Grundlæggende statistik

| Institutionelle ejere | 217 total, 216 long only, 0 short only, 1 long/short - change of 7.133,33% MRQ |

| Gennemsnitlig porteføljeallokering | 0.3789 % - change of % MRQ |

| Institutionelle aktier (lange) | 170.418.907 (ex 13D/G) |

| Institutionel værdi (lang) | $ 8.227.921 USD ($1000) |

Institutionelt ejerskab og aktionærer

Amrize AG (US:AMRZ) har 217 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 170,418,907 aktier. Største aktionærer omfatter Vanguard Group Inc, UBS Group AG, Norges Bank, Dodge & Cox, Ubs Asset Management Americas Inc, Zurcher Kantonalbank (Zurich Cantonalbank), Vontobel Holding Ltd., Wellington Management Group Llp, Pictet Asset Management Holding SA, and Jpmorgan Chase & Co .

Amrize AG (NYSE:AMRZ) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 16, 2025 is 54,59 / share. Previously, on June 23, 2025, the share price was 51,99 / share. This represents an increase of 5,00% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

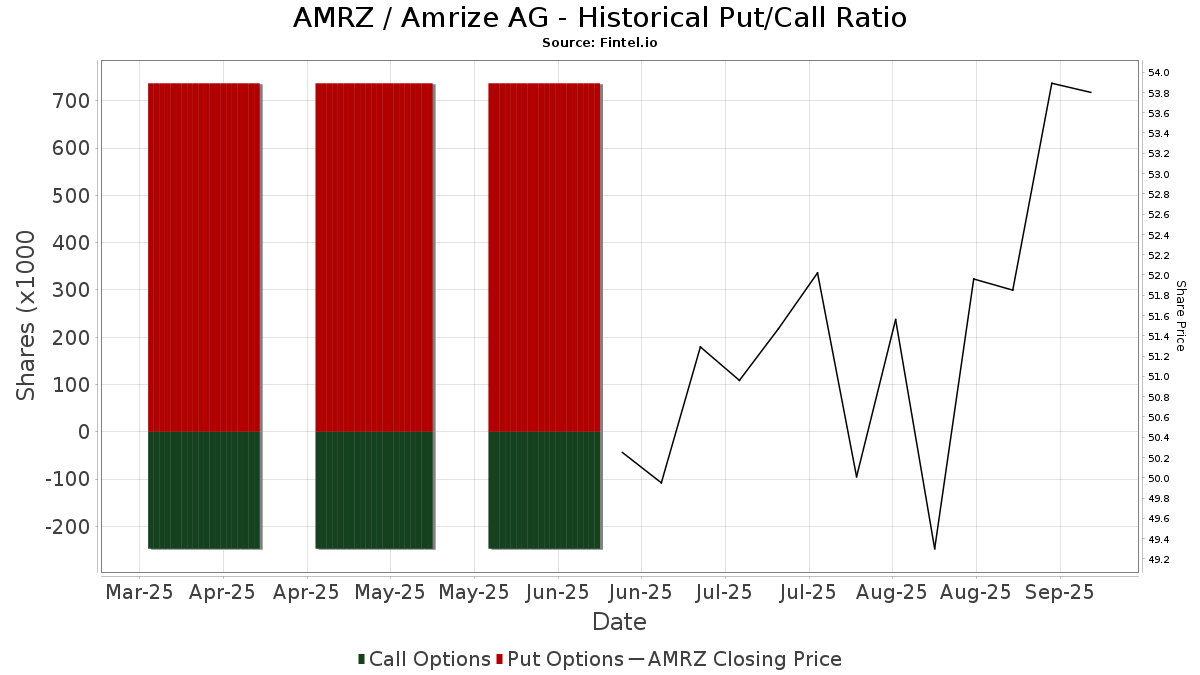

Institutionel Put/Call-forhold

Ud over at indberette standardaktie- og gældsudstedelser skal institutter med mere end 100 mill. aktiver under forvaltning også oplyse deres put- og call-optionsbeholdninger. Da salgsoptioner generelt indikerer negativ stemning, og købsoptioner indikerer positiv stemning, kan vi få en fornemmelse af den overordnede institutionelle stemning ved at plotte forholdet mellem put og kald. Diagrammet til højre viser det historiske put/call-forhold for dette instrument.

