Grundlæggende statistik

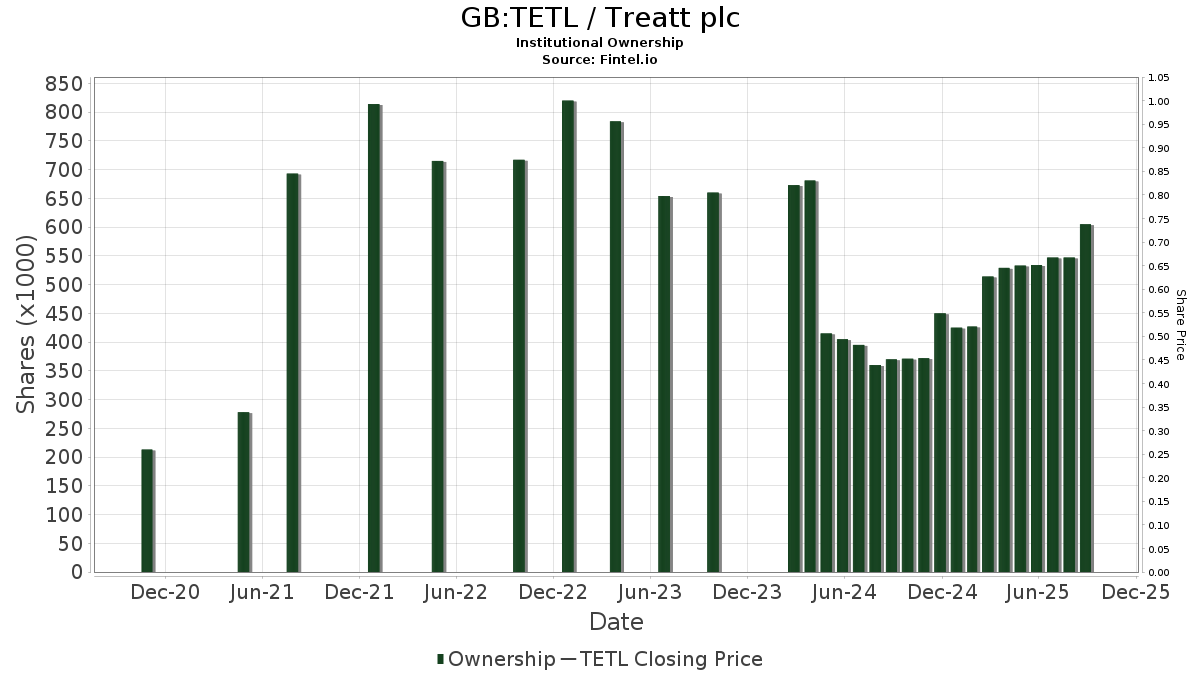

| Institutionelle aktier (lange) | 605.367 - 1,03% (ex 13D/G) - change of 0,07MM shares 13,31% MRQ |

| Institutionel værdi (lang) | $ 2.131 USD ($1000) |

Institutionelt ejerskab og aktionærer

Treatt plc (GB:TETL) har 25 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 605,367 aktier. Største aktionærer omfatter WMMAX - Teton Westwood Mighty Mites Fund Class A, GCASX - The Gabelli Small Cap Growth Fund Class A, DLS - WisdomTree International SmallCap Dividend Fund N/A, GGMMX - Gabelli Global Mini Mites Fund CLASS I, DDLS - WisdomTree Dynamic Currency Hedged International SmallCap Equity Fund N/A, Gabelli Dividend & Income Trust, Gabelli Equity Trust Inc, Dfa Investment Trust Co - The United Kingdom Small Company Series, GGLCX - Gabelli International Small Cap Fund Class C, and DFIEX - International Core Equity Portfolio - Institutional Class .

Treatt plc (BATS-CHIXE:TETL) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.