Grundlæggende statistik

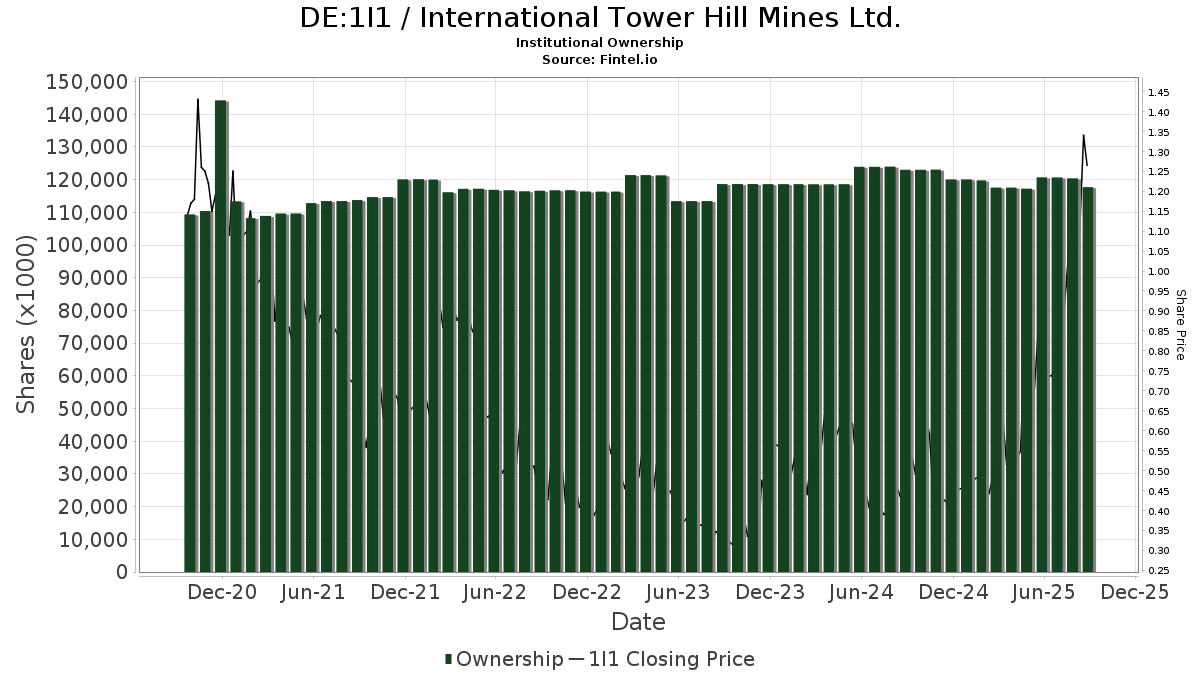

| Institutionelle aktier (lange) | 117.683.008 - 56,61% (ex 13D/G) - change of -2,98MM shares -2,47% MRQ |

| Institutionel værdi (lang) | $ 98.730 USD ($1000) |

Institutionelt ejerskab og aktionærer

International Tower Hill Mines Ltd. (DE:1I1) har 48 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 117,683,008 aktier. Største aktionærer omfatter Paulson & Co. Inc., Sprott Inc., Kopernik Global Investors, LLC, KGGAX - KOPERNIK GLOBAL ALL-CAP FUND CLASS A SHARES, SPROTT FUNDS TRUST - Sprott Gold Equity Fund Institutional Class, Russell Investments Group, Ltd., Morgan Stanley, Sei Investments Co, TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund, and Evoke Wealth, Llc .

International Tower Hill Mines Ltd. (DB:1I1) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 17, 2025 is 1,35 / share. Previously, on September 18, 2024, the share price was 0,44 / share. This represents an increase of 204,05% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 6.862 | -36,01 | 6 | -16,67 | ||||

| 2025-05-13 | 13F | Northern Trust Corp | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 19.136 | 54,32 | 16 | 100,00 | ||||

| 2025-08-15 | 13F | CI Private Wealth, LLC | 12.500 | 0,00 | 11 | 42,86 | ||||

| 2025-08-14 | 13F | CoreCap Advisors, LLC | 700 | 0,00 | 1 | |||||

| 2025-07-25 | 13F | Atria Wealth Solutions, Inc. | 58.000 | 15,63 | 50 | 58,06 | ||||

| 2025-08-15 | 13F | Morgan Stanley | 807.789 | 90,83 | 691 | 158,80 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 59.074 | 97,65 | 51 | 177,78 | ||||

| 2025-07-16 | 13F | Phil A. Younker & Associates, Ltd. | 10.000 | 0,00 | 9 | 33,33 | ||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 81.142 | 69 | ||||||

