Grundlæggende statistik

| Institutionelle ejere | 8 total, 8 long only, 0 short only, 0 long/short - change of -27,27% MRQ |

| Gennemsnitlig porteføljeallokering | 0.0169 % - change of 10,56% MRQ |

| Institutionelle aktier (lange) | 10.788.277 (ex 13D/G) - change of 0,53MM shares 5,15% MRQ |

| Institutionel værdi (lang) | $ 3.846 USD ($1000) |

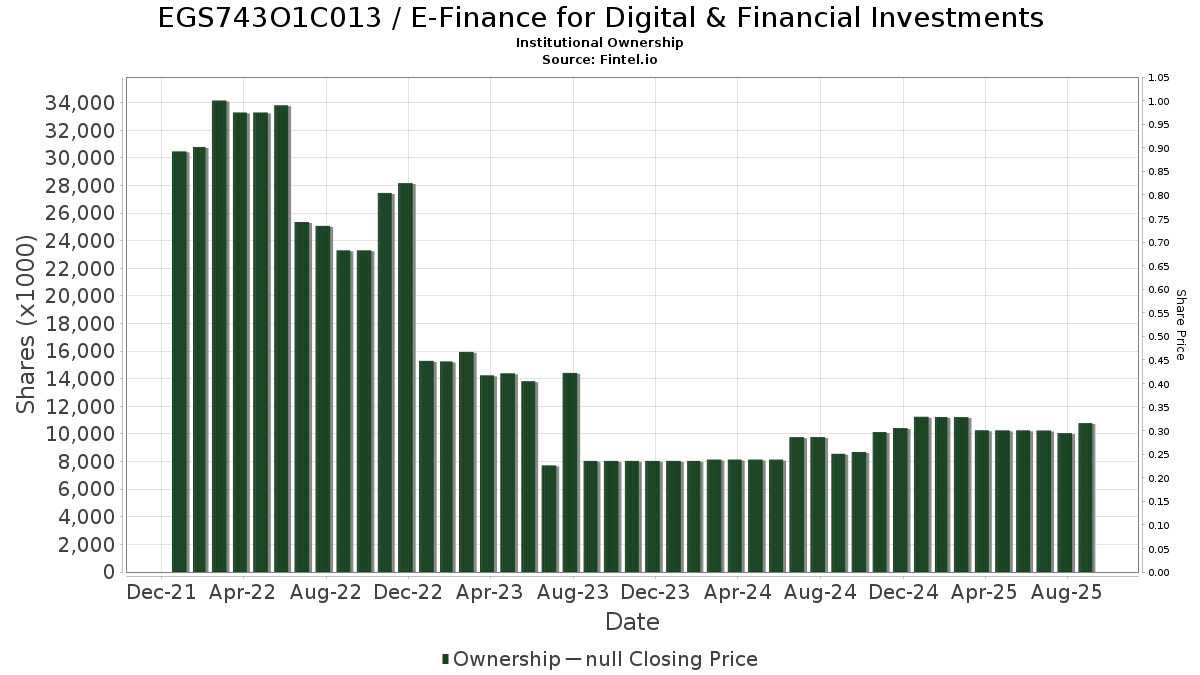

Institutionelt ejerskab og aktionærer

E-Finance for Digital & Financial Investments (EG:EGS743O1C013) har 8 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 10,788,277 aktier. Største aktionærer omfatter IEMG - iShares Core MSCI Emerging Markets ETF, Global Macro Capital Opportunities Portfolio - Global Macro Capital Opportunities Portfolio, QCSTRX - Stock Account Class R1, EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class, EWX - SPDR(R) S&P(R) EMERGING MARKETS SMALL CAP ETF, EAEMX - Parametric Emerging Markets Fund Investor Class, SSGVX - State Street Global Equity ex-U.S. Index Portfolio State Street Global All Cap Equity ex-U.S. Index Portfolio, and TLTE - FlexShares Morningstar Emerging Markets Factor Tilt Index Fund .

E-Finance for Digital & Financial Investments (EGS743O1C013) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.