Credo Technology Group Holding (CRDO) Price Target Increased by 40.68% to 150.80

The average one-year price target for Credo Technology Group Holding (NasdaqGS:CRDO) has been revised to $150.80 / share. This is an increase of 40.68% from the prior estimate of $107.20 dated August 30, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $34.47 to a high of $173.25 / share. The average price target represents a decrease of 6.91% from the latest reported closing price of $161.99 / share.

What is the Fund Sentiment?

There are 948 funds or institutions reporting positions in Credo Technology Group Holding.

This is an increase of 138 owner(s) or 17.04% in the last quarter.

Average portfolio weight of all funds dedicated to CRDO is 0.36%, an increase of 19.21%.

Total shares owned by institutions increased in the last three months by 0.91% to 151,940K shares.

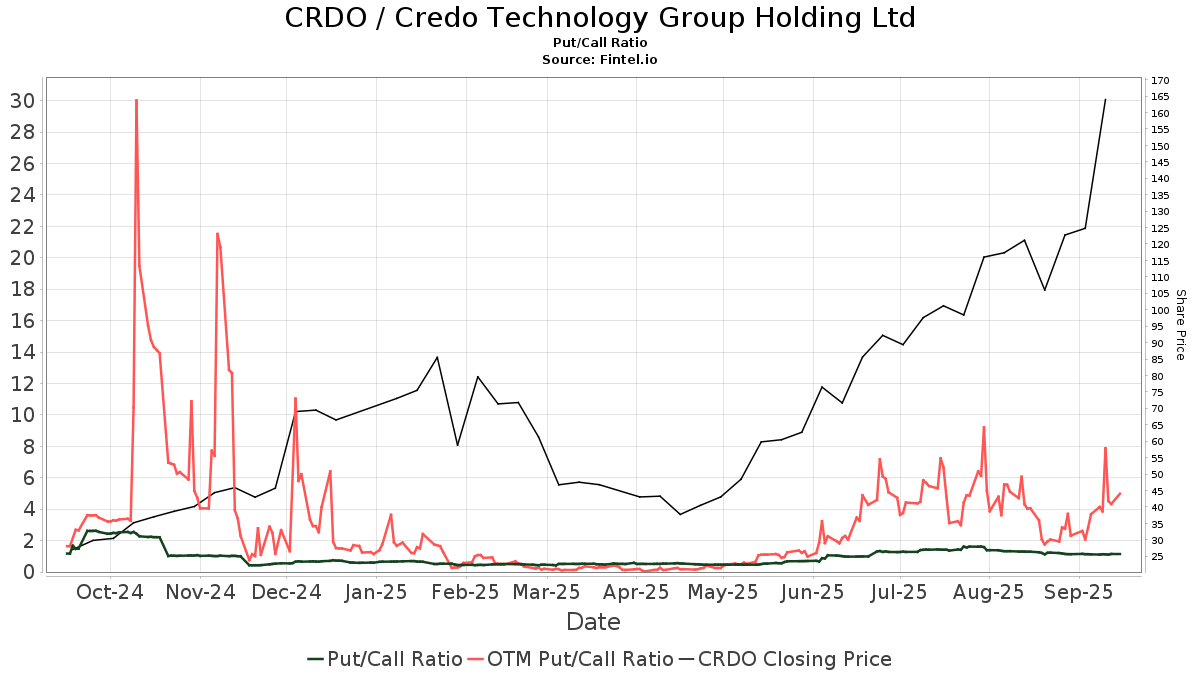

The put/call ratio of CRDO is 1.12, indicating a

bearish outlook.

The put/call ratio of CRDO is 1.12, indicating a

bearish outlook.

What are Other Shareholders Doing?

Jpmorgan Chase holds 6,509K shares representing 3.76% ownership of the company. In its prior filing, the firm reported owning 4,769K shares , representing an increase of 26.73%. The firm increased its portfolio allocation in CRDO by 181.80% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 4,646K shares representing 2.69% ownership of the company. In its prior filing, the firm reported owning 4,485K shares , representing an increase of 3.45%. The firm increased its portfolio allocation in CRDO by 113.06% over the last quarter.

Point72 Asset Management holds 4,104K shares representing 2.37% ownership of the company. In its prior filing, the firm reported owning 6,198K shares , representing a decrease of 51.00%. The firm increased its portfolio allocation in CRDO by 31.30% over the last quarter.

Capital Research Global Investors holds 3,746K shares representing 2.17% ownership of the company. In its prior filing, the firm reported owning 2,489K shares , representing an increase of 33.56%. The firm increased its portfolio allocation in CRDO by 219.52% over the last quarter.

IWM - iShares Russell 2000 ETF holds 3,633K shares representing 2.10% ownership of the company. In its prior filing, the firm reported owning 3,763K shares , representing a decrease of 3.58%. The firm increased its portfolio allocation in CRDO by 124.73% over the last quarter.