Xinte Energy Co. (SEHK:1799) Price Target Increased by 16.52% to 11.66

The average one-year price target for Xinte Energy Co. (SEHK:1799) has been revised to HK$11.66 / share. This is an increase of 16.52% from the prior estimate of HK$10.01 dated August 30, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of HK$8.71 to a high of HK$15.41 / share. The average price target represents an increase of 52.41% from the latest reported closing price of HK$7.65 / share.

Xinte Energy Co. Maintains 17.33% Dividend Yield

At the most recent price, the company’s dividend yield is 17.33%.

Additionally, the company’s dividend payout ratio is -0.16. The payout ratio tells us how much of a company’s income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company’s income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company’s 3-Year dividend growth rate is 0.09% , demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

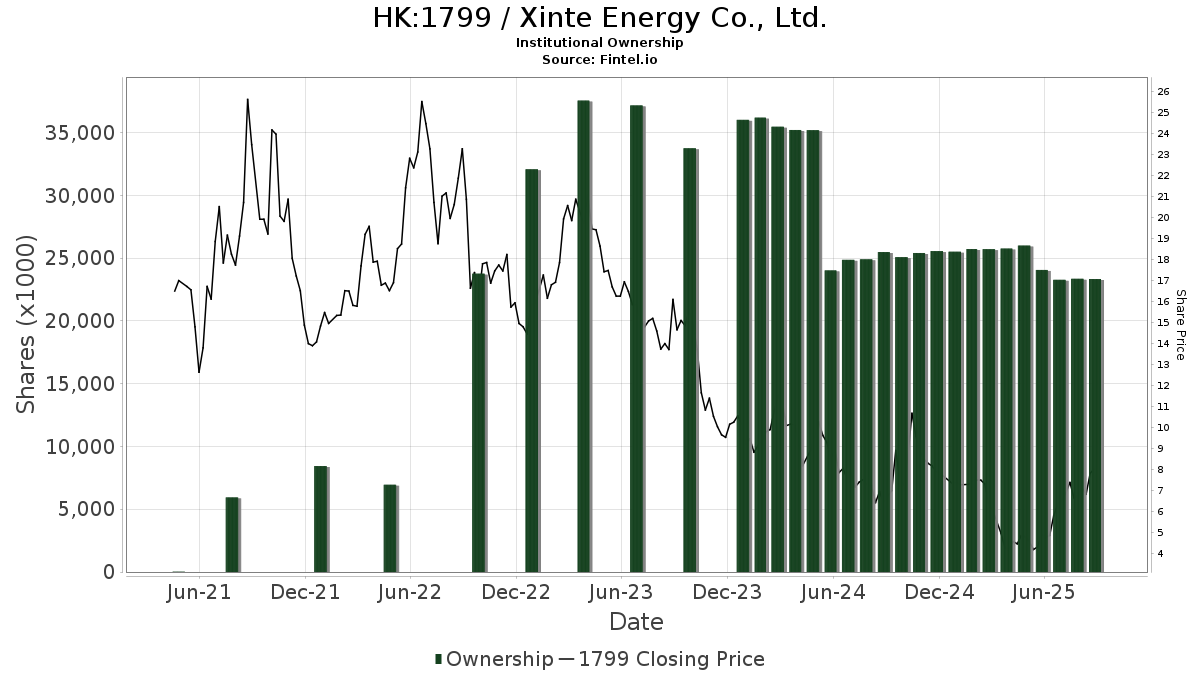

There are 31 funds or institutions reporting positions in Xinte Energy Co.. This is an decrease of 3 owner(s) or 8.82% in the last quarter. Average portfolio weight of all funds dedicated to 1799 is 0.02%, an increase of 41.70%. Total shares owned by institutions decreased in the last three months by 3.00% to 23,335K shares.

What are Other Shareholders Doing?

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 5,262K shares representing 1.40% ownership of the company. No change in the last quarter.

VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares holds 4,854K shares representing 1.29% ownership of the company. No change in the last quarter.

DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class holds 3,981K shares representing 1.06% ownership of the company. No change in the last quarter.

AVEM - Avantis Emerging Markets Equity ETF holds 2,584K shares representing 0.69% ownership of the company. In its prior filing, the firm reported owning 2,353K shares , representing an increase of 8.96%. The firm decreased its portfolio allocation in 1799 by 51.56% over the last quarter.

Dimensional Emerging Markets Value Fund - Dimensional Emerging Markets Value Fund holds 1,556K shares representing 0.41% ownership of the company. No change in the last quarter.