Introduktion

Denne side giver en omfattende analyse af den kendte insiderhandelshistorie for Ocm Holdings I, Llc. Insidere er embedsmænd, direktører eller betydelige investorer i en virksomhed. Det er ulovligt for insidere at foretage handler i deres virksomheder baseret på specifik, ikke-offentlig information. Dette betyder ikke, at det er ulovligt for dem at handle i deres egne virksomheder. De skal dog rapportere alle handler til SEC via en formular 4. På trods af disse begrænsninger tyder akademisk forskning på, at insidere - generelt - har en tendens til at klare sig bedre end markedet i deres egne virksomheder.

Gennemsnitlig handelsrentabilitet

Den gennemsnitlige handelsrentabilitet er det gennemsnitlige afkast af alle køb på det åbne marked foretaget af insideren i de sidste tre år. For at beregne dette undersøger vi ethvert åbent marked, uplanlagte køb foretaget af insideren, eksklusive alle handler, der var markeret som en del af en 10b5-1-handelsplan. Vi beregner derefter den gennemsnitlige præstation for disse handler over 3, 6 og 12 måneder, idet vi tager et gennemsnit af hver af disse varigheder for at generere en endelig præstationsmåling for hver handel. Endelig tager vi et gennemsnit af alle præstationsmålingerne for at beregne en præstationsmåling for insideren. Denne liste inkluderer kun insidere, der har foretaget mindst tre handler i de sidste to år.

Hvis denne insiderhandelsrentabilitet er "N/A", så har insideren enten ikke foretaget nogen køb på det åbne marked i de sidste tre år, eller de handler, de har foretaget, er for nye til at beregne en pålidelig præstationsmåling.

Opdateringsfrekvens: Dagligt

Virksomheder med rapporterede insider-stillinger

SEC-registreringen viser, at Ocm Holdings I, Llc har rapporteret besiddelser eller handler i følgende virksomheder:

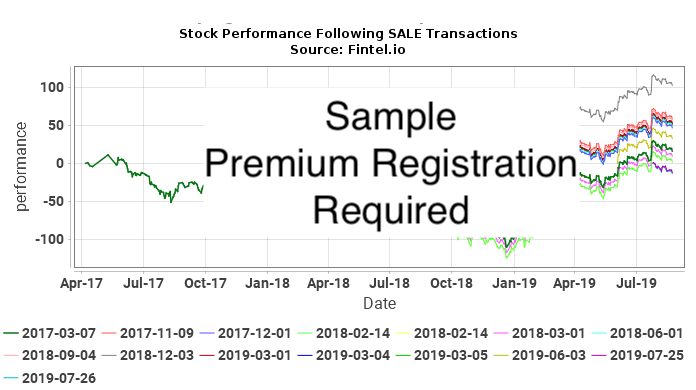

Sådan fortolkes diagrammerne

Følgende diagrammer viser aktieudviklingen for værdipapirer efter hver åben-marked, ikke-planlagt handel foretaget af Ocm Holdings I, Llc. Ikke-planlagt handel er handler, der ikke blev foretaget som en del af en 10b5-1-handelsplan. Aktieudviklingen er kortlagt som den kumulative procentvise ændring i aktiekursen. For eksempel, hvis en insiderhandel blev foretaget den 1. januar 2019, vil diagrammet vise den daglige procentvise ændring af værdipapiret til i dag. Hvis aktiekursen skulle gå fra $10 til $15 i løbet af denne tid, ville den kumulative procentvise ændring i aktiekursen være 50%. En prisændring fra 10 USD til 20 USD ville være 100 %, og en ændring i prisen på 10 USD til 5 USD ville være -50 %.

I sidste ende forsøger vi at bestemme, hvor tæt insiderens handler korrelerer med merafkast (positive eller negative) i aktiekursen for at se, om insideren timing deres handler til at drage fordel af insiderinformation. Overvej situationen, hvor en insider gjorde dette. I denne situation ville vi forvente enten (a) positive afkast efter køb eller (b) negative afkast efter salg. I tilfælde af (a) vil KØB-diagrammet vise en række opadskrånende kurver, der indikerer positive afkast efter hver købstransaktion. I tilfælde af (b) vil SALE-diagrammet vise en række nedadgående kurver, der indikerer negative afkast efter hver salgstransaktion.

Dette alene er dog ikke nok til at drage konklusioner. Hvis for eksempel aktiekursen i selskabet var i en ikke-cyklisk stigning over mange år, så ville vi forvente, at alle efterkøbsgrundene var opadgående. Ligeledes ville ikke-cykliske fald over mange år resultere i nedadgående post-trade plots. Ingen af disse diagrammer tyder på insiderhandel.

