Northland Capital Markets Initiates Coverage of Ouster (OUST) with Outperform Recommendation

Fintel reports that on December 12, 2024, Northland Capital Markets initiated coverage of Ouster (NYSE:OUST) with a Outperform recommendation.

Analyst Price Forecast Suggests 19.84% Upside

As of December 3, 2024, the average one-year price target for Ouster is $10.96/share. The forecasts range from a low of $5.05 to a high of $17.85. The average price target represents an increase of 19.84% from its latest reported closing price of $9.15 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Ouster is 209MM, an increase of 98.41%. The projected annual non-GAAP EPS is -0.41.

What is the Fund Sentiment?

There are 254 funds or institutions reporting positions in Ouster.

This is an increase of 81 owner(s) or 46.82% in the last quarter.

Average portfolio weight of all funds dedicated to OUST is 0.07%, an increase of 46.51%.

Total shares owned by institutions increased in the last three months by 29.33% to 23,986K shares.

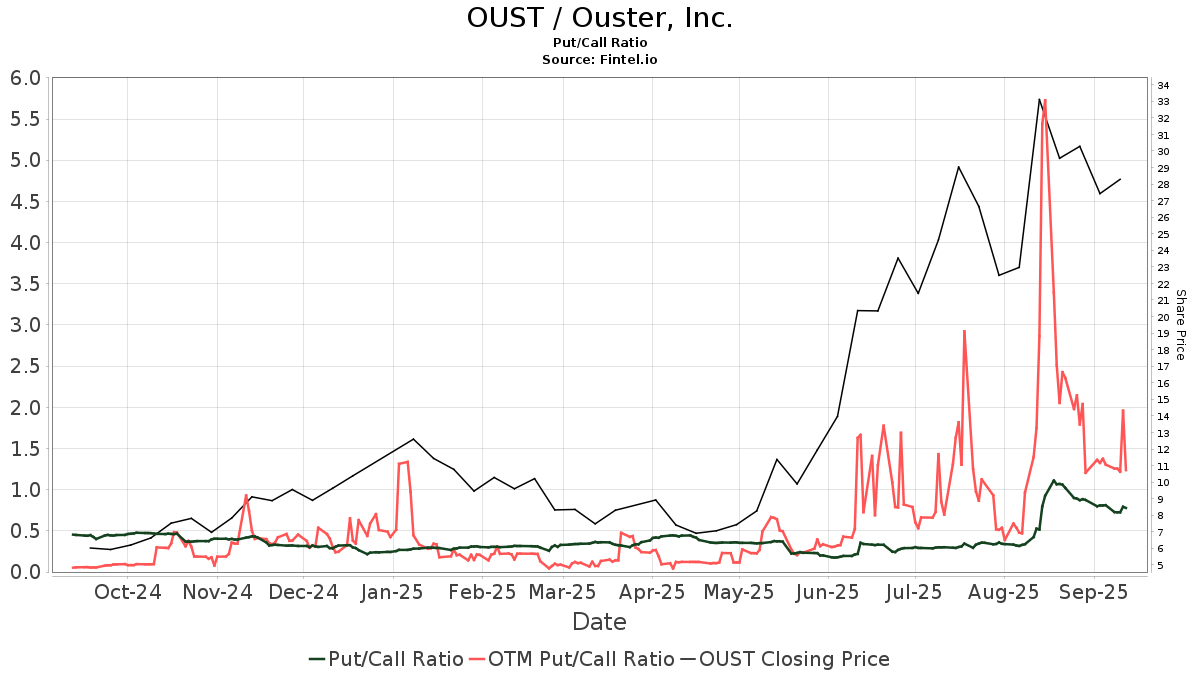

The put/call ratio of OUST is 0.29, indicating a

bullish outlook.

The put/call ratio of OUST is 0.29, indicating a

bullish outlook.

What are Other Shareholders Doing?

D. E. Shaw holds 1,825K shares representing 3.67% ownership of the company. In its prior filing, the firm reported owning 1,405K shares , representing an increase of 23.00%. The firm decreased its portfolio allocation in OUST by 23.60% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,143K shares representing 2.30% ownership of the company. In its prior filing, the firm reported owning 945K shares , representing an increase of 17.37%. The firm decreased its portfolio allocation in OUST by 27.15% over the last quarter.

IWM - iShares Russell 2000 ETF holds 1,135K shares representing 2.28% ownership of the company. In its prior filing, the firm reported owning 0K shares , representing an increase of 100.00%.

Tao Capital Management holds 1,125K shares representing 2.26% ownership of the company. No change in the last quarter.

Geode Capital Management holds 975K shares representing 1.96% ownership of the company. In its prior filing, the firm reported owning 913K shares , representing an increase of 6.38%. The firm decreased its portfolio allocation in OUST by 66.92% over the last quarter.

Ouster Background Information

(This description is provided by the company.)

Ouster invented its digital lidar in 2015 and is a leading manufacturer of high-resolution digital lidar sensors used throughout the industrial automation, smart infrastructure, robotics, and automotive industries. Ouster’s sensors are reliable, compact, affordable and highly customizable, laying the foundation for digital lidar ubiquity across endless applications and industries. Already hundreds of customers have incorporated Ouster lidar sensors in current products or those in development for imminent commercial release.