| Insideraktier | 5.633.785 shares |

| Total Insiders | 89 |

Insider-stemningsscore

Insider Sentiment Score viser, at virksomhederne bliver købt af virksomheders insidere.

Det er resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af insider-akkumulering. Scoringsmodellen bruger en kombination af nettoantallet af insidere, der har købt de foregående 90 dage, det samlede antal aktier købt som en procentdel af float og det samlede antal aktier ejet af insidere. Tallet går fra 0 til 100, hvor højere tal indikerer et højere niveau af akkumulering for sine jævnaldrende, og 50 er gennemsnittet.

Opdateringsfrekvens: Dagligt

Se Insiders Top Picks, som giver en liste over virksomheder med den højeste insider-akkumulering.

Officers sentiment score

Officer Sentiment Score finder virksomheder, der bliver købt af Corporate Officers.

Per definition er Corporate Officers Corporate Insiders, men i modsætning til nogle af de andre Insiders (10 % aktionærer og bestyrelsesmedlemmer), arbejder officerer for virksomheden på daglig basis, og de bruger deres egne penge, når de handler . (10 % aktionærer og bestyrelsesmedlemmer er ofte fondsforvaltere, der administrerer andres penge.) Som sådan er insiderhandler foretaget af embedsmænd meget mere betydningsfulde og bør behandles passende.

Ligesom Insider Sentiment Score er Officer Sentiment Score resultatet af en sofistikeret, multi-faktor kvantitativ model, der identificerer virksomheder med de højeste niveauer af officerakkumulering.

Opdateringsfrekvens: Dagligt

Se Insiders Top Picks, som giver en liste over virksomheder med højeste insider-stemning.

Nøgle Insider Metrics

Dette kort viser, hvordan virksomheden rangerer langs forskellige insider-metrics. Percentilrangen viser, hvordan denne virksomhed sammenligner sig med andre virksomheder på de amerikanske markeder. Højere placeringer er tegn på bedre situationer.

For eksempel er det generelt accepteret, at insider-køb er en positiv indikator, så virksomheder med flere insider-køb vil rangere højere end virksomheder med mindre insider-køb (eller endda insider-salg).

Procent af float købt af insidere (rangering)

N/A

Procent af float købt af insidere er det samlede antal aktier købt af insidere minus det samlede antal aktier solgt af insidere inden for de sidste 90 dage, divideret med den samlede float og ganget med 100.

Insiderhandelsdiagram

Bristol-Myers Squibb Company - Equity Right insiderhandler er vist i følgende diagram. Insidere er embedsmænd, direktører eller betydelige investorer i en virksomhed. Generelt er det generelt ulovligt for insidere at foretage handler i deres virksomheder baseret på væsentlige, ikke-offentlige oplysninger. Dette betyder ikke, at det er ulovligt for dem at handle i deres egne virksomheder. De skal dog rapportere alle handler til SEC via en formular 4.

Insiderliste og lønsomhedsmålinger

Denne tabel viser listen over kendte insidere og genereres automatisk fra arkiveringer, der er videregivet til SEC. Ud over navnene, den seneste titel og direktør, officer eller 10 % ejerbetegnelse giver vi de seneste offentliggjorte besiddelser. Derudover giver vi, når det er muligt, den historiske handelspræstation for insideren. Den historiske handelspræstation er et vægtet gennemsnit af præstationen af faktiske købstransaktioner på det åbne marked foretaget af insideren. For mere information om, hvordan dette beregnes, se dette YouTube-webinar.

See our leaderboard of most profitable insider traders.

| Insider | Gennemsnitlig fortjeneste (%) | Aktier Ejet |

Dele Justeret |

|---|---|---|---|

| Nadim Ahmed EVP and President, Hematology - [O] | 38.889 | 38.889 | |

| Lamberto Andreotti Director - [D] | 935.571 | 935.571 | |

| Peter J Arduini | 38.266 | ||

| Stephen E Bear SVP, Human Resources - [O] | 50.532 | 50.532 | |

| Robert J Bertolini Director - [D] | 11.397 | 11.397 | |

| Andrew G Bodnar SVP, Strat & Med & Ext Affairs - [O] | 166.633 | 166.633 | |

| Boerner Christopher S. Chief Executive Officer, Director - [D] [O] | 125.439 | 125.439 | |

| Andrew R J Bonfield SVP & CFO - [O] | 135.000 | 135.000 | |

| Michael W Bonney Director - [D] | 12.501 | 12.501 | |

| Charles A Bancroft EVP, Head of Integration - [O] | 137.534 | 137.534 | |

| Jose Baselga | 3.681 | ||

| Paul Biondi SVP, Head of Strategy & BD - [O] | 6.214 | 6.214 | |

| Emmanuel Blin SVP, Chief Strategy Officer - [O] | 20.138 | 20.138 | |

| Lewis B Campbell Director - [D] | 0 | 0 | |

| James M Cornelius Director - [D] | 79.851 | 79.851 | |

| Giovanni Caforio Executive Chair of the Board, Director - [D] [O] | 432.266 | 432.266 | |

| Joseph C Caldarella SVP & Controller - [O] | 46.297 | 46.297 | |

| de Notaristefani Carlo President, Tech Ops - [O] | 61 | 61 | |

| Beatrice J Cazala EVP Commercial Operations - [O] | 173.375 | 173.375 | |

| John E Celentano SVP HR Public Affairs & Philan - [O] | 142.142 | 142.142 | |

| Francis M Cuss EVP & CSO - [O] | 321.906 | 321.906 | |

| Brian Daniels SVP Global Dev & Med Affairs - [O] | 94.374 | 94.374 | |

| Wendy L Dixon CMO & Pres, Global Marketing - [O] | 70.000 | 70.000 | |

| Peter R Dolan Chairman of the Board and CEO, Director - [D] [O] | 285.318 | 285.318 | |