Den stærkeste indikator ville være en situation, hvor aktiekursen var ekstremt cyklisk, og der var både positive signaler i KØB-diagrammet og negative plots på SALG-diagrammet. Denne situation ville i høj grad tyde på en insider, der havde timing af handler til deres økonomiske fordel.

Insiderkøb BATL / Battalion Oil Corporation – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BATL / Battalion Oil Corporation – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb BRY / Berry Corporation – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg BRY / Berry Corporation – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb CBL / CBL & Associates Properties, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg CBL / CBL & Associates Properties, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EGLE / Global X Funds - Global X SandP 500 U S Rev Leaders ETF – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EGLE / Global X Funds - Global X SandP 500 U S Rev Leaders ETF – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023-06-22 | EGLE | OCM Opps EB Holdings Ltd. | 3.781.561 | 58,0000 | 3.781.561 | 58,0000 | 219.330.538 | 292 | 0.0000 | -219.330.538 | -100,00 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb EXEEZ / Expand Energy Corporation - Equity Warrant – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg EXEEZ / Expand Energy Corporation - Equity Warrant – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb FBP / First BanCorp. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg FBP / First BanCorp. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb FLYYQ / Spirit Aviation Holdings, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg FLYYQ / Spirit Aviation Holdings, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb MEG / Montrose Environmental Group, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg MEG / Montrose Environmental Group, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2020-11-30 | MEG | Partners Ltd | 4.322.644 | 27,8100 | 4.322.644 | 27,8100 | 120.212.730 | 0 | 27.3900 | -1.815.510 | -1,51 |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb PULS / PGIM ETF Trust - PGIM Ultra Short Bond ETF – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg PULS / PGIM ETF Trust - PGIM Ultra Short Bond ETF – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb RWAY / Runway Growth Finance Corp. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg RWAY / Runway Growth Finance Corp. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb STKL / SunOpta Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg STKL / SunOpta Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TMHC / Taylor Morrison Home Corporation – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TMHC / Taylor Morrison Home Corporation – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Min |

Pris kl Min |

Max tab Undgået ($) |

Max tab Undgået (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderkøb TPICQ / TPI Composites, Inc. – kortsigtet profitanalyse

I dette afsnit analyserer vi rentabiliteten af ethvert uplanlagt insiderkøb i åbent marked foretaget i BATL / Battalion Oil Corporation. Denne analyse hjælper med at forstå, om insideren konsekvent genererer unormale afkast og er værd at følge. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste køb på det åbne marked, der ikke var en del af en automatisk handelsplan.

| Handelsdato | Ticker | Insider | Rapporteret Aktier |

Rapporteret Pris |

Justeret Aktier |

Justeret Pris |

Omkostningsgrundlag | dage til Maks |

Pris kl Maks |

Maks Fortjeneste ($) |

Maks. afkast (%) |

|---|---|---|---|---|---|---|---|

| Der er ingen kendte uplanlagte åbne markedshandler for denne insider- og sikkerhedskombination |

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insidersalg TPICQ / TPI Composites, Inc. – kortsigtet tabsanalyse

I dette afsnit analyserer vi den kortsigtede undgåelse af tab af ethvert uplanlagt insidersalg på åbent marked, der foretages i BATL / Battalion Oil Corporation. Et konsekvent mønster af tabsforebyggelse kan tyde på, at fremtidige salgstransaktioner kan forudsige prisfald. Denne analyse er for et år efter hver handel, og resultaterne er teoretiske .

Følgende tabel viser de seneste salg på det åbne marked, der ikke var en del af en automatisk handelsplan.

Justeret pris er den split-justerede pris. Adjusted Shares er de split-justerede aktier.

Insiderhandelshistorie

Denne tabel viser den komplette liste over insiderhandler foretaget af Ocm Holdings I, Llc som oplyst til Securities Exchange Commission (SEC).

| Fil dato | Transdato | Form | Ticker | Sikkerhed | Kode | Aktier | Resterende aktier | Procent Lave om |

Del Pris |

Tran Værdi |

Tilbage Værdi |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023-06-23 |

|

4 | STR |

Sitio Royalties Corp.

Class C Common Stock |

J - Other | 2.508.490 | 15.443.610 | 19,39 | ||||

| 2023-06-23 |

|

4 | EGLE |

Eagle Bulk Shipping Inc.

