Lasertec Corporation - Depositary Receipt () (LSRCY) Price Target Decreased by 35.96% to 25.40

The average one-year price target for Lasertec Corporation - Depositary Receipt () (OTCPK:LSRCY) has been revised to $25.40 / share. This is a decrease of 35.96% from the prior estimate of $39.67 dated August 5, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of -$19.97 to a high of $72.38 / share. The average price target represents a decrease of 44.47% from the latest reported closing price of $45.75 / share.

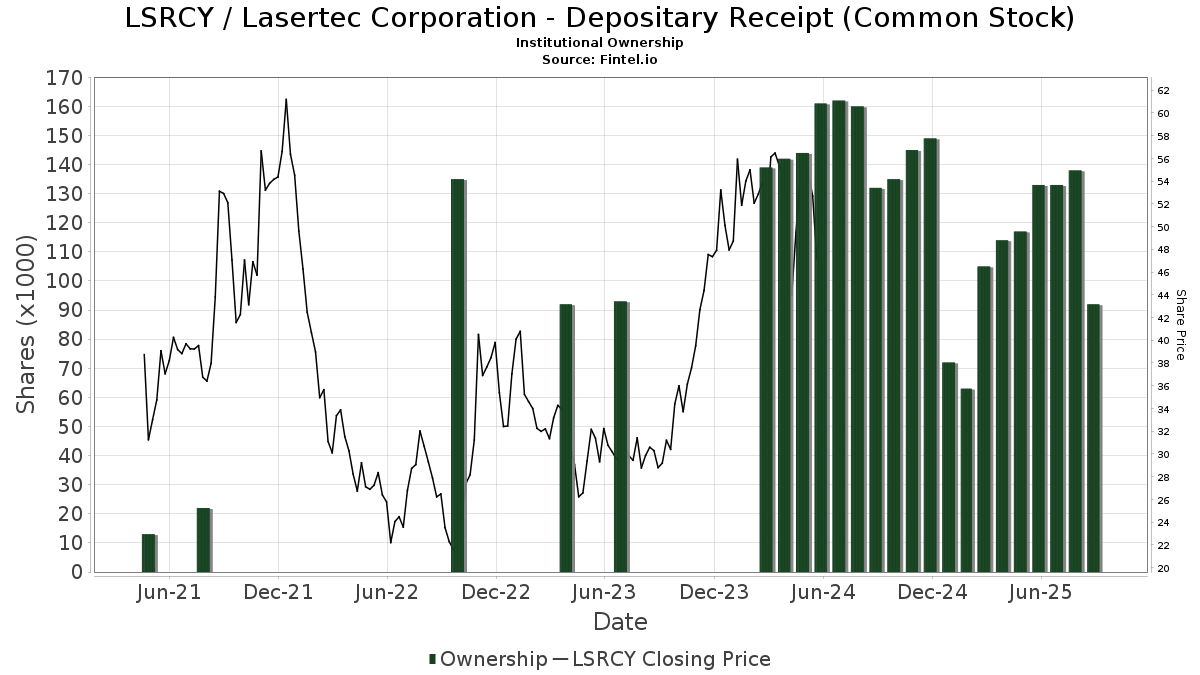

What is the Fund Sentiment?

There are 11 funds or institutions reporting positions in Lasertec Corporation - Depositary Receipt (). This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to LSRCY is 0.05%, an increase of 1.07%. Total shares owned by institutions decreased in the last three months by 30.77% to 92K shares.

What are Other Shareholders Doing?

Madison Asset Management holds 63K shares. In its prior filing, the firm reported owning 63K shares , representing an increase of 0.41%. The firm increased its portfolio allocation in LSRCY by 52.64% over the last quarter.

TRFM - AAM Transformers ETF holds 9K shares. In its prior filing, the firm reported owning 4K shares , representing an increase of 55.47%. The firm increased its portfolio allocation in LSRCY by 36.84% over the last quarter.

Rhumbline Advisers holds 7K shares. In its prior filing, the firm reported owning 7K shares , representing an increase of 5.02%. The firm increased its portfolio allocation in LSRCY by 51.16% over the last quarter.

SPTE - SP Funds S&P Global Technology ETF holds 5K shares. In its prior filing, the firm reported owning 4K shares , representing an increase of 10.02%. The firm increased its portfolio allocation in LSRCY by 3.29% over the last quarter.

GAMMA Investing holds 4K shares. In its prior filing, the firm reported owning 2K shares , representing an increase of 42.76%. The firm increased its portfolio allocation in LSRCY by 130.85% over the last quarter.