Grundlæggende statistik

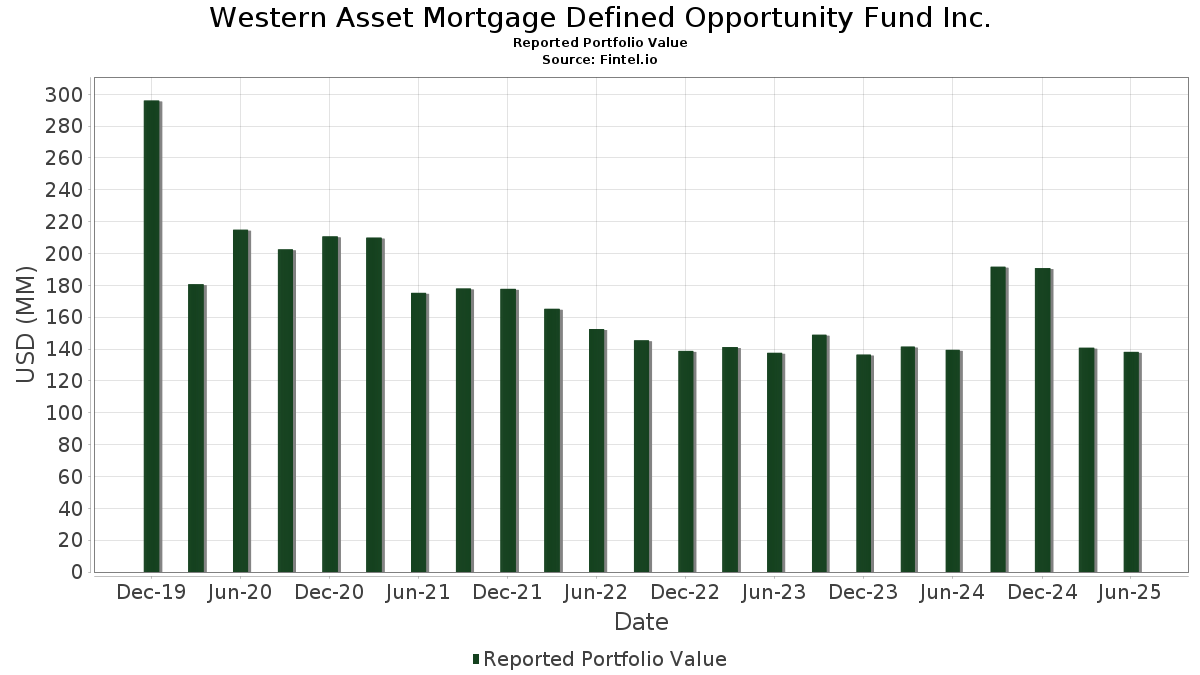

| Porteføljeværdi | $ 138.211.852 |

| Nuværende stillinger | 396 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

Western Asset Mortgage Defined Opportunity Fund Inc. har afsløret 396 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 138.211.852 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Western Asset Mortgage Defined Opportunity Fund Inc.s største beholdninger er STACR Trust 2018-HRP1 (US:US3137G0VB27) , WA Premier Institutional Government Reserves - Premium Shares (US:US52470G4947) , STACR Trust 2018-HRP2 (US:US35564ACC36) , Fannie Mae Connecticut Avenue Securities (US:US30711XDY76) , and 280 Park Avenue 2017-280P Mortgage Trust (US:US90205FAN06) . Western Asset Mortgage Defined Opportunity Fund Inc.s nye stillinger omfatter STACR Trust 2018-HRP1 (US:US3137G0VB27) , STACR Trust 2018-HRP2 (US:US35564ACC36) , Fannie Mae Connecticut Avenue Securities (US:US30711XDY76) , 280 Park Avenue 2017-280P Mortgage Trust (US:US90205FAN06) , and Aegis Asset Backed Securities Trust 2005-3 (US:US00764MFT99) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,93 | 1,4242 | 1,4242 | ||

| 1,68 | 1,2353 | 1,2353 | ||

| 1,28 | 0,9448 | 0,9448 | ||

| 1,20 | 0,8852 | 0,8852 | ||

| 1,02 | 0,7476 | 0,7476 | ||

| 0,93 | 0,6851 | 0,6851 | ||

| 0,04 | 0,89 | 0,6579 | 0,6579 | |

| 1,97 | 1,4537 | 0,5957 | ||

| 0,69 | 0,5105 | 0,5105 | ||

| 0,67 | 0,4967 | 0,4967 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| -5,66 | -4,1642 | -4,1642 | ||

| -3,83 | -2,8156 | -2,8156 | ||

| -3,36 | -2,4741 | -2,4741 | ||

| 5,10 | 5,10 | 3,7526 | -2,1654 | |

| -2,51 | -1,8469 | -1,8469 | ||

| -2,36 | -1,7380 | -1,7380 | ||

| -2,27 | -1,6739 | -1,6739 | ||

| -2,12 | -1,5635 | -1,5635 | ||

| -2,09 | -1,5399 | -1,5399 | ||

| -2,01 | -1,4781 | -1,4781 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-26 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US3137G0VB27 / STACR Trust 2018-HRP1 | 6,50 | 0,42 | 4,7865 | 0,0776 | |||||

