Brambles Limited - Depositary Receipt () (BXBLY) Price Target Increased by 16.67% to 34.66

The average one-year price target for Brambles Limited - Depositary Receipt () (OTCPK:BXBLY) has been revised to $34.66 / share. This is an increase of 16.67% from the prior estimate of $29.71 dated August 21, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $28.44 to a high of $41.39 / share. The average price target represents an increase of 77.02% from the latest reported closing price of $19.58 / share.

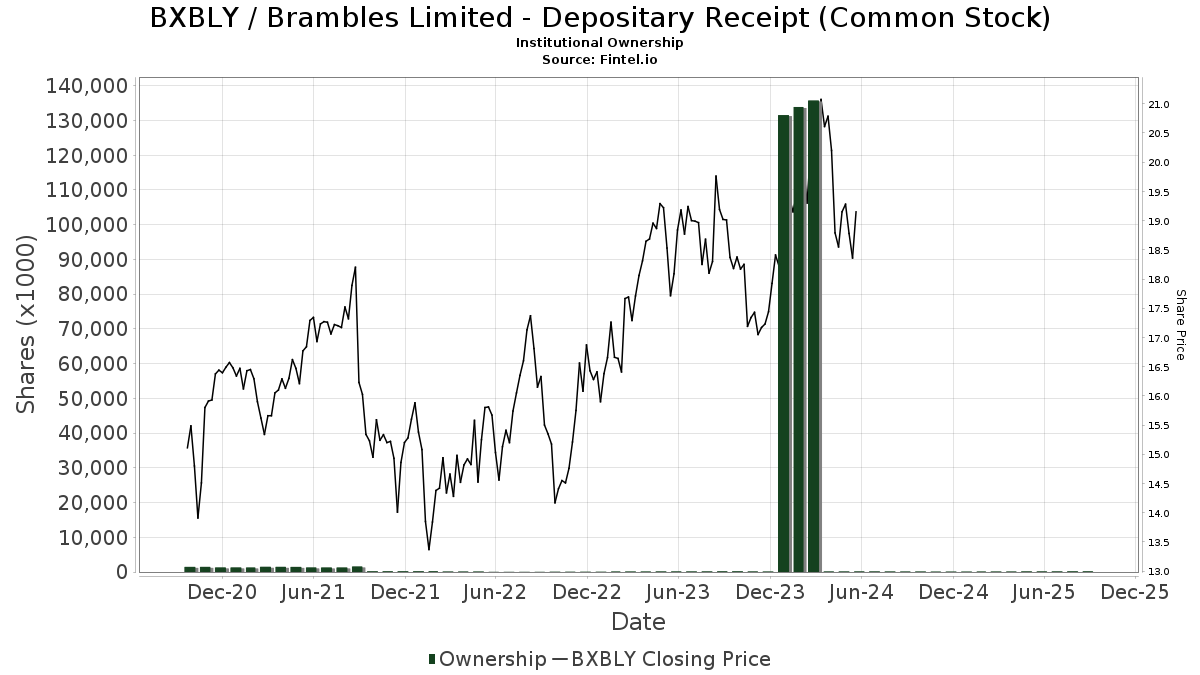

What is the Fund Sentiment?

There are 15 funds or institutions reporting positions in Brambles Limited - Depositary Receipt (). This is an increase of 4 owner(s) or 36.36% in the last quarter. Average portfolio weight of all funds dedicated to BXBLY is 0.16%, an increase of 1.20%. Total shares owned by institutions increased in the last three months by 18.10% to 185K shares.

What are Other Shareholders Doing?

APIE - ActivePassive International Equity ETF holds 51K shares. In its prior filing, the firm reported owning 44K shares , representing an increase of 14.65%. The firm increased its portfolio allocation in BXBLY by 25.68% over the last quarter.

NIAGX - Nia Impact Solutions Fund holds 47K shares. In its prior filing, the firm reported owning 48K shares , representing a decrease of 1.85%. The firm increased its portfolio allocation in BXBLY by 22.47% over the last quarter.

DSEFX - Domini Impact Equity Fund Investor Shares holds 23K shares. In its prior filing, the firm reported owning 24K shares , representing a decrease of 5.63%. The firm increased its portfolio allocation in BXBLY by 16.20% over the last quarter.

Rhumbline Advisers holds 18K shares. In its prior filing, the firm reported owning 15K shares , representing an increase of 13.51%. The firm increased its portfolio allocation in BXBLY by 29.25% over the last quarter.

BLUIX - BLUEPRINT GROWTH FUND Institutional Class holds 16K shares.