Introduktion

Denne side giver en omfattende analyse af den kendte insiderhandelshistorie for Stephen A Schwarzman. Insidere er embedsmænd, direktører eller betydelige investorer i en virksomhed. Det er ulovligt for insidere at foretage handler i deres virksomheder baseret på specifik, ikke-offentlig information. Dette betyder ikke, at det er ulovligt for dem at handle i deres egne virksomheder. De skal dog rapportere alle handler til SEC via en formular 4. På trods af disse begrænsninger tyder akademisk forskning på, at insidere - generelt - har en tendens til at klare sig bedre end markedet i deres egne virksomheder.

Gennemsnitlig handelsrentabilitet

Den gennemsnitlige handelsrentabilitet er det gennemsnitlige afkast af alle køb på det åbne marked foretaget af insideren i de sidste tre år. For at beregne dette undersøger vi ethvert åbent marked, uplanlagte køb foretaget af insideren, eksklusive alle handler, der var markeret som en del af en 10b5-1-handelsplan. Vi beregner derefter den gennemsnitlige præstation for disse handler over 3, 6 og 12 måneder, idet vi tager et gennemsnit af hver af disse varigheder for at generere en endelig præstationsmåling for hver handel. Endelig tager vi et gennemsnit af alle præstationsmålingerne for at beregne en præstationsmåling for insideren. Denne liste inkluderer kun insidere, der har foretaget mindst tre handler i de sidste to år.

Hvis denne insiderhandelsrentabilitet er "N/A", så har insideren enten ikke foretaget nogen køb på det åbne marked i de sidste tre år, eller de handler, de har foretaget, er for nye til at beregne en pålidelig præstationsmåling.

Opdateringsfrekvens: Dagligt

Virksomheder med rapporterede insider-stillinger

SEC-registreringen viser, at Stephen A Schwarzman har rapporteret besiddelser eller handler i følgende virksomheder:

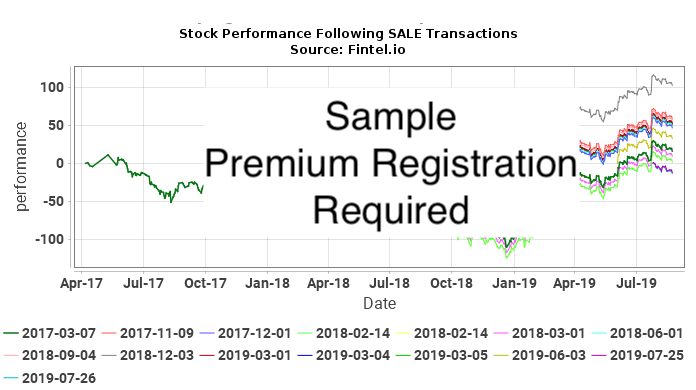

Sådan fortolkes diagrammerne

Følgende diagrammer viser aktieudviklingen for værdipapirer efter hver åben-marked, ikke-planlagt handel foretaget af Stephen A Schwarzman. Ikke-planlagt handel er handler, der ikke blev foretaget som en del af en 10b5-1-handelsplan. Aktieudviklingen er kortlagt som den kumulative procentvise ændring i aktiekursen. For eksempel, hvis en insiderhandel blev foretaget den 1. januar 2019, vil diagrammet vise den daglige procentvise ændring af værdipapiret til i dag. Hvis aktiekursen skulle gå fra $10 til $15 i løbet af denne tid, ville den kumulative procentvise ændring i aktiekursen være 50%. En prisændring fra 10 USD til 20 USD ville være 100 %, og en ændring i prisen på 10 USD til 5 USD ville være -50 %.

I sidste ende forsøger vi at bestemme, hvor tæt insiderens handler korrelerer med merafkast (positive eller negative) i aktiekursen for at se, om insideren timing deres handler til at drage fordel af insiderinformation. Overvej situationen, hvor en insider gjorde dette. I denne situation ville vi forvente enten (a) positive afkast efter køb eller (b) negative afkast efter salg. I tilfælde af (a) vil KØB-diagrammet vise en række opadskrånende kurver, der indikerer positive afkast efter hver købstransaktion. I tilfælde af (b) vil SALE-diagrammet vise en række nedadgående kurver, der indikerer negative afkast efter hver salgstransaktion.

Dette alene er dog ikke nok til at drage konklusioner. Hvis for eksempel aktiekursen i selskabet var i en ikke-cyklisk stigning over mange år, så ville vi forvente, at alle efterkøbsgrundene var opadgående. Ligeledes ville ikke-cykliske fald over mange år resultere i nedadgående post-trade plots. Ingen af disse diagrammer tyder på insiderhandel.

Den stærkeste indikator ville være en situation, hvor aktiekursen var ekstremt cyklisk, og der var både positive signaler i KØB-diagrammet og negative plots på SALG-diagrammet. Denne situation ville i høj grad tyde på en insider, der havde timing af handler til deres økonomiske fordel.

