Grundlæggende statistik

| Institutionelle ejere | 139 total, 130 long only, 2 short only, 7 long/short - change of -9,15% MRQ |

| Del pris | 37,20 |

| Gennemsnitlig porteføljeallokering | 0.3383 % - change of -14,27% MRQ |

| Institutionelle aktier (lange) | 8.248.141 (ex 13D/G) - change of -0,20MM shares -2,33% MRQ |

| Institutionel værdi (lang) | $ 455.910 USD ($1000) |

Institutionelt ejerskab og aktionærer

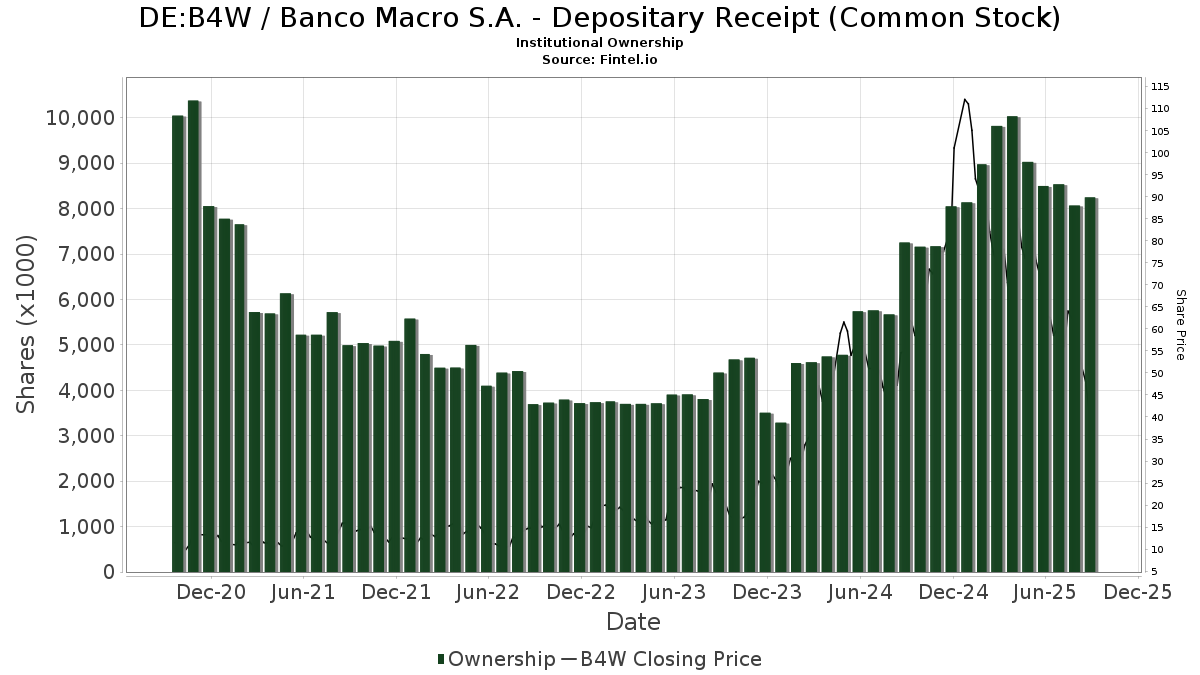

Banco Macro S.A. - Depositary Receipt (Common Stock) (DE:B4W) har 139 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 8,248,187 aktier. Største aktionærer omfatter AIM INVESTMENT FUNDS (INVESCO INVESTMENT FUNDS) - Invesco Oppenheimer International Bond Fund Class R6, TT International Asset Management LTD, ARGT - Global X MSCI Argentina ETF, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd., AIM INVESTMENT FUNDS (INVESCO INVESTMENT FUNDS) - Invesco Oppenheimer Global Strategic Income Fund Class R6, PointState Capital LP, Morgan Stanley, Susquehanna International Group, Llp, Millennium Management Llc, and Cape Ann Asset Management Ltd .

