Nouveau Monde Graphite (NMG) Price Target Decreased by 10.11% to 3.13

The average one-year price target for Nouveau Monde Graphite (NYSE:NMG) has been revised to $3.13 / share. This is a decrease of 10.11% from the prior estimate of $3.49 dated August 21, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $2.54 to a high of $4.30 / share. The average price target represents an increase of 45.74% from the latest reported closing price of $2.15 / share.

What is the Fund Sentiment?

There are 33 funds or institutions reporting positions in Nouveau Monde Graphite.

This is unchanged over the last quarter.

Average portfolio weight of all funds dedicated to NMG is 0.63%, an increase of 0.38%.

Total shares owned by institutions increased in the last three months by 0.49% to 14,649K shares.

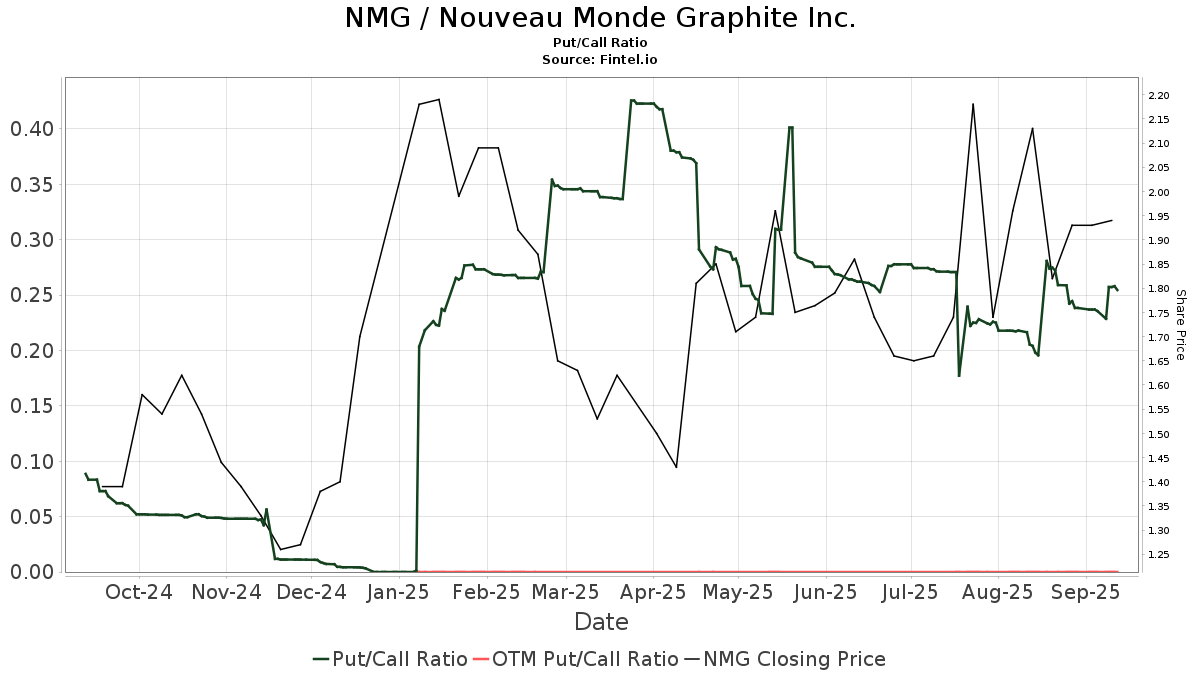

The put/call ratio of NMG is 0.25, indicating a

bullish outlook.

The put/call ratio of NMG is 0.25, indicating a

bullish outlook.

What are Other Shareholders Doing?

General Motors Holdings holds 12,500K shares representing 8.20% ownership of the company. No change in the last quarter.

Caisse De Depot Et Placement Du Quebec holds 744K shares representing 0.49% ownership of the company. No change in the last quarter.

Federation des caisses Desjardins du Quebec holds 565K shares representing 0.37% ownership of the company. In its prior filing, the firm reported owning 561K shares , representing an increase of 0.75%. The firm decreased its portfolio allocation in NMG by 58.49% over the last quarter.

Kestra Advisory Services holds 135K shares representing 0.09% ownership of the company. In its prior filing, the firm reported owning 107K shares , representing an increase of 21.07%. The firm increased its portfolio allocation in NMG by 38.57% over the last quarter.

National Bank Of Canada holds 107K shares representing 0.07% ownership of the company. In its prior filing, the firm reported owning 106K shares , representing an increase of 0.25%. The firm decreased its portfolio allocation in NMG by 5.66% over the last quarter.