Brug af Put/Call Ratio som en indikator for investorernes stemning overvinder en af de vigtigste mangler ved at bruge totalt institutionelt ejerskab, som er, at en betydelig mængde af aktiver under forvaltning investeres passivt for at spore indekser. Passivt forvaltede fonde køber typisk ikke optioner, så indikatoren for put/call-forholdet følger mere nøje følelsen af aktivt forvaltede fonde.

13D/G-arkivering

Vi præsenterer 13D/G ansøgninger separat fra 13F ansøgninger på grund af den forskellige behandling af SEC. 13D/G-ansøgninger kan indgives af grupper af investorer (med én ledende), hvorimod 13F-ansøgninger ikke kan. Dette resulterer i situationer, hvor en investor kan indsende en 13D/G, der rapporterer én værdi for de samlede aktier (der repræsenterer alle de aktier, der ejes af investorgruppen), men derefter indsender en 13F, der rapporterer en anden værdi for de samlede aktier (der udelukkende repræsenterer deres egne) ejendomsret). Det betyder, at aktieejerskab af 13D/G-arkiver og 13F-arkiveringer ofte ikke er direkte sammenlignelige, så vi præsenterer dem separat.

Bemærk: Fra den 16. maj 2021 viser vi ikke længere ejere, der ikke har indsendt en 13D/G inden for det seneste år. Tidligere viste vi den fulde historie af 13D/G-arkiver. Generelt skal enheder, der er forpligtet til at indgive 13D/G-ansøgninger, indgive mindst årligt, før de indsender en afsluttende ansøgning. Dog forlader fonde nogle gange positioner uden at indsende en afsluttende ansøgning (dvs. de afvikler), så visning af den fulde historie resulterede nogle gange i forvirring om det nuværende ejerskab. For at undgå forvirring viser vi nu kun 'aktuelle' ejere - det vil sige - ejere, der har anmeldt inden for det seneste år.

Upgrade to unlock premium data.

| Fil dato | Form | Investor | Forrige Aktier |

Seneste Aktier |

Δ Aktier (Procent) |

Ejendomsret (Procent) |

Δ Ejerskab (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-08-11 | UBS ASSET MANAGEMENT AMERICAS INC | 38,197,652 | 6.70 | |||||

| 2025-07-17 | BlackRock, Inc. | 28,865,330 | 5.20 | |||||

| 2025-06-27 | Thomas Schmidheiny | 37,818,703 | 6.67 |

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Select Equity Group, L.P. | 345.508 | 17.180 | ||||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 100 | 5 | ||||||

| 2025-08-14 | 13F | First Sabrepoint Capital Management Lp | 100.000 | 4.955 | ||||||

| 2025-08-27 | NP | BBIEX - Bridge Builder International Equity Fund | 257.287 | 12.834 | ||||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 143.373 | 7.129 | ||||||

| 2025-08-13 | 13F | River Road Asset Management, LLC | 826.587 | 42.255 | ||||||

| 2025-08-28 | NP | FARYX - Fulcrum Diversified Absolute Return Fund Super Institutional Class | 121 | 6 | ||||||

| 2025-08-13 | 13F | Diametric Capital, LP | 10.901 | 540 | ||||||

| 2025-07-31 | 13F | Caisse Des Depots Et Consignations | 1.931.802 | 103.159 | ||||||

| 2025-07-15 | 13F | Bfsg, Llc | 65.677 | 3.254 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 80.693 | 3.998 | ||||||

| 2025-08-14 | 13F | potrero capital research llc | 65.000 | 3.221 | ||||||

| 2025-08-14 | 13F | Alight Capital Management LP | 180.000 | 8.919 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 299.324 | 14.873 | ||||||

| 2025-08-13 | 13F | Gabelli Funds Llc | 21.848 | 1.083 | ||||||

| 2025-08-26 | NP | PPI - AXS Astoria Inflation Sensitive ETF | 5.413 | 269 | ||||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 147.500 | 7.309 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 17.928 | 889 | ||||||

| 2025-08-26 | 13F/A | MASTERINVEST Kapitalanlage GmbH | 18.321 | 908 | ||||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 46.956 | 2.334 | ||||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 77.810 | 3.870 | ||||||

| 2025-08-26 | NP | NOINX - Northern International Equity Index Fund | 156.116 | 7.788 | ||||||

| 2025-08-14 | 13F | Soros Fund Management Llc | 390.000 | 19.324 | ||||||

| 2025-08-04 | 13F | Virtus Family Office LLC | 5.104 | 253 | ||||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 5.052.035 | 251.203 | ||||||

