Lightspeed Commerce (TSX:LSPD) Price Target Increased by 15.84% to 16.62

The average one-year price target for Lightspeed Commerce (TSX:LSPD) has been revised to $16.62 / share. This is an increase of 15.84% from the prior estimate of $14.35 dated July 15, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $13.15 to a high of $22.02 / share. The average price target represents a decrease of 3.19% from the latest reported closing price of $17.17 / share.

What is the Fund Sentiment?

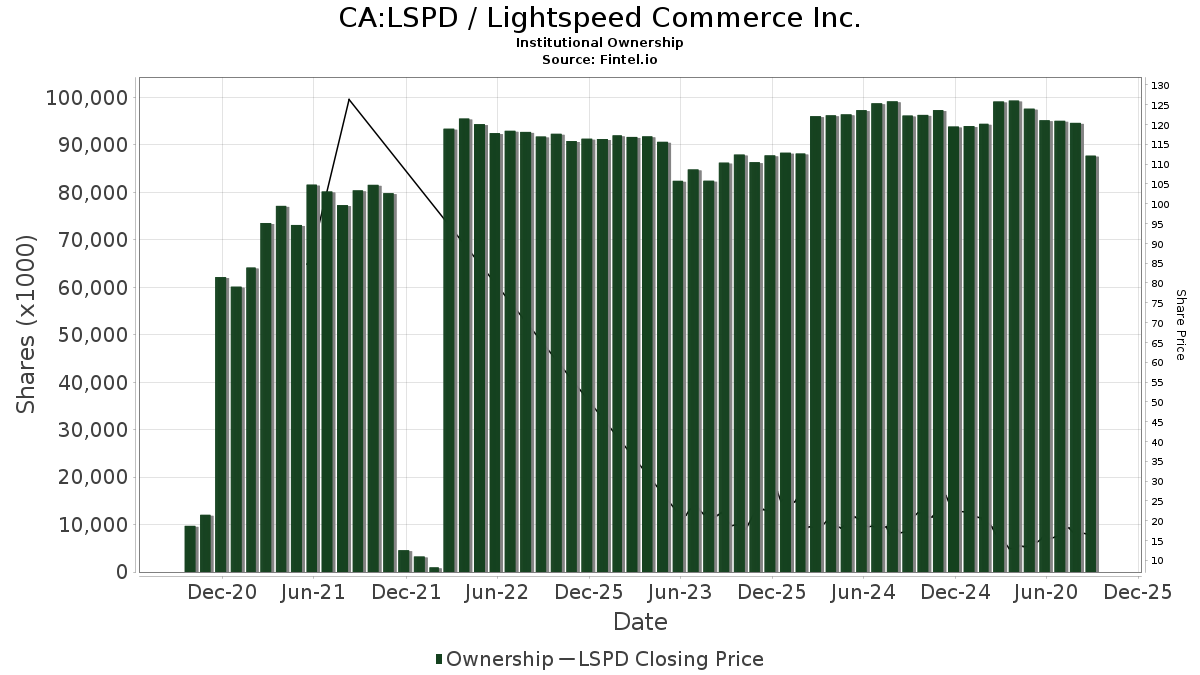

There are 183 funds or institutions reporting positions in Lightspeed Commerce. This is an decrease of 8 owner(s) or 4.19% in the last quarter. Average portfolio weight of all funds dedicated to LSPD is 0.19%, an increase of 54.16%. Total shares owned by institutions decreased in the last three months by 2.56% to 95,435K shares.

What are Other Shareholders Doing?

Caisse De Depot Et Placement Du Quebec holds 24,286K shares representing 17.96% ownership of the company. In its prior filing, the firm reported owning 24,286K shares , representing an increase of 0.00%. The firm decreased its portfolio allocation in LSPD by 42.10% over the last quarter.

FIL holds 17,575K shares representing 13.00% ownership of the company. In its prior filing, the firm reported owning 14,632K shares , representing an increase of 16.74%. The firm decreased its portfolio allocation in LSPD by 29.92% over the last quarter.

Artisan Partners Limited Partnership holds 3,778K shares representing 2.79% ownership of the company. In its prior filing, the firm reported owning 4,555K shares , representing a decrease of 20.56%. The firm decreased its portfolio allocation in LSPD by 48.82% over the last quarter.

Wishbone Management holds 3,675K shares representing 2.72% ownership of the company.

Nuveen Asset Management holds 3,150K shares representing 2.33% ownership of the company. In its prior filing, the firm reported owning 3,125K shares , representing an increase of 0.79%. The firm decreased its portfolio allocation in LSPD by 6.38% over the last quarter.