| 2025-08-07 | 13F | Evoke Wealth, Llc | 318.750 | 0,00 | 273 | 35,32 | ||||

| 2025-07-23 | 13F | Hemenway Trust Co LLC | 83.400 | 0,00 | 71 | 36,54 | ||||

| 2025-08-14 | 13F | Kopernik Global Investors, LLC | 14.448.418 | 0,00 | 12.361 | 35,36 | ||||

| 2025-07-17 | 13F | CWA Asset Management Group, LLC | 10.000 | 0,00 | 9 | 33,33 | ||||

| 2025-08-11 | 13F | Sprott Inc. | 19.778.015 | -8,50 | 17.000 | 23,22 | ||||

| 2025-08-27 | NP | Brighthouse Funds Trust II - Brighthouse/Dimensional International Small Company Portfolio Class A | 21.604 | 0,00 | 19 | 38,46 | ||||

| 2025-05-16 | 13F | Coppell Advisory Solutions LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 28.525 | 24 | ||||||

| 2025-08-27 | NP | TIFF INVESTMENT PROGRAM - TIFF Multi-Asset Fund | 376.174 | 0,00 | 322 | 35,44 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 500 | 0,00 | 0 | |||||

| 2025-06-26 | NP | KGGAX - KOPERNIK GLOBAL ALL-CAP FUND CLASS A SHARES | 6.548.183 | 0,00 | 4.053 | 34,53 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 16.385 | -91,84 | 14 | -88,89 | ||||

| 2025-08-14 | 13F | Sei Investments Co | 600.830 | 0,00 | 514 | 35,62 | ||||

| 2025-08-08 | 13F | Avantax Advisory Services, Inc. | 10.048 | -49,88 | 9 | -33,33 | ||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 135 | -54,08 | 0 | |||||

| 2025-08-07 | 13F | Connor, Clark & Lunn Investment Management Ltd. | 120.600 | 589,14 | 104 | 836,36 | ||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 22.971 | 20 | ||||||

| 2025-07-29 | 13F | Stratos Wealth Partners, LTD. | 11.812 | 0,00 | 10 | 42,86 | ||||

| 2025-07-29 | 13F | Mountain Capital Investment Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-07 | 13F | Kestra Private Wealth Services, Llc | 13.000 | 0,00 | 11 | 37,50 | ||||

| 2025-06-18 | NP | RMYAX - Multi-Strategy Income Fund Class A | 18.199 | -56,16 | 11 | -42,11 | ||||

| 2025-08-13 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Dauntless Investment Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 90.084 | 77 | ||||||

| 2025-05-29 | NP | SPROTT FUNDS TRUST - Sprott Gold Equity Fund Institutional Class | 1.863.852 | -48,18 | 1.178 | -28,14 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | Put | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | Call | 0 | 0 | |||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F | Virtu Financial LLC | 0 | -100,00 | 0 | |||||

| 2025-08-08 | 13F | Thompson Davis & Co., Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-23 | 13F | Traphagen Investment Advisors Llc | 11.257 | 10 | ||||||

| 2025-05-13 | 13F | Ground Swell Capital, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 37.551 | 32 | ||||||

| 2025-08-29 | NP | JAJDX - International Small Company Trust NAV | 2.300 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Paulson & Co. Inc. | 70.239.388 | 0,00 | 60.090 | 35,36 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 50.000 | -85,96 | 43 | -81,33 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 615 | 1 | ||||||

| 2025-07-24 | 13F | Blue Zone Wealth Advisors, LLC | 23.000 | 0,00 | 20 | 35,71 | ||||

| 2025-07-30 | 13F | Journey Advisory Group, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Concurrent Investment Advisors, LLC | 35.275 | 0,00 | 30 | 36,36 | ||||

| 2025-08-12 | 13F | LPL Financial LLC | 12.700 | 11 | ||||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 1.533.445 | -33,02 | 1.312 | -9,34 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 2.000 | 0,00 | 2 | 0,00 | ||||

| 2025-07-28 | 13F | Cypress Wealth Services, LLC | 129.687 | 0,00 | 111 | 35,80 | ||||

| 2025-08-12 | 13F | Tradition Wealth Management, LLC | 31.000 | -24,39 | 27 | 4,00 | ||||

| 2025-08-13 | 13F | Scotia Capital Inc. | 17.500 | -12,50 | 15 | 16,67 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 10.182 | -42,59 | 0 | |||||

| 2025-06-18 | NP | RAZAX - Multi-Asset Growth Strategy Fund Class A | 104.920 | 0,00 | 65 | 33,33 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 5.000 | 4 | ||||||

| 2025-08-14 | 13F | UBS Group AG | 500 | 0,00 | 0 |