| Adam Dubow SVP,ChiefCompliance&EthicsOff. - [O] | 13.777 | 13.777 | |

| Joseph Eid SVP,Head Glob. Medical Affairs - [O] | 9.485 | 9.485 | |

| John E Elicker EVP, Investor Relations - [O] | 70.946 | 70.946 | |

| David V Elkins EVP, Chief Financial Officer - [O] | 167.662 | 167.662 | |

| Matthew Emmens Director - [D] | 520 | 520 |

| Insider | Gennemsnitlig fortjeneste (%) | Aktier Ejet |

Dele Justeret |

|---|---|---|---|

| Louis J Freeh | 40.661 | ||

| Ellen V Futter | 11.556 | ||

| Glimcher Laurie H M.d. Director - [D] | 0 | 0 | |

| Michael Grobstein | 87.898 | ||

| Cari Gallman EVP, General Counsel - [O] | 8.840 | 8.840 | |

| Murdo Gordon EVP, Chief Commercial Officer - [O] | 49.424 | 49.424 | |

| Sharon Greenlees SVP & Controller - [O] | 609 | 609 | |

| Donald J Jr Hayden EVP and President, Americas - [O] | 182.950 | 182.950 | |

| Anthony C Hooper President US Pharmaceuticals - [O] | 2.785 | 2.785 | |

| Tamar D Howson SVP, Corp & Bus Development - [O] | 60.084 | 60.084 | |

| Julia A Haller Director - [D] | 13.619 | 13.619 | |

| Frances K Heller SVP, Business Development - [O] | 4.174 | 4.174 | |

| Benjamin Hickey President, RayzeBio Org. - [O] | 8.789 | 8.789 | |

| Medina Manuel Hidalgo | 5.453 | ||

| Samit Hirawat EVP,Chief Med.Offr.,Drug Dev. - [O] | 83.513 | 83.513 | |

| Lynelle Hoch President, Cell Therapy Org. - [O] | 4.711 | 4.711 | |

| Phil M Holzer SVP and Controller - [O] | 14.967 | 14.967 | |

| Jean-Marc Huet | 16.500 | ||

| Leif Johansson | 7.653 | ||

| Ann Powell Judge EVP, Chief Human Resources - [O] | 27.868 | 27.868 | |

| Alan J Lacy | 78.952 | ||

| Sandra Leung EVP, General Counsel - [O] | 364.296 | 364.296 | |

| Jeremy M Levin SVP Strat Transactions - [O] | 43.689 | 43.689 | |

| Adam Lenkowsky EVP, Chief Commercial Officer - [O] | 12.439 | 12.439 | |

| Lynch Thomas J. Jr. EVP & Chief Scientific Officer - [O] | 22.223 | 22.223 | |

| Anthony A Mcbride | 6.385 | ||

| John L Mcgordrick EVP & General Counsel - [O] | 138.320 | 138.320 | |

| Dean J Mitchell President, U.S. Primary Care - [O] | 60.000 | 60.000 | |

| McMullen Michael R. Director - [D] | 1.000 | 1.000 | |

| Kathryn Metcalfe | 8.126 |

| Insider | Gennemsnitlig fortjeneste (%) | Aktier Ejet |

Dele Justeret |

|---|---|---|---|

| Gregory Scott Meyers EVP, Chief Digital & Tech Off. - [O] | 16.102 | 16.102 | |

| Elizabeth Mily EVP, Strategy & BD - [O] | 34.734 | 34.734 | |

| Samuel J Moed SVP, Strat Plan & Analysis - [O] | 31.015 | 31.015 | |

| Anne Nielsen Chief Compliance & Ethics Off - [O] | 37.974 | 37.974 | |

| James B D Dr Palmer CSO & President, PRI - [O] | 160.000 | 160.000 | |

| Dinesh C Paliwal Director - [D] | 22.109 | 22.109 | |

| Robert M Plenge EVP, Chief Research Officer - [O] | 15.839 | 15.839 | |

| Ahn Amanda Poole EVP, Chief People Officer - [O] | 5.196 | 5.196 | |

| Paula A Price | 8.255 | ||

| Derica W Rice Director - [D] | 1.200 | 1.200 | |

| Vicki L Sato | 70.460 | ||

| Elliot Sigal EVP, CSO & President R&D, Director - [D] [O] | 148.221 | 148.221 | |

| John L Iii Skule SVP, Corp & Envirn Affairs - [O] | 99.485 | 99.485 | |

| Samuels Theodore R. II Director - [D] | 35.500 | 35.500 | |

| Karen Murphy Santiago SVP & Controller - [O] | 16.704 | 16.704 | |

| Louis S Schmukler EVP,Pres.,Glob.Prod. & Supply - [O] | 31.956 | 31.956 | |

| Karin Shanahan EVP, Glob. Prod. Dev. & Supply - [O] | 15.076 | 15.076 | |

| Bartie Wendy Short EVP, Corporate Affairs - [O] | 5.669 | 5.669 | |

| Gerald L Storch | 71.009 | ||

| Rupert Vessey EVP & President, Research - [O] | 48.407 | 48.407 | |

| Karen H Vousden | 21.415 | ||

| Togo D Jr West | 50.495 | ||

| Richard K Willard SVP & General Counsel - [O] | 100.000 | 100.000 | |

| Michelle Weese EVP, Corporate Affairs - [O] | 3.453 | 3.453 | |

| R Sanders Williams | 48.336 | ||

| Richard L Wolgemuth SVP, Global Reg Sciences - [O] | 45.016 | 45.016 | |

| Phyllis R Yale | 14.855 | ||

| David L Zabor VP, Fin Ops & Controller - [O] | 43.697 | 43.697 | |

| Robert T Zito SVP & Chief Comm Officer - [O] | 768 | 768 | |

| Autenried Paul von EVP, Chief Information Officer - [O] | 63.536 | 63.536 |

Report errors via our new Insider Auditing Tool

Track Records af insiderkøb - Kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i CELG.RT / Bristol-Myers Squibb Company - Equity Right. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

