Brenntag SE - Depositary Receipt () (BNTGY) Price Target Increased by 13.21% to 26.25

The average one-year price target for Brenntag SE - Depositary Receipt () (OTCPK:BNTGY) has been revised to $26.25 / share. This is an increase of 13.21% from the prior estimate of $23.18 dated August 21, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $7.75 to a high of $54.88 / share. The average price target represents an increase of 86.02% from the latest reported closing price of $14.11 / share.

What is the Fund Sentiment?

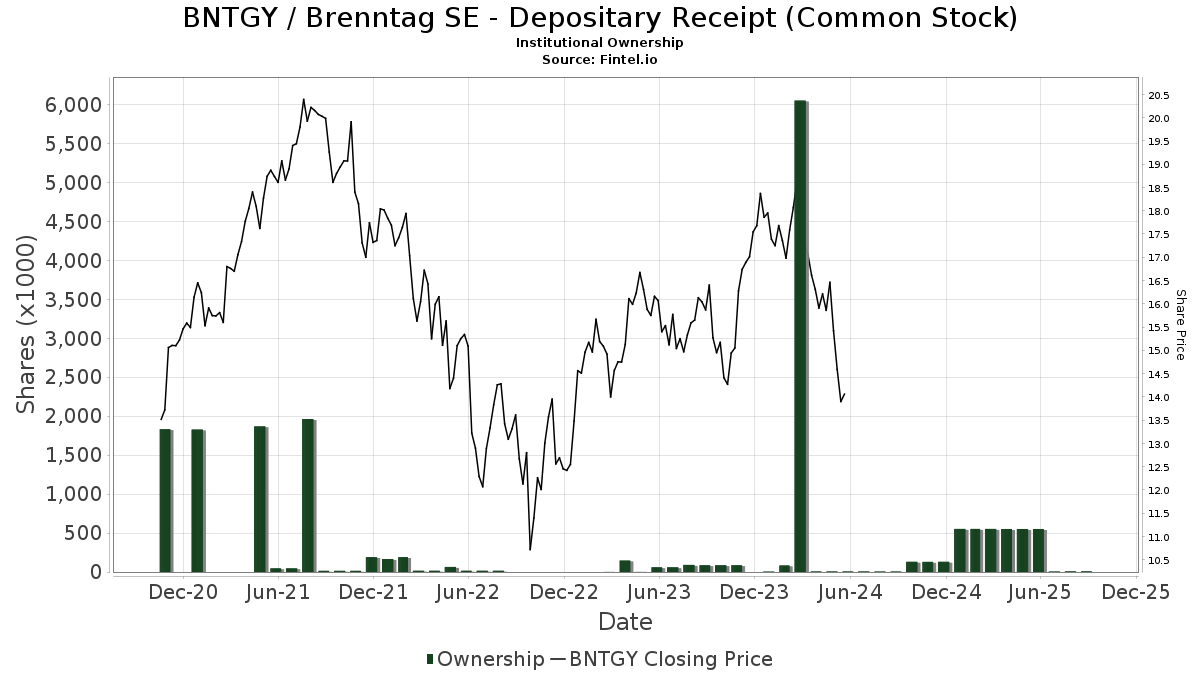

There are 4 funds or institutions reporting positions in Brenntag SE - Depositary Receipt (). This is an decrease of 4 owner(s) or 50.00% in the last quarter. Average portfolio weight of all funds dedicated to BNTGY is 0.00%, an increase of 99.69%. Total shares owned by institutions decreased in the last three months by 98.30% to 9K shares.

What are Other Shareholders Doing?

Rhumbline Advisers holds 7K shares. In its prior filing, the firm reported owning 6K shares , representing an increase of 11.20%. The firm increased its portfolio allocation in BNTGY by 4.75% over the last quarter.

GAMMA Investing holds 3K shares. In its prior filing, the firm reported owning 1K shares , representing an increase of 73.91%. The firm increased its portfolio allocation in BNTGY by 228.16% over the last quarter.

Salomon & Ludwin holds 0K shares.

Skopos Labs holds 0K shares. No change in the last quarter.