Grundlæggende statistik

| Institutionelle aktier (lange) | 3.427.138 - 18,72% (ex 13D/G) - change of 0,00MM shares 0,00% MRQ |

| Institutionel værdi (lang) | $ 258.137 USD ($1000) |

Institutionelt ejerskab og aktionærer

Danaos Corporation (US:DAC) har 131 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 3,428,810 aktier. Største aktionærer omfatter Ion Asset Management Ltd., RBF Capital, LLC, Acadian Asset Management Llc, Arrowstreet Capital, Limited Partnership, No Street GP LP, Morgan Stanley, Susquehanna International Group, Llp, Susquehanna International Group, Llp, Jpmorgan Chase & Co, and Commonwealth Equity Services, Llc .

Danaos Corporation (NYSE:DAC) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 12, 2025 is 94,63 / share. Previously, on September 16, 2024, the share price was 80,08 / share. This represents an increase of 18,17% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

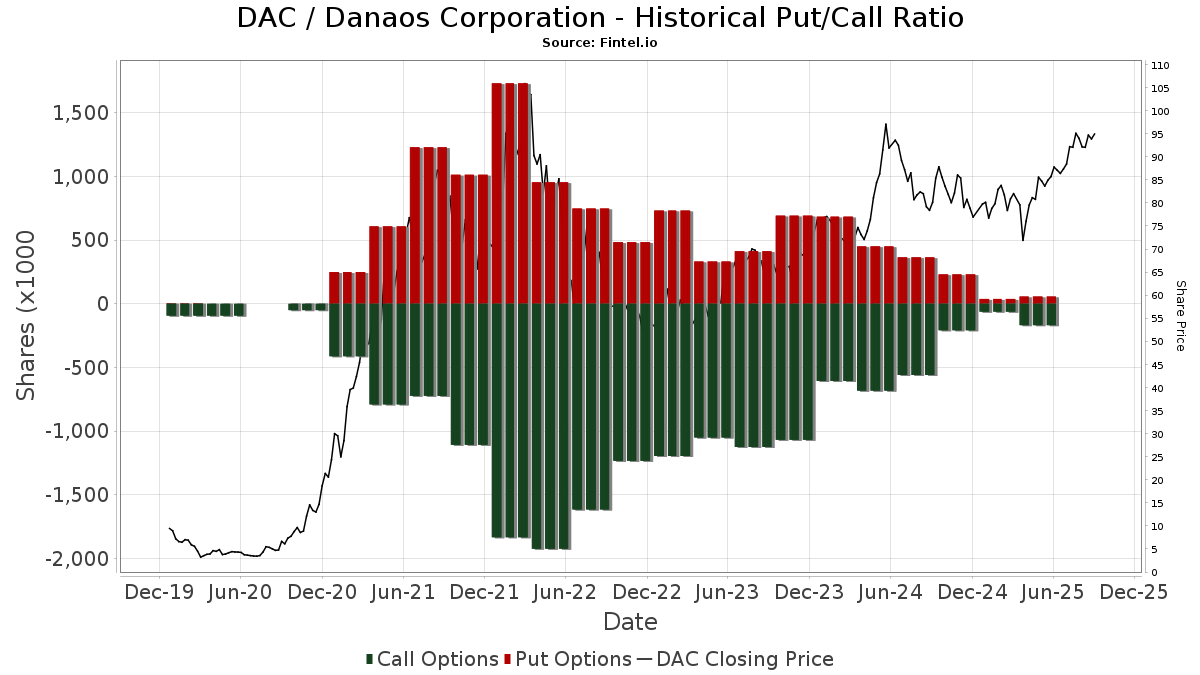

Institutionel Put/Call-forhold

Ud over at indberette standardaktie- og gældsudstedelser skal institutter med mere end 100 mill. aktiver under forvaltning også oplyse deres put- og call-optionsbeholdninger. Da salgsoptioner generelt indikerer negativ stemning, og købsoptioner indikerer positiv stemning, kan vi få en fornemmelse af den overordnede institutionelle stemning ved at plotte forholdet mellem put og kald. Diagrammet til højre viser det historiske put/call-forhold for dette instrument.

Brug af Put/Call Ratio som en indikator for investorernes stemning overvinder en af de vigtigste mangler ved at bruge totalt institutionelt ejerskab, som er, at en betydelig mængde af aktiver under forvaltning investeres passivt for at spore indekser. Passivt forvaltede fonde køber typisk ikke optioner, så indikatoren for put/call-forholdet følger mere nøje følelsen af aktivt forvaltede fonde.

