Grundlæggende statistik

| Institutionelle aktier (lange) | 14.488.996 - 1,11% (ex 13D/G) - change of -0,06MM shares -0,41% MRQ |

| Institutionel værdi (lang) | $ 5.601 USD ($1000) |

Institutionelt ejerskab og aktionærer

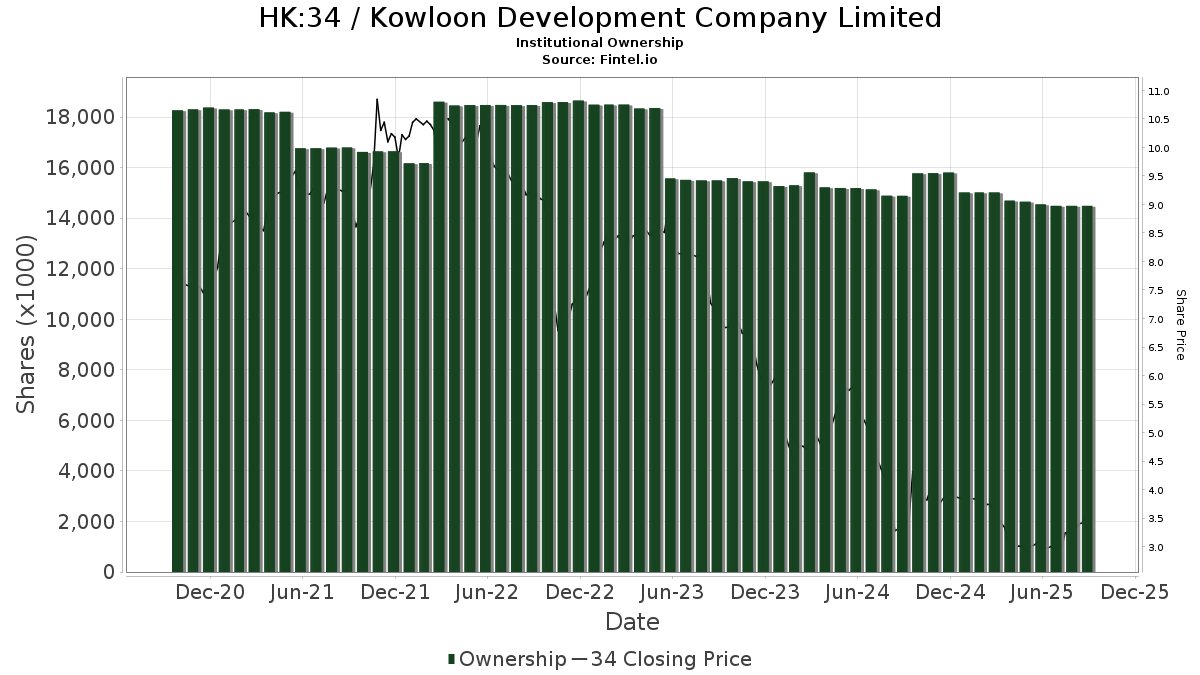

Kowloon Development Company Limited (HK:34) har 22 institutionelle ejere og aktionærer, der har indsendt 13D/G- eller 13F-formularer til Securities Exchange Commission (SEC). Disse institutioner har i alt 14,488,996 aktier. Største aktionærer omfatter DISVX - Dfa International Small Cap Value Portfolio - Institutional Class, DFIEX - International Core Equity Portfolio - Institutional Class, Dfa Investment Trust Co - The Asia Pacific Small Company Series, DISV - Dimensional International Small Cap Value ETF, DFIC - Dimensional International Core Equity 2 ETF, DFA INVESTMENT DIMENSIONS GROUP INC - International Vector Equity Portfolio Shares, DFIS - Dimensional International Small Cap ETF, DFA INVESTMENT DIMENSIONS GROUP INC - International Sustainability Core 1 Portfolio Shares, DFAX - Dimensional World ex U.S. Core Equity 2 ETF, and DFA INVESTMENT DIMENSIONS GROUP INC - World ex U.S. Core Equity Portfolio Institutional Class Shares .

Kowloon Development Company Limited (SEHK:34) institutionel ejerskabsstruktur viser aktuelle positioner i virksomheden efter institutioner og fonde, samt seneste ændringer i positionsstørrelse. Større aktionærer kan omfatte individuelle investorer, investeringsforeninger, hedgefonde eller institutioner. Skema 13D angiver, at investoren besidder (eller besidder) mere end 5 % af virksomheden og har til hensigt (eller har til hensigt at) aktivt at forfølge en ændring i forretningsstrategi. Skema 13G indikerer en passiv investering på over 5%.

The share price as of September 16, 2025 is 3,63 / share. Previously, on September 16, 2024, the share price was 3,09 / share. This represents an increase of 17,48% over that period.

Fondens stemningsscore

Fund Sentiment Score (fka Ownership Accumulation Score) finder de aktier, der bliver mest købt af fonde. Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af institutionel akkumulering. Scoringsmodellen bruger en kombination af den samlede stigning i oplyste ejere, ændringerne i porteføljeallokeringer i disse ejere og andre målinger. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Ownership Explorer, som giver en liste over højest rangerende virksomheder.

13F og NPORT arkivering

Detaljer om 13F-arkivering er gratis. Detaljer om NP-ansøgninger kræver et premium-medlemskab. Grønne rækker angiver nye positioner. Røde rækker angiver lukkede positioner. Klik på linket ikon for at se den fulde transaktionshistorik.

Opgrader

for at låse premium-data op og eksportere til Excel ![]() .

.

Other Listings

| DE:KOX | 0,34 € |