Grundlæggende statistik

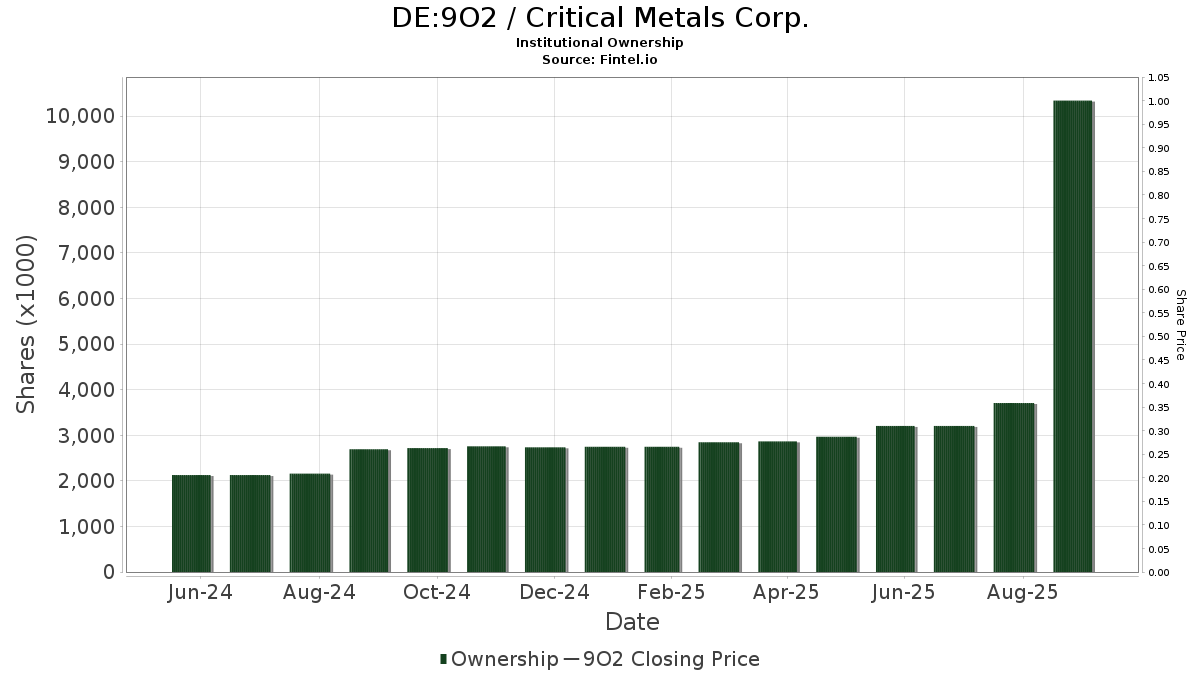

| Institutionelle aktier (lange) | 10.341.630 - 9,98% (ex 13D/G) - change of 7,14MM shares 222,71% MRQ |

| Institutionel værdi (lang) | $ 34.412 USD ($1000) |

Institutionelt ejerskab og aktionærer

Critical Metals Corp. (DE:9O2) har 88 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 10,341,630 aktier. Største aktionærer omfatter Crcm Lp, BlackRock, Inc., UBS Group AG, Linden Advisors Lp, Geode Capital Management, Llc, Aqr Capital Management Llc, Saba Capital Management, L.P., FNY Investment Advisers, LLC, Shay Capital LLC, and Cantor Fitzgerald, L. P. .

Critical Metals Corp. (DB:9O2) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-14 | 13F | Polar Asset Management Partners Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 3.567 | 13 | ||||||

| 2025-08-08 | 13F | Police & Firemen's Retirement System of New Jersey | 9.158 | 33 | ||||||

| 2025-08-11 | 13F | Vanguard Group Inc | 207.879 | 276,91 | 744 | 878,95 | ||||

| 2025-08-14 | 13F | Bnp Paribas Arbitrage, Sa | 3.267 | -92,61 | 12 | -81,97 | ||||

| 2025-08-26 | NP | NSIDX - Northern Small Cap Index Fund | 15.038 | 294,39 | 54 | 960,00 | ||||

| 2025-08-27 | NP | BBVSX - Bridge Builder Small/Mid Cap Value Fund | 8.484 | 30 | ||||||

| 2025-07-08 | 13F | Parallel Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | Virtu Financial LLC | 52.399 | 0 | ||||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 982 | 59,42 | 4 | |||||

| 2025-08-14 | 13F | Point72 Asia (Singapore) Pte. Ltd. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Cantor Fitzgerald, L. P. | 248.796 | 54,41 | 891 | 299,10 | ||||