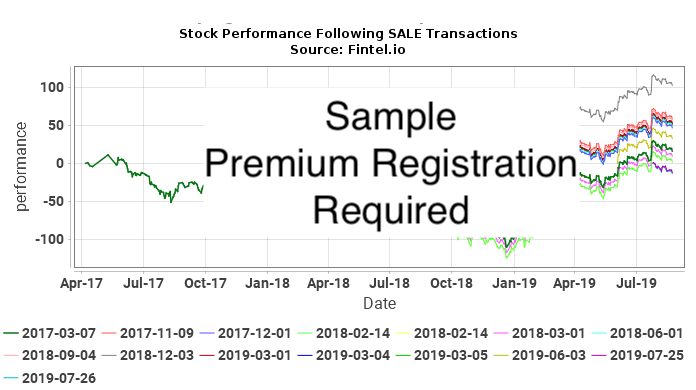

Track Records af insidersalg - Kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i CELG.RT / Bristol-Myers Squibb Company - Equity Right. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Transaktionshistorik

Klik på linkikonet for at se den fulde transaktionshistorik. Transaktioner, der rapporteres som en del af en automatisk handelsplan 10b5-1, vil have et X i kolonnen markeret 10b-5.

| Fil Dato |

Handle Dato |

Form | Insider | Ticker | Sikkerhedstitel | Kode | Direkte | Dyrke motion Pris |

Enhed Pris |

Enheder Ændret |

Værdi Ændret (1K) |

Tilbage Muligheder |

Tilbage Aktier |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-09-03 | 2025-09-02 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 47,3300 | -56.000 | -2.650 | 167.379 | ||||

| 2025-09-03 | 2025-09-01 | 4 | Short Bartie Wendy | BMY | Common Stock, $0.10 par value | D | 47,1800 | -632 | -30 | 5.669 | ||||

| 2025-09-03 | 2025-09-01 | 4 | Short Bartie Wendy | BMY | Common Stock, $0.10 par value | D | 1.235 | 6.301 | ||||||

| 2025-08-05 | 2025-08-01 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 44,2300 | -543 | -24 | 8.840 | ||||

| 2025-08-05 | 2025-08-01 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 1.061 | 9.383 | ||||||

| 2025-08-05 | 2025-08-02 | 4 | Short Bartie Wendy | BMY | Common Stock, $0.10 par value | D | 44,2300 | -378 | -17 | 5.066 | ||||

| 2025-08-05 | 2025-08-02 | 4 | Short Bartie Wendy | BMY | Common Stock, $0.10 par value | D | 738 | 5.444 | ||||||

| 2025-06-16 | 2025-06-13 | 4 | BOERNER CHRISTOPHER S. Trust | BMY | Common Stock, $0.10 par value | I | 62.719 | 125.439 | ||||||

| 2025-06-16 | 2025-06-13 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -62.719 | 0 | ||||||

| 2025-06-04 | 2025-06-03 | 4 | Short Bartie Wendy | BMY | Common Stock, $0.10 par value | D | 48,0900 | -3.334 | -160 | 4.706 | ||||

| 2025-06-04 | 2025-06-03 | 4 | Short Bartie Wendy | BMY | Common Stock, $0.10 par value | D | 8.040 | 8.040 | ||||||

| 2025-06-04 | 2025-06-03 | 4 | BOERNER CHRISTOPHER S. Trust | BMY | Common Stock, $0.10 par value | I | 62.720 | 62.720 | ||||||

| 2025-06-04 | 2025-06-03 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -62.720 | 62.719 | ||||||

| 2025-05-13 | 2025-05-09 | 4 | Hickey Benjamin By Spouse | BMY | Common Stock, $0.10 par value | I | 38,0100 | -97 | -4 | 0 | ||||

| 2025-04-29 | 2025-04-25 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 47,5800 | 4.250 | 202 | 83.513 | ||||

| 2025-04-03 | 2025-04-01 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 59,5500 | -1.692 | -101 | 13.797 | ||||

