Wells Fargo Maintains Lululemon Athletica (LULU) Overweight Recommendation

Fintel reports that on September 1, 2023, Wells Fargo maintained coverage of Lululemon Athletica (NASDAQ:LULU) with a Overweight recommendation.

Analyst Price Forecast Suggests 12.41% Upside

As of August 31, 2023, the average one-year price target for Lululemon Athletica is 428.57. The forecasts range from a low of 252.50 to a high of $557.55. The average price target represents an increase of 12.41% from its latest reported closing price of 381.26.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Lululemon Athletica is 9,276MM, an increase of 4.95%. The projected annual non-GAAP EPS is 11.68.

What is the Fund Sentiment?

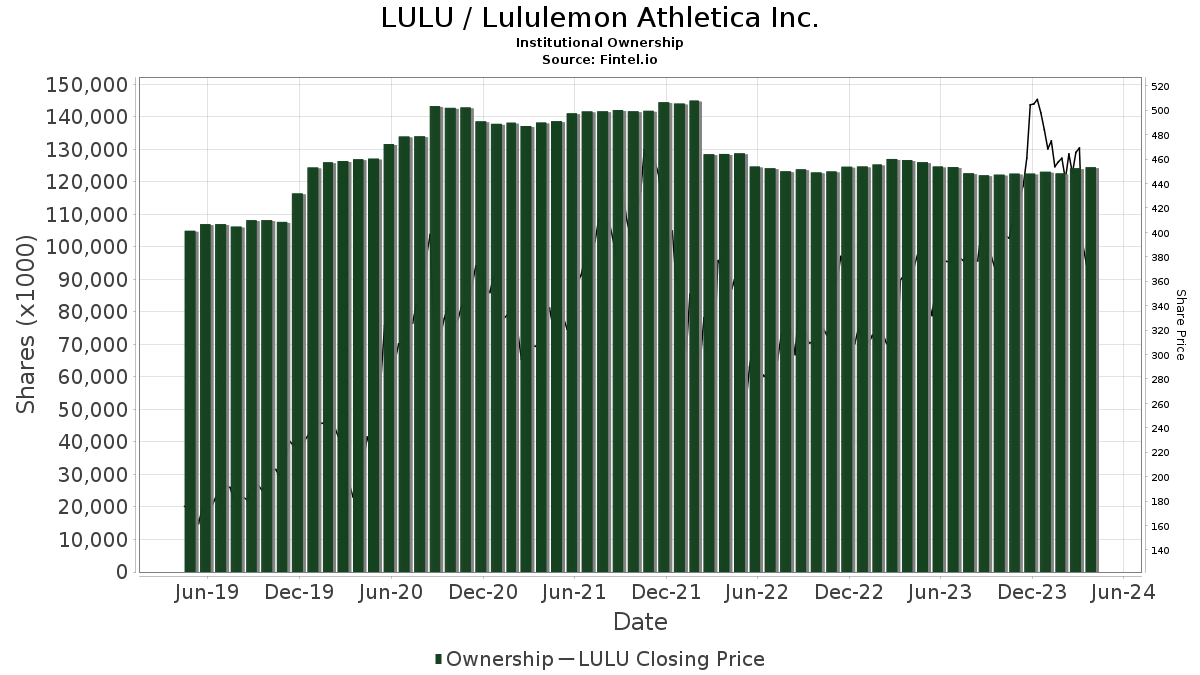

There are 1851 funds or institutions reporting positions in Lululemon Athletica.

This is a decrease

of

47

owner(s) or 2.48% in the last quarter.

Average portfolio weight of all funds dedicated to LULU is 0.39%,

a decrease

of 14.81%.

Total shares owned by institutions decreased

in the last three months by 2.16% to 122,016K shares.

The put/call ratio of LULU is 1.21, indicating a

bearish

outlook.

The put/call ratio of LULU is 1.21, indicating a

bearish

outlook.

What are Other Shareholders Doing?

Jennison Associates holds 4,781K shares representing 3.76% ownership of the company. In it's prior filing, the firm reported owning 4,428K shares, representing an increase of 7.39%. The firm decreased its portfolio allocation in LULU by 0.15% over the last quarter.

FDGRX - Fidelity Growth Company Fund holds 4,696K shares representing 3.70% ownership of the company. In it's prior filing, the firm reported owning 4,797K shares, representing a decrease of 2.15%. The firm decreased its portfolio allocation in LULU by 6.54% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,625K shares representing 2.85% ownership of the company. In it's prior filing, the firm reported owning 3,790K shares, representing a decrease of 4.55%. The firm decreased its portfolio allocation in LULU by 8.29% over the last quarter.

Edgewood Management holds 3,149K shares representing 2.48% ownership of the company. In it's prior filing, the firm reported owning 3,008K shares, representing an increase of 4.50%. The firm increased its portfolio allocation in LULU by 3.07% over the last quarter.

Price T Rowe Associates holds 2,601K shares representing 2.05% ownership of the company. In it's prior filing, the firm reported owning 3,595K shares, representing a decrease of 38.20%. The firm increased its portfolio allocation in LULU by 57.93% over the last quarter.

Lululemon Athletica Background Information

(This description is provided by the company.)

lululemon athletica inc.is a healthy lifestyle inspired athletic apparel company for yoga, running, training, and most other sweaty pursuits, creating transformational products and experiences which enable people to live a life they love. Setting the bar in technical fabrics and functional designs, lululemon works with yogis and athletes in local communities for continuous research and product feedback.

Additional reading:

- LULULEMON ATHLETICA INC. ANNOUNCES SECOND QUARTER FISCAL 2023 RESULTS Revenue increased 18% to $2.2 billion Comparable sales increased 11%, or increased 13% on a constant dollar basis Diluted EPS of $2.68

- Policy for Recovery of Erroneously Awarded Incentive-Based Compensation

- Form of Non-Qualified Stock Option Agreement