| US52470G4947 / WA Premier Institutional Government Reserves - Premium Shares | 5,10 | -37,36 | 5,10 | -37,37 | 3,7526 | -2,1654 | |||

| US36192CAL90 / GSMS 13-GC10 B 144A 3.682% 02-10-46 | 4,45 | 0,95 | 3,2739 | 0,0705 | |||||

| US35564ACC36 / STACR Trust 2018-HRP2 | 4,41 | 0,87 | 3,2454 | 0,0675 | |||||

| US30711XDY76 / Fannie Mae Connecticut Avenue Securities | 3,79 | -1,69 | 2,7887 | -0,0133 | |||||

| US90205FAN06 / 280 Park Avenue 2017-280P Mortgage Trust | 3,31 | -0,06 | 2,4340 | 0,0284 | |||||

| US00764MFT99 / Aegis Asset Backed Securities Trust 2005-3 | 2,94 | 0,48 | 2,1634 | 0,0366 | |||||

| Conseco Finance Corp / ABS-O (US393505Z627) | 2,92 | -6,50 | 2,1490 | -0,1219 | |||||

| US63875LAS25 / Natixis Commercial Mortgage Securities Trust 2022-JERI | 2,80 | 5,46 | 2,0630 | 0,1302 | |||||

| US3137G1DQ70 / Freddie Mac Structured Agency Credit Risk Debt Notes | 2,66 | -1,30 | 1,9567 | -0,0021 | |||||

| US62547NAD12 / Multifamily Connecticut Avenue Securities Trust, Series 2019-01, Class CE | 2,54 | -0,08 | 1,8714 | 0,0213 | |||||

| US36256AAS15 / GS Mortgage Securities Corp Trust 2018-LUAU | 2,48 | -1,16 | 1,8267 | 0,0014 | |||||

| US12649QBE35 / CSMC Series 2015-2R | 2,47 | -1,55 | 1,8218 | -0,0062 | |||||

| US17314TAC53 / Citigroup Mortgage Loan Trust 2008-3 | 2,43 | 0,70 | 1,7919 | 0,0341 | |||||

| US35563XBE13 / Freddie Mac Stacr Trust 2018-HQA2 | 2,32 | -0,51 | 1,7098 | 0,0120 | |||||

| US35563WBE30 / STACR Trust 2018-DNA3 | 2,31 | 0,43 | 1,7030 | 0,0277 | |||||

| US35563PAG46 / Seasoned Credit Risk Transfer Trust Series 2016-1 | 2,27 | -6,35 | 1,6731 | -0,0911 | |||||

| US35564PAC23 / Freddie Mac Stacr Trust 2019-FTR1 | 2,21 | 0,36 | 1,6270 | 0,0252 | |||||

| US05990PAB13 / Banc of America Funding 2014-R5 Trust | 2,11 | -2,00 | 1,5517 | -0,0131 | |||||

| US30711XCR35 / CORP CMO | 2,07 | -2,59 | 1,5235 | -0,0211 | |||||

| US05990QAE35 / Banc of America Funding Corp | 2,03 | -4,06 | 1,4948 | -0,0441 | |||||

| Verus Securitization Trust 2023-7 / ABS-MBS (US92539YAE23) | 1,97 | 67,43 | 1,4537 | 0,5957 | |||||

| US12649FCL04 / CSMC Series 2014-11R | 1,97 | 0,05 | 1,4525 | 0,0184 | |||||

| US55284AAL26 / MF1 2021-FL7 Ltd | 1,97 | 0,51 | 1,4482 | 0,0250 | |||||

| US30711XBQ60 / CORP CMO | 1,96 | -2,15 | 1,4404 | -0,0139 | |||||

| US05608BAQ32 / BX Commercial Mortgage Trust 2019-IMC | 1,96 | -0,05 | 1,4403 | 0,0168 | |||||

| Anchor Mortgage Trust 2025-RTL1 / ABS-MBS (US03290CAB28) | 1,93 | 1,4242 | 1,4242 | ||||||

| US35563PPP89 / Seasoned Credit Risk Transfer Trust Series 2020-1 | 1,91 | 3,87 | 1,4035 | 0,0685 | |||||

| US35564XBE04 / Freddie Mac STACR 2019-HQA3 | 1,90 | -0,63 | 1,4022 | 0,0083 | |||||

| Starwood Mortgage Residential Trust 2021-4 / ABS-MBS (US85573PAH55) | 1,89 | 16,79 | 1,3882 | 0,2144 | |||||

