Grundlæggende statistik

| Institutionelle aktier (lange) | 2.172.596 - 0,75% (ex 13D/G) - change of 0,19MM shares 9,79% MRQ |

| Institutionel værdi (lang) | $ 19.691 USD ($1000) |

Institutionelt ejerskab og aktionærer

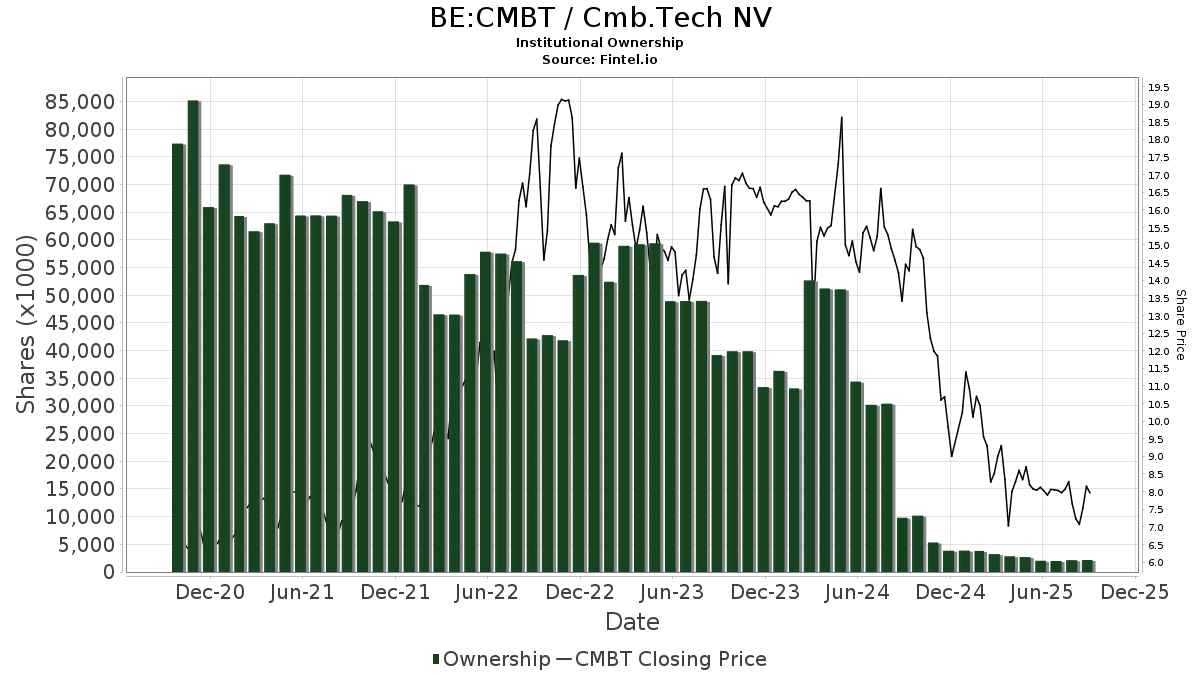

Cmb.Tech NV (BE:CMBT) har 55 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 2,172,596 aktier. Største aktionærer omfatter Uniplan Investment Counsel, Inc., Norges Bank, UBS Group AG, Susquehanna International Group, Llp, DFAI - Dimensional International Core Equity Market ETF, Vanguard Group Inc, Mariner, LLC, DRISX - Foundry Partners Fundamental Small Cap Value Fund Institutional Class, DFAX - Dimensional World ex U.S. Core Equity 2 ETF, and DFIC - Dimensional International Core Equity 2 ETF .

Cmb.Tech NV (ENXTBR:CMBT) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 5, 2025 is 7,68 / share. Previously, on September 9, 2024, the share price was 13,64 / share. This represents a decline of 43,70% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

| Fil dato | Kilde | Investor | Type | Gennemsnitlig pris (Øst) |

Aktier | Δ Aktier (%) |

Rapporteret Værdi ($1000) |

Δ Værdi (%) |

Port Alloc (%) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-12 | 13F | XTX Topco Ltd | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | DFIS - Dimensional International Small Cap ETF | 41.222 | -32,45 | 392 | -40,43 | ||||

| 2025-07-24 | 13F | Us Bancorp \de\ | 0 | -100,00 | 0 | |||||

| 2025-06-26 | NP | DFAI - Dimensional International Core Equity Market ETF | 135.357 | -8,14 | 1.287 | -19,01 | ||||

| 2025-08-13 | 13F | Norges Bank | 312.596 | 2.847 | ||||||

| 2025-08-14 | 13F | Group One Trading, L.p. | 38.593 | 60,61 | 348 | 59,63 | ||||

