Goldman Sachs Initiates Coverage of Nebius Group N.V. (NBIS) with Buy Recommendation

Fintel reports that on July 14, 2025, Goldman Sachs initiated coverage of Nebius Group N.V. (NasdaqGS:NBIS) with a Buy recommendation.

Analyst Price Forecast Suggests 39.68% Upside

As of June 20, 2025, the average one-year price target for Nebius Group N.V. is $61.88/share. The forecasts range from a low of $47.47 to a high of $84.00. The average price target represents an increase of 39.68% from its latest reported closing price of $44.30 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual non-GAAP EPS is -83.02.

What is the Fund Sentiment?

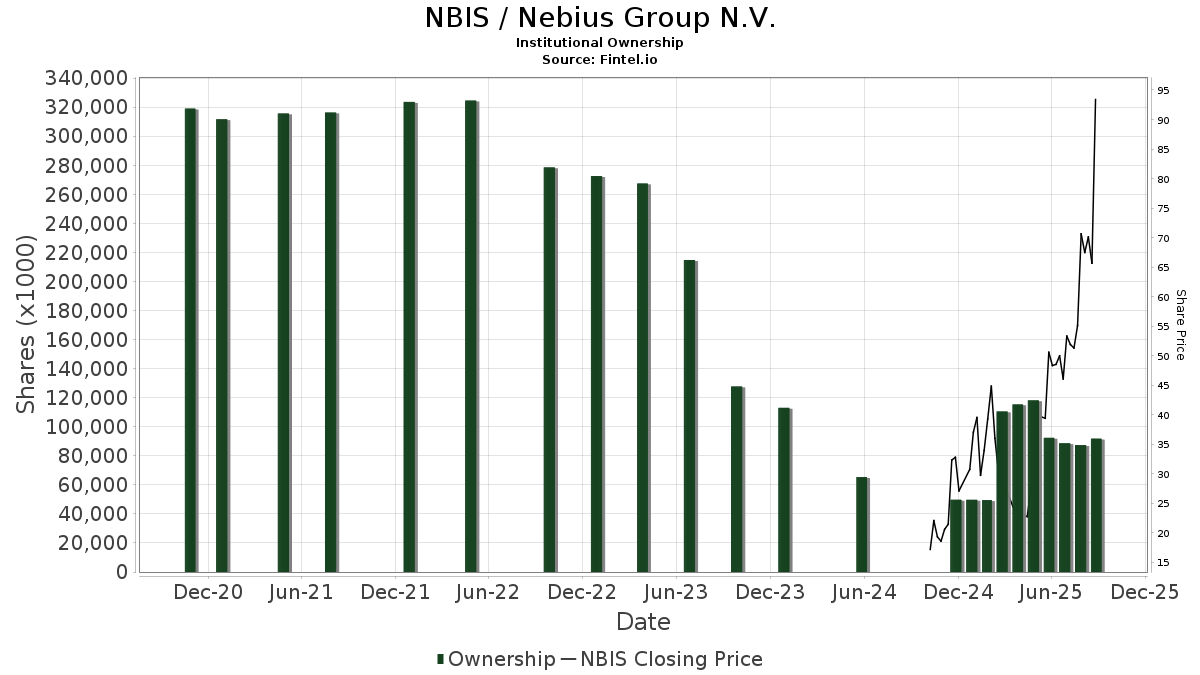

There are 423 funds or institutions reporting positions in Nebius Group N.V..

This is an increase of 41 owner(s) or 10.73% in the last quarter.

Average portfolio weight of all funds dedicated to NBIS is 0.41%, an increase of 37.97%.

Total shares owned by institutions decreased in the last three months by 23.13% to 88,650K shares.

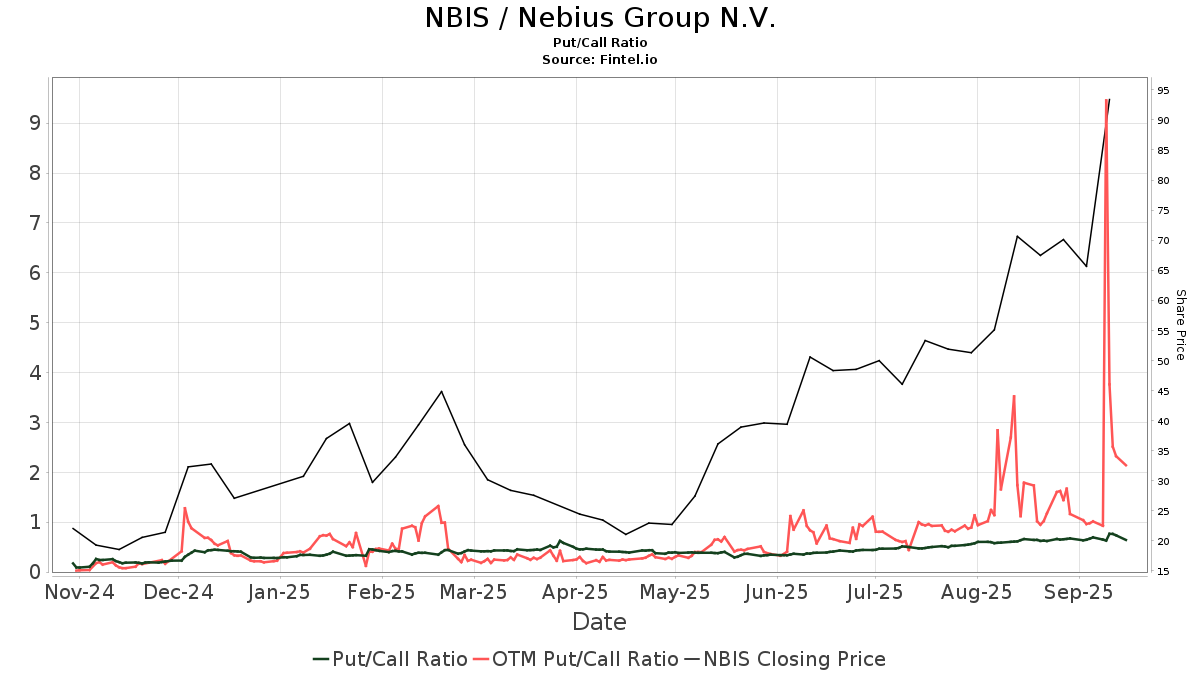

The put/call ratio of NBIS is 0.51, indicating a

bullish outlook.

The put/call ratio of NBIS is 0.51, indicating a

bullish outlook.

What are Other Shareholders Doing?

Orbis Allan Gray holds 15,702K shares representing 7.76% ownership of the company. In its prior filing, the firm reported owning 15,726K shares , representing a decrease of 0.15%. The firm decreased its portfolio allocation in NBIS by 19.11% over the last quarter.

Slate Path Capital holds 5,904K shares representing 2.92% ownership of the company. In its prior filing, the firm reported owning 3,746K shares , representing an increase of 36.55%. The firm increased its portfolio allocation in NBIS by 20.00% over the last quarter.

Citadel Advisors holds 4,630K shares representing 2.29% ownership of the company. In its prior filing, the firm reported owning 4,329K shares , representing an increase of 6.51%. The firm decreased its portfolio allocation in NBIS by 8.51% over the last quarter.

Accel Leaders 4 Associates holds 4,581K shares representing 2.26% ownership of the company. No change in the last quarter.

Invesco holds 3,495K shares representing 1.73% ownership of the company. In its prior filing, the firm reported owning 2,516K shares , representing an increase of 28.01%. The firm decreased its portfolio allocation in NBIS by 90.00% over the last quarter.