Morgan Stanley Downgrades Ameriprise Financial (BMV:AMP)

Fintel reports that on July 15, 2025, Morgan Stanley downgraded their outlook for Ameriprise Financial (BMV:AMP) from Equal-Weight to Underweight.

What is the Fund Sentiment?

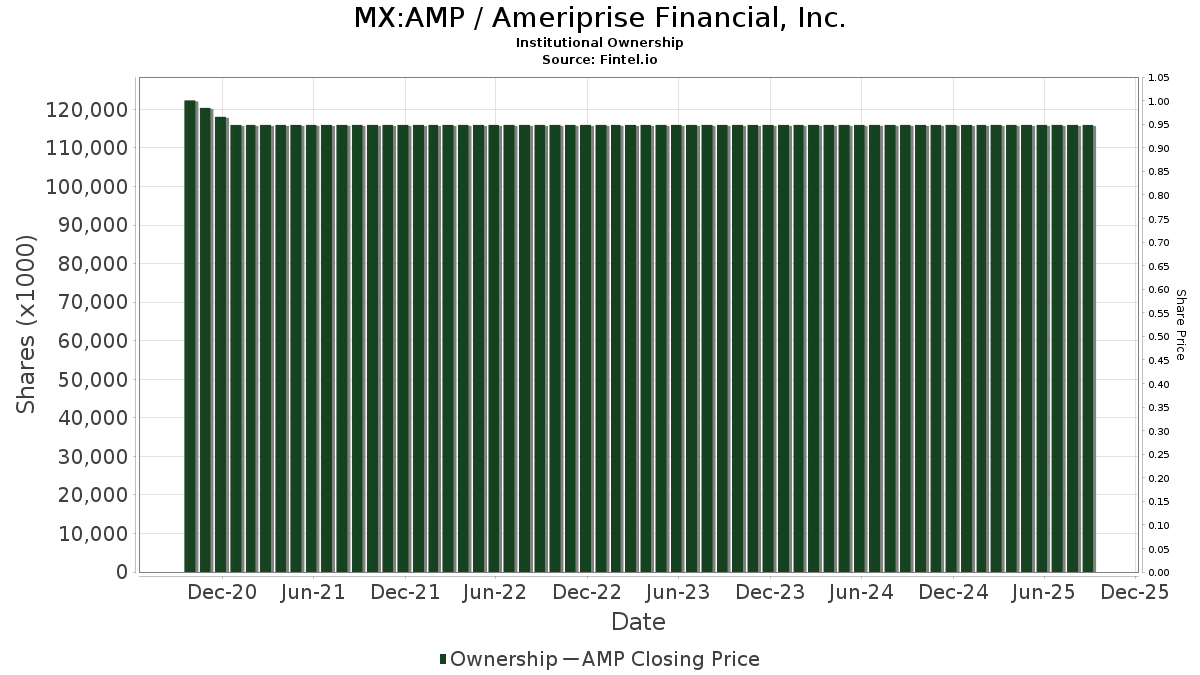

There are 1,569 funds or institutions reporting positions in Ameriprise Financial. This is an decrease of 68 owner(s) or 4.15% in the last quarter. Average portfolio weight of all funds dedicated to AMP is 0.32%, an increase of 0.23%. Total shares owned by institutions decreased in the last three months by 3.91% to 115,960K shares.

What are Other Shareholders Doing?

Jpmorgan Chase holds 5,825K shares representing 4.99% ownership of the company. In its prior filing, the firm reported owning 4,802K shares , representing an increase of 17.56%. The firm decreased its portfolio allocation in AMP by 88.58% over the last quarter.

Aristotle Capital Management holds 3,164K shares representing 2.71% ownership of the company. In its prior filing, the firm reported owning 3,246K shares , representing a decrease of 2.61%. The firm decreased its portfolio allocation in AMP by 8.38% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,034K shares representing 2.60% ownership of the company. In its prior filing, the firm reported owning 3,035K shares , representing a decrease of 0.03%. The firm decreased its portfolio allocation in AMP by 5.18% over the last quarter.

Geode Capital Management holds 2,771K shares representing 2.37% ownership of the company. In its prior filing, the firm reported owning 2,648K shares , representing an increase of 4.45%. The firm decreased its portfolio allocation in AMP by 48.94% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 2,673K shares representing 2.29% ownership of the company. In its prior filing, the firm reported owning 2,626K shares , representing an increase of 1.77%. The firm decreased its portfolio allocation in AMP by 5.48% over the last quarter.