Peninsula Energy (PENMF) Price Target Decreased by 50.75% to 1.26

The average one-year price target for Peninsula Energy (OTCPK:PENMF) has been revised to $1.26 / share. This is a decrease of 50.75% from the prior estimate of $2.57 dated April 1, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $0.53 to a high of $1.93 / share. The average price target represents an increase of 1,705.11% from the latest reported closing price of $0.07 / share.

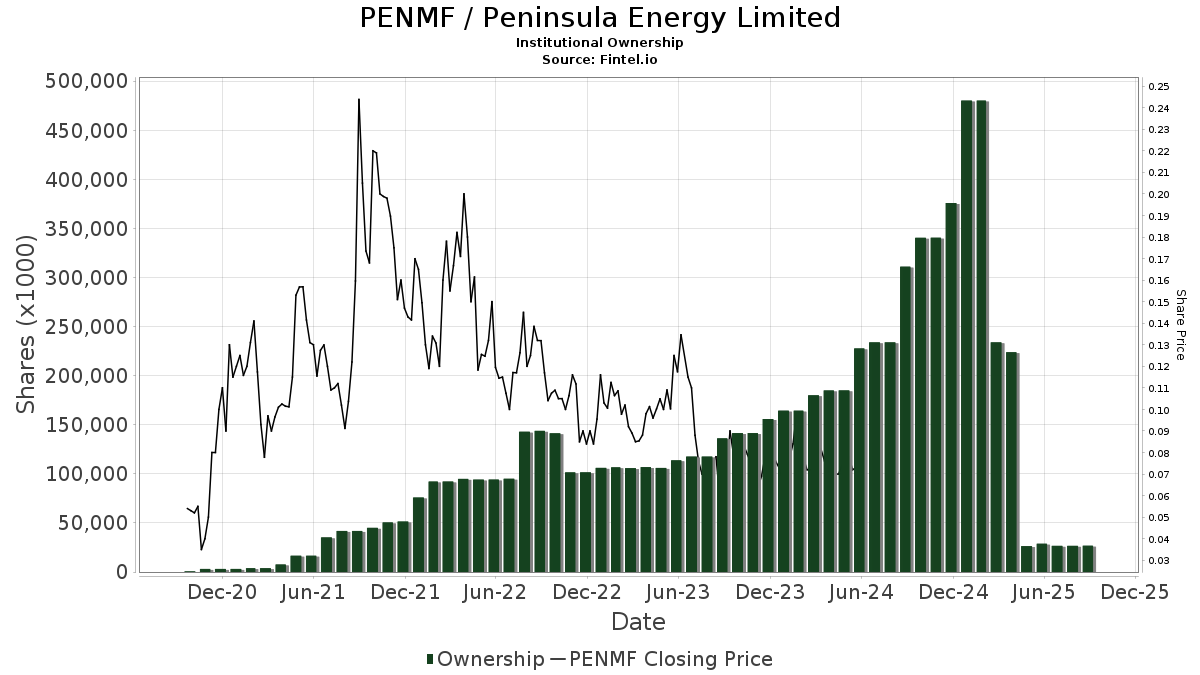

What is the Fund Sentiment?

There are 15 funds or institutions reporting positions in Peninsula Energy. This is an decrease of 1 owner(s) or 6.25% in the last quarter. Average portfolio weight of all funds dedicated to PENMF is 0.08%, an increase of 58.87%. Total shares owned by institutions decreased in the last three months by 7.03% to 26,780K shares.

What are Other Shareholders Doing?

Sprott Funds Trust - Sprott Uranium Miners Etf holds 12,958K shares representing 4.74% ownership of the company. In its prior filing, the firm reported owning 12,900K shares , representing an increase of 0.45%. The firm decreased its portfolio allocation in PENMF by 36.32% over the last quarter.

URA - Global X Uranium ETF holds 8,220K shares representing 3.01% ownership of the company. In its prior filing, the firm reported owning 10,380K shares , representing a decrease of 26.28%. The firm decreased its portfolio allocation in PENMF by 39.71% over the last quarter.

SPROTT FUNDS TRUST - Sprott Junior Uranium Miners ETF holds 4,783K shares representing 1.75% ownership of the company. In its prior filing, the firm reported owning 4,643K shares , representing an increase of 2.93%. The firm decreased its portfolio allocation in PENMF by 36.86% over the last quarter.

Dfa Investment Trust Co - The Asia Pacific Small Company Series holds 436K shares representing 0.16% ownership of the company. No change in the last quarter.

PSPFX - Global Resources Fund holds 95K shares representing 0.03% ownership of the company. No change in the last quarter.