Gulf Oil Lubricants India (NSE:GULFOILLUB) Price Target Increased by 6.65% to 555.90

The average one-year price target for Gulf Oil Lubricants India (NSE:GULFOILLUB) has been revised to 555.90 / share. This is an increase of 6.65% from the prior estimate of 521.22 dated May 10, 2023.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 444.40 to a high of 682.50 / share. The average price target represents an increase of 32.99% from the latest reported closing price of 418.00 / share.

See our leaderboard of companies with the largest price target upside.

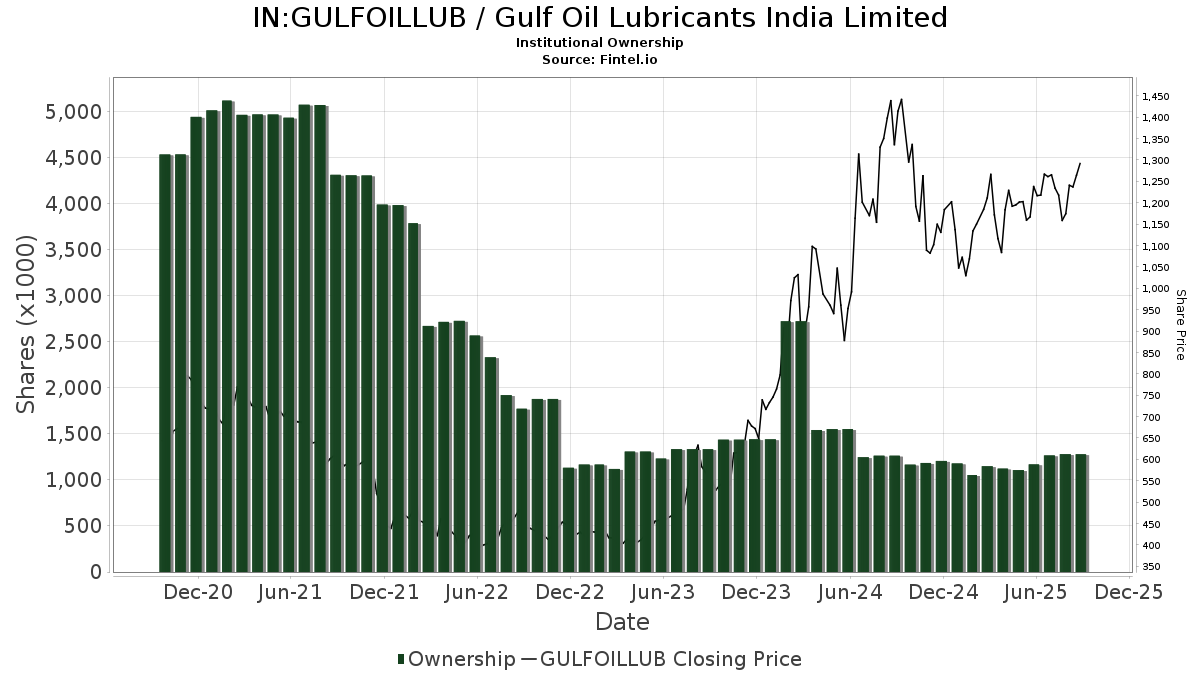

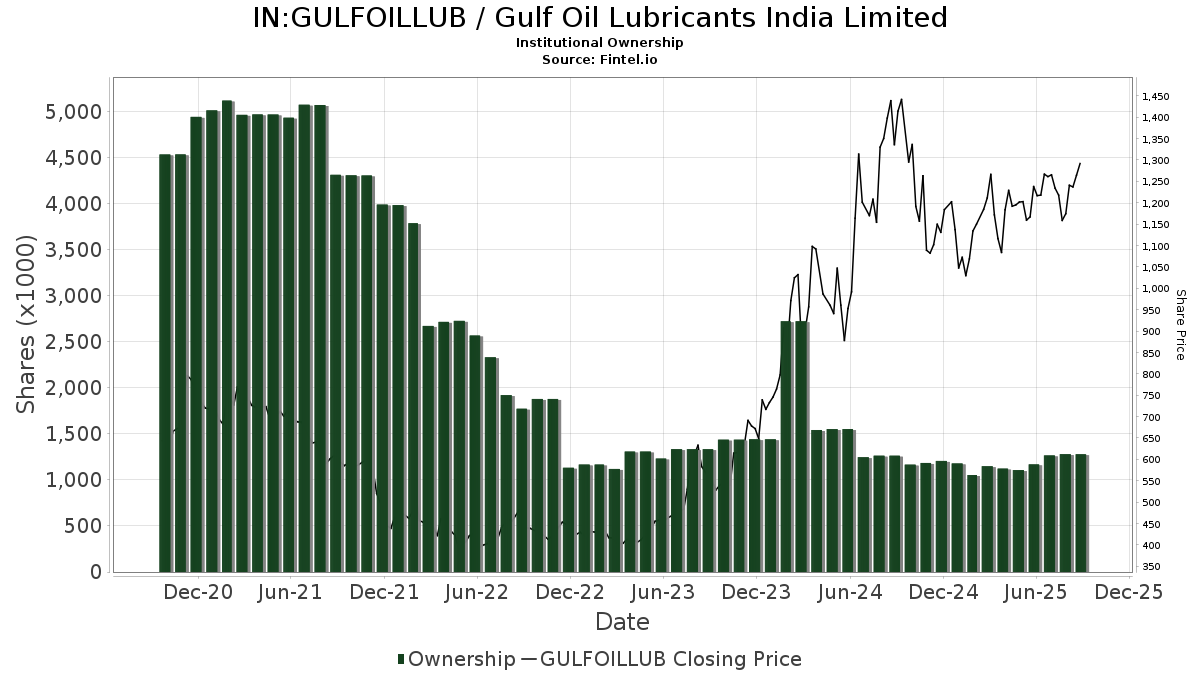

What is the Fund Sentiment?

There are 21 funds or institutions reporting positions in Gulf Oil Lubricants India. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to GULFOILLUB is 0.15%, an increase of 14.10%. Total shares owned by institutions increased in the last three months by 10.08% to 1,232K shares.

What are Other Shareholders Doing?

GPEOX - Grandeur Peak Emerging Markets Opportunities Fund Investor Class holds 269K shares representing 0.55% ownership of the company. In it's prior filing, the firm reported owning 157K shares, representing an increase of 41.60%. The firm increased its portfolio allocation in GULFOILLUB by 67.82% over the last quarter.

FINANCIAL INVESTORS TRUST - Grandeur Peak Global Contrarian Fund Institutional Class holds 229K shares representing 0.47% ownership of the company. In it's prior filing, the firm reported owning 189K shares, representing an increase of 17.68%. The firm increased its portfolio allocation in GULFOILLUB by 4.29% over the last quarter.

GPGOX - Grandeur Peak Global Opportunities Fund Investor Class holds 187K shares representing 0.38% ownership of the company. No change in the last quarter.

GPROX - Grandeur Peak Global Reach Fund Investor Class holds 146K shares representing 0.30% ownership of the company. No change in the last quarter.

DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class holds 126K shares representing 0.26% ownership of the company. No change in the last quarter.