Introduktion

Denne side giver en omfattende analyse af den kendte insiderhandelshistorie for James E Flynn. Insidere er embedsmænd, direktører eller betydelige investorer i en virksomhed. Det er ulovligt for insidere at foretage handler i deres virksomheder baseret på specifik, ikke-offentlig information. Dette betyder ikke, at det er ulovligt for dem at handle i deres egne virksomheder. De skal dog rapportere alle handler til SEC via en formular 4. På trods af disse begrænsninger tyder akademisk forskning på, at insidere - generelt - har en tendens til at klare sig bedre end markedet i deres egne virksomheder.

Gennemsnitlig handelsrentabilitet

Den gennemsnitlige handelsrentabilitet er det gennemsnitlige afkast af alle køb på det åbne marked foretaget af insideren i de sidste tre år. For at beregne dette undersøger vi ethvert åbent marked, uplanlagte køb foretaget af insideren, eksklusive alle handler, der var markeret som en del af en 10b5-1-handelsplan. Vi beregner derefter den gennemsnitlige præstation for disse handler over 3, 6 og 12 måneder, idet vi tager et gennemsnit af hver af disse varigheder for at generere en endelig præstationsmåling for hver handel. Endelig tager vi et gennemsnit af alle præstationsmålingerne for at beregne en præstationsmåling for insideren. Denne liste inkluderer kun insidere, der har foretaget mindst tre handler i de sidste to år.

Hvis denne insiderhandelsrentabilitet er "N/A", så har insideren enten ikke foretaget nogen køb på det åbne marked i de sidste tre år, eller de handler, de har foretaget, er for nye til at beregne en pålidelig præstationsmåling.

Opdateringsfrekvens: Dagligt

Virksomheder med rapporterede insider-stillinger

SEC-registreringen viser, at James E Flynn har rapporteret besiddelser eller handler i følgende virksomheder:

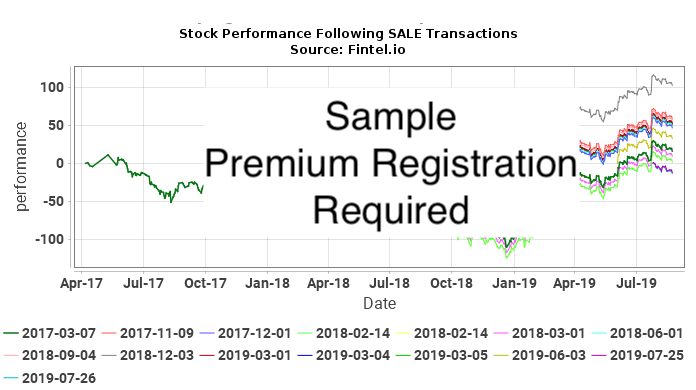

Sådan fortolkes diagrammerne

Følgende diagrammer viser aktieudviklingen for værdipapirer efter hver åben-marked, ikke-planlagt handel foretaget af James E Flynn. Ikke-planlagt handel er handler, der ikke blev foretaget som en del af en 10b5-1-handelsplan. Aktieudviklingen er kortlagt som den kumulative procentvise ændring i aktiekursen. For eksempel, hvis en insiderhandel blev foretaget den 1. januar 2019, vil diagrammet vise den daglige procentvise ændring af værdipapiret til i dag. Hvis aktiekursen skulle gå fra $10 til $15 i løbet af denne tid, ville den kumulative procentvise ændring i aktiekursen være 50%. En prisændring fra 10 USD til 20 USD ville være 100 %, og en ændring i prisen på 10 USD til 5 USD ville være -50 %.

I sidste ende forsøger vi at bestemme, hvor tæt insiderens handler korrelerer med merafkast (positive eller negative) i aktiekursen for at se, om insideren timing deres handler til at drage fordel af insiderinformation. Overvej situationen, hvor en insider gjorde dette. I denne situation ville vi forvente enten (a) positive afkast efter køb eller (b) negative afkast efter salg. I tilfælde af (a) vil KØB-diagrammet vise en række opadskrånende kurver, der indikerer positive afkast efter hver købstransaktion. I tilfælde af (b) vil SALE-diagrammet vise en række nedadgående kurver, der indikerer negative afkast efter hver salgstransaktion.

Dette alene er dog ikke nok til at drage konklusioner. Hvis for eksempel aktiekursen i selskabet var i en ikke-cyklisk stigning over mange år, så ville vi forvente, at alle efterkøbsgrundene var opadgående. Ligeledes ville ikke-cykliske fald over mange år resultere i nedadgående post-trade plots. Ingen af disse diagrammer tyder på insiderhandel.

Den stærkeste indikator ville være en situation, hvor aktiekursen var ekstremt cyklisk, og der var både positive signaler i KØB-diagrammet og negative plots på SALG-diagrammet. Denne situation ville i høj grad tyde på en insider, der havde timing af handler til deres økonomiske fordel.

