Grundlæggende statistik

| Institutionelle aktier (lange) | 72.204.906 - 65,39% (ex 13D/G) - change of -1,86MM shares -2,51% MRQ |

| Institutionel værdi (lang) | $ 312.138 USD ($1000) |

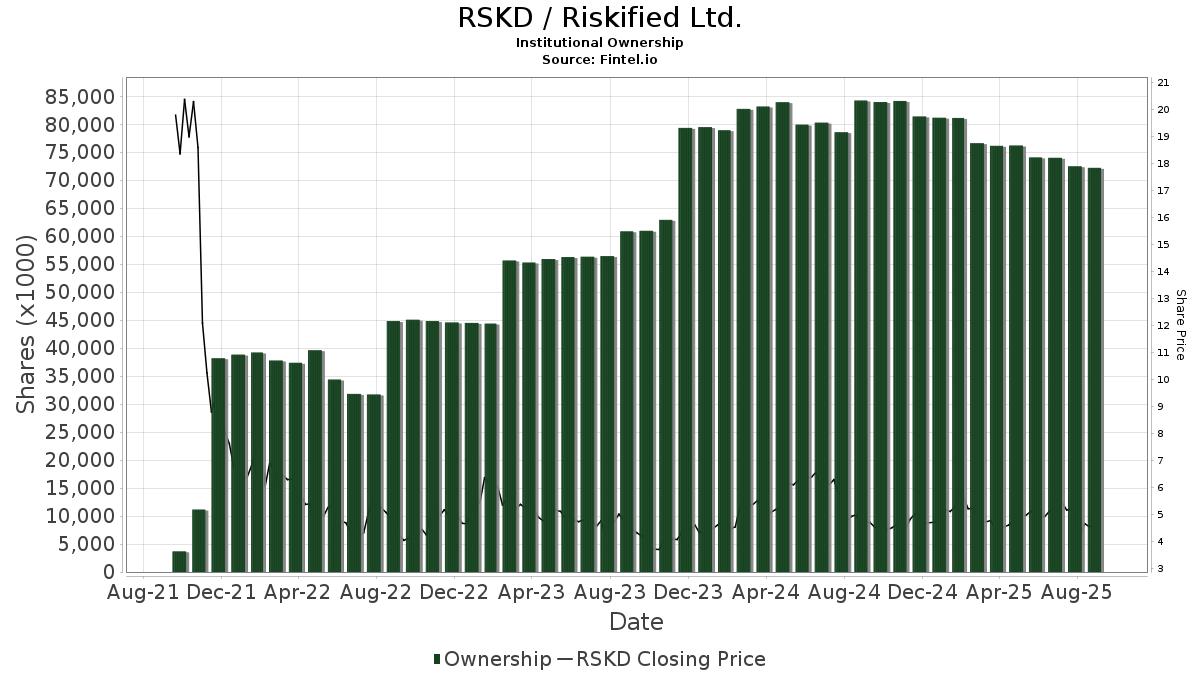

Institutionelt ejerskab og aktionærer

Riskified Ltd. (US:RSKD) har 131 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 72,204,906 aktier. Største aktionærer omfatter Capital World Investors, SMCWX - SMALLCAP WORLD FUND INC Class A, Phoenix Holdings Ltd., Jennison Associates Llc, General Atlantic Llc, Acadian Asset Management Llc, Clal Insurance Enterprises Holdings Ltd, Harvey Partners, LLC, Clearline Capital LP, and PGOAX - PGIM JENNISON SMALL COMPANY FUND Class A .

Riskified Ltd. (NYSE:RSKD) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 9, 2025 is 4,77 / share. Previously, on September 10, 2024, the share price was 4,65 / share. This represents an increase of 2,58% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