Banco Macro S.A. - Depositary Receipt (Common Stock) (DB:B4W) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 15, 2025 is 37,20 / share. Previously, on September 16, 2024, the share price was 61,00 / share. This represents a decline of 39,02% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-21 | 13F | Ameritas Advisory Services, LLC | 4 | 0 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 14.200 | -57,36 | 997 | -60,38 | ||||

| 2025-06-23 | NP | UBPIX - Ultralatin America Profund Investor Class | 436 | 39 | ||||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 37.118 | 12,75 | 2.606 | 4,87 | ||||

| 2025-07-24 | 13F | Ramirez Asset Management, Inc. | 33.433 | 94,97 | 2.347 | 81,38 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2.004 | -77,88 | 141 | -79,50 | ||||

| 2025-05-09 | 13F | JGP Global Gestao de Recursos Ltda. | 0 | -100,00 | 0 | |||||

| 2025-06-23 | NP | Global Macro Portfolio - Global Macro Portfolio | 9.553 | 19,41 | 846 | 6,29 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 4.350 | 0,00 | 305 | -7,01 | ||||

| 2025-05-16 | 13F/A | Axiom International Investors Llc /de | 39.871 | -86,84 | 3.011 | -89,73 | ||||

| 2025-05-13 | 13F | Quadrature Capital Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-29 | NP | AIM VARIABLE INSURANCE FUNDS (INVESCO VARIABLE INSURANCE FUNDS) - Invesco Oppenheimer V.I. Global Strategic Income Fund Series II | 170.000 | 0,00 | 1.193 | -23,88 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | FIL Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 85.228 | 1,38 | 5.984 | -5,73 | ||||

| 2025-05-15 | 13F | Maple Rock Capital Partners Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Invesco Ltd. | 14.445 | -39,89 | 1.014 | -44,10 | ||||

| 2025-08-14 | 13F | Schonfeld Strategic Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Measured Wealth Private Client Group, LLC | 7.365 | 517 | ||||||

| 2025-08-26 | NP | EHLS - Even Herd Long Short ETF | 7.814 | -15,29 | 549 | -21,26 | ||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | Call | 16.700 | 119,74 | 1.173 | 104,54 | |||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Oaktree Capital Management Lp | 60.591 | -76,74 | 4.254 | -78,37 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 213.240 | 453,97 | 14.972 | 415,18 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 290.400 | 114,16 | 20.389 | 99,12 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 77.800 | -33,96 | 5.462 | -38,59 | |||

| 2025-08-01 | 13F | Shilanski & Associates, Inc. | 4.768 | -0,10 | 335 | -7,22 | ||||

| 2025-05-15 | 13F | Hood River Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Monaco Asset Management SAM | 13.000 | 225,00 | 913 | 201,99 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 79.947 | 14,64 | 5.613 | 6,61 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 286.592 | 813,62 | 20.122 | 749,70 | ||||

| 2025-08-14 | 13F | TCG Advisory Services, LLC | 3.828 | 13,39 | 269 | 5,51 | ||||

| 2025-07-21 | 13F | Ping Capital Management, Inc. | 121.004 | -7,14 | 8.496 | -13,66 | ||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Laurion Capital Management LP | 3.000 | 0,00 | 211 | -7,08 | ||||

| 2025-05-15 | 13F | Aqr Capital Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Atria Investments Llc | 7.754 | -2,17 | 544 | -9,03 | ||||

| 2025-08-13 | 13F | Amundi | 16.433 | -22,21 | 1.142 | -27,54 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 29.875 | 117,99 | 2.098 | 102,80 | ||||

| 2025-05-07 | 13F | Nkcfo Llc | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Deuterium Capital Management, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 7.800 | 548 | |||||

| 2025-08-14 | 13F | Gemsstock Ltd. | 196.725 | -4,84 | 13.812 | -11,51 | ||||

| 2025-08-28 | NP | IDVO - Amplify International Enhanced Dividend Income ETF | 41.572 | 20,91 | 2.919 | 12,40 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 35.400 | 218,92 | 2.485 | 196,54 | |||

| 2025-07-21 | 13F | Mirae Asset Global Investments Co., Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 11.989 | 469,82 | 842 | 432,28 | ||||

| 2025-08-04 | 13F | GAM Holding AG | 4.781 | 336 | ||||||

| 2025-08-14 | 13F | Diversify Wealth Management, Llc | 3.541 | -84,14 | 259 | -87,17 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | Call | 30.500 | 30,34 | 2.141 | 21,23 | |||

| 2025-08-14 | 13F | Integrated Wealth Concepts LLC | 5.128 | 360 | ||||||

| 2025-04-29 | 13F | Truist Financial Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 83.393 | 24,81 | 5.855 | 16,06 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Call | 6.400 | 20,75 | 0 | ||||

