Aura Minerals (TSX:ORA) Price Target Increased by 18.18% to 33.15

The average one-year price target for Aura Minerals (TSX:ORA) has been revised to $33.15 / share. This is an increase of 18.18% from the prior estimate of $28.05 dated March 17, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of $25.25 to a high of $42.00 / share. The average price target represents an increase of 18.39% from the latest reported closing price of $28.00 / share.

What is the Fund Sentiment?

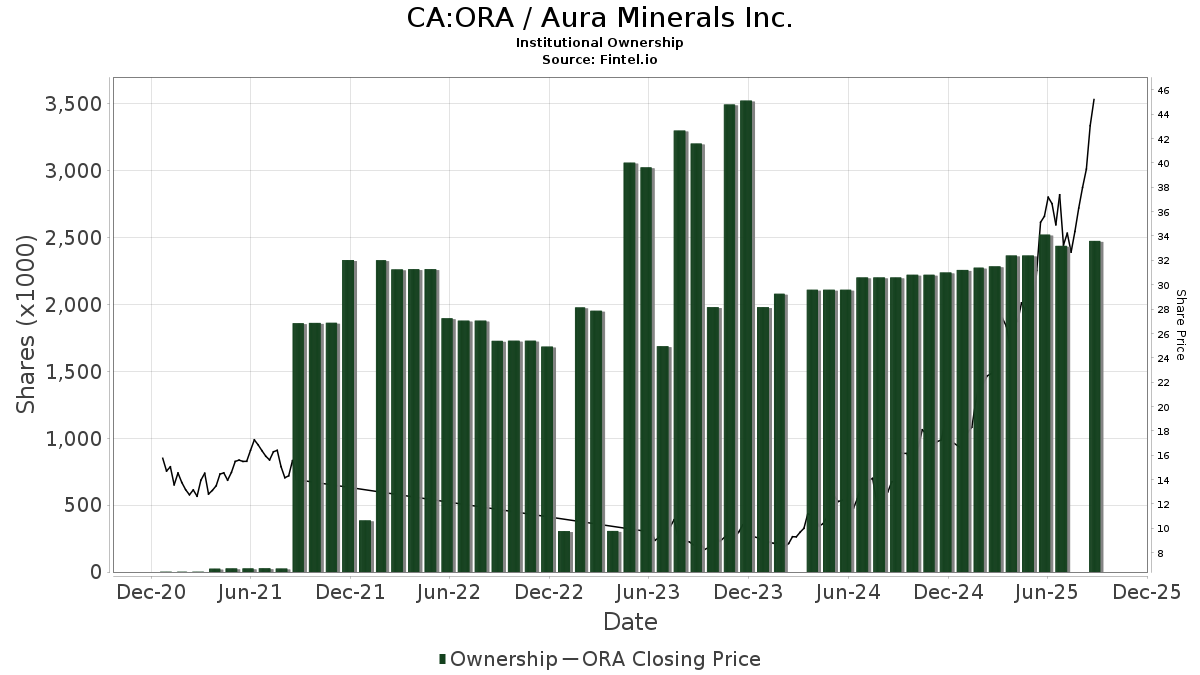

There are 15 funds or institutions reporting positions in Aura Minerals. This is an increase of 3 owner(s) or 25.00% in the last quarter. Average portfolio weight of all funds dedicated to ORA is 0.17%, an increase of 35.68%. Total shares owned by institutions increased in the last three months by 1.69% to 2,297K shares.

What are Other Shareholders Doing?

AIM SECTOR FUNDS (INVESCO SECTOR FUNDS) - Invesco Oppenheimer Gold & Special Minerals Fund Class C holds 2,285K shares representing 3.11% ownership of the company. In its prior filing, the firm reported owning 2,215K shares , representing an increase of 3.06%. The firm increased its portfolio allocation in ORA by 11.49% over the last quarter.

APDPX - Artisan Global Unconstrained Fund Advisor Shares holds 27K shares representing 0.04% ownership of the company. In its prior filing, the firm reported owning 17K shares , representing an increase of 37.04%. The firm increased its portfolio allocation in ORA by 39.68% over the last quarter.

TGFRX - TANAKA Growth Fund Class R holds 16K shares representing 0.02% ownership of the company.

DFIS - Dimensional International Small Cap ETF holds 12K shares representing 0.02% ownership of the company. In its prior filing, the firm reported owning 4K shares , representing an increase of 63.10%. The firm increased its portfolio allocation in ORA by 129.46% over the last quarter.

DFA INVESTMENT DIMENSIONS GROUP INC - International Small Cap Growth Portfolio Institutional Class holds 7K shares representing 0.01% ownership of the company. No change in the last quarter.