Mercialys (MEIYF) Price Target Increased by 28.06% to 15.31

The average one-year price target for Mercialys (OTCPK:MEIYF) has been revised to $15.31 / share. This is an increase of 28.06% from the prior estimate of $11.95 dated December 1, 2022.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $13.14 to a high of $18.01 / share. The average price target represents an increase of 31.85% from the latest reported closing price of $11.61 / share.

What is the Fund Sentiment?

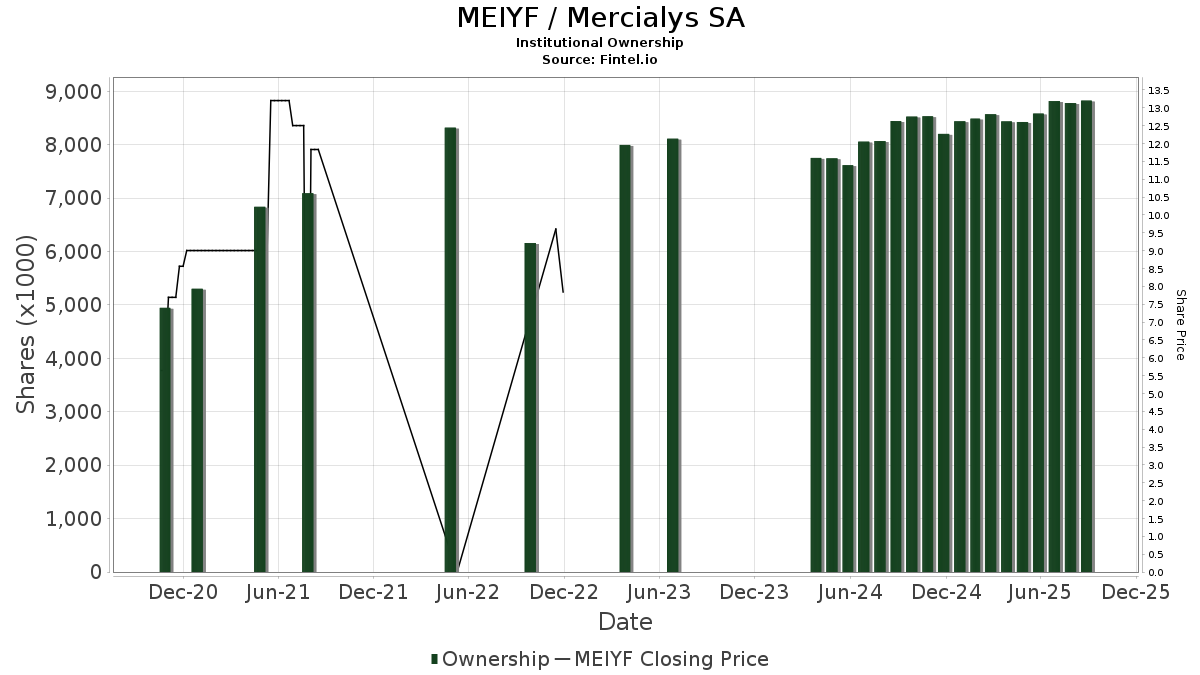

There are 66 funds or institutions reporting positions in Mercialys. This is an increase of 1 owner(s) or 1.54% in the last quarter. Average portfolio weight of all funds dedicated to MEIYF is 0.19%, an increase of 4.38%. Total shares owned by institutions increased in the last three months by 3.53% to 8,828K shares.

What are Other Shareholders Doing?

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 1,298K shares representing 1.39% ownership of the company. No change in the last quarter.

VTMGX - Vanguard Developed Markets Index Fund Admiral Shares holds 815K shares representing 0.87% ownership of the company. No change in the last quarter.

IEFA - iShares Core MSCI EAFE ETF holds 610K shares representing 0.65% ownership of the company. In its prior filing, the firm reported owning 603K shares , representing an increase of 1.02%. The firm increased its portfolio allocation in MEIYF by 14.11% over the last quarter.

DFA INVESTMENT DIMENSIONS GROUP INC - DFA International Real Estate Securities Portfolio - Institutional Class holds 576K shares representing 0.62% ownership of the company. In its prior filing, the firm reported owning 618K shares , representing a decrease of 7.29%. The firm increased its portfolio allocation in MEIYF by 10.39% over the last quarter.

CSFAX - Cohen & Steers Global Realty Shares, Inc. holds 400K shares representing 0.43% ownership of the company. In its prior filing, the firm reported owning 279K shares , representing an increase of 30.08%. The firm increased its portfolio allocation in MEIYF by 37.41% over the last quarter.