| 2025-08-14 | 13F | AWH Capital, L.P. | 64.500 | 3.196 | ||||||

| 2025-08-11 | 13F | Greenland Capital Management LP | 12.025 | 596 | ||||||

| 2025-08-14 | 13F | USS Investment Management Ltd | 78.106 | 3.897 | ||||||

| 2025-08-28 | NP | New Age Alpha Funds Trust - NAA World Equity Income Fund Class P | 1.352 | 67 | ||||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 514.928 | 26 | ||||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 143 | 6 | ||||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 14.522 | 721 | ||||||

| 2025-08-14 | 13F | CastleKnight Management LP | 45.400 | 2.250 | ||||||

| 2025-08-07 | 13F/A | Credit Industriel Et Commercial | 2.202 | 109 | ||||||

| 2025-08-14 | 13F | Wexford Capital Lp | 18.421 | 919 | ||||||

| 2025-07-28 | 13F | Td Asset Management Inc | 164.715 | 8.190 | ||||||

| 2025-08-27 | 13F | Munro Partners | 37.325 | 1.849 | ||||||

| 2025-08-13 | 13F | Loomis Sayles & Co L P | 175.089 | 8.676 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 1.200 | 59 | ||||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 3.365 | 167 | ||||||

| 2025-08-29 | NP | MPLAX - Praxis International Index Fund Class A | 8.532 | 426 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 1.926.658 | 95 | ||||||

| 2025-08-14 | 13F | DC Investments Management, LLC | 16.245 | 805 | ||||||

| 2025-08-08 | 13F | Letko, Brosseau & Associates Inc | 274.148 | 13.632 | ||||||

| 2025-08-13 | 13F | Norges Bank | 13.445.492 | 670.915 | ||||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 8.220 | 407 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 43.313 | 2.146 | ||||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 93.023 | 4.609 | ||||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 316.665 | 15.732 | ||||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 5.346 | 301 | ||||||

| 2025-08-13 | 13F | Mackenzie Financial Corp | 53.165 | 2.653 | ||||||

| 2025-08-14 | 13F | DZ BANK AG Deutsche Zentral Genossenschafts Bank, Frankfurt am Main | 510.906 | 25.352 | ||||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 1.264.210 | 62.646 | ||||||

| 2025-08-05 | 13F | Hiddenite Capital Partners LP | 250.000 | 12.388 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 171.874 | 8.516 | ||||||

| 2025-08-26 | 13F/A | Thrivent Financial For Lutherans | 388.470 | 19 | ||||||

| 2025-08-01 | 13F | Bessemer Group Inc | 331.322 | 16 | ||||||

| 2025-08-13 | 13F | Groupe la Francaise | 1.210 | 60 | ||||||

| 2025-08-14 | 13F | Troluce Capital Advisors LLC | 210.000 | 10.406 | ||||||

| 2025-08-14 | 13F | Ulysses Management LLC | 250.000 | 12.388 | ||||||

| 2025-08-12 | 13F | Public Sector Pension Investment Board | 282.219 | 14.033 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 3.940 | 195 | ||||||

| 2025-08-12 | 13F | Prudential Plc | 15.108 | 754 | ||||||

| 2025-08-14 | 13F | Voya Investment Management Llc | 264.613 | 13.158 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 646.257 | 32.022 | ||||||

| 2025-07-09 | 13F | Norman Fields, Gottscho Capital Management, LLC | 8.140 | 0 | ||||||

| 2025-08-14 | 13F | Optiver Holding B.V. | 13.217 | 655 | ||||||

| 2025-08-04 | 13F | Covey Capital Advisors, LLC | 23.726 | 1.176 | ||||||

| 2025-08-13 | 13F | Centiva Capital, LP | 11.117 | 551 | ||||||

| 2025-08-05 | 13F | swisspartners Advisors Ltd | 6.500 | 324 | ||||||

| 2025-08-08 | 13F | Mitsubishi UFJ Trust & Banking Corp | 13.730 | 685 | ||||||

| 2025-08-14 | 13F | Towarzystwo Funduszy Inwestycyjnych Pzu Sa | 720 | 36 | ||||||

| 2025-07-28 | 13F | Allianz Asset Management GmbH | 3.188.111 | 158.530 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-11 | 13F | Lummis Asset Management, LP | 10.040 | 479 | ||||||

| 2025-07-21 | 13F | ASR Vermogensbeheer N.V. | 70.916 | 3.526 | ||||||

| 2025-08-25 | NP | QCVAX - Clearwater International Fund | 71.632 | 3.573 | ||||||