| 2025-04-03 | 2025-04-01 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 3.306 | 15.489 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.860 | -117 | 15.839 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | -2.449 | 17.699 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 6.641 | 20.148 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -862 | -54 | 13.507 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | -399 | 14.369 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 2.342 | 14.768 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -406 | -26 | 12.426 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | -193 | 12.832 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 1.107 | 13.025 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -482 | -30 | 11.918 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | -80 | 12.400 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 1.165 | 12.480 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 63,1100 | -4.558 | -288 | 16.102 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | -6.277 | 20.660 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 17.021 | 26.937 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.159 | -73 | 9.916 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | -561 | 11.075 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 3.293 | 11.636 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 63,1100 | -994 | -63 | 8.343 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | -495 | 9.337 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 2.836 | 9.832 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 63,1100 | -4.741 | -299 | 12.183 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | -5.415 | 16.924 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 14.683 | 22.339 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.398 | -88 | 7.656 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | -561 | 9.054 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 3.293 | 9.615 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.034 | -65 | 6.322 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | -427 | 7.356 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 2.447 | 7.783 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 63,1100 | -3.538 | -223 | 12.439 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | -4.040 | 15.977 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 10.955 | 20.017 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 63,1100 | -849 | -54 | 9.062 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | -341 | 9.911 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 2.000 | 10.252 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 63,1100 | -771 | -49 | 8.252 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | -318 | 9.023 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 1.825 | 9.341 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 63,1100 | -907 | -57 | 7.516 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | -131 | 8.423 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 1.904 | 8.554 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.557 | -98 | 5.196 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | -1.793 | 6.753 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 4.861 | 8.546 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 63,1100 | -241 | -15 | 3.685 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | -137 | 3.926 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 803 | 4.063 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 63,1100 | -242 | -15 | 3.260 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | -141 | 3.502 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 810 | 3.643 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 63,1100 | -233 | -15 | 2.833 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | -48 | 3.066 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 690 | 3.114 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.359 | -86 | 4.711 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | -1.850 | 6.070 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 5.015 | 7.920 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 63,1100 | -374 | -24 | 2.905 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | -179 | 3.279 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 1.050 | 3.458 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 63,1100 | -296 | -19 | 2.408 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | -146 | 2.704 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 835 | 2.850 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 63,1100 | -219 | -14 | 2.015 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | -38 | 2.234 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 546 | 2.272 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 63,1100 | -10.363 | -654 | 364.296 | ||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | -11.837 | 374.659 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 32.096 | 386.496 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.298 | -145 | 354.400 | ||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | -923 | 356.698 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.415 | 357.621 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.259 | -143 | 352.206 | ||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | -933 | 354.465 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.349 | 355.398 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.790 | -176 | 350.049 | ||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | -404 | 352.839 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.858 | 353.243 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 63,1100 | -9.232 | -583 | 79.263 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | -10.545 | 88.495 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 28.593 | 99.040 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.484 | -157 | 70.447 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | -998 | 72.931 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 5.854 | 73.929 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.013 | -127 | 68.075 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | -831 | 70.088 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 4.765 | 70.919 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.327 | -147 | 66.154 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | -337 | 68.481 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 4.886 | 68.818 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.110 | -70 | 14.967 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | -1.793 | 16.077 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 4.861 | 17.870 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -231 | -15 | 13.009 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | -131 | 13.240 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 768 | 13.371 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -242 | -15 | 12.603 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | -141 | 12.845 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 810 | 12.986 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 63,1100 | -237 | -15 | 12.176 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | -48 | 12.413 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 701 | 12.461 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 63,1100 | -1.290 | -81 | 8.322 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | -2.014 | 9.612 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 5.462 | 11.626 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 63,1100 | -260 | -16 | 6.164 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | -148 | 6.424 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 867 | 6.572 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 63,1100 | -272 | -17 | 5.705 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | -159 | 5.977 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 910 | 6.136 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 63,1100 | -118 | -7 | 5.226 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | -24 | 5.344 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 349 | 5.368 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 63,1100 | -12.295 | -776 | 223.379 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | -16.934 | 235.674 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 45.916 | 252.608 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.782 | -176 | 206.692 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | -1.347 | 209.474 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 7.904 | 210.821 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.680 | -169 | 202.917 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | -1.335 | 205.597 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 7.652 | 206.932 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 63,1100 | -3.178 | -201 | 199.280 | ||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | -555 | 202.458 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 8.045 | 203.013 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 63,1100 | -12.818 | -809 | 125.439 | ||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -14.641 | 138.257 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 39.700 | 152.898 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.858 | -180 | 113.198 | ||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -1.147 | 116.056 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 6.733 | 117.203 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 63,1100 | -2.794 | -176 | 110.470 | ||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -1.154 | 113.264 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 6.616 | 114.418 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 63,1100 | -3.327 | -210 | 107.802 | ||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -482 | 111.129 | ||||||

| 2025-03-12 | 2025-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 6.985 | 111.611 | ||||||

| 2025-03-04 | 2025-03-01 | 4 | Hickey Benjamin | BMY | Common Stock, $0.10 par value | D | 59,6200 | -1.630 | -97 | 8.789 | ||||

| 2025-03-04 | 2025-03-01 | 4 | Hickey Benjamin | BMY | Common Stock, $0.10 par value | D | 3.286 | 10.419 | ||||||

| 2025-02-21 | 2025-02-20 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 55,0480 | 2.000 | 110 | 104.626 | ||||

| 2025-02-19 | 2025-02-14 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 54,8400 | 1.823 | 100 | 63.932 | ||||

| 2025-02-04 | 2025-02-01 | 4 | Hickey Benjamin | BMY | Common Stock, $0.10 par value | D | 58,9500 | -3.725 | -220 | 7.133 | ||||

| 2025-02-04 | 2025-02-01 | 4 | Hickey Benjamin | BMY | Common Stock, $0.10 par value | D | 10.078 | 10.858 | ||||||

| 2025-02-04 | 2025-02-01 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 58,9500 | -833 | -49 | 6.996 | ||||

| 2025-02-04 | 2025-02-01 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 2.543 | 7.829 | ||||||

| 2024-11-05 | 2024-11-04 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 55,6150 | -700 | -39 | 11.760 | ||||

| 2024-11-05 | 2024-11-01 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 54,3200 | -1.488 | -81 | 102.626 | ||||

| 2024-11-05 | 2024-11-01 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -55 | 104.114 | ||||||

| 2024-11-05 | 2024-11-01 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 2.964 | 104.169 | ||||||

| 2024-11-05 | 2024-11-01 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 54,6750 | 1.830 | 100 | 62.109 | ||||

| 2024-10-03 | 2024-10-02 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 53,7600 | -1.648 | -89 | 5.019 | ||||

| 2024-10-03 | 2024-10-02 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 4.558 | 6.667 | ||||||

| 2024-08-05 | 2024-08-01 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 48,1700 | -384 | -18 | 2.109 | ||||

| 2024-08-05 | 2024-08-01 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 1.061 | 2.493 | ||||||

| 2024-07-31 | 3/A | McMullen Michael R. Family Trust | BMY | Common Stock, $0.10 par value | I | 1.000 | ||||||||

| 2024-04-02 | 2024-04-01 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 52,9900 | -1.196 | -63 | 5.336 | ||||

