Grundlæggende statistik

| Institutionelle ejere | 6 total, 6 long only, 0 short only, 0 long/short - change of -1,67% MRQ |

| Gennemsnitlig porteføljeallokering | 0.3109 % - change of -4,77% MRQ |

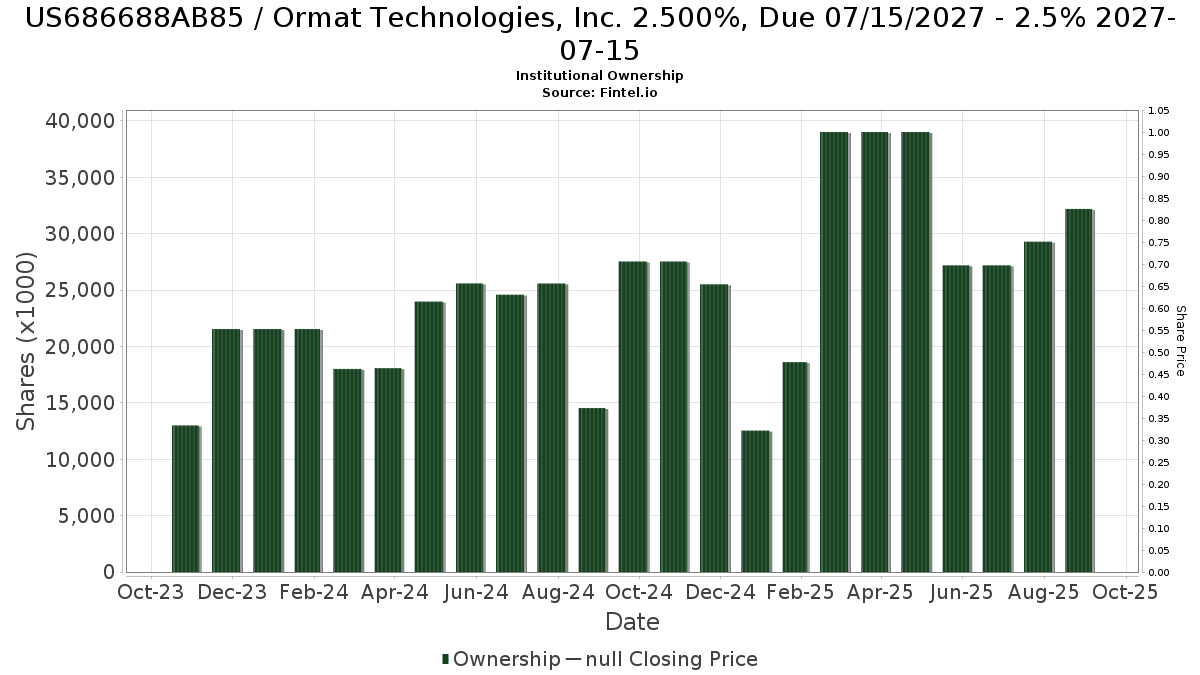

| Institutionelle aktier (lange) | 32.201.280 (ex 13D/G) - change of 5,00MM shares 18,39% MRQ |

| Institutionel værdi (lang) | $ 26.406 USD ($1000) |

Institutionelt ejerskab og aktionærer

Ormat Technologies, Inc. 2.500%, Due 07/15/2027 (US:US686688AB85) har 6 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 32,201,280 aktier. Største aktionærer omfatter Absolute Investment Advisers Llc, Ofi Invest Asset Management, BNP Paribas Asset Management Holding S.A., Fort Baker Capital Management LP, Bank of New York Mellon Corp, and Boussard & Gavaudan Investment Management LLP .

Ormat Technologies, Inc. 2.500%, Due 07/15/2027 (US686688AB85) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.