Grundlæggende statistik

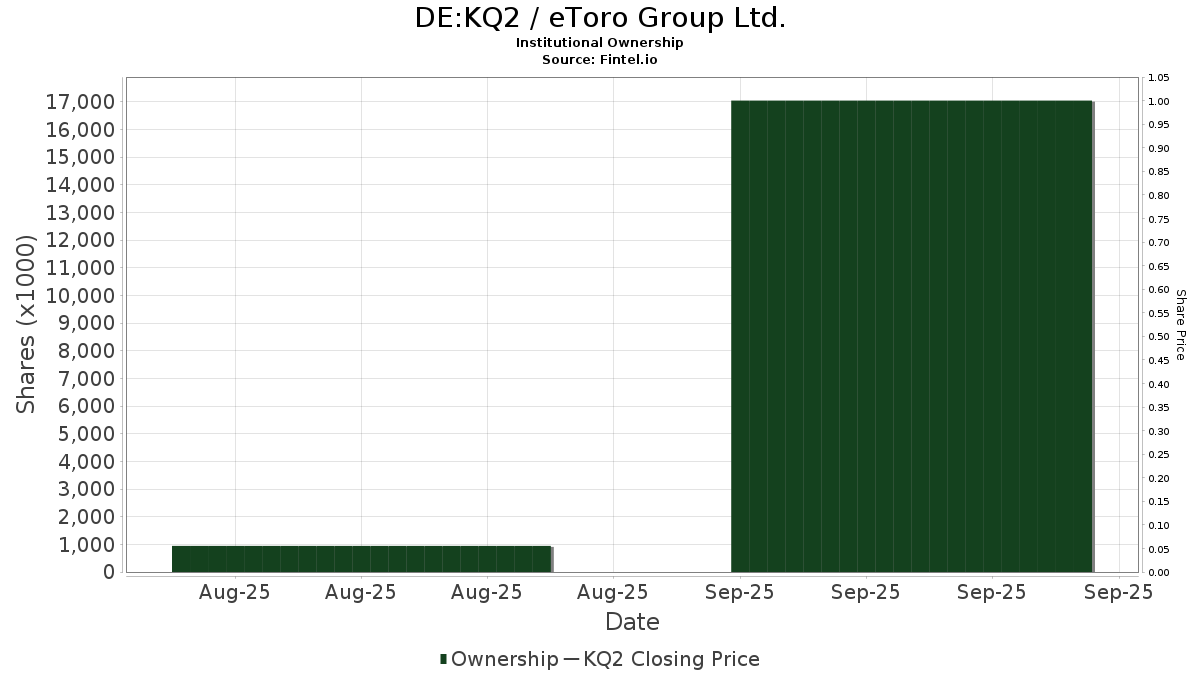

| Institutionelle aktier (lange) | 17.040.245 - 36,09% (ex 13D/G) |

| Institutionel værdi (lang) | $ 969.144 USD ($1000) |

Institutionelt ejerskab og aktionærer

eToro Group Ltd. (DE:KQ2) har 133 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 17,040,245 aktier. Største aktionærer omfatter BlackRock, Inc., T. Rowe Price Investment Management, Inc., GQG Partners LLC, Balyasny Asset Management Llc, Capital World Investors, Fmr Llc, ExodusPoint Capital Management, LP, Adage Capital Partners Gp, L.l.c., Wellington Management Group Llp, and Price T Rowe Associates Inc /md/ .

eToro Group Ltd. (DB:KQ2) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Symmetry Peak Management Llc | Call | 14.600 | 972 | |||||

| 2025-08-14 | 13F | Limestone Investment Advisors LP | 45.000 | 2.997 | ||||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1.917 | 128 | ||||||

| 2025-08-11 | 13F | Monashee Investment Management LLC | 77.500 | 5.161 | ||||||

| 2025-08-14 | 13F | Ghisallo Capital Management LLC | 100.000 | 6.659 | ||||||

| 2025-08-13 | 13F | Capital World Investors | 588.250 | 39.172 | ||||||

| 2025-07-28 | 13F | Harbour Investments, Inc. | 200 | 13 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 10.048 | 669 | ||||||

| 2025-08-13 | 13F | Pictet Asset Management Holding SA | 87.960 | 5.857 | ||||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 837 | 54 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 23.024 | 2 | ||||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | 207.733 | 13.833 | ||||||

| 2025-08-14 | 13F | Millennium Management Llc | 256.910 | 17.108 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 500 | 33 | ||||||

| 2025-08-14 | 13F | Tiger Global Management Llc | 80.000 | 5.327 | ||||||

| 2025-08-11 | 13F | Citigroup Inc | 340 | 23 | ||||||

| 2025-08-14 | 13F | Alyeska Investment Group, L.P. | 160.000 | 10.654 | ||||||

| 2025-08-14 | 13F | Softbank Group Corp | 397.998 | 26.503 | ||||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 55.998 | 3.729 | ||||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 20.000 | 1.332 | ||||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 651.703 | 43.397 | ||||||