| 2024-04-02 | 2024-04-01 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 3.306 | 6.532 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 53,7900 | -3.235 | -174 | 6.650 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | -3.974 | 9.885 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 11.416 | 13.859 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 53,7900 | -570 | -31 | 2.443 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | -328 | 3.013 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 1.902 | 3.341 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 53,7900 | -518 | -28 | 1.439 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | -267 | 1.957 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 1.698 | 2.224 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 53,7900 | -11.695 | -629 | 347.385 | ||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | -12.232 | 359.080 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 35.139 | 371.312 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 53,7900 | -2.475 | -133 | 336.173 | ||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | -1.009 | 338.648 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.856 | 339.657 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 53,7900 | -2.490 | -134 | 333.801 | ||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | -912 | 336.291 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.789 | 337.203 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 53,7900 | -1.436 | -77 | 11.315 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | -2.431 | 12.751 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 6.985 | 15.182 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 53,7900 | -283 | -15 | 8.197 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | -201 | 8.480 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 1.164 | 8.681 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 53,7900 | -246 | -13 | 7.517 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | -157 | 7.763 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 994 | 7.920 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 53,7900 | -976 | -52 | 2.424 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | -1.441 | 3.400 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 4.140 | 4.841 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 53,7900 | -207 | -11 | 701 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | -119 | 908 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 690 | 1.027 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 53,7900 | -192 | -10 | 337 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | -99 | 529 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Poole Ahn Amanda | BMY | Common Stock, $0.10 par value | D | 628 | 628 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 53,7900 | -9.774 | -526 | 60.279 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | -10.203 | 70.053 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 29.311 | 80.256 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 53,7900 | -2.068 | -111 | 50.945 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | -842 | 53.013 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 4.885 | 53.855 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 53,7900 | -1.807 | -97 | 48.970 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | -660 | 50.777 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 4.192 | 51.437 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 53,7900 | -992 | -53 | 12.460 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | -1.464 | 13.452 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 4.206 | 14.916 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 53,7900 | -210 | -11 | 10.710 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | -121 | 10.920 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 701 | 11.041 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 53,7900 | -187 | -10 | 10.340 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | -97 | 10.527 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 613 | 10.624 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 53,7900 | -917 | -49 | 1.726 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | -1.138 | 2.643 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 3.268 | 3.781 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 53,7900 | -194 | -10 | 513 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | -94 | 707 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 544 | 801 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 53,7900 | -197 | -11 | 257 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | -85 | 454 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Hoch Lynelle | BMY | Common Stock, $0.10 par value | D | 539 | 539 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 53,7900 | -494 | -27 | 1.432 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | -729 | 1.926 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 2.094 | 2.655 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 53,7900 | -105 | -6 | 561 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | -60 | 666 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 349 | 726 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 53,7900 | -97 | -5 | 377 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | -50 | 474 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 318 | 524 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 53,7900 | -13.975 | -752 | 101.205 | ||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -14.589 | 115.180 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 41.910 | 129.769 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 53,7900 | -2.957 | -159 | 87.859 | ||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -1.204 | 90.816 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 6.985 | 92.020 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 53,7900 | -2.475 | -133 | 85.035 | ||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | -905 | 87.510 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 5.743 | 88.415 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 53,7900 | -13.345 | -718 | 194.968 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | -16.798 | 208.313 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 48.257 | 225.111 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 53,7900 | -2.824 | -152 | 176.854 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | -1.386 | 179.678 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 8.042 | 181.064 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 53,7900 | -2.353 | -127 | 173.022 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | -1.264 | 175.375 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 8.027 | 176.639 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 53,7900 | -47.651 | -2.563 | 432.266 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | -49.745 | 479.917 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 142.904 | 529.662 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 53,7900 | -10.084 | -542 | 386.758 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | -4.104 | 396.842 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 23.817 | 400.946 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 53,7900 | -10.088 | -543 | 377.129 | ||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | -3.687 | 387.217 | ||||||

| 2024-03-12 | 2024-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 23.409 | 390.904 | ||||||

| 2024-03-04 | 3 | Hickey Benjamin By Spouse | BMY | Common Stock, $0.10 par value | I | 91 | ||||||||

| 2024-03-04 | 3 | Hickey Benjamin | BMY | Common Stock, $0.10 par value | D | 780 | ||||||||

| 2024-02-23 | 3 | Holzer Phil M | BMY | Common Stock, $0.10 par value | D | 10.011 | ||||||||

| 2024-02-05 | 2024-02-01 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 48,6700 | -754 | -37 | 5.286 | ||||

| 2024-02-05 | 2024-02-01 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 2.543 | 6.040 | ||||||

| 2024-01-03 | 3 | Poole Ahn Amanda BMS Savings and Investment Program | BMY | Common Stock, $0.10 par value | I | 164 | ||||||||

| 2023-12-07 | 2023-12-05 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 49,7800 | 2.000 | 100 | 82.672 | ||||

| 2023-12-05 | 2023-12-02 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 50,1000 | -274 | -14 | 6.926 | ||||

| 2023-12-05 | 2023-12-02 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 616 | 7.200 | ||||||

| 2023-12-05 | 2023-12-02 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 50,1000 | -3.730 | -187 | 168.612 | ||||

| 2023-12-05 | 2023-12-02 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 8.792 | 172.342 | ||||||

| 2023-12-05 | 2023-12-02 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 50,1000 | -1.350 | -68 | 80.672 | ||||

| 2023-12-05 | 2023-12-02 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 2.638 | 82.022 | ||||||

| 2023-11-30 | 2023-11-28 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 48,8600 | 3.071 | 150 | 79.384 | ||||

| 2023-11-24 | 2023-11-21 | 4 | LEUNG SANDRA Trust (SLAT) | BMY | Common Stock, $0.10 par value | I | 48,7450 | 9.830 | 479 | 93.436 | ||||

| 2023-11-24 | 2023-11-21 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 48,7450 | -9.830 | -479 | 331.414 | ||||

| 2023-11-21 | 2023-11-20 | 4 | Samuels Theodore R. II | BMY | Common Stock, $0.10 par value | D | 49,8100 | 8.500 | 423 | 35.500 | ||||

| 2023-10-12 | 2023-10-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | -440 | 367.495 | ||||||

| 2023-10-04 | 3 | Gallman Cari | BMY | Common Stock, $0.10 par value | D | 206 | ||||||||

| 2023-08-28 | 2023-08-24 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 61,2500 | -17.986 | -1.102 | 27.868 | ||||

| 2023-08-07 | 2023-08-03 | 4 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 61,1400 | -732 | -45 | 6.584 | ||||

| 2023-07-05 | 2023-07-01 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 63,9500 | -4.787 | -306 | 47.245 | ||||

| 2023-07-05 | 2023-07-01 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 9.357 | 52.032 | ||||||

| 2023-07-05 | 2023-07-01 | 4 | Weese Michelle | BMY | Common Stock, $0.10 par value | D | 63,9500 | -682 | -44 | 3.453 | ||||

