Outdoor Holding (POWW) Price Target Decreased by 22.73% to 1.73

The average one-year price target for Outdoor Holding (NasdaqCM:POWW) has been revised to $1.73 / share. This is a decrease of 22.73% from the prior estimate of $2.24 dated June 18, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $1.41 to a high of $2.10 / share. The average price target represents an increase of 43.90% from the latest reported closing price of $1.20 / share.

What is the Fund Sentiment?

There are 245 funds or institutions reporting positions in Outdoor Holding.

This is an increase of 9 owner(s) or 3.81% in the last quarter.

Average portfolio weight of all funds dedicated to POWW is 0.09%, an increase of 28.95%.

Total shares owned by institutions increased in the last three months by 10.92% to 67,009K shares.

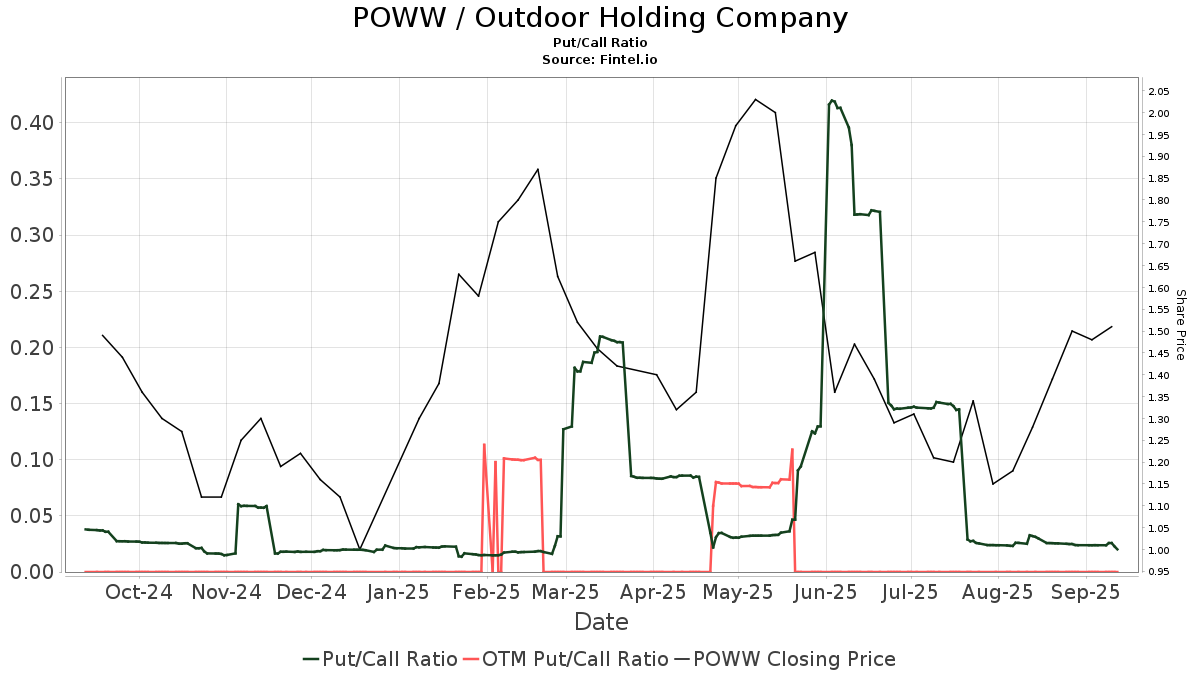

The put/call ratio of POWW is 0.15, indicating a

bullish outlook.

The put/call ratio of POWW is 0.15, indicating a

bullish outlook.

What are Other Shareholders Doing?

Balentine holds 16,100K shares representing 13.75% ownership of the company. In its prior filing, the firm reported owning 16,020K shares , representing an increase of 0.50%. The firm increased its portfolio allocation in POWW by 30.08% over the last quarter.

Kanen Wealth Management holds 8,692K shares representing 7.42% ownership of the company. In its prior filing, the firm reported owning 3,778K shares , representing an increase of 56.53%. The firm increased its portfolio allocation in POWW by 102.62% over the last quarter.

Tealwood Asset Management holds 3,335K shares representing 2.85% ownership of the company. No change in the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 2,807K shares representing 2.40% ownership of the company. No change in the last quarter.

IWM - iShares Russell 2000 ETF holds 2,416K shares representing 2.06% ownership of the company. In its prior filing, the firm reported owning 2,465K shares , representing a decrease of 2.04%. The firm increased its portfolio allocation in POWW by 38.91% over the last quarter.

AMMO Background Information

(This description is provided by the company.)

With its corporate offices headquartered in Scottsdale, Arizona. AMMO designs and manufactures products for a variety of aptitudes, including law enforcement, military, sport shooting and self-defense. The Company was founded in 2016 with a vision to change, innovate and invigorate the complacent munitions industry. AMMO promotes branded munitions as well as its patented STREAK™ Visual Ammunition, /stelTH/™ subsonic munitions, and armor piercing rounds for military use.