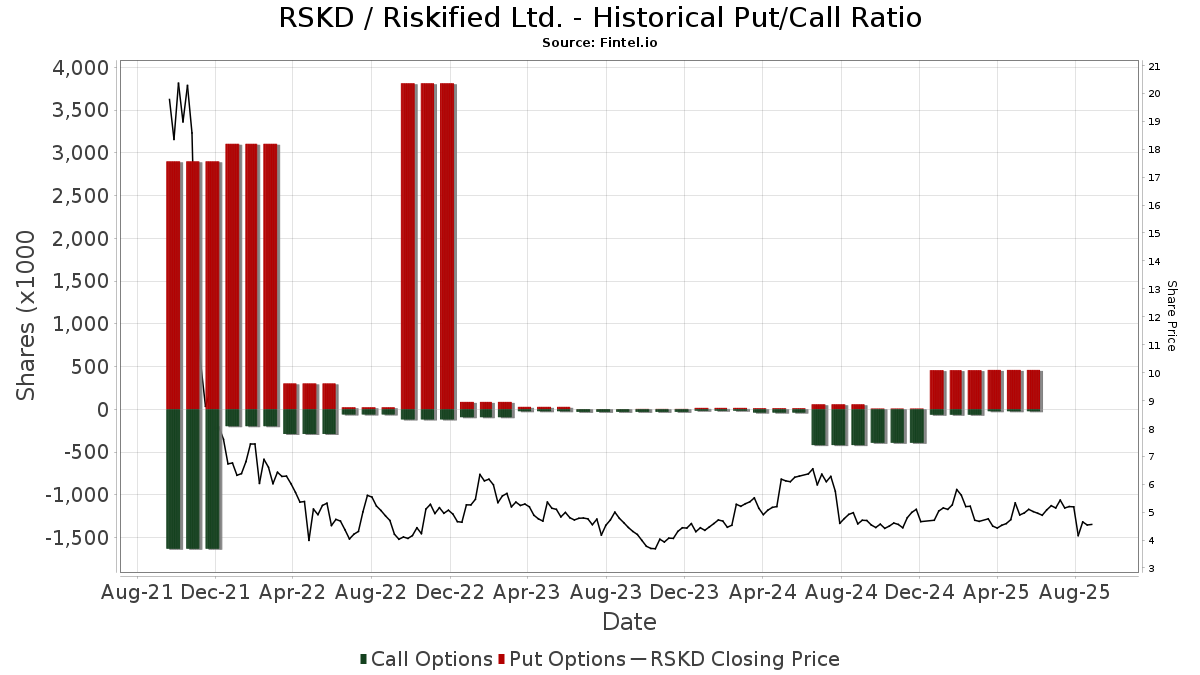

Institutionel Put/Call-forhold

Ud over at indberette standardaktie- og gældsudstedelser skal institutter med mere end 100 mill. aktiver under forvaltning også oplyse deres put- og call-optionsbeholdninger. Da salgsoptioner generelt indikerer negativ stemning, og købsoptioner indikerer positiv stemning, kan vi få en fornemmelse af den overordnede institutionelle stemning ved at plotte forholdet mellem put og kald. Diagrammet til højre viser det historiske put/call-forhold for dette instrument.

Brug af Put/Call Ratio som en indikator for investorernes stemning overvinder en af de vigtigste mangler ved at bruge totalt institutionelt ejerskab, som er, at en betydelig mængde af aktiver under forvaltning investeres passivt for at spore indekser. Passivt forvaltede fonde køber typisk ikke optioner, så indikatoren for put/call-forholdet følger mere nøje følelsen af aktivt forvaltede fonde.

13D/G-arkivering

Vi præsenterer 13D/G ansøgninger separat fra 13F ansøgninger på grund af den forskellige behandling af SEC. 13D/G-ansøgninger kan indgives af grupper af investorer (med én ledende), hvorimod 13F-ansøgninger ikke kan. Dette resulterer i situationer, hvor en investor kan indsende en 13D/G, der rapporterer én værdi for de samlede aktier (der repræsenterer alle de aktier, der ejes af investorgruppen), men derefter indsender en 13F, der rapporterer en anden værdi for de samlede aktier (der udelukkende repræsenterer deres egne) ejendomsret). Det betyder, at aktieejerskab af 13D/G-arkiver og 13F-arkiveringer ofte ikke er direkte sammenlignelige, så vi præsenterer dem separat.

Bemærk: Fra den 16. maj 2021 viser vi ikke længere ejere, der ikke har indsendt en 13D/G inden for det seneste år. Tidligere viste vi den fulde historie af 13D/G-arkiver. Generelt skal enheder, der er forpligtet til at indgive 13D/G-ansøgninger, indgive mindst årligt, før de indsender en afsluttende ansøgning. Dog forlader fonde nogle gange positioner uden at indsende en afsluttende ansøgning (dvs. de afvikler), så visning af den fulde historie resulterede nogle gange i forvirring om det nuværende ejerskab. For at undgå forvirring viser vi nu kun 'aktuelle' ejere - det vil sige - ejere, der har anmeldt inden for det seneste år.