13D/G-arkivering

Vi præsenterer 13D/G ansøgninger separat fra 13F ansøgninger på grund af den forskellige behandling af SEC. 13D/G-ansøgninger kan indgives af grupper af investorer (med én ledende), hvorimod 13F-ansøgninger ikke kan. Dette resulterer i situationer, hvor en investor kan indsende en 13D/G, der rapporterer én værdi for de samlede aktier (der repræsenterer alle de aktier, der ejes af investorgruppen), men derefter indsender en 13F, der rapporterer en anden værdi for de samlede aktier (der udelukkende repræsenterer deres egne) ejendomsret). Det betyder, at aktieejerskab af 13D/G-arkiver og 13F-arkiveringer ofte ikke er direkte sammenlignelige, så vi præsenterer dem separat.

Bemærk: Fra den 16. maj 2021 viser vi ikke længere ejere, der ikke har indsendt en 13D/G inden for det seneste år. Tidligere viste vi den fulde historie af 13D/G-arkiver. Generelt skal enheder, der er forpligtet til at indgive 13D/G-ansøgninger, indgive mindst årligt, før de indsender en afsluttende ansøgning. Dog forlader fonde nogle gange positioner uden at indsende en afsluttende ansøgning (dvs. de afvikler), så visning af den fulde historie resulterede nogle gange i forvirring om det nuværende ejerskab. For at undgå forvirring viser vi nu kun 'aktuelle' ejere - det vil sige - ejere, der har anmeldt inden for det seneste år.

Upgrade to unlock premium data.

| Fil dato | Form | Investor | Forrige Aktier |

Seneste Aktier |

Δ Aktier (Procent) |

Ejendomsret (Procent) |

Δ Ejerskab (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-04-09 | Danaos Investments Ltd As Trustee Of The 883 Trust | 9,338,502 | 9,338,502 | 0.00 | 50.50 | 2.23 |

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 648 | -88,74 | 56 | -87,75 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | MAI Capital Management | 179 | 15 | ||||||

| 2025-08-04 | 13F | Spire Wealth Management | 28 | 2 | ||||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 22.319 | -14,95 | 1.925 | -7,54 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 16.848 | -7,58 | 1.453 | 2,18 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 327 | 4,81 | 28 | 16,67 | ||||

| 2025-08-28 | NP | CPAEX - Counterpoint Tactical Equity Fund Class A Shares | 4.636 | 400 | ||||||

| 2025-05-14 | 13F | Peak6 Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 38.100 | 10,43 | 3.286 | 22,03 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 95.707 | 153,07 | 8.254 | 179,76 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 84.500 | 262,66 | 7.287 | 300,83 | |||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 9.202 | 0,00 | 794 | 10,45 | ||||

| 2025-08-14 | 13F | State Street Corp | 16.348 | -21,98 | 1.410 | -13,77 | ||||

| 2025-08-19 | 13F | State of Wyoming | 2.128 | 205,31 | 184 | 238,89 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Put | 2.800 | 3,70 | 245 | 14,02 | |||

| 2025-08-14 | 13F | CastleKnight Management LP | 5.100 | -32,89 | 440 | -25,97 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 2.505 | 216 | ||||||

| 2025-08-14 | 13F | Two Sigma Investments, Lp | 45.497 | 97,00 | 3.924 | 117,70 | ||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | Short | -1.672 | -144 | |||||

| 2025-04-24 | NP | FNDB - Schwab Fundamental U.S. Broad Market Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 96 | -43,20 | 8 | -46,15 | ||||

| 2025-08-13 | 13F | Northern Trust Corp | 11.319 | 139,91 | 976 | 165,22 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 3.200 | 276 | ||||||

| 2025-08-11 | 13F | Principal Securities, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 1.250 | 107 | ||||||

| 2025-05-13 | 13F | Clear Street Markets Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Advisory Research Inc | 36.815 | 50,42 | 3.175 | 66,27 | ||||

| 2025-07-10 | 13F | Redhawk Wealth Advisors, Inc. | 12.594 | 1,49 | 1.086 | 12,19 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 742 | 64 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 82.834 | 39,83 | 7.144 | 54,54 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 7.850 | -36,65 | 677 | -30,02 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | 7.940 | 695 | ||||||

| 2025-04-17 | 13F | FNY Investment Advisers, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 18.900 | 158,90 | 1.653 | 185,49 | |||

