Goldman Sachs Initiates Coverage of Q2 Holdings (QTWO) with Buy Recommendation

Fintel reports that on July 12, 2023, Goldman Sachs initiated coverage of Q2 Holdings (NYSE:QTWO) with a Buy recommendation.

Analyst Price Forecast Suggests 3.61% Downside

As of July 6, 2023, the average one-year price target for Q2 Holdings is 30.84. The forecasts range from a low of 24.24 to a high of $37.80. The average price target represents a decrease of 3.61% from its latest reported closing price of 31.99.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Q2 Holdings is 659MM, an increase of 12.80%. The projected annual non-GAAP EPS is 0.53.

What is the Fund Sentiment?

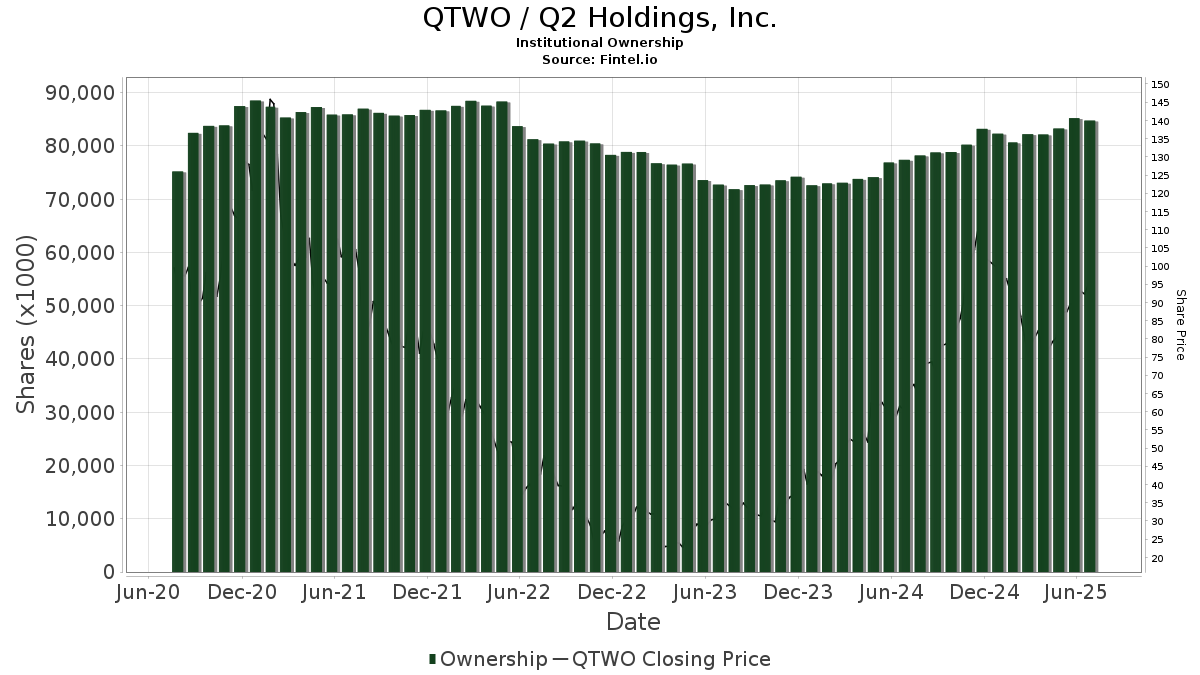

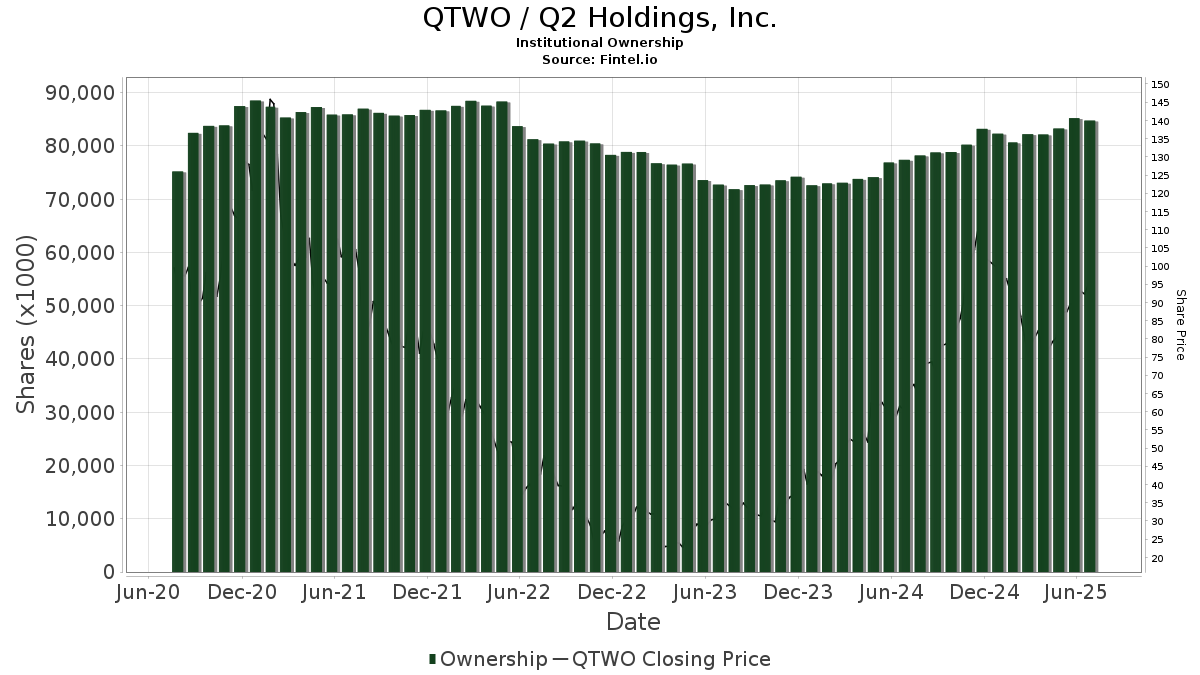

There are 474 funds or institutions reporting positions in Q2 Holdings.

This is a decrease

of

4

owner(s) or 0.84% in the last quarter.

Average portfolio weight of all funds dedicated to QTWO is 0.19%,

a decrease

of 9.72%.

Total shares owned by institutions decreased

in the last three months by 5.15% to 72,545K shares.