Upgrade to unlock premium data.

| Fil dato | Form | Investor | Forrige Aktier |

Seneste Aktier |

Δ Aktier (Procent) |

Ejendomsret (Procent) |

Δ Ejerskab (Procent) |

|

|---|---|---|---|---|---|---|---|---|

| 2025-07-31 | Feldman Assaf | 13,203,424 | 12,424,377 | -5.90 | 10.40 | -1.89 | ||

| 2025-05-15 | PRUDENTIAL FINANCIAL INC | 5,697,323 | 5.10 | |||||

| 2025-05-09 | JENNISON ASSOCIATES LLC | 5,697,323 | 5.10 | |||||

| 2024-11-13 | Capital World Investors | 9,774,367 | 8,313,598 | -14.94 | 6.80 | -15.00 | ||

| 2024-10-18 | Gal Eido | 13,827,137 | 13,732,613 | -0.68 | 11.00 | 10.00 |

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-13 | 13F | Northern Trust Corp | 153.123 | 0,00 | 764 | 8,06 | ||||

| 2025-08-14 | 13F | Caption Management, LLC | Put | 100.000 | 0,00 | 499 | 8,01 | |||

| 2025-05-14 | 13F | Jump Financial, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 48.371 | -64,51 | 241 | -61,69 | ||||

| 2025-06-25 | NP | PQJCX - PGIM Jennison Small-Cap Core Equity Fund Class R6 | 9.654 | 21,28 | 44 | 10,00 | ||||

| 2025-05-15 | 13F | Bayesian Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 441.489 | 7,53 | 2.203 | 16,19 | ||||

| 2025-08-14 | 13F | Lazard Asset Management Llc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 120.740 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 59.795 | -43,26 | 298 | -38,81 | ||||

| 2025-08-28 | NP | QCSTRX - Stock Account Class R1 | 381.503 | 386,80 | 1.904 | 425,69 | ||||

| 2025-08-13 | 13F/A | StoneX Group Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 698 | 3,25 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 271.536 | 7,39 | 1.355 | 15,92 | ||||

| 2025-08-27 | NP | Advanced Series Trust - Ast Prudential Growth Allocation Portfolio | 32.762 | 0,00 | 163 | 7,95 | ||||

| 2025-08-14 | 13F | C M Bidwell & Associates Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-28 | NP | GWX - SPDR(R) S&P(R) International Small Cap ETF | 91.174 | -1,57 | 455 | 6,32 | ||||

| 2025-05-15 | 13F | Luxor Capital Group, LP | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Boothbay Fund Management, Llc | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | IEFA - iShares Core MSCI EAFE ETF | 519.231 | 1,02 | 2.383 | -9,77 | ||||

| 2025-08-13 | 13F | Capital World Investors | 8.313.598 | 0,00 | 41.485 | 8,01 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 107.200 | 1,23 | 535 | 9,20 | |||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 52.043 | -31,91 | 260 | -26,63 | ||||

| 2025-08-14 | 13F | Nebula Research & Development LLC | 38.432 | -20,25 | 192 | -13,96 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 22.200 | -9,02 | 111 | -1,79 | |||

| 2025-08-06 | 13F | Savant Capital, LLC | 11.515 | 57 | ||||||

| 2025-08-14 | 13F | Anson Funds Management LP | 318.492 | 1.589 | ||||||

| 2025-07-31 | 13F | MQS Management LLC | 51.512 | 42,62 | 257 | 54,82 | ||||

| 2025-05-14 | 13F | Brown Brothers Harriman & Co | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Shay Capital LLC | 0 | -100,00 | 0 | |||||

| 2025-05-07 | 13F | Phoenix Holdings Ltd. | Call | 0 | -100,00 | 0 | -100,00 | |||

| 2025-05-15 | 13F | PDT Partners, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | D. E. Shaw & Co., Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Balyasny Asset Management Llc | 20.833 | 9,88 | 104 | 18,39 | ||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 10.912 | 54 | ||||||