Insiderkøb ACRS / Aclaris Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg ACRS / Aclaris Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb ADVM / Adverum Biotechnologies, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg ADVM / Adverum Biotechnologies, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb AFIB / Acutus Medical, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg AFIB / Acutus Medical, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb AHCO / AdaptHealth Corp. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018-02-21 | DFBH | Flynn James E | 2.500.000 | 2.500.000 | 266 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg AHCO / AdaptHealth Corp. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb AIS / Tidal Trust III - VistaShares Artificial Intelligence Supercycle ETF – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg AIS / Tidal Trust III - VistaShares Artificial Intelligence Supercycle ETF – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb ANNX / Annexon, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg ANNX / Annexon, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb ARVN / Arvinas, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg ARVN / Arvinas, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb ATYR / aTyr Pharma, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg ATYR / aTyr Pharma, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb AVDL / Avadel Pharmaceuticals plc – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg AVDL / Avadel Pharmaceuticals plc – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018-06-25 | AVDL | Flynn James E | 114.034 | 5,9922 | 114.034 | 5,9922 | 683.315 | 304 | 1.0900 | -559.017 | -81,81 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb AXGN / Axogen, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg AXGN / Axogen, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BDTX / Black Diamond Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-02-03 | BDTX | Flynn James E | 400.000 | 19,0000 | 400.000 | 19,0000 | 7.600.000 | 140 | 44.8 | 10.320.000 | 135,79 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BDTX / Black Diamond Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BGMS / Bio Green Med Solution, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BGMS / Bio Green Med Solution, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BOLD / Boundless Bio, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BOLD / Boundless Bio, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CABA / Cabaletta Bio, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019-10-29 | CABA | Flynn James E | 700.000 | 11,0000 | 700.000 | 11,0000 | 7.700.000 | 92 | 18.67 | 5.369.000 | 69,73 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CABA / Cabaletta Bio, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CALC / CalciMedica, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-09-29 | GRAY | Flynn James E | 1.562.500 | 16,0000 | 111.607 | 224,0000 | 25.000.000 | 115 | 490 | 29.687.430 | 118,75 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CALC / CalciMedica, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CTMX / CytomX Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CTMX / CytomX Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EDIT / Editas Medicine, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2016-02-08 | EDIT | Flynn James E | 100.000 | 16,0000 | 100.000 | 16,0000 | 1.600.000 | 57 | 42.0400 | 2.604.000 | 162,75 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EDIT / Editas Medicine, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EHTH / eHealth, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EHTH / eHealth, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EWTX / Edgewise Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021-03-30 | EWTX | Flynn James E | 625.000 | 16,0000 | 625.000 | 16,0000 | 10.000.000 | 1 | 32.5 | 10.312.500 | 103,12 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EWTX / Edgewise Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb GBIO / Generation Bio Co. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-06-16 | GBIO | Flynn James E | 225.000 | 19,0000 | 22.500 | 190,0000 | 4.275.000 | 169 | 51.61 | -3.113.775 | -72,84 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg GBIO / Generation Bio Co. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb GUTS / Fractyl Health, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg GUTS / Fractyl Health, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb HOWL / Werewolf Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021-05-04 | HOWL | Flynn James E | 800.000 | 16,0000 | 800.000 | 16,0000 | 12.800.000 | 59 | 20.3100 | 3.448.000 | 26,94 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg HOWL / Werewolf Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb KNSA / Kiniksa Pharmaceuticals, Ltd. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg KNSA / Kiniksa Pharmaceuticals, Ltd. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb KRRO / Korro Bio, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019-10-07 | FREQ | Flynn James E | 285.714 | 14,0000 | 285.714 | 14,0000 | 3.999.996 | 121 | 27.55 | 3.871.425 | 96,79 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg KRRO / Korro Bio, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb LRMR / Larimar Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg LRMR / Larimar Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb MIRM / Mirum Pharmaceuticals, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg MIRM / Mirum Pharmaceuticals, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb NKTX / Nkarta, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg NKTX / Nkarta, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb NUVL / Nuvalent, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg NUVL / Nuvalent, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PEPG / PepGen Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PEPG / PepGen Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PHGE / BiomX Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PHGE / BiomX Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb QTTB / Q32 Bio Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg QTTB / Q32 Bio Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb RGNX / REGENXBIO Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg RGNX / REGENXBIO Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb RIGL / Rigel Pharmaceuticals, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg RIGL / Rigel Pharmaceuticals, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb RVMD / Revolution Medicines, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg RVMD / Revolution Medicines, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb RYTM / Rhythm Pharmaceuticals, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg RYTM / Rhythm Pharmaceuticals, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb SDGR / Schrödinger, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-02-10 | SDGR | Flynn James E | 250.000 | 17,0000 | 250.000 | 17,0000 | 4.250.000 | 365 | 105.46 | 22.115.000 | 520,35 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg SDGR / Schrödinger, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb SPRY / ARS Pharmaceuticals, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg SPRY / ARS Pharmaceuticals, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb SYRS / Syros Pharmaceuticals, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg SYRS / Syros Pharmaceuticals, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TARA / Protara Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TARA / Protara Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2017-11-30 | PRTO | Flynn James E | 110.557 | 1,7500 | 110.557 | 1,7500 | 193.475 | 312 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TERN / Terns Pharmaceuticals, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021-02-09 | TERN | Flynn James E | 665.000 | 17,0000 | 665.000 | 17,0000 | 11.305.000 | 38 | 27.25 | 6.816.250 | 60,29 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TERN / Terns Pharmaceuticals, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb VNDA / Vanda Pharmaceuticals Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg VNDA / Vanda Pharmaceuticals Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb XLO / Xilio Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ACRS / Aclaris Therapeutics, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg XLO / Xilio Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ACRS / Aclaris Therapeutics, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderhandelshistorie

Denne tabel viser den komplette liste over insiderhandler foretaget af James E Flynn som oplyst til Securities Exchange Commission (SEC).

| Fil dato | Transdato | Form | Ticker | Sikkerhed | Kode | Aktier | Resterende aktier | Procent Lave om |

Del Pris |

Tran Værdi |

Tilbage Værdi |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025-08-04 |

|

4 | LRMR |

Larimar Therapeutics, Inc.

Common Stock |

P - Purchase | 2.599.932 | 7.321.129 | 55,07 | 3,20 | 8.319.782 | 23.427.613 | |

| 2025-08-04 |

|

4 | LRMR |

Larimar Therapeutics, Inc.

Common Stock |

P - Purchase | 3.387.539 | 9.538.945 | 55,07 | 3,20 | 10.840.125 | 30.524.624 | |

| 2025-08-04 |

|

4 | LRMR |

Larimar Therapeutics, Inc.

Common Stock |

P - Purchase | 3.387.529 | 9.538.918 | 55,07 | 3,20 | 10.840.093 | 30.524.538 | |

| 2025-07-01 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -370.074 | 4.887.254 | -7,04 | 18,46 | -6.831.566 | 90.218.709 | |

| 2025-07-01 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -370.075 | 4.887.254 | -7,04 | 18,46 | -6.831.584 | 90.218.709 | |

| 2025-06-20 |

|

4 | NUVL |

Nuvalent, Inc.

Class A Common Stock |

A - Award | 2.647 | 2.647 | |||||

| 2025-06-20 |

|

4 | NUVL |

Nuvalent, Inc.

Class A Common Stock |

A - Award | 2.647 | 2.647 | |||||

| 2025-03-03 |

|

4 | PHGE |

BiomX Inc.

Common Stock |

M - Exercise | 353.249 | 1.247.054 | 39,52 | 0,93 | 328.734 | 1.160.508 | |

| 2025-03-03 |

|

4 | PHGE |

BiomX Inc.

Common Stock |

M - Exercise | 353.249 | 1.247.054 | 39,52 | 0,93 | 328.734 | 1.160.508 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -9.553 | 5.257.328 | -0,18 | 17,77 | -169.757 | 93.422.719 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -9.554 | 5.257.329 | -0,18 | 17,77 | -169.775 | 93.422.736 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -7.854 | 5.266.881 | -0,15 | 17,16 | -134.775 | 90.379.678 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -7.853 | 5.266.883 | -0,15 | 17,16 | -134.757 | 90.379.712 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -223.632 | 5.274.735 | -4,07 | 18,15 | -4.058.921 | 95.736.440 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -223.632 | 5.274.735 | -4,07 | 18,15 | -4.058.921 | 95.736.440 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -40.596 | 5.498.367 | -0,73 | 17,45 | -708.400 | 95.946.504 | |

| 2024-11-13 |

|

4 | SPRY |

ARS Pharmaceuticals, Inc.

Class A Common Stock |

S - Sale | -40.596 | 5.498.367 | -0,73 | 17,45 | -708.400 | 95.946.504 | |

| 2024-10-24 |

|

4 | NUVL |

Nuvalent, Inc.

Class A Common Stock |

S - Sale | -1.000.000 | 8.670.512 | -10,34 | 97,75 | -97.750.000 | 847.542.548 | |

| 2024-10-24 |

|

4 | NUVL |

Nuvalent, Inc.

Class A Common Stock |

S - Sale | -1.000.000 | 8.670.512 | -10,34 | 97,75 | -97.750.000 | 847.542.548 | |

| 2024-09-17 |

|

4 | BCAX |

Bicara Therapeutics Inc.

Common Stock |

P - Purchase | 35.000 | 897.587 | 4,06 | 18,00 | 630.000 | 16.156.566 | |

| 2024-09-17 |

|

4 | BCAX |

Bicara Therapeutics Inc.

Common Stock |