| 2025-08-13 | 13F | Grantham, Mayo, Van Otterloo & Co. LLC | 26.766 | 1.331 | ||||||

| 2025-08-14 | 13F | Alpine Global Management, LLC | 25.000 | 1.239 | ||||||

| 2025-08-14 | 13F | Cruiser Capital Advisors, Llc | 27.000 | 1.338 | ||||||

| 2025-08-14 | 13F | Royal London Asset Management Ltd | 93.838 | 4.650 | ||||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 89.885 | 4.454 | ||||||

| 2025-08-14 | 13F | 1060 Capital, LLC | 60.000 | 2.973 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 110 | 5 | ||||||

| 2025-08-14 | 13F | Sei Investments Co | 82.638 | 4.095 | ||||||

| 2025-08-14 | 13F | GWM Advisors LLC | 50 | 2 | ||||||

| 2025-08-27 | NP | TAAGX - Timothy Aggressive Growth Fund Class A | 29.969 | 1.485 | ||||||

| 2025-08-13 | 13F | Voss Capital, LLC | 44.305 | 2.195 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 680.835 | 33.735 | ||||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 386.125 | 19.261 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 15.454.489 | 765.770 | ||||||

| 2025-08-13 | 13F | MetLife Investment Management, LLC | 50.407 | 2.506 | ||||||

| 2025-08-05 | 13F | K.J. Harrison & Partners Inc | 10.000 | 496 | ||||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 783.106 | 38.803 | ||||||

| 2025-07-11 | 13F | Assenagon Asset Management S.A. | 35.387 | 1.760 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 429.990 | 21.306 | ||||||

| 2025-08-13 | 13F | Groupama Asset Managment | 25.635 | 1.001 | ||||||

| 2025-08-14 | 13F | Burkehill Global Management, LP | 50.000 | 2.478 | ||||||

| 2025-08-01 | 13F | Banco Santander, S.A. | 10.344 | 513 | ||||||

| 2025-08-14 | 13F | Principia Wealth Advisory, LLC | 8 | 0 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 71 | 0 | ||||||

| 2025-08-11 | 13F | Thames Capital Management Llc | 94.494 | 4.682 | ||||||

| 2025-08-21 | NP | MXINX - Great-West International Index Fund Investor Class | 77.976 | 3.890 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 1.808 | 90 | ||||||

| 2025-08-14 | 13F | Hrt Financial Lp | 156.582 | 8 | ||||||

| 2025-08-11 | 13F | Universal- Beteiligungs- und Servicegesellschaft mbH | 1.693.123 | 83.913 | ||||||

| 2025-08-13 | 13F | Rsm Us Wealth Management Llc | 5.144 | 257 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 2.294.135 | 114.073 | ||||||

| 2025-08-26 | NP | CIEQX - Segall Bryant & Hamill International Equity Fund - Institutional Class | 248 | 12 | ||||||

| 2025-07-21 | 13F | J. Safra Sarasin Holding AG | 8.649 | 423 | ||||||

| 2025-07-16 | 13F | Kirr Marbach & Co Llc /in/ | 74.174 | 3.675 | ||||||

| 2025-08-14 | 13F | Polymer Capital Management (US) LLC | 18.600 | 922 | ||||||

| 2025-08-14 | 13F | Maven Securities LTD | 11.935 | 591 | ||||||

| 2025-07-15 | 13F | Compagnie Lombard Odier SCmA | 471.800 | 23.460 | ||||||

| 2025-08-12 | 13F | Jefferies Financial Group Inc. | 75.896 | 3.761 | ||||||

| 2025-08-14 | 13F | First Manhattan Co | 2.364.164 | 117.144 | ||||||

| 2025-08-14 | 13F | Woodline Partners LP | 393.548 | 19.500 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 21.350.540 | 1.065.029 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 1.132.277 | 56.104 | ||||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 22.645 | 1.122 | ||||||

| 2025-08-13 | 13F | Cooper Creek Partners Management Llc | 1.248.289 | 62 | ||||||

| 2025-08-12 | 13F | APG Asset Management N.V. | 12.788 | 542 | ||||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 13.519 | 670 | ||||||

| 2025-08-13 | 13F | Dodge & Cox | 12.470.706 | 622.085 | ||||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 128.866 | 6.385 | ||||||