Common Stock, par value $0.01 per share ("Common Stock") |

S - Sale | -3.781.561 | 0 | -100,00 | 58,00 | -219.330.538 | ||

| 2023-06-14 |

|

4 | GTX,GTXAP |

Garrett Motion Inc.

Common Stock |

A - Award | 1.016.669 | 1.119.397 | 989,67 | ||||

| 2023-06-14 |

|

4 | GTX,GTXAP |

Garrett Motion Inc.

Common Stock |

A - Award | 28.082.484 | 30.913.997 | 991,78 | ||||

| 2023-06-14 |

|

4 | GTX,GTXAP |

Garrett Motion Inc.

Common Stock |

A - Award | 7.681.964 | 9.174.940 | 514,54 | ||||

| 2023-06-09 |

|

4 | GTX,GTXAP |

Garrett Motion Inc.

Common Stock |

A - Award | 102.728 | 1.023.308 | 11,16 | 8,18 | 840.007 | 8.367.590 | |

| 2023-06-09 |

|

4 | GTX,GTXAP |

Garrett Motion Inc.

Common Stock |

A - Award | 2.831.513 | 28.259.811 | 11,14 | 8,18 | 23.153.282 | 231.080.475 | |

| 2023-06-09 |

|

4 | GTX,GTXAP |

Garrett Motion Inc.

Common Stock |

A - Award | 774.354 | 8.448.888 | 10,09 | 8,18 | 6.331.893 | 69.086.557 | |

| 2023-03-30 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

S - Sale | -50.256 | 21.054.667 | -0,24 | 11,94 | -599.805 | 251.287.451 | |

| 2023-03-30 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

S - Sale | -24.744 | 21.104.923 | -0,12 | 11,96 | -295.988 | 252.457.089 | |

| 2023-01-09 | 3 | STR |

Sitio Royalties Corp.

Class A Common Stock |

10.431 | ||||||||

| 2023-01-09 | 3 | STR |

Sitio Royalties Corp.

Class C Common Stock |

12.935.120 | ||||||||

| 2023-01-03 |

|

4 | STR |

STR Sub Inc.

Class C Common Stock |

J - Other | -12.935.120 | 0 | -100,00 | ||||

| 2023-01-03 |

|

4 | STR |

STR Sub Inc.

Class A Common Stock |

J - Other | -10.431 | 0 | -100,00 | ||||

| 2022-11-10 | 3 | BRY |

Berry Corp (bry)

Common Stock |

7.797.000 | ||||||||

| 2022-11-10 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -1.000.000 | 6.797.000 | -12,83 | 9,60 | -9.603.600 | 65.275.669 | |

| 2022-10-17 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -2.825.000 | 7.797.000 | -26,60 | 8,50 | -24.012.500 | 66.274.500 | |

| 2022-10-11 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -1.000.000 | 10.622.000 | -8,60 | 9,00 | -9.000.000 | 95.598.000 | |

| 2022-09-12 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

S - Sale | -69.360 | 12.263 | -84,98 | 18,85 | -1.307.436 | 231.158 | |

| 2022-09-12 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

S - Sale | -1.486.281 | 262.777 | -84,98 | 18,85 | -28.016.397 | 4.953.346 | |

| 2022-09-12 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

S - Sale | -2.407.775 | 425.699 | -84,98 | 18,85 | -45.386.559 | 8.024.426 | |

| 2022-09-06 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

S - Sale | -44 | 81.623 | -0,05 | 18,59 | -818 | 1.517.372 | |

| 2022-09-06 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

X - Other | 81.667 | 81.667 | 0,01 | 817 | 817 | ||

| 2022-09-06 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

S - Sale | -942 | 1.749.058 | -0,05 | 18,59 | -17.512 | 32.514.988 | |

| 2022-09-06 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

X - Other | 1.750.000 | 1.750.000 | 0,01 | 17.500 | 17.500 | ||

| 2022-09-06 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

S - Sale | -1.526 | 2.833.474 | -0,05 | 18,59 | -28.368 | 52.674.282 | |

| 2022-09-06 |

|

4 | TPIC |

TPI COMPOSITES, INC

Common Stock |

X - Other | 2.835.000 | 2.835.000 | 0,01 | 28.350 | 28.350 | ||

| 2022-08-23 |

|

4 | STR |

Sitio Royalties Corp.

Class A Common Stock |

A - Award | 10.431 | 10.431 | |||||

| 2022-06-16 | 3 | STR |

Sitio Royalties Corp.