Insiderkøb ANNX / Annexon, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-07-28 | ANNX | Clarus Lifesciences III, L.P. | 200.000 | 17,0000 | 200.000 | 17,0000 | 3.400.000 | 231 | 35.01 | 3.602.000 | 105,94 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg ANNX / Annexon, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb APG / APi Group Corporation – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg APG / APi Group Corporation – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb AXL / American Axle & Manufacturing Holdings, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg AXL / American Axle & Manufacturing Holdings, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BAERW / Bridger Aerospace Group Holdings, Inc. - Equity Warrant – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BAERW / Bridger Aerospace Group Holdings, Inc. - Equity Warrant – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BGB / Blackstone Strategic Credit 2027 Term Fund – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BGB / Blackstone Strategic Credit 2027 Term Fund – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BKU / BankUnited, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BKU / BankUnited, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BRX / Brixmor Property Group Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BRX / Brixmor Property Group Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BXMT / Blackstone Mortgage Trust, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2013-05-29 | BXMT | Blackstone Holdings III L.P. | 1.960.784 | 25,5000 | 1.960.784 | 25,5000 | 49.999.992 | 365 | 29.7400 | 8.313.724 | 16,63 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BXMT / Blackstone Mortgage Trust, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BXSL / Blackstone Secured Lending Fund – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018-11-06 | NONE | Blackstone BGSL Holdings LLC | 192.000 | 25,0000 | 192.000 | 25,0000 | 4.800.000 | 731 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BXSL / Blackstone Secured Lending Fund – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CALC / CalciMedica, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-09-29 | GRAY | Clarus Lifesciences III, L.P. | 250.000 | 16,0000 | 17.857 | 224,0000 | 4.000.000 | 115 | 490 | 4.749.930 | 118,75 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CALC / CalciMedica, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CQP / Cheniere Energy Partners, L.P. - Limited Partnership – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CQP / Cheniere Energy Partners, L.P. - Limited Partnership – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CRBD / Corebridge Financial, Inc. - Preferred Security – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CRBD / Corebridge Financial, Inc. - Preferred Security – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CROX / Crocs, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CROX / Crocs, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CTOS / Custom Truck One Source, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CTOS / Custom Truck One Source, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CYRX / Cryoport, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CYRX / Cryoport, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EARN / Ellington Credit Company – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EARN / Ellington Credit Company – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021-06-17 | EARN | Blackstone Holdings III L.P. | 2.675.000 | 12,8000 | 2.675.000 | 12,8000 | 34.240.000 | 6 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EPIX / ESSA Pharma Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EPIX / ESSA Pharma Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EXEEZ / Expand Energy Corporation - Equity Warrant – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EXEEZ / Expand Energy Corporation - Equity Warrant – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb FOA / Finance of America Companies Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg FOA / Finance of America Companies Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb GRTX / Galera Therapeutics, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg GRTX / Galera Therapeutics, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb GTES / Gates Industrial Corporation plc – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg GTES / Gates Industrial Corporation plc – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb HGV / Hilton Grand Vacations Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg HGV / Hilton Grand Vacations Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb KNTK / Kinetik Holdings Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg KNTK / Kinetik Holdings Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb KOS / Kosmos Energy Ltd. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg KOS / Kosmos Energy Ltd. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb LNG / Cheniere Energy, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg LNG / Cheniere Energy, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb NCRRP / NCR Voyix Corporation - Preferred Security – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg NCRRP / NCR Voyix Corporation - Preferred Security – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb OPFI / OppFi Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg OPFI / OppFi Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PACK / Ranpak Holdings Corp. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PACK / Ranpak Holdings Corp. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PBF / PBF Energy Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PBF / PBF Energy Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PFGC / Performance Food Group Company – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PFGC / Performance Food Group Company – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PJT / PJT Partners Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PJT / PJT Partners Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PK / Park Hotels & Resorts Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PK / Park Hotels & Resorts Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PRAX / Praxis Precision Medicines, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PRAX / Praxis Precision Medicines, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PRKS / United Parks & Resorts Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PRKS / United Parks & Resorts Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PTEN / Patterson-UTI Energy, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PTEN / Patterson-UTI Energy, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb RUN / Sunrun Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg RUN / Sunrun Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb SD / SandRidge Energy, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg SD / SandRidge Energy, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb SN / SharkNinja, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg SN / SharkNinja, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TASK / TaskUs, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TASK / TaskUs, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TGE / The Generation Essentials Group – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TGE / The Generation Essentials Group – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TRML / Tourmaline Bio, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TRML / Tourmaline Bio, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TW / Tradeweb Markets Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TW / Tradeweb Markets Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i ANNX / Annexon, Inc.. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb UAN / CVR Partners, LP - Limited Partnership – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i ANNX / Annexon, Inc.. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg UAN / CVR Partners, LP - Limited Partnership – kortsigtet tabsanalyse