| 2025-08-11 | 13F | Cape Ann Asset Management Ltd | 277.516 | 38,07 | 19.484 | 28,38 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 40 | -86,06 | 3 | -90,48 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 27.500 | 145,54 | 2 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 20.843 | 952,68 | 1 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 265.740 | -22,67 | 18.658 | -28,10 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 490 | -17,09 | 34 | -22,73 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 5 | -50,00 | 0 | |||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 1.816 | 96,75 | 128 | 84,06 | ||||

| 2025-08-04 | 13F | Hantz Financial Services, Inc. | 334 | 6.580,00 | 0 | |||||

| 2025-05-15 | 13F | Jain Global LLC | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | AdvisorShares Investments LLC | 22.703 | 18,68 | 1.594 | 8,59 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 120.191 | 4.089,30 | 8.439 | 3.806,48 | ||||

| 2025-05-15 | 13F | Verition Fund Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Erste Asset Management GmbH | 10.000 | 0,00 | 716 | -8,68 | ||||

| 2025-06-30 | NP | AIM INVESTMENT FUNDS (INVESCO INVESTMENT FUNDS) - Invesco Oppenheimer International Bond Fund Class R6 | 950.000 | 0,00 | 8.506 | -20,92 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 61.558 | -25,80 | 4.322 | -31,02 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 22.500 | -69,43 | 1.580 | -71,59 | |||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 5.146 | 0 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 14.800 | 34,55 | 1.039 | 25,18 | |||

| 2025-08-11 | 13F | Lsv Asset Management | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Discovery Capital Management, Llc / Ct | 23.400 | 1.643 | ||||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 25.310 | 57,69 | 1.777 | 177.600,00 | ||||

| 2025-08-14 | 13F | CIBC World Markets Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 31 | 2 | ||||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 107 | 8 | ||||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 32.747 | 16,82 | 2.299 | 8,65 | ||||

| 2025-08-05 | 13F | Claro Advisors LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-05-12 | 13F | Fmr Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Hsbc Holdings Plc | 20.253 | -31,93 | 1.431 | -36,96 | ||||

| 2025-05-13 | 13F | Alliance Wealth Advisors, LLC /UT | 0 | -100,00 | 0 | |||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 749 | -27,21 | 53 | -32,47 | ||||

| 2025-08-12 | 13F | Ci Investments Inc. | 98.392 | 41,22 | 7 | 20,00 | ||||

| 2025-05-15 | 13F | Mariner, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 655 | 46 | ||||||

| 2025-07-30 | NP | APIE - ActivePassive International Equity ETF | 3.876 | -20,52 | 328 | -19,85 | ||||

| 2025-07-28 | 13F | Bayforest Capital Ltd | 234 | 16 | ||||||

| 2025-08-07 | 13F | Capital Wealth Planning, LLC | 21.802 | -36,59 | 1.531 | -41,06 | ||||

| 2025-07-08 | 13F | Northwest & Ethical Investments L.P. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-29 | 13F | Beverly Hills Private Wealth, LLC | 4.070 | -4,46 | 286 | -11,21 | ||||

| 2025-05-27 | NP | NMMEX - Active M Emerging Markets Equity Fund | 2.285 | -67,43 | 173 | -74,63 | ||||

| 2025-08-12 | 13F | SPX Equities Gestao de Recursos Ltda | 41.483 | -49,33 | 2.913 | -52,90 | ||||

| 2025-03-26 | NP | MCYAX - MainStay Candriam Emerging Markets Equity Fund Class A | 3.200 | -65,96 | 318 | -56,73 | ||||

| 2025-07-25 | 13F | NorthRock Partners, LLC | 6.000 | 0,00 | 421 | -7,06 | ||||

| 2025-08-14 | 13F | Militia Capital Partners, LP | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 56.568 | 0,00 | 3.972 | -7,02 | ||||

| 2025-08-06 | 13F | Titan Global Capital Management Usa Llc | 8.368 | 4,01 | 588 | -3,29 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 579 | -86,06 | 41 | -87,22 | ||||

| 2025-07-30 | 13F | Eqis Capital Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-07-09 | 13F | Crocodile Capital Partners GmbH | 7.500 | 0,00 | 527 | -7,07 | ||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1 | 0,00 | 0 | |||||