Class C Common Stock |

12.935.120 | ||||||||

| 2022-06-03 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -191.591 | 11.622.000 | -1,62 | 11,30 | -2.164.978 | 131.328.600 | |

| 2022-06-03 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -435.048 | 11.813.591 | -3,55 | 11,33 | -4.929.094 | 133.847.986 | |

| 2022-05-31 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -254.754 | 12.227.043 | -2,04 | 11,32 | -2.883.815 | 138.410.127 | |

| 2022-05-31 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -246.005 | 12.481.797 | -1,93 | 11,34 | -2.789.697 | 141.543.578 | |

| 2022-05-31 |

|

4 | BRY |

Berry Corp (bry)

Common Stock |

S - Sale | -163.915 | 12.727.802 | -1,27 | 11,35 | -1.860.435 | 144.460.553 | |

| 2022-04-21 |

|

4 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock |

S - Sale | -535.735 | 0 | -100,00 | 30,87 | -16.538.139 | ||

| 2022-04-21 |

|

4 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock |

S - Sale | -50.000 | 535.735 | -8,54 | 32,40 | -1.620.000 | 17.357.814 | |

| 2022-04-14 |

|

4 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock |

S - Sale | -5.925 | 0 | -100,00 | 32,13 | -190.393 | ||

| 2022-04-06 | 3 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock, par value $0.001 per share |

342.315 | ||||||||

| 2022-04-06 | 3 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock, par value $0.001 per share |

1.821.984 | ||||||||

| 2022-04-06 | 3 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock, par value $0.001 per share |

5.925 | ||||||||

| 2022-04-06 |

|

4 | CBL |

CBL & ASSOCIATES PROPERTIES INC

7.0% Exchangeable Senior Secured Notes due 2028 |

C - Conversion | -243.420 | 0 | -100,00 | 3.324.573,00 | -809.267.559.660 | ||

| 2022-04-06 |

|

4 | CBL |

CBL & ASSOCIATES PROPERTIES INC

7.0% Exchangeable Senior Secured Notes due 2028 |

C - Conversion | -2.161.983 | 0 | -100,00 | 29.527.685,00 | -63.838.352.999.355 | ||

| 2022-04-06 |

|

4 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock |

C - Conversion | 243.420 | 585.735 | 71,11 | 16,67 | 4.057.811 | 9.764.202 | |

| 2022-04-06 |

|

4 | CBL |

CBL & ASSOCIATES PROPERTIES INC

Common Stock |

C - Conversion | 2.161.983 | 3.983.967 | 118,66 | 16,67 | 36.040.257 | 66.412.730 | |

| 2022-03-29 |

|

4 | CHK |

CHESAPEAKE ENERGY CORP

Common Stock |

D - Sale to Issuer | -1.000.000 | 11.001.153 | -8,33 | 82,98 | -82.980.000 | 912.875.676 | |

| 2022-03-09 |

|

4 | NONE |

Oaktree Strategic Credit Fund

Class I Common Shares of Beneficial Interest |

P - Purchase | 1.600.000 | 4.000.000 | 66,67 | 25,00 | 40.000.000 | 100.000.000 | |

| 2022-03-01 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 15.359 | 20.765.158 | 0,07 | 13,35 | 205.112 | 277.308.303 | |

| 2022-02-28 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 11.672 | 20.749.799 | 0,06 | 12,73 | 148.621 | 264.209.266 | |

| 2022-02-28 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 18.335 | 20.738.127 | 0,09 | 12,94 | 237.279 | 268.378.323 | |

| 2022-02-28 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 16.268 | 20.719.792 | 0,08 | 12,96 | 210.824 | 268.516.072 | |

| 2022-02-23 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 18.372 | 20.703.524 | 0,09 | 13,22 | 242.865 | 273.686.095 | |

| 2022-02-23 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 18.141 | 20.685.152 | 0,09 | 13,39 | 242.928 | 276.996.939 | |

| 2022-02-23 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 11.461 | 20.667.011 | 0,06 | 13,61 | 155.960 | 281.234.619 | |

| 2022-02-17 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 18.146 | 20.655.550 | 0,09 | 13,58 | 246.339 | 280.407.353 | |

| 2022-02-17 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.438 | 20.637.404 | 0,09 | 13,37 | 259.834 | 275.866.370 | |

| 2022-02-17 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.733 | 20.617.966 | 0,10 | 13,62 | 268.842 | 280.899.169 | |

| 2022-02-14 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.400 | 20.598.233 | 0,09 | 13,55 | 262.930 | 279.169.912 | |

| 2022-02-14 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.600 | 20.578.833 | 0,10 | 13,26 | 259.990 | 272.974.104 | |