| 2025-08-12 | 13F | Legal & General Group Plc | 145 | 0,00 | 13 | 9,09 | ||||

| 2025-08-13 | 13F | Corsair Capital Management, L.p. | 14.000 | 180,00 | 1.207 | 209,49 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 4.226 | 364 | ||||||

| 2025-08-07 | 13F | Resources Investment Advisors, LLC. | 3.289 | 0,03 | 284 | 10,55 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 0 | -100,00 | 0 | |||||

| 2025-04-24 | 13F | U S Global Investors Inc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 69.863 | 0,72 | 6 | 20,00 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 42.100 | 20,63 | 3.631 | 33,31 | ||||

| 2025-08-13 | 13F | Victory Financial Group, Llc | 4.178 | 360 | ||||||

| 2025-07-18 | 13F | Founders Capital Management | 900 | 0,00 | 78 | 10,00 | ||||

| 2025-08-05 | 13F | GHP Investment Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 282.655 | -5,64 | 24.376 | 4,29 | ||||

| 2025-08-13 | 13F | ExodusPoint Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Indiana Trust & Investment Management CO | 100 | 0,00 | 9 | 14,29 | ||||

| 2025-04-21 | 13F | Nelson, Van Denburg & Campbell Wealth Management Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Creative Planning | 5.989 | -27,11 | 516 | -19,50 | ||||

| 2025-04-29 | 13F | Envestnet Asset Management Inc | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | Walleye Trading LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-05-14 | 13F | Walleye Trading LLC | Put | 0 | -100,00 | 0 | ||||

| 2025-08-08 | 13F | Smithfield Trust Co | 160 | 0,00 | 0 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 0 | -100,00 | 0 | |||||

| 2025-08-01 | 13F | Y-Intercept (Hong Kong) Ltd | 3.057 | 264 | ||||||

| 2025-08-04 | 13F | Assetmark, Inc | 468 | 15.500,00 | 40 | |||||

| 2025-08-13 | 13F | Natixis Advisors, L.p. | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 52 | -45,83 | 4 | -42,86 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 71 | -6,58 | 6 | 20,00 | ||||

| 2025-05-29 | NP | OAIEX - Optimum International Fund Class A | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-04-22 | 13F | TrueMark Investments, LLC | 0 | -100,00 | 0 | |||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 37.290 | 27,07 | 3.218 | 40,46 | ||||

| 2025-07-14 | 13F | GAMMA Investing LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 57.598 | -13,09 | 4.967 | -3,95 | ||||

| 2025-08-08 | 13F | Pinney & Scofield, Inc. | 255 | 0,00 | 22 | 10,53 | ||||

| 2025-08-11 | 13F | Bell Investment Advisors, Inc | 126 | 0,00 | 11 | 11,11 | ||||

| 2025-07-08 | 13F | Ballew Advisors, Inc | 3.001 | 0,37 | 263 | 20,09 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-13 | 13F | Jump Financial, LLC | 19.500 | 1.682 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 184 | -17,86 | 16 | -11,76 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 853 | 11,80 | 74 | 23,73 | ||||

| 2025-08-13 | 13F | Aristides Capital LLC | 2.856 | 246 | ||||||

| 2025-08-28 | NP | SIEMX - SIT EMERGING MARKETS EQUITY FUND - CLASS F, effective 1-31-2017 (formerly Class A) | 4.644 | -43,70 | 400 | -37,79 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 51.008 | -3,12 | 4.399 | 7,06 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 3.797 | -2,99 | 327 | 7,57 | ||||

| 2025-07-30 | NP | DEEP - Roundhill Acquirers Deep Value ETF | 3.128 | -17,10 | 267 | -10,14 | ||||

| 2025-05-16 | 13F/A | Kestra Investment Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Hi-Line Capital Management, LLC | 28.768 | 2.481 | ||||||

| 2025-08-14 | 13F | RBF Capital, LLC | 418.015 | 0,00 | 36.050 | 10,52 | ||||

| 2025-08-06 | 13F | Malaga Cove Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 0 | -100,00 | 0 | |||||

| 2025-05-09 | 13F | New Age Alpha Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | UBS Group AG | 30.299 | -18,44 | 2.613 | -9,87 | ||||

| 2025-08-05 | 13F | Harel Insurance Investments & Financial Services Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Hrt Financial Lp | 18.992 | 115,16 | 2 | |||||

| 2025-07-16 | 13F | Signaturefd, Llc | 905 | 12,98 | 78 | 25,81 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 18.938 | -60,08 | 1.633 | -55,88 | ||||

| 2025-08-26 | NP | BOAT - SonicShares Global Shipping ETF | 7.850 | 8,43 | 677 | 19,86 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 65 | 6 | ||||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Sei Investments Co | 11.024 | -7,59 | 951 | 2,15 | ||||