| 2025-08-06 | 13F | Fox Run Management, L.l.c. | 4.089 | -53,68 | 287 | -56,91 | ||||

| 2025-05-28 | NP | WBENX - William Blair Emerging Markets Growth Fund Class N | 39.793 | 23,62 | 3.005 | -3,53 | ||||

| 2025-08-14 | 13F | Banco BTG Pactual S.A. | 5.850 | -86,27 | 411 | -87,25 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 117.770 | 10,01 | 8.269 | 2,29 | ||||

| 2025-08-15 | 13F | Duquesne Family Office LLC | 220.900 | -48,84 | 16 | -53,12 | ||||

| 2025-08-14 | 13F | PointState Capital LP | 435.374 | 73,19 | 30.568 | 61,03 | ||||

| 2025-08-14 | 13F | Stifel Financial Corp | 15.539 | -0,36 | 1.091 | -7,39 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1.128 | -1,91 | 79 | -8,14 | ||||

| 2025-08-14 | 13F | Tudor Investment Corp Et Al | Call | 6.000 | 15,38 | 421 | 7,40 | |||

| 2025-08-19 | 13F | Marex Group plc | 14.493 | 1.018 | ||||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 18.337 | 65,99 | 1.287 | 54,32 | ||||

| 2025-06-23 | NP | Global Macro Absolute Return Advantage Portfolio - Global Macro Absolute Return Advantage Portfolio | 37.671 | 24,46 | 3.335 | 10,76 | ||||

| 2025-06-27 | NP | ARGT - Global X MSCI Argentina ETF This fund is a listed as child fund of Mirae Asset Global Investments Co., Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 567.141 | -9,23 | 50.203 | -19,20 | ||||

| 2025-07-30 | 13F | Wallace Advisory Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 9.330 | 0,14 | 655 | -6,83 | ||||

| 2025-04-15 | 13F | Redhawk Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-16 | 13F | ABS Direct Equity Fund LLC | 3.695 | -9,88 | 259 | -16,18 | ||||

| 2025-08-13 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | NP | QGBLX - Quantified Global Fund Investor Class | 5.653 | 397 | ||||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 511 | -93,44 | 36 | -94,05 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 72 | -77,85 | 5 | -79,17 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 9.718 | 67,55 | 1 | |||||

| 2025-08-14 | 13F | Barometer Capital Management Inc. | 8.871 | 11,29 | 619 | 3,00 | ||||

| 2025-08-12 | 13F | Personal Cfo Solutions, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Berbice Capital Management LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 536.497 | -6,28 | 37.667 | -12,86 | ||||

| 2025-06-30 | NP | AIM INVESTMENT FUNDS (INVESCO INVESTMENT FUNDS) - Invesco Oppenheimer Global Strategic Income Fund Class R6 | 530.000 | 0,00 | 4.745 | -20,92 | ||||

| 2025-07-11 | 13F | Harbour Capital Advisors, LLC | 4.995 | -1,38 | 347 | -7,96 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 1.029 | 743,44 | 72 | 700,00 | ||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Atlas Capital Advisors Llc | 4.806 | 0,00 | 337 | -6,91 | ||||

| 2025-05-05 | 13F | Kestra Private Wealth Services, Llc | 0 | -100,00 | 0 | |||||

| 2025-04-28 | 13F | D.a. Davidson & Co. | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 50 | 1.566,67 | 4 | |||||

| 2025-08-25 | NP | AADR - AdvisorShares Dorsey Wright ADR ETF | 22.703 | 18,68 | 1.594 | 10,32 | ||||

| 2025-08-06 | 13F | First Horizon Advisors, Inc. | 814 | 57 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Glenorchy Capital Ltd | 50.759 | -1,69 | 3.564 | -8,59 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 354.414 | 71,93 | 24.883 | 59,87 | ||||

| 2025-08-05 | 13F | X-Square Capital, LLC | 5.440 | -9,33 | 0 | |||||

| 2025-07-09 | 13F | Systrade AG | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northern Trust Corp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 31.634 | 2.221 | ||||||

| 2025-07-16 | 13F | ORG Wealth Partners, LLC | 91 | 0,00 | 6 | 0,00 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 15.652 | 148,64 | 1.099 | 131,16 | ||||

| 2025-06-23 | NP | Global Macro Capital Opportunities Portfolio - Global Macro Capital Opportunities Portfolio | 77.755 | 45,86 | 6.883 | 29,82 | ||||