| 2022-02-14 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.100 | 20.559.233 | 0,10 | 13,07 | 262.711 | 268.713.287 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 17.566 | 20.539.133 | 0,09 | 129.977,00 | 2.283.175.982 | 2.669.614.889.941 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.800 | 20.521.567 | 0,10 | 13,10 | 272.542 | 268.894.092 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.400 | 20.500.767 | 0,10 | 13,61 | 277.644 | 279.015.439 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 14.109 | 20.481.007 | 0,07 | 133.490,00 | 1.883.410.410 | 2.734.009.624.430 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 18.231 | 20.460.607 | 0,09 | 13,03 | 237.574 | 266.628.308 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 16.973 | 20.446.498 | 0,08 | 12,89 | 218.731 | 263.494.020 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.521 | 20.428.267 | 0,10 | 12,68 | 247.501 | 259.003.869 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.365 | 20.391.773 | 0,10 | 13,01 | 264.918 | 265.266.379 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.400 | 20.371.408 | 0,10 | 12,87 | 249.705 | 262.208.541 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.000 | 20.352.008 | 0,10 | 12,72 | 254.412 | 258.889.753 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.488 | 20.332.008 | 0,10 | 12,94 | 252.151 | 263.071.785 | |

| 2022-02-09 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.840 | 20.312.520 | 0,10 | 13,13 | 260.545 | 266.750.106 | |

| 2022-02-03 | 3 | NONE |

Oaktree Strategic Credit Fund

Class I Common Shares of Beneficial Interest |

2.400.000 | ||||||||

| 2022-01-21 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.646 | 20.217.680 | 0,10 | 13,24 | 260.038 | 267.605.256 | |

| 2022-01-21 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.500 | 20.198.034 | 0,10 | 13,26 | 271.840 | 267.836.030 | |

| 2022-01-21 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.421 | 20.177.534 | 0,10 | 13,21 | 269.782 | 266.565.402 | |

| 2022-01-18 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 16.935 | 20.157.113 | 0,08 | 13,30 | 225.210 | 268.059.367 | |

| 2022-01-18 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 13.087 | 20.140.178 | 0,07 | 13,23 | 173.124 | 266.428.373 | |

| 2022-01-18 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.341 | 20.127.091 | 0,10 | 13,18 | 268.005 | 265.186.500 | |

| 2022-01-18 |

|

4/A | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.300 | 20.106.749 | 0,10 | 13,49 | 273.810 | 271.203.852 | |

| 2022-01-12 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.300 | 20.106.749 | 0,10 | 12,49 | 253.510 | 251.097.103 | |

| 2022-01-12 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 21.100 | 20.086.449 | 0,11 | 13,31 | 280.816 | 267.326.532 | |

| 2022-01-12 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 22.000 | 20.065.349 | 0,11 | 13,20 | 290.444 | 264.902.737 | |

| 2022-01-07 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.662 | 20.042.873 | 0,10 | 12,94 | 254.456 | 259.384.841 | |

| 2022-01-07 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 21.800 | 20.023.211 | 0,11 | 13,13 | 286.271 | 262.938.800 | |

| 2022-01-07 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 22.200 | 20.001.411 | 0,11 | 13,35 | 296.417 | 267.060.840 | |

| 2022-01-05 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.976 | 19.979.211 | 0,10 | 12,90 | 257.696 | 257.737.816 | |

| 2022-01-04 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 17.482 | 19.979.211 | 0,09 | 12,94 | 226.243 | 258.560.959 | |

| 2022-01-04 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 21.900 | 19.961.729 | 0,11 | 13,13 | 287.584 | 262.131.437 | |

| 2022-01-04 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.000 | 19.939.829 | 0,10 | 13,35 | 267.042 | 266.238.591 | |

| 2021-12-29 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.500 | 19.919.829 | 0,10 | 13,28 | 258.960 | 264.535.329 | |

| 2021-12-29 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.610 | 19.900.329 | 0,10 | 13,12 | 270.432 | 261.120.177 | |

| 2021-12-29 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.959 | 19.879.719 | 0,11 | 13,35 | 279.794 | 265.386.297 | |

| 2021-12-23 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 20.010 | 19.858.760 | 0,10 | 13,34 | 266.911 | 264.894.014 | |

| 2021-12-23 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 21.570 | 19.838.660 | 0,11 | 13,36 | 288.240 | 265.104.014 | |

| 2021-12-23 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 21.325 | 19.817.090 | 0,11 | 13,42 | 286.171 | 265.935.439 | |

| 2021-12-20 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 21.010 | 19.795.765 | 0,11 | 13,34 | 280.250 | 264.053.730 | |