| 2025-08-14 | 13F | Weiss Asset Management LP | 37.685 | 2.509 | ||||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 13.900 | 926 | ||||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 2.500 | 160 | ||||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 1.000 | 67 | ||||||

| 2025-08-14 | 13F | Adage Capital Partners Gp, L.l.c. | 507.763 | 33.812 | ||||||

| 2025-08-13 | 13F | Seven Grand Managers, Llc | 25.000 | 1.665 | ||||||

| 2025-08-12 | 13F | Eisler Capital Management Ltd. | 50.000 | 3.325 | ||||||

| 2025-08-14 | 13F | Whetstone Capital Advisors, LLC | 34.562 | 2.301 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 48.817 | 3.251 | ||||||

| 2025-08-14 | 13F | Jain Global LLC | 61.365 | 4.086 | ||||||

| 2025-08-13 | 13F | Invesco Ltd. | 231.148 | 15.392 | ||||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 1.803 | 120 | ||||||

| 2025-07-22 | 13F | IMC-Chicago, LLC | 14.801 | 986 | ||||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 4.601 | 289 | ||||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 118.795 | 7.911 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-13 | 13F | Norges Bank | 245.000 | 16.315 | ||||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 260.703 | 17.360 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 3.482 | 232 | ||||||

| 2025-08-13 | 13F | Federated Hermes, Inc. | 170.000 | 11.320 | ||||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 87.900 | 5.853 | ||||||

| 2025-08-06 | 13F | Atlantic Union Bankshares Corp | 100 | 7 | ||||||

| 2025-08-14 | 13F | Fmr Llc | 529.811 | 35.280 | ||||||

| 2025-08-14 | 13F | Sandia Investment Management LP | 10.000 | 666 | ||||||

| 2025-08-14 | 13F | Zimmer Partners, LP | 11.000 | 732 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 34.215 | 2.278 | ||||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 167.143 | 11.130 | ||||||

| 2025-08-14 | 13F | T. Rowe Price Investment Management, Inc. | 1.351.228 | 90 | ||||||

| 2025-08-14 | 13F | Davidson Kempner Capital Management Lp | 30.000 | 1.998 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 51.000 | 3.396 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 27.000 | 1.798 | |||||

| 2025-07-21 | 13F | Hennessy Advisors Inc | 15.000 | 999 | ||||||

| 2025-08-14 | 13F | Fortress Investment Group LLC | 125.000 | 8.324 | ||||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 100.000 | 6.659 | |||||

| 2025-08-28 | NP | BITQ - Bitwise Crypto Industry Innovators ETF | 55.998 | 3.729 | ||||||

| 2025-08-11 | 13F | Nikko Asset Management Americas, Inc. | 419.355 | 27.875 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 20.013 | 1.333 | ||||||

| 2025-08-14 | 13F | Cinctive Capital Management LP | 4.117 | 274 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 19.072 | 1.270 | ||||||

| 2025-08-13 | 13F | Healthcare Of Ontario Pension Plan Trust Fund | 100.000 | 6.659 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | Call | 49.700 | 3.310 | |||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 4.000 | 266 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 35 | 2 | ||||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | Put | 49.700 | 3.310 | |||||

| 2025-08-13 | 13F | MYDA Advisors LLC | Call | 100.000 | 6.659 | |||||

| 2025-08-13 | 13F | MYDA Advisors LLC | 32.000 | 2.131 | ||||||

| 2025-08-26 | NP | TTEQ - T. Rowe Price Technology ETF | 1.500 | 100 | ||||||

| 2025-08-14 | 13F | Boothbay Fund Management, Llc | 16.731 | 1.114 | ||||||

| 2025-08-14 | 13F | Arizona PSPRS Trust | 4.186 | 279 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 54.100 | 3.603 | |||||

| 2025-08-14 | 13F | Penn Capital Management Co Inc | 183.949 | 12.280 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 225.850 | 15.039 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 64.700 | 4.308 | |||||

| 2025-07-23 | 13F | Meitav Dash Investments Ltd | 5.500 | 366 | ||||||

| 2025-08-13 | 13F | Walleye Capital LLC | 20.000 | 1.332 | ||||||

| 2025-07-28 | 13F | Td Asset Management Inc | 112.620 | 7.499 | ||||||

| 2025-08-13 | 13F | GQG Partners LLC | 871.976 | 58.065 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 3.332 | 222 | ||||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 510.787 | 34 | ||||||

| 2025-08-14 | 13F | Plustick Management Llc | 30.000 | 1.998 | ||||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 100 | 7 | ||||||

| 2025-08-14 | 13F | Freestone Grove Partners LP | 35.000 | 2.331 | ||||||

| 2025-08-14 | 13F | Scientech Research LLC | 15.915 | 1.060 | ||||||

| 2025-08-11 | 13F | Nomura Asset Management Co Ltd | 0 | 0 | ||||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 458.926 | 31 | ||||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 4.086 | 272 | ||||||