| 2025-05-05 | 13F | Lindbrook Capital, Llc | 92 | 0 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 248.188 | 250,97 | 889 | 806,12 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 17.166 | 196,48 | 61 | 662,50 | ||||

| 2025-06-23 | NP | PPNMX - SmallCap Growth Fund I R-3 | 902 | 0,00 | 1 | -83,33 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 1.096 | 258,17 | 4 | |||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 13.258 | 121,78 | 47 | 487,50 | ||||

| 2025-08-14 | 13F | Linden Advisors Lp | 625.000 | 0,00 | 2.238 | 179,97 | ||||

| 2025-07-24 | 13F | IFP Advisors, Inc | 129 | 4.200,00 | 0 | |||||

| 2025-07-10 | 13F | Wealth Enhancement Advisory Services, Llc | 16.520 | 57 | ||||||

| 2025-08-25 | NP | SPROTT FUNDS TRUST - Sprott Lithium Miners ETF | 39.674 | 7,81 | 142 | 178,43 | ||||

| 2025-08-27 | NP | BBGSX - Bridge Builder Small/Mid Cap Growth Fund | 1.542 | 0,00 | 6 | 150,00 | ||||

| 2025-08-12 | 13F | BlackRock, Inc. | 1.648.773 | 600,13 | 5.903 | 1.704,89 | ||||

| 2025-08-14 | 13F | MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. | 17.592 | 288,26 | 63 | 933,33 | ||||

| 2025-08-08 | 13F | Intech Investment Management Llc | 17.444 | 62 | ||||||

| 2025-07-30 | 13F | FNY Investment Advisers, LLC | 295.976 | 1 | ||||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | State Street Corp | 145.592 | 151,85 | 521 | 551,25 | ||||

| 2025-08-14 | 13F | Aqr Capital Management Llc | 443.855 | 789,67 | 1.589 | 2.202,90 | ||||

| 2025-08-05 | 13F | Next Capital Management LLC | 19.982 | 0,00 | 72 | 162,96 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 25.966 | 89,80 | 93 | 384,21 | ||||

| 2025-08-22 | NP | Columbia Funds Variable Series Trust II - Variable Portfolio - Partners Small Cap Growth Fund Class 1 | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-06 | 13F | Savant Capital, LLC | 80.067 | 287 | ||||||

| 2025-08-04 | 13F | Amalgamated Bank | 253 | 0,00 | 0 | |||||

| 2025-08-19 | 13F/A | Pitcairn Co | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Cubist Systematic Strategies, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 13.443 | 48 | ||||||

| 2025-08-14 | 13F | Alliancebernstein L.p. | 145.920 | 522 | ||||||

| 2025-08-06 | 13F | True Wealth Design, LLC | 1.759 | 14.558,33 | 6 | |||||

| 2025-07-14 | 13F | Abacus Wealth Partners, LLC | 50.000 | 179 | ||||||

| 2025-08-04 | 13F | Canton Hathaway, LLC | 86.000 | 0 | ||||||

| 2025-08-05 | 13F | Bank of New York Mellon Corp | 72.246 | 539,80 | 259 | 1.620,00 | ||||

| 2025-08-14 | 13F | Saba Capital Management, L.P. | 300.000 | 0,00 | 1.074 | 240,95 | ||||

| 2025-08-14 | 13F | Shay Capital LLC | 275.000 | 984 | ||||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 33.751 | 121 | ||||||

| 2025-08-13 | 13F | Cerity Partners LLC | 63.000 | 226 | ||||||

| 2025-07-25 | 13F | Cwm, Llc | 31.284 | 456,56 | 0 | |||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 2.000 | 7 | ||||||

| 2025-08-13 | 13F | New York State Common Retirement Fund | 8.700 | 0,00 | 0 | |||||

| 2025-07-31 | 13F | Nisa Investment Advisors, Llc | 149 | 0,00 | 1 | |||||

| 2025-08-18 | 13F/A | Hudson Bay Capital Management LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-08 | 13F | Geode Capital Management, Llc | 455.006 | 272,56 | 1.629 | 863,31 | ||||

| 2025-07-16 | 13F | Signaturefd, Llc | 40 | -93,33 | 0 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 544 | 9,90 | 2 | |||||

| 2025-08-26 | NP | Profunds - Profund Vp Small-cap | 74 | 311,11 | 0 | |||||

| 2025-07-09 | 13F | Pallas Capital Advisors LLC | 12.481 | 45 | ||||||

| 2025-08-14 | 13F/A | Barclays Plc | 177.673 | 478,04 | 1 | |||||

| 2025-08-14 | 13F | Toronto Dominion Bank | 5.000 | -75,00 | 18 | -37,04 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 101.742 | 65,57 | 364 | 328,24 | ||||