| 2021-12-20 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.800 | 19.774.755 | 0,10 | 13,36 | 264.587 | 264.250.051 | |

| 2021-12-20 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 18.639 | 19.754.955 | 0,09 | 13,42 | 250.126 | 265.101.619 | |

| 2021-12-15 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 22.400 | 19.736.316 | 0,11 | 13,48 | 301.885 | 265.986.331 | |

| 2021-12-15 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 17.119 | 19.713.916 | 0,09 | 13,52 | 231.416 | 266.494.688 | |

| 2021-12-15 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.500 | 19.696.797 | 0,10 | 13,41 | 261.462 | 264.100.563 | |

| 2021-12-10 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 19.943 | 19.677.297 | 0,10 | 13,21 | 263.429 | 259.919.384 | |

| 2021-12-10 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 21.158 | 19.657.797 | 0,11 | 13,19 | 278.989 | 259.207.711 | |

| 2021-12-10 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 23.050 | 19.616.696 | 0,12 | 12,80 | 295.022 | 251.078.015 | |

| 2021-12-10 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 29.378 | 19.593.646 | 0,15 | 13,49 | 396.206 | 264.249.707 | |

| 2021-12-10 |

|

4 | RWAY |

Runway Growth Finance Corp.

Common Stock, par value $0.01 per share |

P - Purchase | 8.566 | 19.564.268 | 0,04 | 13,61 | 116.573 | 266.246.210 | |

| 2021-07-09 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-07-09 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-07-06 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-07-06 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-07-06 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-07-06 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-07-06 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-07-06 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-06-30 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-06-30 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-06-30 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-06-30 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-06-30 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-06-30 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-28 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-28 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-19 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-19 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-19 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-19 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-19 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-19 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2021-05-14 | 3 | GTX |

Garrett Motion Inc.

Common Stock |

3.593.111 | ||||||||

| 2021-05-04 |

|

4 | GTX |

Garrett Motion Inc.

Common Stock |

J - Other | -3.593.111 | 0 | -100,00 | ||||

| 2021-03-25 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock, par value $0.0001 per share |

J - Other | -1.169.847 | 775.370 | -60,14 | ||||

| 2021-02-22 |

|

4 | STKL |

SunOpta Inc.

Series A Preferred Stock |

C - Conversion | -13.804 | 0 | -100,00 | ||||

| 2021-02-22 |

|

4 | STKL |

SunOpta Inc.

Common Stock |

C - Conversion | 2.051.668 | 3.410.233 | 151,02 | 7,00 | 14.361.676 | 23.871.631 | |

| 2021-02-22 |

|

4 | STKL |

SunOpta Inc.

Special Shares, Series 1 |

J - Other | -1.972.000 | 0 | -100,00 | ||||

| 2021-02-22 |

|

4 | STKL |

SunOpta Inc.

Series A Preferred Stock |

C - Conversion | -71.196 | 0 | -100,00 | ||||

| 2021-02-22 |

|

4 | STKL |

SunOpta Inc.

Common Stock |

C - Conversion | 10.581.759 | 17.315.893 | 157,14 | 7,00 | 74.072.313 | 121.211.251 | |

| 2021-02-22 |

|

4 | STKL |

SunOpta Inc.

Special Shares, Series 1 |

J - Other | -10.170.857 | 0 | -100,00 | ||||

| 2021-02-19 | 3 | CHK |

CHESAPEAKE ENERGY CORP

Common Stock |

7.646.594 | ||||||||

| 2021-02-19 | 3 | CHK |

CHESAPEAKE ENERGY CORP

Common Stock |

3.142.523 | ||||||||

| 2021-02-10 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B-3 Preferred Stock par value $0.0001 per share |

S - Sale | -19.124 | 0 | -100,00 | 1.071,13 | -20.484.151 | ||

| 2021-02-10 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B-1 Preferred Stock, par value $0.0001 per share |

S - Sale | -20.000 | 0 | -100,00 | 1.166,94 | -23.338.800 | ||

| 2021-02-10 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock, par value $0.0001 per share |

S - Sale | -17.482 | 0 | -100,00 | 1.267,11 | -22.152.251 | ||

| 2021-02-10 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock, par value $0.0001 per share |

S - Sale | -8.853.283 | 1.945.217 | -81,99 | 16,75 | -148.292.490 | 32.582.385 | |

| 2020-12-30 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock, par value $0.0001 per share |

A - Award | 525.000 | 10.838.500 | 5,09 | ||||

| 2020-12-02 |

|

4 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

S - Sale | -4.322.644 | 0 | -100,00 | 27,81 | -120.212.730 | ||

| 2020-10-30 | 3 | GTX |

Garrett Motion Inc.

