Grundlæggende statistik

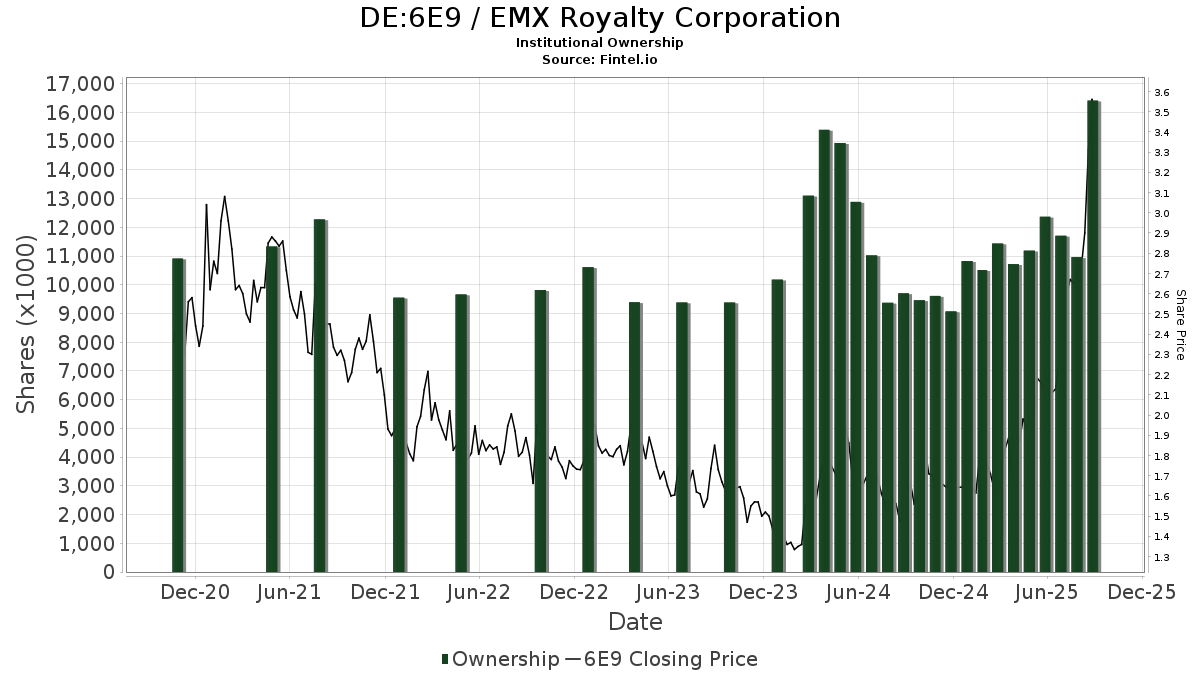

| Institutionelle aktier (lange) | 16.413.271 - 15,05% (ex 13D/G) - change of 4,06MM shares 32,90% MRQ |

| Institutionel værdi (lang) | $ 39.662 USD ($1000) |

Institutionelt ejerskab og aktionærer

EMX Royalty Corporation (DE:6E9) har 58 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 16,413,271 aktier. Største aktionærer omfatter Sprott Inc., Medici Capital Llc, Marshall Wace, Llp, Morgan Stanley, Citadel Advisors Llc, EPGFX - EuroPac Gold Fund Class A, USERX - Gold and Precious Metals Fund, U S Global Investors Inc, Arrowstreet Capital, Limited Partnership, and Euro Pacific Asset Management, LLC .

EMX Royalty Corporation (DB:6E9) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 15, 2025 is 3,56 / share. Previously, on September 16, 2024, the share price was 1,62 / share. This represents an increase of 119,08% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-06 | 13F | Commonwealth Equity Services, Llc | 16.019 | 0,00 | 0 | |||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1.567 | 110,62 | 4 | 100,00 | ||||

| 2025-07-11 | 13F | Ullmann Financial Group, Inc. | 20.000 | 0,00 | 50 | 25,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 200 | 1 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 1.115.690 | 32,87 | 2.812 | 64,19 | ||||

| 2025-05-12 | 13F | Citigroup Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | GWM Advisors LLC | 4.897 | 12 | ||||||

| 2025-08-14 | 13F | Two Sigma Securities, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Arbiter Partners Capital Management LLC | 205.915 | 100,12 | 519 | 147,85 | ||||

| 2025-08-07 | 13F | Rathbone Brothers plc | 10.000 | 0,00 | 25 | 25,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 1.500 | 0,00 | 4 | 0,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-12 | 13F | XTX Topco Ltd | 153.896 | 254,44 | 388 | 339,77 | ||||

| 2025-08-12 | 13F | Virtu Financial LLC | 27.545 | -56,18 | 0 | |||||

| 2025-08-11 | 13F | Private Advisor Group, LLC | 156.852 | 0,00 | 395 | 23,82 | ||||

| 2025-08-14 | 13F | Hrt Financial Lp | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 53.411 | 37,36 | 135 | 69,62 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 134.700 | 22,68 | 339 | 52,02 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Put | 12.500 | 32 | |||||

| 2025-08-13 | 13F | Quadrature Capital Ltd | 57.854 | 146 | ||||||

| 2025-07-30 | 13F | Cullen/frost Bankers, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Marshall Wace, Llp | 1.304.509 | 30,55 | 3.287 | 61,29 | ||||

