Elevra Lithium (SYAXF) Price Target Increased by 86.52% to 0.04

The average one-year price target for Elevra Lithium (OTCPK:SYAXF) has been revised to $0.04 / share. This is an increase of 86.52% from the prior estimate of $0.02 dated August 21, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $0.03 to a high of $0.05 / share. The average price target represents an increase of 58.78% from the latest reported closing price of $0.02 / share.

What is the Fund Sentiment?

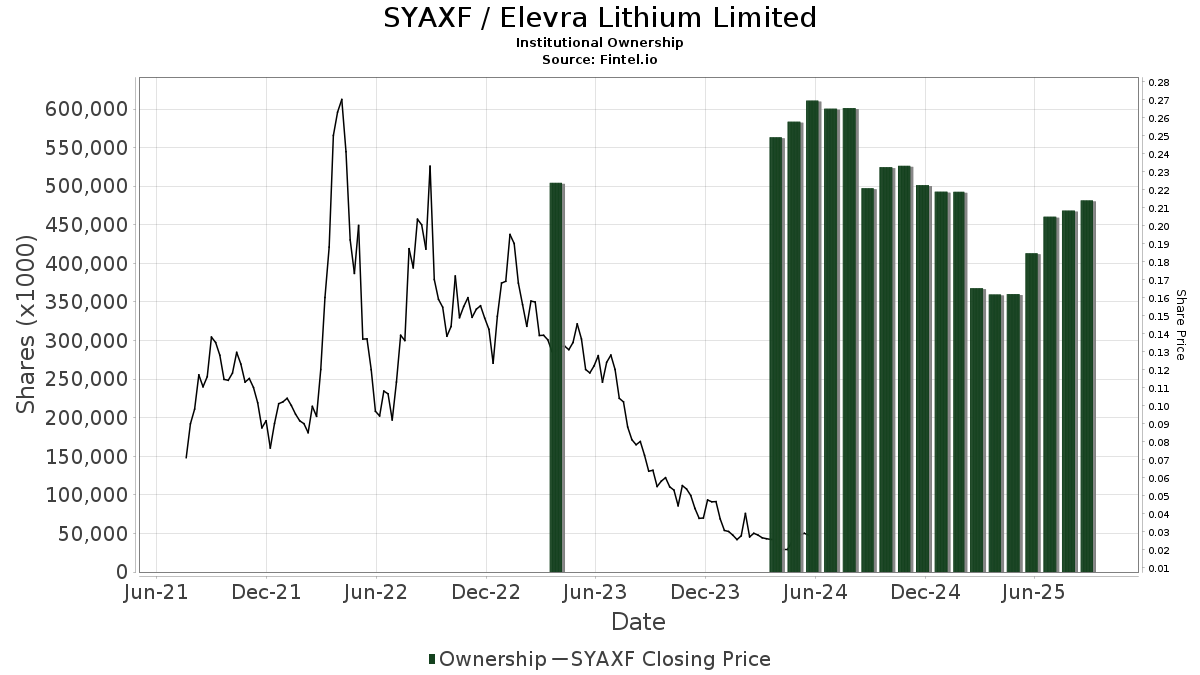

There are 15 funds or institutions reporting positions in Elevra Lithium. This is unchanged over the last quarter. Average portfolio weight of all funds dedicated to SYAXF is 0.29%, an increase of 21.35%. Total shares owned by institutions increased in the last three months by 16.58% to 481,623K shares.

What are Other Shareholders Doing?

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 156,068K shares representing 92.66% ownership of the company. In its prior filing, the firm reported owning 115,164K shares , representing an increase of 26.21%. The firm increased its portfolio allocation in SYAXF by 9.89% over the last quarter.

VTMGX - Vanguard Developed Markets Index Fund Admiral Shares holds 108,166K shares representing 64.22% ownership of the company. No change in the last quarter.

LIT - Global X Lithium & Battery Tech ETF holds 74,835K shares representing 44.43% ownership of the company. In its prior filing, the firm reported owning 76,334K shares , representing a decrease of 2.00%. The firm decreased its portfolio allocation in SYAXF by 2.99% over the last quarter.

VFSNX - Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares holds 37,964K shares representing 22.54% ownership of the company. In its prior filing, the firm reported owning 30,013K shares , representing an increase of 20.94%. The firm increased its portfolio allocation in SYAXF by 11.79% over the last quarter.

SPROTT FUNDS TRUST - Sprott Lithium Miners ETF holds 26,977K shares representing 16.02% ownership of the company. In its prior filing, the firm reported owning 18,681K shares , representing an increase of 30.75%. The firm increased its portfolio allocation in SYAXF by 22.53% over the last quarter.