| 2025-08-28 | NP | SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio This fund is a listed as child fund of State Street Corp and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 40.700 | 0,00 | 203 | 7,98 | ||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 288.204 | 35,46 | 1.438 | 46,44 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 327.741 | -15,85 | 1.635 | -9,12 | ||||

| 2025-06-26 | NP | OWSMX - Old Westbury Small & Mid Cap Strategies Fund | 105.496 | -10,51 | 484 | -20,00 | ||||

| 2025-08-08 | 13F | Commonwealth Of Pennsylvania Public School Empls Retrmt Sys | 191.015 | 129,12 | 469 | 21,56 | ||||

| 2025-08-11 | 13F | HighTower Advisors, LLC | 10.460 | 52 | ||||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 93.086 | 5,47 | 464 | 14,00 | ||||

| 2025-08-13 | 13F | Toronado Partners, LLC | 287.270 | -72,37 | 1.433 | -70,16 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 3.224 | -31,84 | 16 | -23,81 | ||||

| 2025-08-14 | 13F | General Atlantic Llc | 5.324.998 | 0,00 | 26.572 | 8,01 | ||||

| 2025-08-14 | 13F | Prestige Wealth Management Group LLC | 50 | 0,00 | 0 | |||||

| 2025-06-27 | NP | BIVIX - Invenomic Fund Institutional Class shares | 574.685 | -6,93 | 2.638 | -16,89 | ||||

| 2025-08-12 | 13F | Clal Insurance Enterprises Holdings Ltd | 4.278.883 | 0,00 | 21 | 10,53 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 4.814.671 | -1,03 | 24 | 9,09 | ||||

| 2025-08-14 | 13F | Verition Fund Management LLC | 14.600 | -89,61 | 73 | -88,91 | ||||

| 2025-07-29 | NP | PBQAX - PGIM Jennison Blend Fund Class A | 252.487 | -23,16 | 1.265 | -25,12 | ||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Point72 Asset Management, L.P. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Penn Capital Management Co Inc | 319.016 | 46,48 | 1.592 | 58,15 | ||||

| 2025-08-19 | 13F | State of Wyoming | 82.833 | 245,40 | 413 | 275,45 | ||||

| 2025-08-12 | 13F | Tocqueville Asset Management L.p. | 346.000 | 0,00 | 1.727 | 8,01 | ||||

| 2025-07-30 | 13F | Phoenix Holdings Ltd. | 6.282.562 | -22,12 | 31.350 | -15,88 | ||||

| 2025-08-14 | 13F | Prelude Capital Management, Llc | 25.300 | 126 | ||||||

| 2025-08-14 | 13F | Clearline Capital LP | 2.508.280 | 2,23 | 12.516 | 10,42 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 94.545 | 0,00 | 472 | 8,03 | ||||

| 2025-08-01 | 13F | Brookwood Investment Group LLC | 20.055 | 100 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 225.468 | 178,23 | 1.125 | 200,80 | ||||

| 2025-07-23 | 13F | Klp Kapitalforvaltning As | 18.800 | 0,00 | 94 | 8,14 | ||||

| 2025-05-15 | 13F | Two Sigma Investments, Lp | 0 | -100,00 | 0 | |||||

| 2025-07-25 | NP | EIS - iShares MSCI Israel ETF | 85.559 | -17,11 | 429 | -19,25 | ||||

| 2025-08-01 | 13F | Bessemer Group Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna Fundamental Investments, Llc | 20.702 | -47,60 | 103 | -43,41 | ||||

| 2025-08-25 | NP | SMCWX - SMALLCAP WORLD FUND INC Class A | 8.313.598 | 0,00 | 41.485 | 8,01 | ||||

| 2025-08-14 | 13F | Algert Global Llc | 98.586 | 121,25 | 0 | |||||

| 2025-08-14 | 13F | Ophir Asset Management Pty Ltd | 0 | -100,00 | 0 | |||||

| 2025-07-22 | 13F | Gsa Capital Partners Llp | 94.249 | 0 | ||||||

| 2025-06-26 | NP | SCZ - iShares MSCI EAFE Small-Cap ETF | 285.900 | 3,11 | 1.312 | -7,93 | ||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 12.097 | -54,19 | 60 | -50,41 | ||||

| 2025-08-12 | 13F | Bronte Capital Management Pty Ltd. | 531.929 | 14,30 | 2.989 | 18,81 | ||||