| 2025-08-14 | 13F | Turim 21 Investimentos Ltda. | 8.675 | 609 | ||||||

| 2025-08-08 | 13F | Cetera Investment Advisers | 13.925 | 3,33 | 978 | -3,93 | ||||

| 2025-08-04 | 13F | Yorktown Management & Research Co Inc | 5.100 | 0,00 | 358 | -7,01 | ||||

| 2025-08-05 | 13F | Sigma Planning Corp | 6.275 | 0,00 | 441 | -6,98 | ||||

| 2025-08-14 | 13F | Brevan Howard Capital Management LP | 90.357 | -14,34 | 6.565 | -15,93 | ||||

| 2025-08-13 | 13F | Mirabella Financial Services Llp | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 544 | -29,81 | 38 | -34,48 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 25.253 | 59,86 | 1.773 | 48,74 | ||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | Short | -46 | -3 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 265.284 | 0,00 | 18.626 | -7,02 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1.270 | -28,65 | 89 | -34,07 | ||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 44.775 | 3.144 | ||||||

| 2025-07-10 | 13F | TT International Asset Management LTD | 894.385 | -7,15 | 62.795 | -13,67 | ||||

| 2025-08-08 | 13F | Candriam Luxembourg S.C.A. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 45.900 | -17,89 | 3.223 | -23,67 | |||

| 2025-08-14 | 13F | Caption Management, LLC | 41.478 | 26,00 | 2.912 | 17,18 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 81.700 | 108,05 | 5.736 | 93,46 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Walleye Capital LLC | 9.390 | 659 | ||||||

| 2025-08-14 | 13F | Peak6 Llc | Put | 0 | -100,00 | 0 | ||||

| 2025-04-16 | 13F | Byrne Asset Management LLC | 0 | -100,00 | 0 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Peak6 Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | UBS Group AG | 39.842 | 99,69 | 2.797 | 85,72 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 7.814 | -15,29 | 549 | -21,26 | ||||

| 2025-08-08 | 13F | Fiera Capital Corp | 71.498 | 5.020 | ||||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 4.700 | 336 | |||||

| 2025-08-13 | 13F | Walleye Trading LLC | Call | 2.600 | 2.500,00 | 183 | 2.500,00 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | Put | 81.900 | -33,58 | 5.750 | -38,24 | |||

| 2025-08-13 | 13F | Walleye Trading LLC | 76.983 | -21,47 | 5.405 | -26,98 | ||||

| 2025-08-08 | 13F | Wrapmanager Inc | 3.337 | -4,55 | 234 | -11,03 | ||||

| 2025-08-14 | 13F | Rokos Capital Management LLP | 37.683 | 0,00 | 2.645 | -6,77 | ||||

| 2025-08-11 | 13F | Dorsey Wright & Associates | 32.170 | -38,65 | 2.259 | -42,94 | ||||

| 2025-03-27 | NP | REMSX - Emerging Markets Fund Class S | 12.744 | 46,15 | 1.267 | 85,78 | ||||

| 2025-07-29 | 13F | William Blair Investment Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-16 | 13F | ORG Partners LLC | 71 | 57,78 | 5 | 100,00 | ||||

| 2025-05-15 | 13F | D. E. Shaw & Co., Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 52 | 85,71 | 4 | 50,00 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Diversify Advisory Services, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Quantbot Technologies LP | 3.308 | -60,67 | 232 | -63,46 | ||||

| 2025-08-25 | NP | EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class | 1.900 | 0,00 | 133 | -6,99 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Burns Matteson Capital Management, LLC | 3.777 | 40,99 | 265 | 31,19 | ||||

| 2025-08-12 | 13F | Sagil Capital Llp | 143.765 | 10.094 | ||||||

| 2025-05-14 | 13F | Absolute Gestao de Investimentos Ltda. | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Insigneo Advisory Services, Llc | 9.603 | 130,07 | 674 | 113,97 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-25 | 13F | Legal Advantage Investments, Inc. | 7.850 | 0,00 | 551 | -6,93 | ||||

| 2025-07-29 | 13F | Activest Wealth Management | 9.826 | -3,04 | 690 | -9,93 | ||||

| 2025-06-30 | NP | APITX - Yorktown Growth Fund Class L Shares | 5.100 | 0,00 | 451 | -11,05 |