| 2023-07-05 | 2023-07-01 | 4 | Weese Michelle | BMY | Common Stock, $0.10 par value | D | 1.885 | 4.135 | ||||||

| 2023-07-05 | 3 | Plenge Robert M Family Trust | BMY | Common Stock, $0.10 par value | I | 200 | ||||||||

| 2023-07-05 | 3 | Plenge Robert M | BMY | Common Stock, $0.10 par value | D | 7.316 | ||||||||

| 2023-06-06 | 2023-06-03 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 65,6600 | -551 | -36 | 526 | ||||

| 2023-06-06 | 2023-06-03 | 4 | Lenkowsky Adam | BMY | Common Stock, $0.10 par value | D | 1.077 | 1.077 | ||||||

| 2023-05-04 | 2023-05-03 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 67,0600 | -50.385 | -3.379 | 47.751 | ||||

| 2023-05-03 | 2023-05-02 | 4 | Greenlees Sharon | BMY | Common Stock, $0.10 par value | D | 68,1000 | -119 | -8 | 609 | ||||

| 2023-05-03 | 2023-05-02 | 4 | Greenlees Sharon | BMY | Common Stock, $0.10 par value | D | 328 | 728 | ||||||

| 2023-05-03 | 2023-05-02 | 4 | Greenlees Sharon | BMY | Common Stock, $0.10 par value | D | 68,1000 | -227 | -15 | 400 | ||||

| 2023-05-03 | 2023-05-02 | 4 | Greenlees Sharon | BMY | Common Stock, $0.10 par value | D | -62 | 627 | ||||||

| 2023-05-03 | 2023-05-02 | 4 | Greenlees Sharon | BMY | Common Stock, $0.10 par value | D | 689 | 689 | ||||||

| 2023-05-03 | 3 | Lenkowsky Adam By Spouse | BMY | Common Stock, $0.10 par value | I | 4.900 | ||||||||

| 2023-05-03 | 3 | Lenkowsky Adam BMS Savings and Investment Program | BMY | Common Stock, $0.10 par value | I | 5.149 | ||||||||

| 2023-04-04 | 2023-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 69,3100 | -1.139 | -79 | 34.734 | ||||

| 2023-04-04 | 2023-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 2.684 | 35.873 | ||||||

| 2023-04-04 | 2023-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 69,3100 | -2.059 | -143 | 33.189 | ||||

| 2023-04-04 | 2023-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 1.190 | 35.248 | ||||||

| 2023-04-04 | 2023-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 3.662 | 34.058 | ||||||

| 2023-04-04 | 2023-04-01 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 69,3100 | -1.692 | -117 | 3.226 | ||||

| 2023-04-04 | 2023-04-01 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 3.306 | 4.918 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 65,7100 | -10.460 | -687 | 30.396 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 2.683 | 40.856 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 21.973 | 38.173 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 65,7100 | -1.602 | -105 | 16.200 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 118 | 17.802 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 3.658 | 17.684 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 65,7100 | -1.978 | -130 | 14.026 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 657 | 16.004 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 4.005 | 15.347 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 65,7100 | -25.565 | -1.680 | 98.136 | ||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 5.438 | 123.701 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 44.541 | 118.263 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 65,7100 | -3.774 | -248 | 73.722 | ||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 231 | 77.496 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 7.147 | 77.265 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 65,7100 | -4.659 | -306 | 70.118 | ||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 1.284 | 74.777 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 7.824 | 73.493 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 65,7100 | -4.500 | -296 | 65.669 | ||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 1.373 | 70.169 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 7.423 | 68.796 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 65,7100 | -19.916 | -1.309 | 341.244 | ||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 4.240 | 361.160 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 34.726 | 356.920 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 65,7100 | -2.823 | -185 | 322.194 | ||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 173 | 325.017 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.349 | 324.844 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 65,7100 | -3.485 | -229 | 319.495 | ||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 961 | 322.980 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.856 | 322.019 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 65,7100 | -3.505 | -230 | 316.163 | ||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 1.070 | 319.668 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.787 | 318.598 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 65,7100 | -4.375 | -287 | 312.811 | ||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 2.287 | 317.186 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 6.272 | 314.899 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 65,7100 | -9.746 | -640 | 45.854 | ||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 2.500 | 55.600 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 20.475 | 53.100 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 65,7100 | -1.435 | -94 | 32.625 | ||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 106 | 34.060 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 3.275 | 33.954 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 65,7100 | -1.771 | -116 | 30.679 | ||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 588 | 32.450 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 3.586 | 31.862 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 65,7100 | -1.716 | -113 | 28.276 | ||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 631 | 29.992 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 3.412 | 29.361 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 65,7100 | -2.142 | -141 | 25.949 | ||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 1.349 | 28.091 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 3.699 | 26.742 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 65,7100 | -14.429 | -948 | 42.675 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 3.069 | 57.104 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 25.139 | 54.035 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 65,7100 | -2.517 | -165 | 28.896 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 154 | 31.413 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 4.765 | 31.259 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 65,7100 | -2.909 | -191 | 26.494 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 802 | 29.403 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 4.885 | 28.601 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 65,7100 | -2.540 | -167 | 23.716 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 775 | 26.256 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 4.189 | 25.481 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 65,7100 | -19.773 | -1.299 | 76.313 | ||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 4.206 | 96.086 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 34.450 | 91.880 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 65,7100 | -3.494 | -230 | 57.430 | ||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 214 | 60.924 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 6.616 | 60.710 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 65,7100 | -4.160 | -273 | 54.094 | ||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 1.146 | 58.254 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 6.985 | 57.108 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 65,7100 | -3.480 | -229 | 50.123 | ||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 1.062 | 53.603 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 5.741 | 52.541 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 65,7100 | -3.713 | -244 | 46.800 | ||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 1.940 | 50.513 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 5.319 | 48.573 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 65,7100 | -1.243 | -82 | 3.497 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 92 | 4.740 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 2.836 | 4.648 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Weese Michelle | BMY | Common Stock, $0.10 par value | D | 65,7100 | -594 | -39 | 2.250 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Weese Michelle | BMY | Common Stock, $0.10 par value | D | 51 | 2.844 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Weese Michelle | BMY | Common Stock, $0.10 par value | D | 1.590 | 2.793 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 65,7100 | -914 | -60 | 1.612 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 79 | 2.526 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Shanahan Karin | BMY | Common Stock, $0.10 par value | D | 2.447 | 2.447 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 65,7100 | -80.594 | -5.296 | 367.935 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 17.148 | 448.529 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 140.445 | 431.381 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 65,7100 | -11.728 | -771 | 290.936 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 718 | 302.664 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 22.214 | 301.946 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 65,7100 | -14.179 | -932 | 279.732 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 3.908 | 293.911 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 23.817 | 290.003 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 65,7100 | -14.184 | -932 | 266.186 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 4.328 | 280.370 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 23.407 | 276.042 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 65,7100 | -17.304 | -1.137 | 252.635 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 9.042 | 269.939 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 24.793 | 260.897 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 65,7100 | -27.637 | -1.816 | 163.550 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 5.879 | 191.187 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 48.152 | 185.308 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 65,7100 | -4.041 | -266 | 137.156 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 247 | 141.197 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 7.652 | 140.950 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 65,7100 | -4.789 | -315 | 133.298 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 1.320 | 138.087 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 8.042 | 136.767 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 65,7100 | -4.864 | -320 | 128.725 | ||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 1.484 | 133.589 | ||||||

