3D Systems (BIT:1DDD) Price Target Decreased by 14.66% to 2.41

The average one-year price target for 3D Systems (BIT:1DDD) has been revised to €2.41 / share. This is a decrease of 14.66% from the prior estimate of €2.83 dated May 6, 2025.

The price target is an average of many targets provided by analysts. The latest targets range from a low of €1.79 to a high of €3.72 / share. The average price target represents an increase of 75.49% from the latest reported closing price of €1.37 / share.

What is the Fund Sentiment?

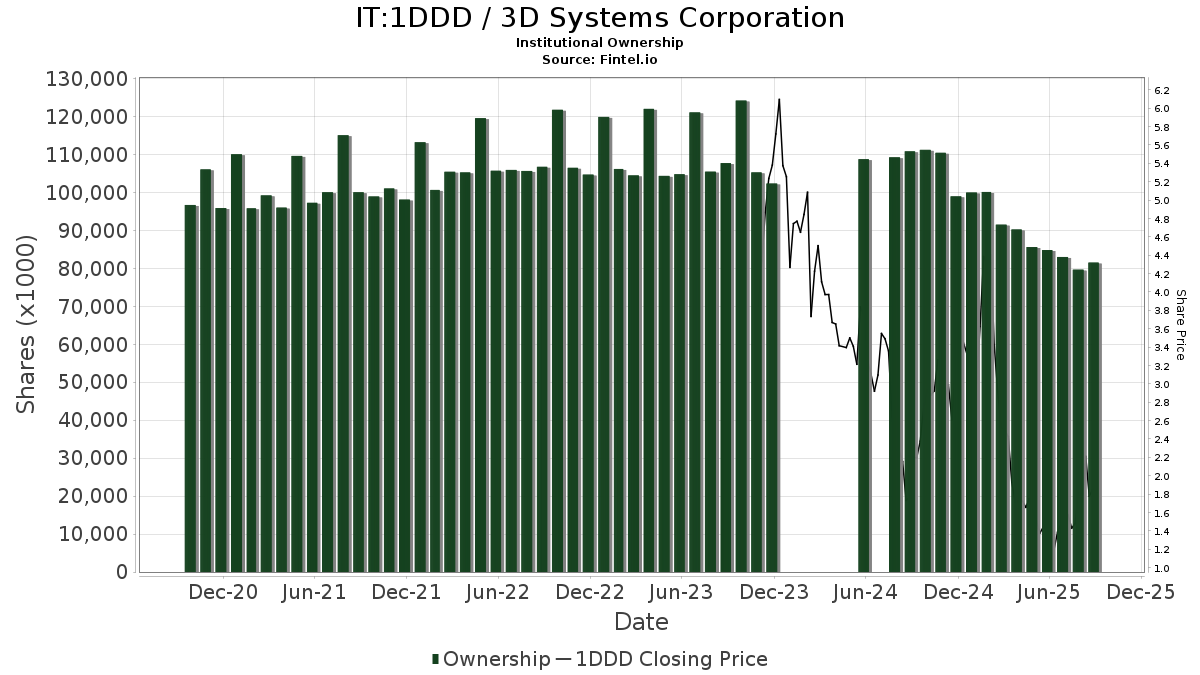

There are 365 funds or institutions reporting positions in 3D Systems. This is an decrease of 16 owner(s) or 4.20% in the last quarter. Average portfolio weight of all funds dedicated to 1DDD is 0.08%, an increase of 21.97%. Total shares owned by institutions decreased in the last three months by 7.31% to 84,817K shares.

What are Other Shareholders Doing?

ARK Investment Management holds 4,283K shares representing 3.14% ownership of the company. In its prior filing, the firm reported owning 4,414K shares , representing a decrease of 3.05%. The firm decreased its portfolio allocation in 1DDD by 24.62% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 3,994K shares representing 2.93% ownership of the company. No change in the last quarter.

IWM - iShares Russell 2000 ETF holds 3,496K shares representing 2.56% ownership of the company. In its prior filing, the firm reported owning 3,415K shares , representing an increase of 2.33%. The firm decreased its portfolio allocation in 1DDD by 25.23% over the last quarter.

KOMP - SPDR S&P Kensho New Economies Composite ETF holds 3,246K shares representing 2.38% ownership of the company. In its prior filing, the firm reported owning 3,174K shares , representing an increase of 2.22%. The firm decreased its portfolio allocation in 1DDD by 28.77% over the last quarter.

ROBO - ROBO Global(R) Robotics and Automation Index ETF holds 3,191K shares representing 2.34% ownership of the company. In its prior filing, the firm reported owning 3,022K shares , representing an increase of 5.31%. The firm increased its portfolio allocation in 1DDD by 25.07% over the last quarter.