| 2025-08-14 | 13F | One Fin Capital Management LP | 415.000 | 20.563 | ||||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 4.886 | 244 | ||||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 225.000 | 11.149 | ||||||

| 2025-08-14 | 13F | Janus Henderson Group Plc | 306.539 | 15.240 | ||||||

| 2025-08-14 | 13F | PointState Capital LP | 578.633 | 28.671 | ||||||

| 2025-08-14 | 13F | Ancora Advisors, LLC | 4.170 | 207 | ||||||

| 2025-08-07 | 13F | DJE Kapital AG | 36.235 | 1.795 | ||||||

| 2025-08-14 | 13F | Axa S.a. | 21.486 | 1.065 | ||||||

| 2025-07-28 | 13F | Generali Asset Management SPA SGR | 99.353 | 3.932 | ||||||

| 2025-08-12 | 13F | Franklin Resources Inc | 395.626 | 19.744 | ||||||

| 2025-08-11 | 13F | Bislett Management, Llc | 50.000 | 2.478 | ||||||

| 2025-07-23 | 13F | Maryland State Retirement & Pension System | 46.703 | 2.331 | ||||||

| 2025-07-30 | 13F | Private Capital Advisors, Inc. | 4.668 | 233 | ||||||

| 2025-08-25 | NP | FPAG - FPA Global Equity ETF | 87.727 | 4.376 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 7.520 | 0 | ||||||

| 2025-08-12 | 13F | Nuveen, LLC | 1.310.934 | 65.184 | ||||||

| 2025-07-18 | 13F | Generali Investments CEE, investicni spolecnost, a.s. | 5.570 | 276 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 372.886 | 18.477 | ||||||

| 2025-08-07 | 13F | Aviva Plc | 598.487 | 29.836 | ||||||

| 2025-07-23 | 13F | Vontobel Holding Ltd. | 8.432.693 | 420.830 | ||||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 56 | 3 | ||||||

| 2025-08-13 | 13F | Brant Point Investment Management Llc | 45.000 | 2.230 | ||||||

| 2025-08-01 | 13F | Wesleyan Assurance Society | 48.768 | 2 | ||||||

| 2025-08-14 | 13F | Gates Capital Management, Inc. | 1.976.759 | 97.948 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 4.448.119 | 220.404 | ||||||

| 2025-08-14 | 13F | Manufacturers Life Insurance Company, The | 965.683 | 47.847 | ||||||

| 2025-08-14 | 13F | Moore Capital Management, Lp | 992.047 | 49.174 | ||||||

| 2025-08-12 | 13F | Legal & General Group Plc | 3.253.080 | 161.761 | ||||||

| 2025-08-13 | 13F | M&t Bank Corp | 4.102 | 205 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 30.491 | 1.511 | ||||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 12.343.881 | 611.639 | ||||||

| 2025-08-11 | NP | CIUEX - Six Circles International Unconstrained Equity Fund | 332.558 | 16.589 | ||||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 64.909 | 3.216 | ||||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 4.265 | 211 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 7.812.891 | 388.485 | ||||||

| 2025-08-12 | 13F | Union Square Park Capital Management, LLC | 30.000 | 1.486 | ||||||

| 2025-08-06 | 13F | Metis Global Partners, LLC | 12.723 | 635 | ||||||

| 2025-08-14 | 13F | Zurich Insurance Group Ltd/FI | 141.116 | 7.024 | ||||||

| 2025-08-12 | 13F | Deutsche Bank Ag\ | 4.354.301 | 215.756 | ||||||

| 2025-08-13 | 13F | BLI - Banque de Luxembourg Investments | 28.100 | 1.392 | ||||||

| 2025-08-14 | 13F | Quantinno Capital Management LP | 12.010 | 595 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Put | 737.100 | 36.523 | |||||

| 2025-08-15 | 13F | Harvest Fund Management Co., Ltd | 0 | 0 | ||||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 1.172.244 | 58.423 | ||||||

| 2025-08-14 | 13F | Clearline Capital LP | 106.026 | 5.254 | ||||||

| 2025-08-08 | 13F | Allianz Se | 1.610 | 80 | ||||||

| 2025-08-25 | 13F/A | Neuberger Berman Group LLC | 81.857 | 4.070 | ||||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 5.176 | 257 | ||||||

| 2025-07-16 | 13F | Pictet & Cie (Europe) SA | 22.199 | 1.104 | ||||||

| 2025-08-14 | 13F | FIL Ltd | 1.272.451 | 63.050 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 5.195 | 259 | ||||||

