BrainsWay - Depositary Receipt () (BWAY) Price Target Increased by 16.99% to 0.11

The average one-year price target for BrainsWay - Depositary Receipt () (NasdaqGM:BWAY) has been revised to $0.11 / share. This is an increase of 16.99% from the prior estimate of $0.10 dated August 21, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $0.11 to a high of $0.12 / share. The average price target represents a decrease of 99.28% from the latest reported closing price of $15.76 / share.

What is the Fund Sentiment?

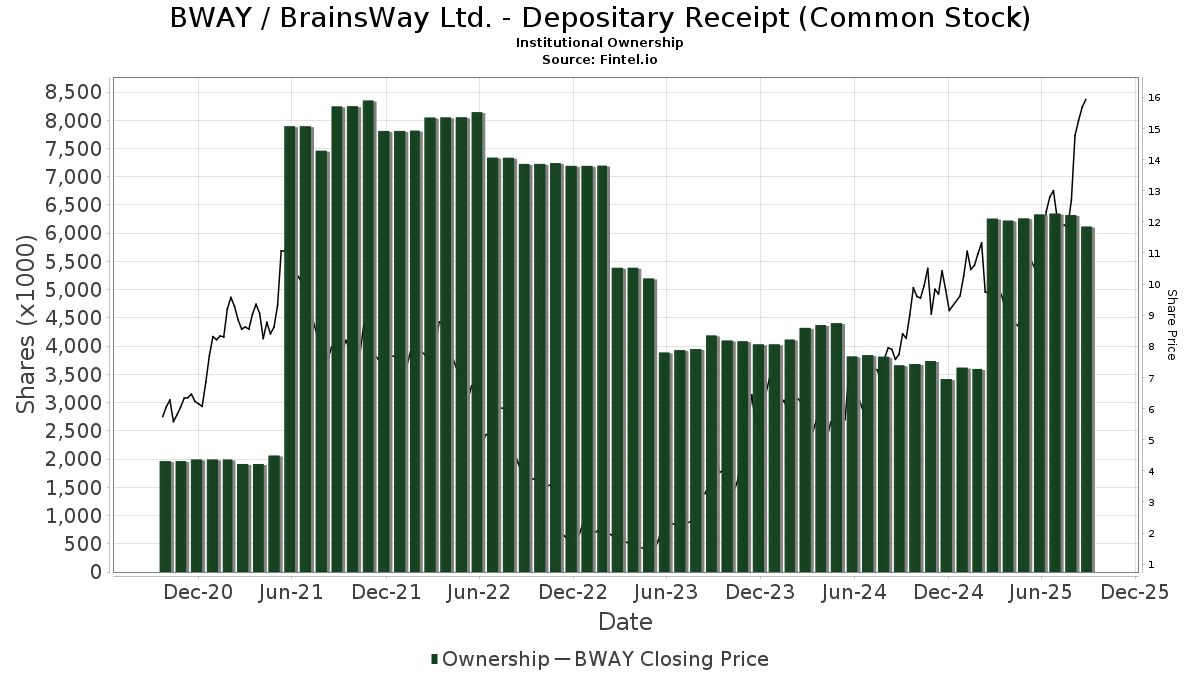

There are 52 funds or institutions reporting positions in BrainsWay - Depositary Receipt ().

This is unchanged over the last quarter.

Average portfolio weight of all funds dedicated to BWAY is 0.33%, an increase of 28.05%.

Total shares owned by institutions decreased in the last three months by 3.38% to 6,117K shares.

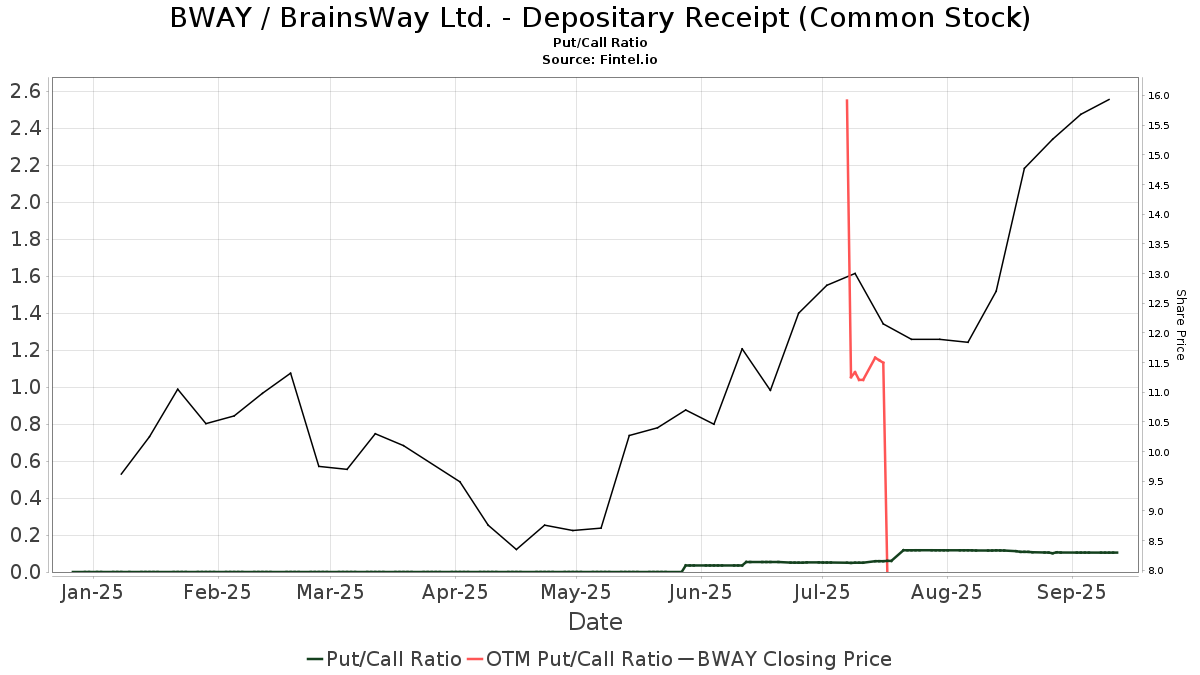

The put/call ratio of BWAY is 0.10, indicating a

bullish outlook.

The put/call ratio of BWAY is 0.10, indicating a

bullish outlook.

What are Other Shareholders Doing?

Valor Management holds 2,104K shares. No change in the last quarter.

Masters Capital Management holds 1,000K shares. No change in the last quarter.

Phoenix Holdings holds 362K shares. In its prior filing, the firm reported owning 404K shares , representing a decrease of 11.50%. The firm decreased its portfolio allocation in BWAY by 37.85% over the last quarter.

Acadian Asset Management holds 334K shares. In its prior filing, the firm reported owning 337K shares , representing a decrease of 0.69%. The firm increased its portfolio allocation in BWAY by 0.86% over the last quarter.

Essex Investment Management Co holds 301K shares. In its prior filing, the firm reported owning 303K shares , representing a decrease of 0.74%. The firm increased its portfolio allocation in BWAY by 20.14% over the last quarter.