| 2025-05-14 | 13F | Rubric Capital Management LP | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | ExodusPoint Capital Management, LP | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Assetmark, Inc | 13 | 0 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 461.103 | -8,25 | 2.301 | -0,90 | ||||

| 2025-08-14 | 13F | Toroso Investments, LLC | 91.689 | 0,00 | 458 | 8,04 | ||||

| 2025-08-15 | NP | Guardian Variable Products Trust - Guardian Small-Mid Cap Core VIP Fund | 277.334 | 26,24 | 1.384 | 36,39 | ||||

| 2025-08-01 | 13F | Teacher Retirement System Of Texas | 36.539 | -6,98 | 182 | 0,55 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2.383 | 115,46 | 12 | 120,00 | ||||

| 2025-08-14 | 13F | GWM Advisors LLC | 193 | 0,00 | 1 | |||||

| 2025-06-25 | NP | IZRL - ARK Israel Innovative Technology ETF | 368.386 | -5,80 | 1.691 | -15,92 | ||||

| 2025-08-27 | NP | PGOAX - PGIM JENNISON SMALL COMPANY FUND Class A | 2.444.421 | 2,40 | 12.198 | 10,60 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | 227.600 | 1,34 | 1.136 | 9,45 | ||||

| 2025-07-31 | 13F | State of New Jersey Common Pension Fund D | 67.686 | 0,00 | 338 | 8,01 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 333.520 | -15,07 | 1.664 | -8,27 | ||||

| 2025-08-26 | NP | SCSAX - Wells Fargo Common Stock Fund Class A | 815.185 | 20,41 | 4.068 | 30,06 | ||||

| 2025-07-15 | 13F | Public Employees Retirement System Of Ohio | 299.362 | -3,35 | 1.494 | 4,33 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 4.090 | -77,27 | 20 | -75,90 | ||||

| 2025-08-13 | 13F | Centiva Capital, LP | Put | 228.500 | 1,56 | 1.140 | 9,72 | |||

| 2025-08-11 | 13F | Covestor Ltd | 5.821 | -2,69 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 4.243 | -84,55 | 21 | -83,33 | ||||

| 2025-08-14 | 13F | Newport Capital Group, LLC | 31.500 | 0,00 | 157 | 8,28 | ||||

| 2025-05-05 | 13F | IFP Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 77.037 | 0,24 | 384 | 8,17 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 7.126 | 36 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 18.244 | -88,17 | 91 | -87,22 | ||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 12.110 | -30,28 | 0 | |||||

| 2025-07-28 | NP | AVDS - Avantis International Small Cap Equity ETF | 1.867 | 80,56 | 9 | 80,00 | ||||

| 2025-08-12 | 13F | Trexquant Investment LP | 134.004 | -60,20 | 669 | -57,04 | ||||

| 2025-04-14 | 13F | Farther Finance Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Nuveen, LLC | 568.073 | 624,87 | 2.835 | 682,87 | ||||

| 2025-05-14 | 13F | Winslow Capital Management, LLC | 0 | -100,00 | 0 | |||||

| 2025-06-30 | NP | GGME - Invesco Dynamic Media ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 8.295 | 218,18 | 38 | 192,31 | ||||

| 2025-07-31 | 13F | Caitong International Asset Management Co., Ltd | 420 | 0,72 | 2 | 100,00 | ||||

| 2025-08-11 | 13F | Y.D. More Investments Ltd | 39.789 | 20,40 | 198 | 15,88 | ||||

| 2025-07-25 | 13F | Allspring Global Investments Holdings, LLC | 1.104.694 | 17,68 | 5.512 | 27,09 | ||||

| 2025-08-15 | 13F | State of Tennessee, Treasury Department | 117.264 | 0,00 | 585 | 8,13 | ||||

| 2025-08-14 | 13F/A | Barclays Plc | 16.823 | -8,73 | 0 | |||||

| 2025-08-11 | 13F | Vanguard Group Inc | 68.935 | -11,98 | 344 | -4,99 | ||||

| 2025-08-28 | NP | Amplify ETF Trust - Amplify BlueStar Israel Technology ETF | 89.070 | -2,86 | 444 | 4,96 | ||||

| 2025-06-26 | NP | KCXIX - Knights of Columbus U.S. All Cap Index Fund I Shares | 350 | 6,71 | 2 | 0,00 | ||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 3.000 | 0,00 | 15 | 7,69 | ||||

