Grundlæggende statistik

| Institutionelle aktier (lange) | 58.035.252 - 45,81% (ex 13D/G) - change of -3,22MM shares -5,26% MRQ |

| Institutionel værdi (lang) | $ 91.900 USD ($1000) |

Institutionelt ejerskab og aktionærer

Vor Biopharma Inc. (US:VOR) har 68 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 58,035,252 aktier. Største aktionærer omfatter Ra Capital Management, L.p., 5AM Venture Management, LLC, Susquehanna International Group, Llp, Fmr Llc, Vanguard Group Inc, UBS Group AG, FDGRX - Fidelity Growth Company Fund, VTSMX - Vanguard Total Stock Market Index Fund Investor Shares, Johnson & Johnson, and Citadel Advisors Llc .

Vor Biopharma Inc. (NasdaqGS:VOR) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 10, 2025 is 1,80 / share. Previously, on September 11, 2024, the share price was 1,06 / share. This represents an increase of 69,81% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

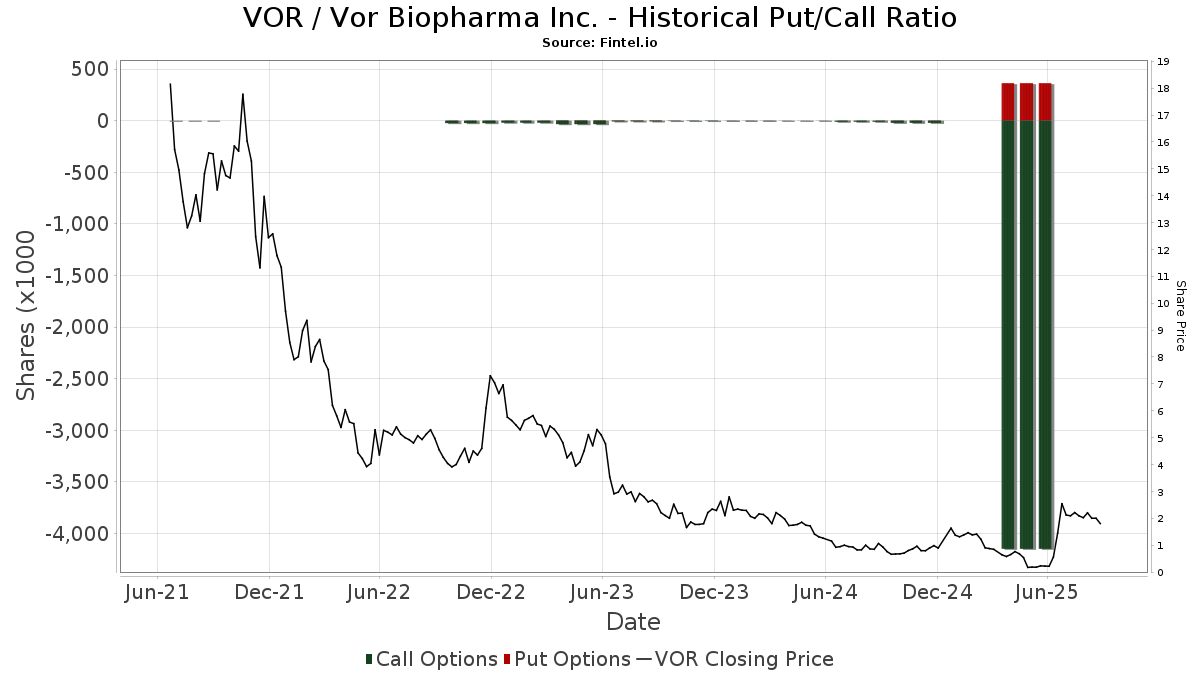

Institutionel Put/Call-forhold

Ud over at indberette standardaktie- og gældsudstedelser skal institutter med mere end 100 mill. aktiver under forvaltning også oplyse deres put- og call-optionsbeholdninger. Da salgsoptioner generelt indikerer negativ stemning, og købsoptioner indikerer positiv stemning, kan vi få en fornemmelse af den overordnede institutionelle stemning ved at plotte forholdet mellem put og kald. Diagrammet til højre viser det historiske put/call-forhold for dette instrument.

Brug af Put/Call Ratio som en indikator for investorernes stemning overvinder en af de vigtigste mangler ved at bruge totalt institutionelt ejerskab, som er, at en betydelig mængde af aktiver under forvaltning investeres passivt for at spore indekser. Passivt forvaltede fonde køber typisk ikke optioner, så indikatoren for put/call-forholdet følger mere nøje følelsen af aktivt forvaltede fonde.

13D/G-arkivering

Vi præsenterer 13D/G ansøgninger separat fra 13F ansøgninger på grund af den forskellige behandling af SEC. 13D/G-ansøgninger kan indgives af grupper af investorer (med én ledende), hvorimod 13F-ansøgninger ikke kan. Dette resulterer i situationer, hvor en investor kan indsende en 13D/G, der rapporterer én værdi for de samlede aktier (der repræsenterer alle de aktier, der ejes af investorgruppen), men derefter indsender en 13F, der rapporterer en anden værdi for de samlede aktier (der udelukkende repræsenterer deres egne) ejendomsret). Det betyder, at aktieejerskab af 13D/G-arkiver og 13F-arkiveringer ofte ikke er direkte sammenlignelige, så vi præsenterer dem separat.

Bemærk: Fra den 16. maj 2021 viser vi ikke længere ejere, der ikke har indsendt en 13D/G inden for det seneste år. Tidligere viste vi den fulde historie af 13D/G-arkiver. Generelt skal enheder, der er forpligtet til at indgive 13D/G-ansøgninger, indgive mindst årligt, før de indsender en afsluttende ansøgning. Dog forlader fonde nogle gange positioner uden at indsende en afsluttende ansøgning (dvs. de afvikler), så visning af den fulde historie resulterede nogle gange i forvirring om det nuværende ejerskab. For at undgå forvirring viser vi nu kun 'aktuelle' ejere - det vil sige - ejere, der har anmeldt inden for det seneste år.

Upgrade to unlock premium data.

| Fil dato | Form | Investor | Forrige Aktier |

Seneste Aktier |

Δ Aktier (Procent) |

Ejendomsret (Procent) |

Δ Ejerskab (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-09-09 | Reprogrammed Interchange LLC | 36,884,567 | 35,476,939 | -3.82 | 28.00 | -3.78 | ||

| 2025-08-06 | FMR LLC | 6,422,496 | 2,092,686 | -67.42 | 1.70 | -66.67 | ||

| 2025-07-09 | 5AM Ventures VI, L.P. | 6,361,723 | 4,422,863 | -30.48 | 3.50 | -62.77 | ||

| 2025-06-27 | RA CAPITAL MANAGEMENT, L.P. | 39,709,850 | 39,739,850 | 0.08 | 31.80 | -0.31 | ||

| 2024-11-14 | Paradigm Biocapital Advisors LP | 6,457,293 | 0 | -100.00 | 0.00 | -100.00 |

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.