| 2025-07-24 | 13F/A | Mraz, Amerine & Associates, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | RBF Capital, LLC | 15.955 | 0,00 | 144 | -0,69 | ||||

| 2025-03-31 | NP | DRISX - Foundry Partners Fundamental Small Cap Value Fund Institutional Class | 108.869 | -57,49 | 1.175 | -67,04 | ||||

| 2025-06-26 | NP | DFAX - Dimensional World ex U.S. Core Equity 2 ETF | 91.996 | 0,00 | 875 | -11,90 | ||||

| 2025-07-24 | 13F | Lester Murray Antman dba SimplyRich | 34.206 | -0,61 | 0 | |||||

| 2025-06-30 | NP | PDN - Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF This fund is a listed as child fund of Invesco Ltd. and if that institution has disclosed ownership in this security, then these positions will not be double counted when calculating total shares and total value | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Wells Fargo & Company/mn | 590 | -17,13 | 5 | -16,67 | ||||

| 2025-05-12 | 13F | Townsquare Capital Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Css Llc/il | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Qube Research & Technologies Ltd | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Css Llc/il | Put | 0 | -100,00 | 0 | ||||

| 2025-08-11 | 13F | Vanguard Group Inc | 135.033 | 1.232 | ||||||

| 2025-08-12 | 13F | MAI Capital Management | 90 | 0,00 | 1 | |||||

| 2025-08-14 | 13F | Ubs Asset Management Americas Inc | 5.788 | 4.187,41 | 52 | 5.100,00 | ||||

| 2025-08-14 | 13F | Vident Advisory, LLC | 44.961 | -35,62 | 406 | -36,12 | ||||

| 2025-04-23 | 13F | Chapin Davis, Inc. | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-26 | NP | DFIC - Dimensional International Core Equity 2 ETF | 70.999 | 0,00 | 675 | -11,88 | ||||

| 2025-05-05 | 13F | Foundry Partners, LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-14 | 13F | Headlands Technologies LLC | 1.448 | 34,57 | 13 | 44,44 | ||||

| 2025-08-27 | NP | ALLIANZ VARIABLE INSURANCE PRODUCTS TRUST - AZL DFA International Core Equity Fund | 1.031 | 0,00 | 9 | 0,00 | ||||

| 2025-09-04 | 13F/A | Advisor Group Holdings, Inc. | 2.864 | 39,98 | 26 | 38,89 | ||||

| 2025-05-14 | 13F | Credit Agricole S A | 456 | 0,00 | 4 | 0,00 | ||||

| 2025-07-17 | 13F | Sound Income Strategies, LLC | 997 | 0,00 | 9 | -11,11 | ||||

| 2025-08-08 | 13F | Itau Unibanco Holding S.A. | 0 | -100,00 | 0 | |||||

| 2025-08-27 | 13F/A | Brinker Capital Investments, LLC | 10.899 | 98 | ||||||

| 2025-05-05 | 13F | IFP Advisors, Inc | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | FourWorld Capital Management LLC | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-08-12 | 13F | Proequities, Inc. | 0 | 0 | ||||||

| 2025-05-14 | 13F | State of Wyoming | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Mesirow Financial Investment Management, Inc. | 11.336 | -17,08 | 102 | -17,74 | ||||

| 2025-08-14 | 13F | Bank Of America Corp /de/ | 20.767 | -62,03 | 187 | -62,30 | ||||

| 2025-07-28 | 13F | BRYN MAWR TRUST Co | 168 | 0,00 | 2 | 0,00 | ||||

| 2025-08-14 | 13F | Royal Bank Of Canada | 3.945 | 9,58 | 36 | 9,09 | ||||

| 2025-06-26 | NP | DISV - Dimensional International Small Cap Value ETF | 29.234 | 0,00 | 278 | -11,75 | ||||

| 2025-08-01 | 13F | Envestnet Asset Management Inc | 65.624 | -9,22 | 592 | -9,91 | ||||

| 2025-08-13 | 13F | Barclays Plc | 0 | -100,00 | 0 | |||||

| 2025-08-18 | 13F/A | National Bank Of Canada /fi/ | 700 | 0,00 | 6 | 0,00 | ||||

| 2025-08-12 | 13F | Jpmorgan Chase & Co | 30.752 | 3.978,51 | 277 | 4.516,67 | ||||

| 2025-08-14 | 13F | Goldman Sachs Group Inc | 69.911 | -71,81 | 631 | -72,01 | ||||

| 2025-08-14 | 13F | Susquehanna International Group, Llp | Call | 176.900 | 1.596 | |||||