| 2023-03-14 | 2023-03-10 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 8.025 | 132.105 | ||||||

| 2023-02-08 | 2023-02-06 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 74,6500 | -240.000 | -17.916 | 236.104 | ||||

| 2023-02-08 | 2023-02-06 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 74,6900 | -11.183 | -835 | 23.043 | ||||

| 2023-02-03 | 2023-02-01 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 71,2300 | -731 | -52 | 1.812 | ||||

| 2023-02-03 | 2023-02-01 | 4 | Meyers Gregory Scott | BMY | Common Stock, $0.10 par value | D | 2.543 | 2.543 | ||||||

| 2022-12-06 | 2022-12-02 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 81,1300 | -1.349 | -109 | 43.254 | ||||

| 2022-12-06 | 2022-12-02 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 2.637 | 44.603 | ||||||

| 2022-12-06 | 2022-12-02 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 81,1300 | -4.498 | -365 | 124.080 | ||||

| 2022-12-06 | 2022-12-02 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 8.792 | 128.578 | ||||||

| 2022-12-06 | 2022-12-02 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 81,1300 | -4.498 | -365 | 61.373 | ||||

| 2022-12-06 | 2022-12-02 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 8.792 | 65.871 | ||||||

| 2022-11-14 | 2022-11-09 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 80,4500 | -16.250 | -1.307 | 34.226 | ||||

| 2022-11-09 | 2022-11-07 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 78,8800 | -45.910 | -3.621 | 57.079 | ||||

| 2022-11-09 | 2022-11-07 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 38,4100 | 8.491 | 326 | 102.989 | ||||

| 2022-11-09 | 2022-11-07 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 47,8100 | 8.491 | 406 | 94.498 | ||||

| 2022-11-09 | 2022-11-07 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 44,7000 | 8.491 | 380 | 86.007 | ||||

| 2022-11-09 | 2022-11-07 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 72,4200 | 21.288 | 1.542 | 77.516 | ||||

| 2022-11-09 | 2022-11-07 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 70,8900 | 5.843 | 414 | 56.228 | ||||

| 2022-09-22 | 2022-09-20 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 69,7100 | -25.000 | -1.743 | 476.104 | ||||

| 2022-09-16 | 2022-09-15 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 71,8400 | -50.000 | -3.592 | 501.104 | ||||

| 2022-09-15 | 2022-09-13 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 71,2900 | -103.951 | -7.411 | 119.786 | ||||

| 2022-09-15 | 2022-09-13 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 48,4900 | 121.214 | 5.878 | 223.737 | ||||

| 2022-09-15 | 2022-09-13 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 48,4900 | 2.063 | 100 | 102.523 | ||||

| 2022-09-15 | 2022-09-13 | 4 | Elkins David V | BMY | Common Stock, $0.10 par value | D | 71,3500 | -30.000 | -2.140 | 100.460 | ||||

| 2022-09-15 | 2022-09-14 | 4 | JUDGE ANN POWELL | BMY | Common Stock, $0.10 par value | D | 70,7500 | -25.000 | -1.769 | 50.476 | ||||

| 2022-07-05 | 2022-07-01 | 4 | Weese Michelle | BMY | Common Stock, $0.10 par value | D | 76,8400 | -682 | -52 | 1.203 | ||||

| 2022-07-05 | 2022-07-01 | 4 | Weese Michelle | BMY | Common Stock, $0.10 par value | D | 1.885 | 1.885 | ||||||

| 2022-07-05 | 2022-07-01 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 76,8400 | -4.786 | -368 | 21.292 | ||||

| 2022-07-05 | 2022-07-01 | 4 | Hirawat Samit | BMY | Common Stock, $0.10 par value | D | 9.356 | 26.078 | ||||||

| 2022-06-14 | 2022-06-13 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 74,0400 | -30.000 | -2.221 | 551.104 | ||||

| 2022-06-07 | 2022-06-06 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 74,8900 | -65.000 | -4.868 | 308.627 | ||||

| 2022-06-07 | 2022-06-03 | 4 | Haller Julia A | BMY | Common Stock, $0.10 par value | D | 2.949 | 13.619 | ||||||

| 2022-05-04 | 2022-05-02 | 4 | Greenlees Sharon | BMY | Performance Shares | D | 4.134 | 4.134 | ||||||

| 2022-05-04 | 2022-05-02 | 4 | Greenlees Sharon | BMY | Market Share Units | D | 2.756 | 2.756 | ||||||

| 2022-05-04 | 2022-05-02 | 4 | Greenlees Sharon | BMY | Restricted Stock Units | D | 1.312 | 1.312 | ||||||

