Perpetua Resources (TSX:PPTA) Price Target Decreased by 15.45% to 23.46

The average one-year price target for Perpetua Resources (TSX:PPTA) has been revised to $23.46 / share. This is a decrease of 15.45% from the prior estimate of $27.75 dated May 4, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $22.22 to a high of $25.20 / share. The average price target represents an increase of 23.21% from the latest reported closing price of $19.04 / share.

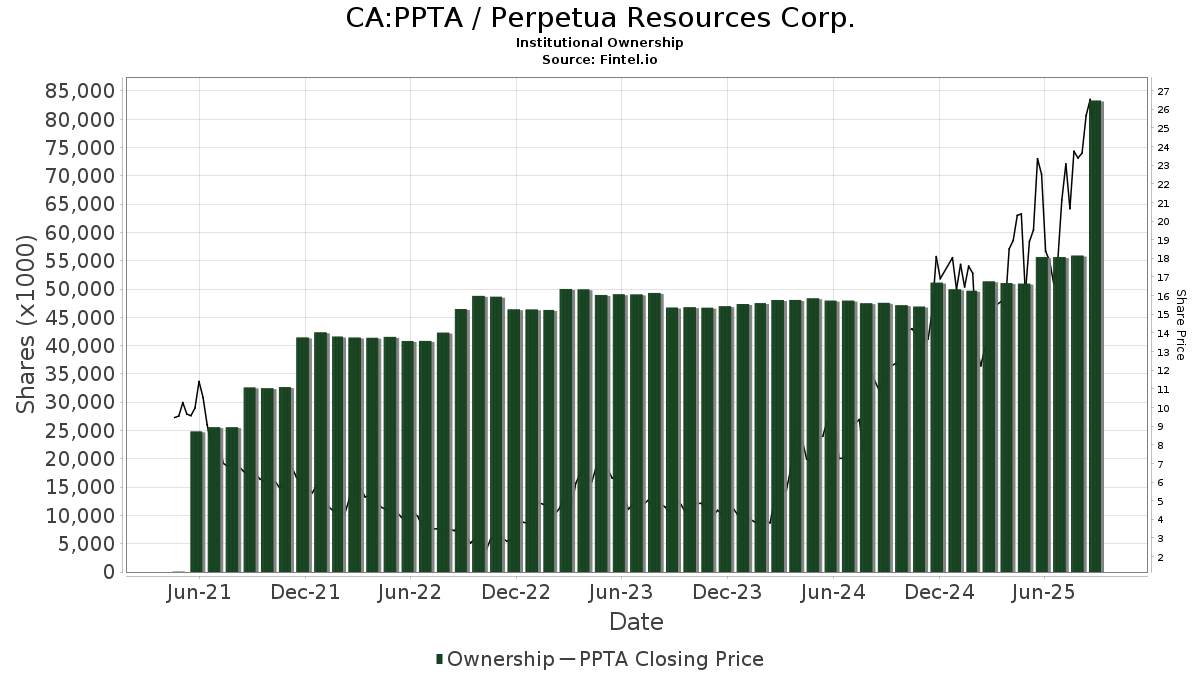

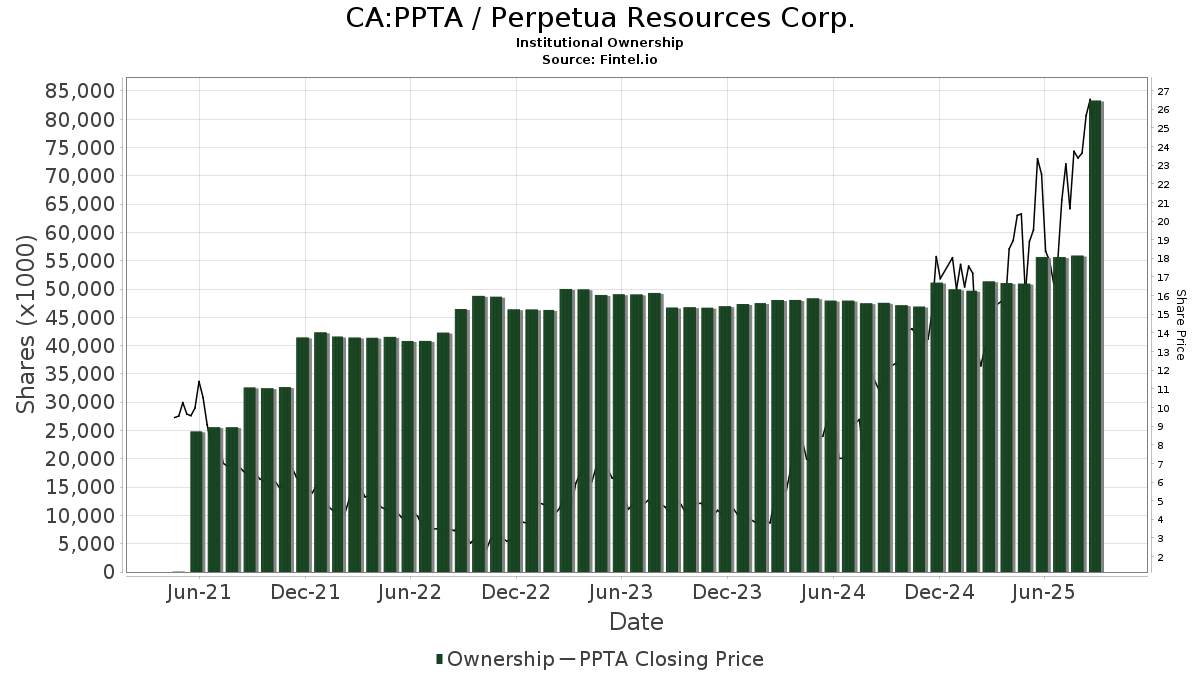

What is the Fund Sentiment?

There are 225 funds or institutions reporting positions in Perpetua Resources. This is an increase of 27 owner(s) or 13.64% in the last quarter. Average portfolio weight of all funds dedicated to PPTA is 0.18%, an increase of 52.67%. Total shares owned by institutions increased in the last three months by 8.39% to 55,649K shares.

What are Other Shareholders Doing?

Paulson holds 24,772K shares representing 34.62% ownership of the company. No change in the last quarter.

Sprott holds 3,395K shares representing 4.75% ownership of the company. In its prior filing, the firm reported owning 2,939K shares , representing an increase of 13.45%. The firm increased its portfolio allocation in PPTA by 5.54% over the last quarter.

SPROTT FUNDS TRUST - Sprott Gold Equity Fund Institutional Class holds 2,411K shares representing 3.37% ownership of the company. No change in the last quarter.

Van Eck Associates holds 1,960K shares representing 2.74% ownership of the company. In its prior filing, the firm reported owning 0K shares , representing an increase of 100.00%.

GDXJ - VanEck Vectors Junior Gold Miners ETF holds 1,766K shares representing 2.47% ownership of the company.