Common Stock |

3.593.111 | ||||||||

| 2020-10-16 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 2.129.748 | 17.457.226 | 13,89 | 15,00 | 31.946.216 | 261.858.398 | |

| 2020-10-16 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 21.045 | 15.327.479 | 0,14 | 13,00 | 273.587 | 199.257.224 | |

| 2020-08-24 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 81.129 | 14.933.310 | 0,55 | 13,00 | 1.054.674 | 194.133.029 | |

| 2020-08-24 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 16.663 | 14.852.181 | 0,11 | 13,00 | 216.614 | 193.078.356 | |

| 2020-08-20 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2020-08-20 |

|

4 | STKL |

SunOpta Inc.

Cash-Settled Total Return Swap |

P - Purchase | 1 | 1 | |||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

4.324.310 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.643.623 | ||||||||

| 2020-08-06 | 3 | MEG |

Montrose Environmental Group, Inc.

Common Stock |

6.322.643 | ||||||||

| 2020-04-28 |

|

4 | STKL |

SunOpta Inc.

Series B-1 Preferred Stock |

P - Purchase | 12.539 | 12.539 | 1.000,00 | 12.538.520 | 12.538.520 | ||

| 2020-04-28 |

|

4 | STKL |

SunOpta Inc.

Special Shares, Series 2 |

J - Other | 0 | 0 | |||||

| 2020-04-28 |

|

4 | STKL |

SunOpta Inc.

Series B-1 Preferred Stock |

P - Purchase | 2.461 | 2.461 | 1.000,00 | 2.461.480 | 2.461.480 | ||

| 2020-04-28 |

|

4 | STKL |

SunOpta Inc.

Special Shares, Series 2 |

J - Other | 0 | 0 | |||||

| 2020-03-23 |

|

4 | INFN |

INFINERA Corp

Common Stock |

P - Purchase | 1.000.000 | 25.175.384 | 4,14 | 4,94 | 4.940.000 | 124.366.397 | |

| 2020-03-18 |

|

4 | INFN |

INFINERA Corp

Common Stock |

P - Purchase | 1.410.886 | 24.175.384 | 6,20 | 4,31 | 6.080.919 | 104.195.905 | |

| 2020-03-18 |

|

4 | INFN |

INFINERA Corp

Common Stock |

P - Purchase | 589.114 | 22.764.498 | 2,66 | 4,19 | 2.468.388 | 95.383.247 | |

| 2020-03-18 |

|

4 | INFN |

INFINERA Corp

Common Stock |

P - Purchase | 1.200.000 | 22.175.384 | 5,72 | 3,95 | 4.740.000 | 87.592.767 | |

| 2019-12-20 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 2.157.011 | 13.743.841 | 18,62 | 15,00 | 32.355.172 | 206.157.610 | |

| 2019-11-18 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Warrants |

A - Award | 657.383 | 657.383 | |||||

| 2019-11-18 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B-3 Preferred Stock |

A - Award | 19.124 | 19.124 | |||||

| 2019-11-18 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

D - Sale to Issuer | -17.482 | 17.482 | -50,00 | ||||

| 2019-10-29 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

S - Sale | -56.715 | 3.950.660 | -1,42 | 1,08 | -61.252 | 4.266.713 | |

| 2019-10-29 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

S - Sale | -470.482 | 4.007.375 | -10,51 | 1,07 | -503.416 | 4.287.891 | |

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-22 | 3 | HK |

HALCON RESOURCES CORP

Common Stock |

7.976.176 | ||||||||

| 2019-10-03 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 1.086.494 | 11.586.829 | 10,35 | 15,00 | 16.297.404 | 173.802.436 | |

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-06-24 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

25.783.434 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

40.000 | ||||||||

| 2019-05-22 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Warrants |

A - Award | 1.018.374 | 1.018.374 | |||||

| 2019-05-22 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series B Preferred Stock, par value $0.0001 |

A - Award | 20.000 | 20.000 | |||||

| 2019-05-14 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 1.628.366 | 9.650.423 | 20,30 | 15,16 | 24.686.033 | 146.300.419 | |

| 2019-01-04 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 2.192.658 | 7.815.569 | 39,00 | 15,19 | 33.306.476 | 118.718.496 | |

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-10-11 | 3 | INFN |

INFINERA Corp

Common Stock, par value $0.001 per share |

41.950.768 | ||||||||

| 2018-09-18 |

|

4 | NONE |

Runway Growth Credit Fund Inc.