| 2025-08-14 | 13F | Harvey Partners, LLC | 2.569.145 | 0,63 | 12.820 | 8,70 | ||||

| 2025-05-13 | 13F | Keebeck Alpha, LP | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Citigroup Inc | 47.149 | 11,34 | 235 | 20,51 | ||||

| 2025-08-14 | 13F | Two Sigma Advisers, Lp | 41.600 | 13,66 | 208 | 22,49 | ||||

| 2025-08-05 | 13F | Carolinas Wealth Consulting Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Alta Fox Capital Management, Llc | 757.044 | 0,00 | 3.778 | 8,01 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 25.400 | -6,62 | 127 | 0,80 | |||

| 2025-08-14 | 13F | TFJ Management, LLC | 1.058.675 | 35,30 | 5.283 | 46,15 | ||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 4.955 | -34,18 | 25 | -29,41 | ||||

| 2025-07-25 | NP | WSML - iShares MSCI World Small-Cap ETF | 7.098 | 36 | ||||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 37.075 | 185 | ||||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 0 | -100,00 | 0 | |||||

| 2025-08-15 | 13F | Monimus Capital Management, Lp | 979.938 | 3,01 | 4.890 | 11,24 | ||||

| 2025-08-14 | 13F | Shay Capital LLC | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Invenomic Capital Management LP | 581.943 | -17,55 | 2.904 | -10,95 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | Engineers Gate Manager LP | 17.925 | 89 | ||||||

| 2025-08-14 | 13F | 272 Capital LP | 60.750 | 303 | ||||||

| 2025-08-29 | 13F | Total Investment Management Inc | 456 | 2 | ||||||

| 2025-08-12 | 13F | Swiss National Bank | 162.513 | -3,45 | 811 | 4,25 | ||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | FSISX - Fidelity SAI International Small Cap Index Fund | 23.919 | -7,58 | 110 | -18,05 | ||||

| 2025-08-01 | 13F | Jennison Associates Llc | 5.886.511 | 3,32 | 29.374 | 11,60 | ||||

| 2025-08-12 | 13F | Edmond De Rothschild Holding S.a. | 3.000 | 0,00 | 15 | 7,69 | ||||

| 2025-07-30 | 13F | ARK Investment Management LLC | 364.062 | -6,91 | 1.817 | 0,55 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 24.250 | -77,96 | 121 | -76,18 | ||||

| 2025-06-25 | NP | NTKLX - Voya Multi-Manager International Small Cap Fund Class A | 107.591 | 0,00 | 494 | -10,85 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1.891.424 | -0,16 | 9.438 | 7,84 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Renaissance Technologies Llc | 1.317.100 | 5,10 | 6.572 | 13,53 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 13.815 | -96,38 | 69 | -96,15 | ||||

| 2025-08-14 | 13F/A | Skopos Labs, Inc. | 136 | 1 | ||||||

| 2025-06-26 | NP | FTIHX - Fidelity Total International Index Fund This fund is a listed as child fund of Fmr Llc and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 48.387 | 7,19 | 222 | -4,31 | ||||

| 2025-08-07 | 13F | Zurcher Kantonalbank (Zurich Cantonalbank) | 26.082 | 0,00 | 130 | 8,33 | ||||

| 2025-08-13 | 13F | Invesco Ltd. | 10.939 | -0,50 | 55 | 8,00 | ||||

| 2025-08-04 | 13F | Keybank National Association/oh | 36.361 | 0,00 | 181 | 8,38 | ||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 291.121 | 1.453 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 179.686 | 49,03 | 897 | 60,86 | ||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 44.016 | 115,97 | 220 | 132,98 | ||||

| 2025-05-15 | 13F | Sirios Capital Management L P | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Legal & General Group Plc | 95.829 | 0,00 | 478 | 8,14 | ||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 19.028 | 0,00 | 95 | 8,05 | ||||

| 2025-05-13 | 13F | Quantbot Technologies LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 200.000 | 0,00 | 924 | -2,33 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 33 | 560,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 775.675 | -0,91 | 3.871 | 7,02 | ||||

| 2025-08-08 | 13F | Avalon Trust Co | 1.213 | 0,00 | 6 | 20,00 |

Other Listings

| DE:9TN |