 11.668 | 0,00 | 278 | 6,13 | ||||

| 2025-08-08 | 13F | Hartland & Co., LLC | 18.000 | 0,00 | 429 | 6,47 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 32.266 | -38,05 | 1 | -100,00 | ||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 39.859 | 0,00 | 949 | 6,39 | ||||

| 2025-08-13 | 13F | Truvestments Capital Llc | 193.963 | -0,71 | 4.618 | 5,65 | ||||

| 2025-07-30 | 13F | Mid-American Wealth Advisory Group, Inc. | 189 | 4 | ||||||

| 2025-08-08 | 13F | Bouchey Financial Group Ltd | 30.252 | 0,00 | 720 | 6,35 | ||||

| 2025-04-30 | 13F | Stratos Wealth Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-28 | 13F | RMR Capital Management, LLC | 190.495 | -21,68 | 4.536 | -16,68 | ||||

| 2025-07-23 | 13F | Columbus Macro, LLC | 437.561 | 12,40 | 10.418 | 19,60 | ||||

| 2025-08-13 | 13F | Natixis | 25.249 | 0,00 | 601 | 6,75 | ||||

| 2025-07-30 | 13F | Blume Capital Management, Inc. | 450 | 0,00 | 11 | 0,00 | ||||

| 2025-08-08 | 13F/A | Ignite Planners, LLC | 71.358 | 53,96 | 1.770 | 85,82 | ||||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 18.339 | 10,88 | 437 | 17,84 | ||||

| 2025-08-14 | 13F | Progeny 3, Inc. | 2.476.398 | 0,96 | 58.963 | 7,41 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 5.115 | 0,00 | 122 | 6,14 | ||||

| 2025-07-07 | 13F | Thurston, Springer, Miller, Herd & Titak, Inc. | 200 | 0,00 | 5 | 0,00 | ||||

| 2025-08-28 | NP | SMVIX - Simt Small Cap Value Fund Class I | 4.848 | -71,11 | 115 | -69,33 | ||||

| 2025-08-07 | 13F | Merrion Investment Management Co, LLC | 25.000 | 0,00 | 595 | 6,44 | ||||

| 2025-08-14 | 13F | Ameriprise Financial Inc | 215.650 | 6,58 | 5.176 | 14,24 | ||||

| 2025-06-10 | 13F | Birchbrook, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 942.789 | 0,49 | 22.448 | 6,92 | ||||

| 2025-08-14 | 13F | State Street Corp | 89.663 | 257,76 | 2.135 | 281,07 | ||||

| 2025-07-22 | 13F | Grimes & Company, Inc. | 12.161 | 290 | ||||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-07-10 | 13F | Peoples Bank/KS | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 58.035 | 1.382 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 44.425 | -31,00 | 1.058 | -26,60 | ||||

| 2025-08-13 | 13F | Plan Group Financial, LLC | 51.428 | 32,13 | 1.224 | 40,53 | ||||

| 2025-05-14 | 13F | Caitlin John, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-29 | NP | GIMFX - GMO Implementation Fund | 6.729 | 157 | ||||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 4.123 | 73,97 | 98 | 84,91 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 51.926 | 1.236 | ||||||

| 2025-07-15 | 13F | Riverbridge Partners Llc | 48.835 | 3,37 | 1.163 | 9,93 | ||||

| 2025-05-14 | 13F | Group One Trading, L.p. | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 31.070 | 0,00 | 740 | 6,33 | ||||

| 2025-08-14 | 13F | Ares Management Llc | 1.402.689 | 2,19 | 33.398 | 8,72 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 347.494 | 336,55 | 8.274 | 364,51 | ||||

| 2025-07-17 | 13F | Janney Montgomery Scott LLC | 264.827 | -4,34 | 6 | 0,00 | ||||

| 2025-07-18 | 13F | SOA Wealth Advisors, LLC. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | IHT Wealth Management, LLC | 105.149 | 6,64 | 2.504 | 13,46 | ||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 9.484 | 0,32 | 226 | 6,64 | ||||

| 2025-07-09 | 13F | Gilman Hill Asset Management, LLC | 465.241 | 4,09 | 11.077 | 10,74 | ||||

| 2025-08-14 | 13F/A | Rockefeller Capital Management L.P. | 207.112 | 7,31 | 4.931 | 14,17 | ||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 47.430 | -1,66 | 1 | 0,00 | ||||

| 2025-07-22 | 13F | Sage Investment Counsel LLC | 26.277 | 0,00 | 626 | 6,29 | ||||

| 2025-08-13 | 13F | Cresset Asset Management, LLC | 303.843 | -0,12 | 7.235 | 6,26 | ||||

| 2025-08-12 | 13F | Sixth Street Partners Management Company, L.P. | 2.714.226 | 0,00 | 64.626 | 6,39 | ||||

| 2025-08-15 | 13F | Great West Life Assurance Co /can/ | 136.054 | 2,59 | 3 | 50,00 | ||||

| 2025-08-21 | NP | MOFTX - Mercer Opportunistic Fixed Income Fund Class I | 30.000 | 714 | ||||||

| 2025-08-26 | NP | GMOV - GMO U.S. Value ETF | 2.345 | -1,64 | 56 | 3,77 | ||||

| 2025-08-06 | 13F | Texas Yale Capital Corp. | 35.500 | 1,43 | 845 | 7,92 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 25.113 | 0,00 | 598 | 6,23 | ||||

| 2025-08-08 | 13F | Lgt Capital Partners Ltd. | 336.500 | -14,81 | 8.012 | -9,37 | ||||

| 2025-08-12 | 13F | Financial Advocates Investment Management | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 24.606 | 586 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 |