| 2025-08-07 | 13F | CENTRAL TRUST Co | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Alps Advisors Inc | 39.674 | 7,81 | 142 | 178,43 | ||||

| 2025-08-14 | 13F | Peak6 Llc | 224.422 | 25,08 | 803 | 222,49 | ||||

| 2025-07-22 | NP | DSMFX - Destinations Small-Mid Cap Equity Fund Class I | 438 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | 38.955 | 139 | ||||||

| 2025-08-12 | 13F | Nuveen, LLC | 44.232 | 158 | ||||||

| 2025-06-23 | NP | UAPIX - Ultrasmall-cap Profund Investor Class | 81 | -31,93 | 0 | |||||

| 2025-08-14 | 13F | Ieq Capital, Llc | 29.612 | 106 | ||||||

| 2025-08-13 | 13F | Northern Trust Corp | 173.878 | 622 | ||||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-08-14 | 13F | California State Teachers Retirement System | 2.009 | 279,06 | 7 | |||||

| 2025-06-23 | NP | SLPIX - Small-cap Profund Investor Class | 8 | -20,00 | 0 | |||||

| 2025-08-08 | 13F/A | Sterling Capital Management LLC | 565 | 6.962,50 | 2 | |||||

| 2025-08-12 | 13F | Rhumbline Advisers | 26.585 | -38,24 | 95 | 61,02 | ||||

| 2025-07-29 | NP | VRTGX - Vanguard Russell 2000 Growth Index Fund Institutional Shares | 7.446 | -1,51 | 10 | -28,57 | ||||

| 2025-06-26 | NP | TISBX - TIAA-CREF Small-Cap Blend Index Fund Institutional Class | 9.649 | 0,00 | 16 | -79,73 | ||||

| 2025-07-11 | 13F | Farther Finance Advisors, LLC | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 100.000 | 358 | ||||||

| 2025-08-14 | 13F | Scientech Research LLC | 86.662 | 310 | ||||||

| 2025-08-12 | 13F | LPL Financial LLC | 34.375 | 123 | ||||||

| 2025-08-27 | 13F/A | Squarepoint Ops LLC | 37.332 | 134 | ||||||

| 2025-08-26 | NP | Profunds - Profund Vp Ultrasmall-cap | 112 | 286,21 | 0 | |||||

| 2025-08-14 | 13F | Fmr Llc | 2.300 | -71,45 | 8 | -27,27 | ||||

| 2025-08-11 | 13F | Blue Owl Capital Holdings LP | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 984.497 | 868,07 | 3.524 | 2.399,29 | ||||

| 2025-07-29 | NP | VRTTX - Vanguard Russell 3000 Index Fund Institutional Shares | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Price T Rowe Associates Inc /md/ | 16.260 | 0 | ||||||

| 2025-08-11 | 13F | Covestor Ltd | 29 | 222,22 | 0 | |||||

| 2025-07-29 | NP | VRTIX - Vanguard Russell 2000 Index Fund Institutional Shares | 41.543 | 8,88 | 57 | -20,83 | ||||

| 2025-08-12 | 13F | Corebridge Financial, Inc. | 0 | -100,00 | 0 | |||||

| 2025-06-27 | NP | RSSL - Global X Russell 2000 ETF | 4.582 | 6,48 | 7 | -78,79 | ||||

| 2025-08-12 | 13F | Ameritas Investment Partners, Inc. | 3.287 | 359,08 | 12 | |||||

| 2025-07-31 | 13F | Cambridge Investment Research Advisors, Inc. | 40.000 | -4,76 | 0 | |||||

| 2025-08-04 | 13F | Strs Ohio | 1.400 | 0,00 | 5 | 400,00 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 3.107 | 287,41 | 11 | 1.000,00 | ||||

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Charles Schwab Investment Management Inc | 80.841 | 367,13 | 289 | 1.104,17 | ||||

| 2025-08-13 | 13F | Crcm Lp | 2.039.358 | 7.301 | ||||||

| 2025-08-15 | 13F | Captrust Financial Advisors | 54.773 | 196 | ||||||

| 2025-08-13 | 13F | MYDA Advisors LLC | 170.000 | 609 | ||||||

| 2025-08-19 | 13F | National Asset Management, Inc. | 10.210 | 37 | ||||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 33.039 | 142,56 | 118 | 555,56 | ||||

| 2025-08-14 | 13F | Banque Transatlantique SA | 0 | -100,00 | 0 | |||||

| 2025-07-28 | NP | MSSM - Morgan Stanley Pathway Small-Mid Cap Equity ETF | 4.909 | 773,49 | 7 | 500,00 |

Other Listings

| US:CRML | 6,17 $ |