Common Stock, par value $0.01 per share |

P - Purchase | 1.006.899 | 5.495.268 | 22,43 | 15,02 | 15.123.619 | 82.538.920 | |

| 2018-08-01 |

|

4 | BRY |

Berry Petroleum Corp

Common Stock |

D - Sale to Issuer | -410.229 | 7.678.671 | -5,07 | 13,16 | -5.398.614 | 101.051.310 | |

| 2018-08-01 |

|

4 | BRY |

Berry Petroleum Corp

Series A Convertible Preferred Stock |

C - Conversion | 5.155.976 | 0 | -100,00 | ||||

| 2018-08-01 |

|

4 | BRY |

Berry Petroleum Corp

Common Stock |

C - Conversion | 5.413.772 | 8.088.900 | 202,37 | ||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-07-25 | 3 | BRY |

Berry Petroleum Corp

Common Stock |

16.177.800 | ||||||||

| 2018-06-12 |

|

4 | GNRT |

Euronav MI II Inc.

Common Stock |

D - Sale to Issuer | -11.923.244 | 0 | -100,00 | ||||

| 2018-06-07 |

|

4 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock, par value $0.0001 |

J - Other | -115.000 | 10.327.000 | -1,10 | ||||

| 2018-05-16 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 5.634 | 4.477.857 | 0,13 | 6,09 | 34.311 | 27.270.149 | |

| 2018-05-16 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 12.956 | 4.472.223 | 0,29 | 6,05 | 78.384 | 27.056.949 | |

| 2018-05-16 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 1.866 | 4.459.267 | 0,04 | 6,00 | 11.196 | 26.755.602 | |

| 2018-05-11 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 10.000 | 4.457.401 | 0,22 | 6,00 | 60.000 | 26.744.406 | |

| 2018-05-03 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 3.831 | 4.447.401 | 0,09 | 6,03 | 23.101 | 26.817.828 | |

| 2018-05-03 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 20.428 | 4.443.570 | 0,46 | 6,08 | 124.202 | 27.016.906 | |

| 2018-05-03 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 5.600 | 4.423.142 | 0,13 | 5,93 | 33.208 | 26.229.232 | |

| 2018-04-05 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 72.908 | 4.417.542 | 1,68 | 6,04 | 440.364 | 26.681.954 | |

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Common Stock |

20.891.965 | ||||||||

| 2018-04-05 | 3 | IEA |

Infrastructure & Energy Alternatives, Inc.

Series A Preferred Stock |

10.498.430 | ||||||||

| 2018-04-02 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 99.961 | 4.344.634 | 2,35 | 6,15 | 614.760 | 26.719.499 | |

| 2018-03-16 |

|

4/A | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 35.000 | 4.221.000 | 0,84 | 5,87 | 205.450 | 24.777.270 | |

| 2018-03-06 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 12.373 | 4.244.673 | 0,29 | 6,00 | 74.238 | 25.468.038 | |

| 2018-02-16 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 11.300 | 4.231.700 | 0,27 | 6,03 | 68.139 | 25.517.151 | |

| 2018-02-16 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 34.400 | 4.220.400 | 0,82 | 5,87 | 201.928 | 24.773.748 | |

| 2018-02-16 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 76.000 | 4.186.000 | 1,85 | 5,96 | 452.960 | 24.948.560 | |

| 2018-02-13 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 40.000 | 4.110.000 | 0,98 | 5,81 | 232.400 | 23.879.100 | |

| 2018-02-13 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 60.000 | 4.070.000 | 1,50 | 5,12 | 307.200 | 20.838.400 | |

| 2018-02-07 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 20.000 | 4.010.000 | 0,50 | 5,30 | 105.942 | 21.241.371 | |

| 2018-02-07 |

|

4 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

P - Purchase | 84.054 | 3.990.000 | 2,15 | 5,22 | 438.737 | 20.826.603 | |

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2018-02-07 | 3 | STON |

STONEMOR PARTNERS LP

Common units representing partnership interests |

7.811.892 | ||||||||

| 2017-12-18 |

|

4 | STKL |

SunOpta Inc.

Common Stock |

P - Purchase | 3.055.460 | 6.734.134 | 83,06 | 7,50 | 22.915.950 | 50.506.005 | |

| 2017-12-18 |

|

4 | STKL |

SunOpta Inc.

Common Stock |

P - Purchase | 644.540 | 1.358.565 | 90,27 | 7,50 | 4.834.050 | 10.189.238 | |