| 2025-07-25 | 13F | JustInvest LLC | 2.578 | 222 | ||||||

| 2025-07-11 | 13F | Kingstone Capital Partners Texas, LLC | 26.400 | 2 | ||||||

| 2025-08-07 | 13F | Allworth Financial LP | 1.512 | -22,10 | 130 | -16,67 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 13.092 | 1.129 | ||||||

| 2025-08-05 | 13F | Simplex Trading, Llc | Put | 5.400 | 5.300,00 | 0 | ||||

| 2025-08-28 | NP | WAGNX - Pabrai Wagons Fund Retail Class | 16.660 | 13,33 | 1.437 | 25,20 | ||||

| 2025-05-09 | 13F | Headlands Technologies LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Quadrant Capital Group Llc | 0 | -100,00 | 0 | |||||

| 2025-08-06 | 13F | Bastion Asset Management Inc. | 37.514 | 50,61 | 3.217 | 59,65 | ||||

| 2025-05-09 | 13F | Charles Schwab Investment Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Voloridge Investment Management, Llc | 66.192 | -27,95 | 5.708 | -20,37 | ||||

| 2025-04-28 | 13F | First Horizon Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 1.123 | -17,18 | 97 | -8,57 | ||||

| 2025-08-08 | 13F | Commonwealth Of Pennsylvania Public School Empls Retrmt Sys | 9.071 | 0,00 | 782 | 10,61 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-04-24 | NP | FNDA - Schwab Fundamental U.S. Small Company Index ETF This fund is a listed as child fund of Charles Schwab Investment Management Inc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 14.341 | -49,34 | 1.127 | -49,84 | ||||

| 2025-08-07 | 13F | Parkside Financial Bank & Trust | 20 | -25,93 | 2 | -50,00 | ||||

| 2025-08-11 | 13F | Inspire Advisors, LLC | 9.666 | -18,93 | 834 | -10,43 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 50.951 | 271,55 | 4.394 | 310,65 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 23.411 | 719,14 | 2.019 | 804,93 | ||||

| 2025-07-29 | 13F | Morgan Dempsey Capital Management Llc | 4.564 | 41,70 | 394 | 56,57 | ||||

| 2025-08-28 | NP | SEEM - SEI Select Emerging Markets Equity ETF | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-07-29 | 13F | Millburn Ridgefield Corp | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Pacer Advisors, Inc. | 6 | -50,00 | 1 | |||||

| 2025-08-28 | NP | EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF | 6.980 | 0,00 | 602 | 10,48 | ||||

| 2025-05-08 | 13F | Moors & Cabot, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 121 | 37,50 | 10 | 66,67 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Call | 41.000 | 791,30 | 3.536 | 887,43 | |||

| 2025-08-14 | 13F | Jane Street Group, Llc | 10.446 | -55,31 | 901 | -50,63 | ||||

| 2025-08-14 | 13F | Point72 Asset Management, L.P. | 7.092 | -31,15 | 612 | -23,91 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | Put | 4.200 | 362 | |||||

| 2025-07-10 | 13F | Exchange Traded Concepts, Llc | 2.773 | -9,76 | 239 | 0,00 | ||||

| 2025-08-15 | 13F | WealthCollab, LLC | 522 | -7,94 | 45 | 2,27 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | GWM Advisors LLC | 2.605 | 23.581,82 | 225 | |||||

| 2025-08-05 | 13F | NewSquare Capital LLC | 2 | 0,00 | 0 | |||||

| 2025-05-15 | 13F | Millennium Management Llc | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-14 | 13F | Counterpoint Mutual Funds LLC | 4.636 | 400 | ||||||

| 2025-05-30 | NP | TFPN - Blueprint Chesapeake Multi-Asset Trend ETF | 5.151 | -9,41 | 402 | -11,87 | ||||

| 2025-05-14 | 13F | Walleye Capital LLC | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-05-05 | 13F | IFP Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 164 | -7,87 | 13 | -14,29 | ||||

| 2025-08-14 | 13F | PDT Partners, LLC | 10.640 | 0,00 | 918 | 10,48 | ||||

| 2025-07-15 | 13F | Ballentine Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 775 | 67 | ||||||

| 2025-04-29 | 13F | Td Private Client Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Aquatic Capital Management LLC | 4.553 | -52,35 | 393 | -47,38 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-05-22 | NP | MXENX - Great-West Emerging Markets Equity Fund Institutional Class | 10.840 | -3,51 | 846 | -6,01 | ||||