| 2025-08-14 | 13F | Shay Capital LLC | Call | 5.000 | 333 | |||||

| 2025-08-14 | 13F | Granahan Investment Management Inc/ma | 198.140 | 13.194 | ||||||

| 2025-08-14 | 13F | Saba Capital Management, L.P. | 260.000 | 17.313 | ||||||

| 2025-08-14 | 13F | Longaeva Partners L.P. | 27.785 | 1.850 | ||||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 225.000 | 14.983 | ||||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 248.032 | 16.516 | ||||||

| 2025-08-14 | 13F | Masters Capital Management Llc | 100.000 | 6.659 | ||||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON Federated Strategic Value Dividend Portfolio | 2.980 | 198 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 2.768 | 184 | ||||||

| 2025-07-30 | 13F | Phoenix Holdings Ltd. | 3.723 | 248 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | Call | 13 | 0 | |||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 108.224 | 7.207 | ||||||

| 2025-08-14 | 13F | Wellington Management Group Llp | 500.406 | 33.322 | ||||||

| 2025-07-18 | 13F | PFG Investments, LLC | 4.175 | 278 | ||||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 117.371 | 7.816 | ||||||

| 2025-08-14 | 13F | LMR Partners LLP | 61.638 | 4.104 | ||||||

| 2025-08-14 | 13F | CastleKnight Management LP | 52.000 | 3.463 | ||||||

| 2025-08-14 | 13F | Holocene Advisors, LP | 7.384 | 492 | ||||||

| 2025-07-30 | 13F | Bogart Wealth, LLC | 21 | 1 | ||||||

| 2025-08-15 | 13F | Ion Asset Management Ltd. | 200.000 | 13.318 | ||||||

| 2025-08-19 | 13F | Marex Group plc | 52.556 | 3.500 | ||||||

| 2025-08-08 | 13F | Massachusetts Financial Services Co /ma/ | 251.450 | 16.744 | ||||||

| 2025-08-12 | 13F | American Century Companies Inc | 100.083 | 6.665 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | Call | 180.000 | 12 | |||||

| 2025-07-23 | 13F | Guild Investment Management, Inc. | 22.050 | 1.468 | ||||||

| 2025-08-14 | 13F | Perbak Capital Partners LLP | 3.794 | 253 | ||||||

| 2025-08-14 | 13F | Azora Capital LP | 192.680 | 12.831 | ||||||

| 2025-08-12 | 13F | BlackRock, Inc. | 2.001.664 | 133.291 | ||||||

| 2025-08-14 | 13F | Sphera Management Technology Funds Ltd | 20.000 | 1.332 | ||||||

| 2025-08-13 | 13F | Intrinsic Edge Capital Management LLC | 5.000 | 333 | ||||||

| 2025-08-14 | 13F | Prana Capital Management, LP | 20.143 | 1.341 | ||||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 35 | 2 | ||||||

| 2025-08-14 | 13F | BlueCrest Capital Management Ltd | 252.000 | 16.781 | ||||||

| 2025-08-05 | 13F | Pier Capital, LLC | 77.743 | 5.177 | ||||||

| 2025-08-14 | 13F | Woodline Partners LP | 35.000 | 2.331 | ||||||

| 2025-08-14 | 13F | Burkehill Global Management, LP | 50.000 | 3.330 | ||||||

| 2025-08-14 | 13F | Cohen & Steers, Inc. | 2.500 | 0 | ||||||

| 2025-08-27 | NP | OHIO NATIONAL FUND INC - ON BlackRock Advantage Small Cap Growth Portfolio | 2.631 | 175 | ||||||

| 2025-08-13 | 13F | Diametric Capital, LP | 3.465 | 231 | ||||||

| 2025-08-14 | 13F | Soros Fund Management Llc | 160.000 | 10.654 | ||||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 101.674 | 6.771 | ||||||

| 2025-07-31 | 13F | Sumitomo Mitsui Trust Holdings, Inc. | 421.205 | 28.048 | ||||||

| 2025-08-19 | 13F | Newbridge Financial Services Group, Inc. | 1.230 | 82 | ||||||

| 2025-08-29 | NP | JAEQX - Small Company Value Trust NAV | 4.609 | 307 | ||||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 103.617 | 6.900 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 358.778 | 23.891 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 7.270 | 0 | ||||||

| 2025-08-14 | 13F | Point72 Europe (London) LLP | 2.101 | 140 | ||||||

| 2025-07-29 | 13F | Conway Capital Management, Inc. | 5.850 | 390 | ||||||

| 2025-08-14 | 13F | Altshuler Shaham Ltd | 399.995 | 26.636 | ||||||

| 2025-07-29 | 13F | International Assets Investment Management, Llc | 7.720 | 514 | ||||||

| 2025-08-11 | 13F | Greenland Capital Management LP | 5.032 | 335 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 133.435 | 9 | ||||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 273.000 | 18.179 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 111.600 | 7.431 |

Other Listings

| US:ETOR | 44,14 $ |