Digital World Acquisition Sees 12% After-Hours Lift on News of Trump Indictment

SPAC is set to merge with ex-president's Truth Social parent

Shares of Digital World Acquisition Corp. (US:DWAC), the blank-check company set to take former President Donald Trump's social media company public, rose almost 12% after hours Thursday following the news of his indictment.

The Manhattan district attorney late Thursday confirmed earlier reports that a grand jury voted to indict Trump for his role in paying hush money to a porn star, multiple media outlets reported.

Digital World Acquisition is a special-purpose acquisition company (SPAC) that in October 2021 announced a deal to merge with Trump Media & Technology Group, parent company of social media app Truth Social.

SPACs are publicly traded companies created as a way for investors to pool their capital with the intention of merging with a private company, which goes public through the merger. Typically, the shares of these companies trade in a very narrow range around the $10 level.

Huge Run-up

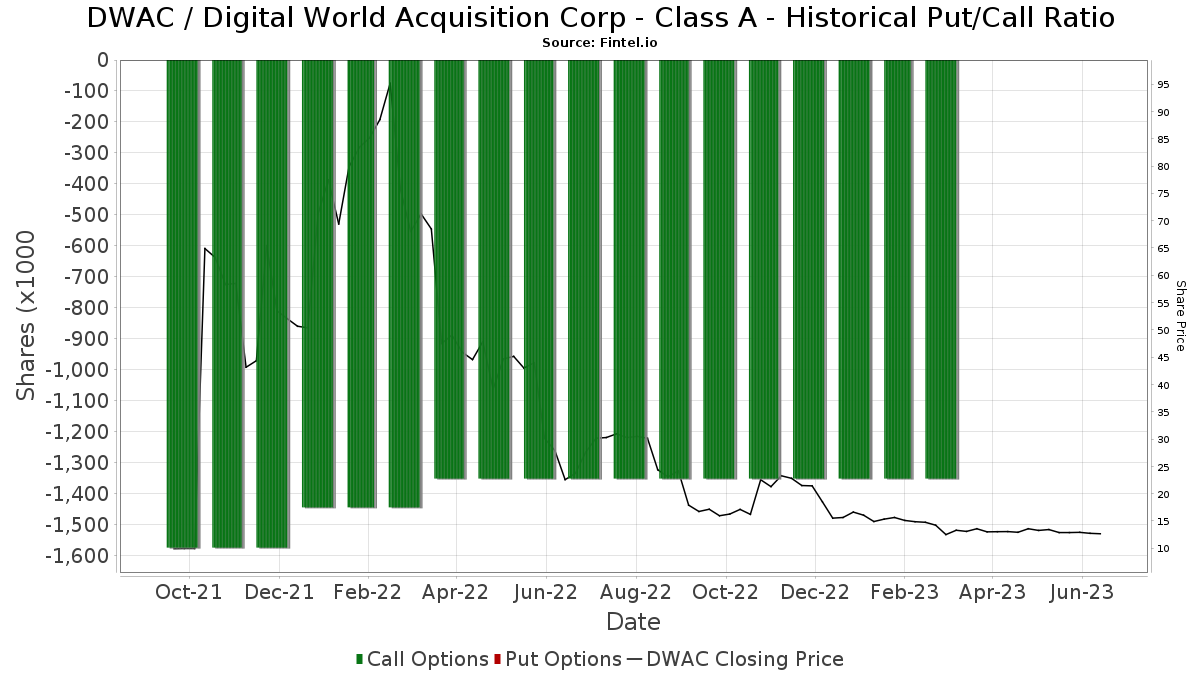

DWAC conducted its initial public offering in September 2021, selling 30 million units (shares plus warrants) to 11 institutional investors as well as the founder, at $10 per unit, raising around $300 million. By January 2022, the shares were trading for more than $70 a piece. At yesterday’s close, DWAC stock was at $13.06, jumping to $14.61 a share in the after hours trading.

Since the now-indicted Trump announced his third run for the White House, on Nov. 15, 2022, DWAC is down almost 53%. By comparison, the SPAC and New Issue ETF (US:SPCX) is down 8.6%. However, the Global X Social Media ETF (US:SOCL) is up 27.2%.

The historic indictment of the former president comes as the SPAC just regained compliance with Nasdaq listing requirements. On Wednesday, the company said it had been cleared by the exchange over non-payment of certain dues.

"The company's fee delinquency has been cured, and as a result the company has regained compliance with the applicable listing standard," it said in a filing. A hearing scheduled for next month related to the issue has also been canceled.

That came just days after Digital World Acquisition sacked Chief Executive Patrick Orlando, a move described as "in the best interest of its shareholders” as it selects a new management team.

Fund Interest

According to Fintel’s dashboard of DWAC stock’s Institutional Ownership, fund sentiment for the shares is low, currently showing a score of 11.2, ranking the SPAC at 35,677 out of 36,675 stocks tracked. The database shows 29 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC).

Last month saw some six-figure call option purchases, including by fund managers at Millenium Management LLC, Marshall Wace LLP, and Skandinaviska Enskilda Banken AB.

As a short-squeeze candidate, DWAC ranks in the top 10% of Fintel-tracked stocks, with a score of 76.98, ranking it at 474 out of 4,879.