Shanghai Mechanical & Electrical Industry Co. (SHSE:900925) Price Target Increased by 26.07% to 1.37

The average one-year price target for Shanghai Mechanical & Electrical Industry Co. (SHSE:900925) has been revised to CN¥1.37 / share. This is an increase of 26.07% from the prior estimate of CN¥1.09 dated March 19, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of CN¥1.36 to a high of CN¥1.41 / share. The average price target represents an increase of 17.46% from the latest reported closing price of CN¥1.17 / share.

What is the Fund Sentiment?

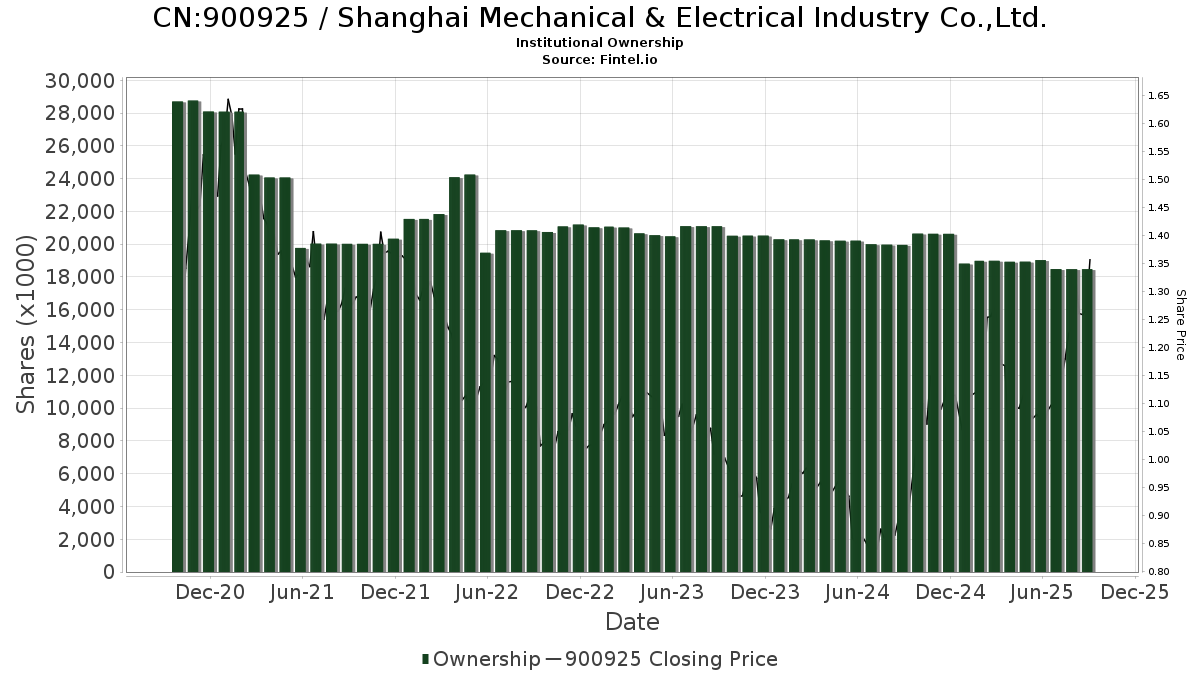

There are 18 funds or institutions reporting positions in Shanghai Mechanical & Electrical Industry Co.. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to 900925 is 0.07%, an increase of 18.59%. Total shares owned by institutions increased in the last three months by 0.61% to 18,927K shares.

What are Other Shareholders Doing?

TBGVX - Tweedy, Browne Global Value Fund holds 6,463K shares representing 2.99% ownership of the company. No change in the last quarter.

VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares holds 3,637K shares representing 1.68% ownership of the company. No change in the last quarter.

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 3,360K shares representing 1.55% ownership of the company. No change in the last quarter.

KGIIX - KOPERNIK INTERNATIONAL FUND CLASS I SHARES holds 2,298K shares representing 1.06% ownership of the company. No change in the last quarter.

FTIHX - Fidelity Total International Index Fund holds 714K shares representing 0.33% ownership of the company. In its prior filing, the firm reported owning 518K shares , representing an increase of 27.45%. The firm increased its portfolio allocation in 900925 by 74.02% over the last quarter.