| 2025-08-14 | 13F | Man Group plc | 368.949 | 136,65 | 930 | 192,14 | ||||

| 2025-08-14 | 13F | Papamarkou Wellner Asset Management inc. | 46.100 | 9,87 | 116 | 35,29 | ||||

| 2025-08-21 | NP | USERX - Gold and Precious Metals Fund | 500.000 | -50,00 | 1.259 | -38,37 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 266.504 | 2.565,04 | 672 | 3.255,00 | ||||

| 2025-08-07 | 13F | Acadian Asset Management Llc | 6.000 | 0 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 17.748 | -10,13 | 45 | 10,00 | ||||

| 2025-08-13 | 13F | Arrowstreet Capital, Limited Partnership | 381.695 | 339,84 | 962 | 442,94 | ||||

| 2025-07-24 | 13F | U S Global Investors Inc | 500.000 | -50,00 | 1.268 | -37,74 | ||||

| 2025-08-14 | 13F | Jane Street Group, Llc | 0 | -100,00 | 0 | |||||

| 2025-08-05 | 13F | Simplex Trading, Llc | 22.843 | 0 | ||||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 89.594 | 287,58 | 226 | 378,72 | ||||

| 2025-06-25 | NP | EPGFX - EuroPac Gold Fund Class A | 543.171 | -54,92 | 1.257 | -40,56 | ||||

| 2025-07-14 | 13F | Caitlin John, LLC | 11.050 | 9,95 | 28 | 35,00 | ||||

| 2025-08-18 | 13F | Wolverine Trading, Llc | Call | 0 | -100,00 | 0 | ||||

| 2025-08-13 | 13F | Russell Investments Group, Ltd. | 28.510 | 0,00 | 72 | 22,41 | ||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 1.228 | 36,60 | 3 | 200,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 19.553 | -49,76 | 49 | -37,97 | ||||

| 2025-05-15 | 13F | Tower Research Capital LLC (TRC) | 0 | -100,00 | 0 | |||||

| 2025-05-28 | 13F/A | Modern Wealth Management, LLC | 13.587 | 22 | ||||||

| 2025-08-11 | 13F | Sprott Inc. | 5.630.863 | 207,98 | 14.193 | 280,58 | ||||

| 2025-08-14 | 13F | Financial Advisors Network, Inc. | 27.563 | 0,00 | 69 | 23,21 | ||||

| 2025-08-14 | 13F | Federation des caisses Desjardins du Quebec | 7.000 | 0,00 | 17 | 30,77 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 19.500 | 0,00 | 40 | 18,18 | ||||

| 2025-07-23 | 13F/A | Euro Pacific Asset Management, LLC | 378.366 | -45,42 | 1 | -100,00 | ||||

| 2025-08-13 | 13F | Walleye Capital LLC | 109.486 | 276 | ||||||

| 2025-07-22 | 13F | Sage Investment Counsel LLC | 15.000 | 0,00 | 38 | 23,33 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 41.651 | -2,32 | 105 | 20,93 | ||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 50.001 | 126 | ||||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 157.679 | -13,73 | 0 | |||||

| 2025-07-16 | 13F | Eagle Global Advisors Llc | 121.900 | 0,00 | 307 | 23,79 | ||||

| 2025-08-15 | 13F | Kestra Advisory Services, LLC | 31.404 | 185,49 | 79 | 259,09 | ||||

| 2025-07-11 | 13F | Caldwell Securities, Inc | 8.487 | 0,00 | 21 | 23,53 | ||||

| 2025-07-31 | 13F | City State Bank | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 862.821 | 9,75 | 2.174 | 35,62 | ||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 14.700 | 37 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Put | 28.200 | 28.100,00 | 71 | ||||

| 2025-05-12 | 13F | National Bank Of Canada /fi/ | 0 | -100,00 | 0 | |||||

| 2025-08-13 | 13F | Investment Counsel Co Of Nevada | 18.834 | 0,00 | 47 | 23,68 | ||||

| 2025-07-30 | 13F | Privium Fund Management B.V. | 216.968 | 0,00 | 545 | 23,08 | ||||

| 2025-07-07 | 13F | Medici Capital Llc | 2.107.927 | 5,35 | 5.300 | 29,66 | ||||

| 2025-08-14 | 13F | Millennium Management Llc | 210.740 | 79,41 | 531 | 122,18 | ||||

| 2025-08-08 | 13F | Creative Planning | 14.367 | 0,00 | 36 | 24,14 | ||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 170.000 | 428 | ||||||

| 2025-08-13 | 13F | BCJ Capital Management, LLC | 20.000 | 0,00 | 50 | 25,00 | ||||

| 2025-08-05 | 13F | Meixler Investment Management, Ltd. | 59.100 | -5,21 | 149 | 16,54 | ||||

| 2025-08-12 | 13F | SRS Capital Advisors, Inc. | 2.750 | 0,00 | 7 | 20,00 | ||||

| 2025-07-28 | 13F | Kiker Wealth Management, LLC | 500 | 0,00 | 1 | 0,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 35.000 | 16,67 | 89 | 44,26 | ||||

| 2025-05-01 | 13F | Stillwater Wealth Management Group | 0 | -100,00 | 0 | |||||

| 2025-07-25 | 13F | Apollon Wealth Management, LLC | 14.277 | 0,00 | 36 | 20,69 |