| 2025-08-11 | NP | CMIUX - Six Circles Managed Equity Portfolio International Unconstrained Fund | 158.283 | 7.896 | ||||||

| 2025-08-14 | 13F | Cantor Fitzgerald, L. P. | 7.703 | 382 | ||||||

| 2025-08-28 | NP | New Age Alpha Variable Funds Trust - NAA WORLD EQUITY INCOME SERIES | 3.316 | 165 | ||||||

| 2025-08-14 | 13F | Marathon Partners Equity Management, LLC | 20.000 | 991 | ||||||

| 2025-08-26 | NP | NOIGX - Northern International Equity Fund | 7.467 | 372 | ||||||

| 2025-08-14 | 13F | Cinctive Capital Management LP | 13.229 | 655 | ||||||

| 2025-07-15 | 13F | Pictet North America Advisors SA | 169.354 | 8.421 | ||||||

| 2025-08-13 | 13F | Korea Investment CORP | 283.663 | 14.105 | ||||||

| 2025-07-08 | 13F | Nbc Securities, Inc. | 2.853 | 0 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 12.317 | 1 | ||||||

| 2025-08-13 | 13F | Qtron Investments LLC | 18.974 | 943 | ||||||

| 2025-07-29 | 13F | Rockbridge Capital Management LLC | 40.276 | 1.996 | ||||||

| 2025-08-14 | 13F | Laurion Capital Management LP | 16.000 | 793 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 52.693 | 2.611 | ||||||

| 2025-08-14 | 13F | Holocene Advisors, LP | 20.384 | 1.010 | ||||||

| 2025-08-14 | 13F | AYAL Capital Advisors Ltd | 110.000 | 5.450 | ||||||

| 2025-08-26 | NP | GIIYX - International Equity Index Fund Institutional | 44.626 | 2.226 | ||||||

| 2025-08-11 | 13F | Great Lakes Advisors, Llc | 115.349 | 5.716 | ||||||

| 2025-08-13 | 13F | Wolf Hill Capital Management, LP | 950.000 | 47.072 | ||||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 9.097.290 | 452.350 | ||||||

| 2025-08-14 | 13F/A | Bank Julius Baer & Co. Ltd, Zurich | 1.924.419 | 79.595 | ||||||

| 2025-08-21 | NP | MXECX - Great-West Core Strategies: International Equity Fund Institutional Class | 14.735 | 735 | ||||||

| 2025-08-14 | 13F | Macquarie Group Ltd | 73.583 | 2.947 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 420.031 | 20.852 | ||||||

| 2025-08-13 | 13F | Westerkirk Capital Inc. | 2.700 | 134 | ||||||

| 2025-08-14 | 13F | Kailix Advisors LLC | 136.580 | 6.768 | ||||||

| 2025-08-14 | 13F | Scientech Research LLC | 18.194 | 902 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 42.143 | 2.088 | ||||||

| 2025-08-14 | 13F | SIH Partners, LLLP | 1.003.159 | 49.707 | ||||||

| 2025-08-14 | 13F | Cnh Partners Llc | 133.000 | 6.590 | ||||||

| 2025-08-27 | NP | BBTIX - Bridge Builder Tax Managed International Equity Fund | 2.590 | 129 | ||||||

| 2025-08-13 | 13F | Gamco Investors, Inc. Et Al | 40.384 | 2.001 | ||||||

| 2025-08-26 | NP | GIEYX - INTERNATIONAL EQUITY FUND Institutional | 9.315 | 465 | ||||||

| 2025-08-13 | 13F | Skandinaviska Enskilda Banken AB (publ) | 166.931 | 8.285 | ||||||

| 2025-08-12 | 13F | Artisan Partners Limited Partnership | 747.555 | 37.041 | ||||||

| 2025-08-14 | 13F | Limestone Investment Advisors LP | 30.000 | 1.486 | ||||||

| 2025-08-08 | 13F | Forsta Ap-fonden | 75.859 | 0 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 3.505.116 | 173.678 | ||||||

| 2025-07-16 | 13F | Banque Pictet & Cie Sa | 93.197 | 4.634 | ||||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 584 | 29 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | Call | 247.600 | 12.269 | |||||

| 2025-08-12 | 13F | ABN AMRO Bank N.V. | 8.568 | 428 | ||||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 158.397 | 7.849 | ||||||

| 2025-07-22 | 13F | Valley National Advisers Inc | 1.011 | 0 |