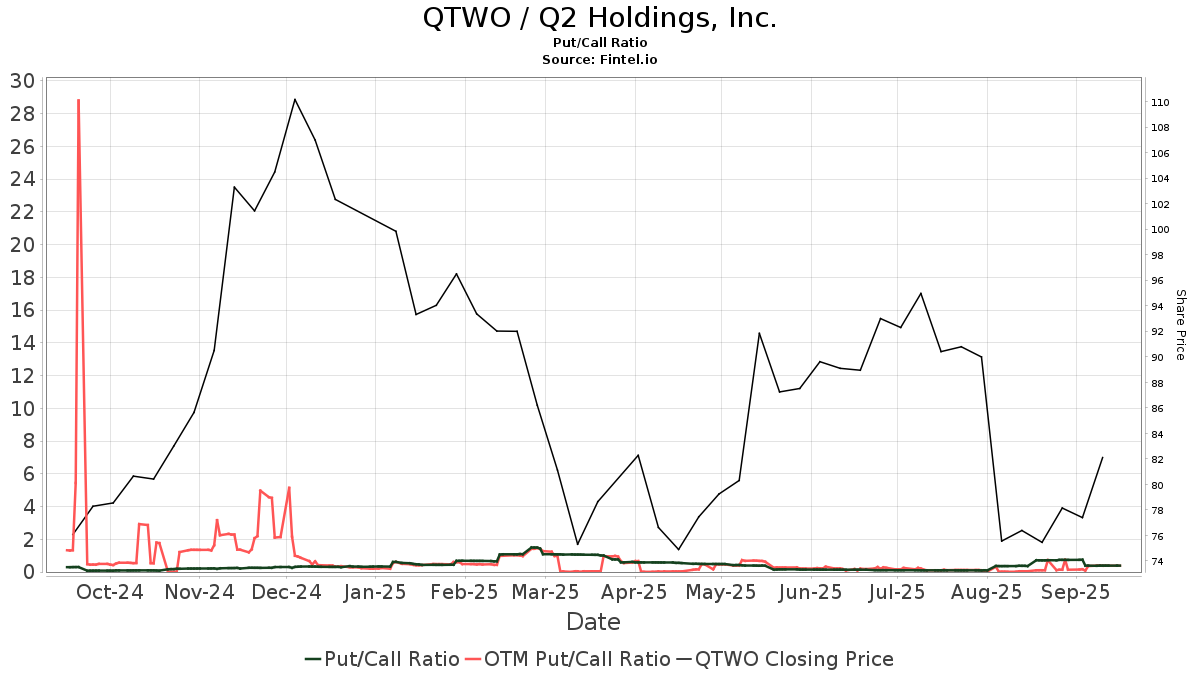

The put/call ratio of QTWO is 0.37, indicating a

bullish

outlook.

The put/call ratio of QTWO is 0.37, indicating a

bullish

outlook.

What are Other Shareholders Doing?

Wasatch Advisors holds 3,641K shares representing 6.26% ownership of the company. In it's prior filing, the firm reported owning 2,795K shares, representing an increase of 23.24%. The firm increased its portfolio allocation in QTWO by 10.40% over the last quarter.

Brown Capital Management holds 3,315K shares representing 5.70% ownership of the company. In it's prior filing, the firm reported owning 3,148K shares, representing an increase of 5.04%. The firm decreased its portfolio allocation in QTWO by 12.81% over the last quarter.

Jpmorgan Chase holds 2,481K shares representing 4.26% ownership of the company. In it's prior filing, the firm reported owning 2,760K shares, representing a decrease of 11.24%. The firm decreased its portfolio allocation in QTWO by 23.89% over the last quarter.

Wellington Management Group Llp holds 2,287K shares representing 3.93% ownership of the company. In it's prior filing, the firm reported owning 2,816K shares, representing a decrease of 23.11%. The firm decreased its portfolio allocation in QTWO by 89.62% over the last quarter.

Conestoga Capital Advisors holds 2,218K shares representing 3.81% ownership of the company. In it's prior filing, the firm reported owning 2,184K shares, representing an increase of 1.57%. The firm increased its portfolio allocation in QTWO by 83,208.45% over the last quarter.

Q2 Holdings Background Information

(This description is provided by the company.)

Q2 is a financial experience company dedicated to providing digital banking and lending solutions to banks, credit unions, alternative finance, and fintech companies in the U.S. and internationally. With comprehensive end-to-end solution sets, Q2 enables its partners to provide cohesive, secure, data-driven experiences to every account holder - from consumer to small business and corporate. Headquartered in Austin, Texas, Q2 has offices throughout the world.

Additional reading:

- Q2 HOLDINGS, INC. 2023 EQUITY INCENTIVE PLAN Q2 Holdings, Inc. 2023 Equity Incentive Plan

- Q2 Holdings, Inc. Announces First Quarter 2023 Financial Results

- AMENDED AND RESTATED EXECUTIVE EMPLOYMENT AGREEMENT

- Q2 Announces Promotion of Kirk Coleman to President Coleman to Lead Day-to-Day Business Operations

- Q2 HOLDINGS, INC. NOTICE OF GRANT OF PSUS PERFORMANCE STOCK UNITS AGREEMENT