| 2025-05-14 | 13F | Northwestern Mutual Wealth Management Co | 0 | -100,00 | 0 | |||||

| 2025-05-14 | 13F | JustInvest LLC | 0 | -100,00 | 0 | |||||

| 2025-05-15 | 13F | Citadel Advisors Llc | Put | 0 | -100,00 | 0 | -100,00 | |||

| 2025-07-31 | 13F | City State Bank | 100 | 0,00 | 1 | |||||

| 2025-08-13 | 13F | EverSource Wealth Advisors, LLC | 1.889 | -40,11 | 17 | -39,29 | ||||

| 2025-07-24 | 13F | Ronald Blue Trust, Inc. | 5.059 | -21,75 | 46 | -22,41 | ||||

| 2025-08-08 | 13F | Larson Financial Group LLC | 260 | 2 | ||||||

| 2025-08-12 | 13F | Steward Partners Investment Advisory, Llc | 5.873 | 8,86 | 53 | 8,33 | ||||

| 2025-07-24 | 13F | Ramirez Asset Management, Inc. | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | 37.577 | 339 | ||||||

| 2025-08-14 | 13F | Uniplan Investment Counsel, Inc. | 372.643 | -10,00 | 3.361 | -10,59 | ||||

| 2025-04-08 | 13F | Pacifica Partners Inc. | 0 | -100,00 | 0 | |||||

| 2025-07-15 | 13F | Fifth Third Bancorp | 9.760 | 0,05 | 88 | 0,00 | ||||

| 2025-08-01 | 13F | Rossby Financial, LCC | 290 | 0,00 | 3 | 0,00 | ||||

| 2025-08-14 | 13F | UBS Group AG | 247.715 | -11,16 | 2.234 | -11,73 | ||||

| 2025-05-15 | 13F | Millennium Management Llc | 0 | -100,00 | 0 | -100,00 | ||||

| 2025-06-30 | 13F/A | Deutsche Bank Ag\ | 0 | -100,00 | 0 | |||||

| 2025-08-14 | 13F | Citadel Advisors Llc | Call | 14.000 | 126 | |||||

| 2025-08-08 | 13F | SBI Securities Co., Ltd. | 7.158 | 3,23 | 65 | 3,23 | ||||

| 2025-08-11 | 13F | Citigroup Inc | 2.395 | 22 | ||||||

| 2025-08-14 | 13F | Css Llc/il | Call | 0 | -100,00 | 0 | ||||

| 2025-08-14 | 13F | Mariner, LLC | 113.496 | 138,86 | 1.024 | 137,35 | ||||

| 2025-08-12 | 13F | Legal & General Group Plc | 6.529 | 221,31 | 59 | 227,78 | ||||

| 2025-08-15 | 13F | Tower Research Capital LLC (TRC) | 426 | 14.100,00 | 4 | |||||

| 2025-08-14 | 13F | Raymond James Financial Inc | 2.953 | 27 | ||||||

| 2025-08-15 | 13F | Morgan Stanley | 11.902 | -82,25 | 107 | -82,40 | ||||

| 2025-08-14 | 13F | Boston Private Wealth Llc | 0 | -100,00 | 0 | |||||

| 2025-08-04 | 13F | Wolverine Asset Management Llc | 900 | 8 | ||||||

| 2025-07-15 | 13F | Td Private Client Wealth Llc | 250 | 0,00 | 2 | 0,00 | ||||

| 2025-08-07 | 13F | Mitsubishi UFJ Kokusai Asset Management Co., Ltd. | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | Hexagon Capital Partners LLC | 0 | -100,00 | 0 | |||||

| 2025-08-11 | 13F | TD Waterhouse Canada Inc. | 152 | 0,00 | 1 | 0,00 | ||||

| 2025-08-13 | 13F | Jones Financial Companies Lllp | 55 | 0,00 | 1 | |||||

| 2025-07-22 | 13F | Highland Capital Management, Llc | 42.100 | -2,77 | 380 | -3,56 | ||||

| 2025-08-12 | 13F | Coldstream Capital Management Inc | 0 | -100,00 | 0 | |||||

| 2025-08-12 | 13F | BlackRock, Inc. | 2.846 | 314,26 | 26 | 316,67 | ||||

| 2025-07-18 | 13F/A | MJT & Associates Financial Advisory Group, Inc. | 100 | 0,00 | 1 | |||||

| 2025-05-14 | 13F | Orion Portfolio Solutions, LLC | 13.781 | 0,00 | 137 | 0,00 | ||||

| 2025-05-13 | 13F | Caitong International Asset Management Co., Ltd | 0 | -100,00 | 0 |