| 2025-05-30 | NP | New Age Alpha Funds Trust - NAA Opportunity Fund Class C | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Aigen Investment Management, Lp | 3.286 | 283 | ||||||

| 2025-08-08 | 13F | SG Americas Securities, LLC | 2.727 | 11,08 | 0 | |||||

| 2025-08-12 | 13F | Global Retirement Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | |||||

| 2025-03-26 | NP | SFSNX - Schwab Fundamental US Small Company Index Fund Institutional Shares | 2.692 | -51,01 | 213 | -52,67 | ||||

| 2025-08-07 | 13F | Commerce Bank | 2.360 | 204 | ||||||

| 2025-06-30 | NP | PRFZ - Invesco FTSE RAFI US 1500 Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 28.372 | -26,70 | 2.302 | -24,95 | ||||

| 2025-08-14 | 13F | Petrus Trust Company, LTA | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 48 | 0,00 | 4 | 33,33 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 8.395 | -58,68 | 724 | -54,32 | ||||

| 2025-08-07 | 13F | Readystate Asset Management Lp | 6.377 | 550 | ||||||

| 2025-08-07 | 13F | PFG Advisors | 6.637 | 8,18 | 572 | 19,67 | ||||

| 2025-07-14 | 13F | UMA Financial Services, Inc. | 15 | 1 | ||||||

| 2025-04-24 | 13F | Wingate Wealth Advisors, Inc. | 0 | -100,00 | 0 | |||||

| 2025-06-30 | NP | EELV - Invesco S&P Emerging Markets Low Volatility ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 17.929 | -14,86 | 1.454 | -12,83 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 33.944 | -26,55 | 2.927 | -18,83 | ||||

| 2025-05-28 | NP | LEAIX - Lazard Emerging Markets Equity Advantage Portfolio Institutional Shares | 3.192 | 23,10 | 249 | 20,29 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 3.919 | -75,69 | 338 | -73,21 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Group One Trading, L.p. | Put | 3.000 | 259 | |||||

| 2025-03-28 | NP | HAOSX - Harbor Overseas Fund Institutional Class | 49 | -98,61 | 4 | -98,96 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 348 | 30 | ||||||

| 2025-08-11 | 13F | Semanteon Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-08-28 | NP | SPEM - SPDR(R) Portfolio Emerging Markets ETF | 7.526 | 2,08 | 649 | 12,87 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 100 | -53,92 | 9 | -50,00 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 188.482 | 16,05 | 16.255 | 28,26 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 305.103 | -11,62 | 26 | 0,00 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 272 | 4.433,33 | 23 | |||||

| 2025-07-18 | 13F | Westhampton Capital, LLC | 4.255 | 0,00 | 367 | 10,24 | ||||

| 2025-05-14 | 13F | Peak6 Llc | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-06-30 | NP | SHPP - Pacer Industrials and Logistics ETF | 12 | -7,69 | 1 | -100,00 | ||||

| 2025-08-07 | 13F | Pinnacle Holdings, LLC | 645 | -36,20 | 56 | -29,49 | ||||

| 2025-05-14 | 13F | Peak6 Llc | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-08-14 | 13F | Royal Bank Of Canada | 301 | 34,98 | 26 | 52,94 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | CIBC Private Wealth Group, LLC | 378 | 26,00 | 33 | 68,42 | ||||

| 2025-08-14 | 13F | No Street GP LP | 250.000 | 0,00 | 21.560 | 10,52 | ||||

| 2025-05-05 | 13F | Eagle Bay Advisors LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 3.800 | 153,33 | 328 | 179,49 | |||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 2.921 | -94,08 | 252 | -93,48 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 40.729 | 46,51 | 3.512 | 61,92 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 5.900 | -56,87 | 509 | -52,39 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 24.500 | 6,06 | 2.113 | 17,20 | |||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 8.430 | 1 | ||||||

| 2025-08-08 | 13F | Fiera Capital Corp | 15.857 | 0,00 | 1.368 | 10,51 | ||||

| 2025-08-12 | 13F | O'shaughnessy Asset Management, Llc | 4.599 | -60,37 | 397 | -56,24 | ||||

| 2025-08-15 | 13F | Ion Asset Management Ltd. | 654.308 | 15,46 | 56.428 | 27,61 | ||||

| 2025-08-07 | 13F | Campbell & CO Investment Adviser LLC | 14.104 | -4,61 | 1.216 | 5,46 |

Other Listings

| DE:DVW1 | 80,35 € |