| 2022-04-04 | 2022-03-31 | 4 | Samuels Theodore R. II | BMY | Deferred Share Units | D | 73,0300 | 668 | 49 | 31.923 | ||||

| 2022-04-04 | 2022-03-31 | 4 | YALE PHYLLIS R | BMY | Deferred Share Units | D | 73,0300 | 462 | 34 | 14.855 | ||||

| 2022-04-04 | 2022-03-31 | 4 | Hidalgo Medina Manuel | BMY | Deferred Share Units | D | 73,0300 | 103 | 8 | 5.453 | ||||

| 2022-04-04 | 2022-03-31 | 4 | Storch Gerald L | BMY | Deferred Share Units | D | 73,0300 | 496 | 36 | 71.009 | ||||

| 2022-04-04 | 2022-03-31 | 4 | Rice Derica W | BMY | Deferred Share Units | D | 73,0300 | 496 | 36 | 10.859 | ||||

| 2022-04-04 | 2022-03-31 | 4 | Haller Julia A | BMY | Deferred Share Units | D | 73,0300 | 462 | 34 | 15.108 | ||||

| 2022-04-04 | 2022-03-31 | 4 | Arduini Peter J | BMY | Deferred Share Units | D | 73,0300 | 462 | 34 | 38.266 | ||||

| 2022-04-04 | 2022-04-01 | 4 | Mily Elizabeth | BMY | Restricted Stock Units | D | -2.685 | 5.369 | ||||||

| 2022-04-04 | 2022-04-01 | 4 | Mily Elizabeth | BMY | Market Share Units | D | -3.662 | 7.325 | ||||||

| 2022-04-04 | 2022-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 73,8200 | -1.139 | -84 | 11.342 | ||||

| 2022-04-04 | 2022-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 2.685 | 12.481 | ||||||

| 2022-04-04 | 2022-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 73,8200 | -2.194 | -162 | 9.796 | ||||

| 2022-04-04 | 2022-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 1.508 | 11.990 | ||||||

| 2022-04-04 | 2022-04-01 | 4 | Mily Elizabeth | BMY | Common Stock, $0.10 par value | D | 3.662 | 10.482 | ||||||

| 2022-04-04 | 2022-04-01 | 4 | Shanahan Karin | BMY | Restricted Stock Units | D | 13.225 | 13.225 | ||||||

| 2022-03-23 | 2022-03-22 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | -420 | 581.104 | ||||||

| 2022-03-23 | 2022-03-21 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 71,5200 | -25.000 | -1.788 | 581.524 | ||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Option (right to buy) | D | 38,41 | -8.490 | 8.491 | |||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Option (right to buy) | D | 55,52 | -5.294 | 0 | |||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Option (right to buy) | D | 54,29 | -12.233 | 0 | |||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Option (right to buy) | D | 66,35 | -21.288 | 0 | |||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 69,2300 | -43.228 | -2.993 | 50.385 | ||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 38,4100 | 8.490 | 326 | 93.613 | ||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 54,2900 | 12.233 | 664 | 85.123 | ||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 55,5200 | 5.294 | 294 | 72.890 | ||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 66,3500 | 21.288 | 1.412 | 67.596 | ||||

| 2022-03-18 | 2022-03-16 | 4 | VESSEY RUPERT | BMY | Common Stock, $0.10 par value | D | 69,2700 | -31.331 | -2.170 | 46.308 | ||||

| 2022-03-16 | 2022-03-14 | 4 | BOERNER CHRISTOPHER S. | BMY | Common Stock, $0.10 par value | D | 69,1970 | -29.532 | -2.044 | 41.966 | ||||

| 2022-03-16 | 2022-03-14 | 4 | Santiago Karen Murphy | BMY | Common Stock, $0.10 par value | D | 69,1950 | -6.577 | -455 | 16.704 | ||||

| 2022-03-15 | 2022-03-10 | 4 | Shanahan Karin | BMY | Performance Shares | D | 14.683 | 14.683 | ||||||

| 2022-03-15 | 2022-03-10 | 4 | Shanahan Karin | BMY | Market Share Units | D | 9.789 | 9.789 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Performance Shares | D | 32.096 | 32.096 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Performance Shares | D | -37.623 | 0 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Market Share Units | D | 21.398 | 21.398 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Market Share Units | D | -5.856 | 17.570 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Market Share Units | D | -5.787 | 11.576 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Market Share Units | D | -6.270 | 6.272 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Market Share Units | D | -4.737 | 0 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 68,4200 | -30.015 | -2.054 | 373.627 | ||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 14.895 | 403.642 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 37.623 | 388.747 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 68,4200 | -3.723 | -255 | 351.124 | ||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 657 | 354.847 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.856 | 354.190 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 68,4200 | -3.744 | -256 | 348.334 | ||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 764 | 352.078 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 5.787 | 351.314 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 68,4200 | -4.673 | -320 | 345.527 | ||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 1.905 | 350.200 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 6.270 | 348.295 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 68,4200 | -2.746 | -188 | 342.025 | ||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 67 | 344.771 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | LEUNG SANDRA | BMY | Common Stock, $0.10 par value | D | 4.737 | 344.704 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Performance Shares | D | 133.285 | 133.285 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Performance Shares | D | -148.758 | 0 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Market Share Units | D | 88.857 | 88.857 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Market Share Units | D | -23.817 | 71.452 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Market Share Units | D | -23.407 | 46.816 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Market Share Units | D | -24.793 | 24.793 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Market Share Units | D | -18.726 | 0 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 68,4200 | -105.761 | -7.236 | 606.524 | ||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 58.893 | 712.285 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 148.758 | 653.392 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 68,4200 | -13.492 | -923 | 504.634 | ||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 2.672 | 518.126 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 23.817 | 515.454 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 68,4200 | -13.497 | -923 | 491.637 | ||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 3.092 | 505.134 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 23.407 | 502.042 | ||||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 68,4200 | -16.466 | -1.127 | 478.635 | ||||

| 2022-03-14 | 2022-03-10 | 4 | Caforio Giovanni | BMY | Common Stock, $0.10 par value | D | 7.535 | 495.101 | ||||||