| US90187BAB71 / TWO HARBORS INVESTMENT COR CONV 6.25% 01/15/2026 | 1,80 | -0,93 | 1,3285 | 0,0041 | |||||

| CAFL 2023-RTL1 Issuer LLC / ABS-MBS (US124762AB11) | 1,79 | -0,33 | 1,3210 | 0,0118 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-RTL4 / ABS-MBS (US79584CAB72) | 1,77 | 0,68 | 1,3037 | 0,0243 | |||||

| Verus Securitization Trust 2024-8 / ABS-MBS (US92540PAE88) | 1,75 | 0,29 | 1,2906 | 0,0190 | |||||

| US35564KPP83 / Freddie Mac STACR REMIC Trust 2021-HQA4 | 1,75 | -0,40 | 1,2869 | 0,0100 | |||||

| US35564KLV97 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1,74 | -0,17 | 1,2837 | 0,0136 | |||||

| US52474XAB10 / Legacy Mortgage Asset Trust 2021-GS3 | 1,74 | 0,99 | 1,2822 | 0,0283 | |||||

| US05609KAQ22 / BX TRUST 1ML+372.55 10/15/2036 144A | 1,74 | 1,93 | 1,2815 | 0,0397 | |||||

| US35563PAF62 / Seasoned Credit Risk Transfer Trust Series 2016-1 | 1,73 | -0,17 | 1,2740 | 0,0133 | |||||

| US40442AAN90 / HIT Trust 2022-HI32 | 1,71 | -10,08 | 1,2613 | -0,1240 | |||||

| US17312DAL29 / Citicorp Mortgage Securities Trust Series 2007-8 | 1,69 | -0,18 | 1,2455 | 0,0128 | |||||

| US35564KWG02 / FHLMC STACR REMIC Trust, Series 2022-DNA3, Class B2 | 1,68 | 1,2353 | 1,2353 | ||||||

| MFA.PRC / MFA Financial, Inc. - Preferred Stock | 0,07 | 0,00 | 1,65 | -5,18 | 1,2128 | -0,0505 | |||

| US78458MAN48 / SMR 2022-IND Mortgage Trust | 1,65 | 1,54 | 1,2116 | 0,0326 | |||||

| NYMT Loan Trust Series 2024-BPL1 / ABS-MBS (US62956MAB19) | 1,63 | -0,61 | 1,2016 | 0,0075 | |||||

| US95003GAQ47 / WELLS FARGO COMMERCIAL MORTGAG WFCM 2022 JS2 G 144A | 1,62 | 2,09 | 1,1889 | 0,0383 | |||||

| Freddie Mac Whole Loan Securities Trust 2015-SC01 / ABS-MBS (US3137G1AG26) | 1,61 | -2,18 | 1,1882 | -0,0118 | |||||

| US12651QAQ29 / CSMC Trust 2017-CHOP | 1,60 | -0,25 | 1,1810 | 0,0115 | |||||

| US00178YAE14 / AMSR Trust, Series 2023-SFR2, Class E1 | 1,60 | 0,69 | 1,1776 | 0,0225 | |||||

| US35565CBE57 / Freddie Mac Stacr Remic Trust 2019-Hqa4 | 1,58 | 0,32 | 1,1627 | 0,0179 | |||||

| US20754KAJ07 / CAS_21-R02 | 1,58 | -0,13 | 1,1595 | 0,0126 | |||||

| US62548QAF81 / MCAS 2020-01 CE | 1,57 | -0,19 | 1,1546 | 0,0116 | |||||

| US22945AAG40 / CSMC 2017-RPL1 Trust | 1,54 | -2,04 | 1,1339 | -0,0093 | |||||

| US20754CAF68 / CORP CMO | 1,54 | -0,71 | 1,1324 | 0,0057 | |||||

| US06540CCJ45 / BANK 2021-BNK35 | 1,54 | -0,32 | 1,1301 | 0,0098 | |||||

| US73316PGW41 / Popular ABS Mortgage Pass-Through Trust 2005-5 | 1,53 | -1,61 | 1,1261 | -0,0041 | |||||

| US63543VAG86 / National Collegiate Student Loan Trust 2006-3, Class B | 1,52 | 1,60 | 1,1201 | 0,0310 | |||||

| US693981AD42 / PRKCM 2023-AFC1 Trust | 1,50 | 0,13 | 1,1014 | 0,0144 | |||||

| US05608RAQ83 / BX TR 2021-ARIA G 1ML+320 10/15/2036 144A | 1,49 | 1,36 | 1,0965 | 0,0282 | |||||

| US64828EAF25 / New Residential Mortgage Loan Trust, Series 2019-NQM4, Class B2 | 1,49 | 1,37 | 1,0936 | 0,0277 | |||||

| US76243NAL01 / RIAL 2022-FL8 Issuer Ltd | 1,48 | 0,07 | 1,0926 | 0,0139 | |||||

| LHOME Mortgage Trust 2024-RTL5 / ABS-MBS (US50205WAD92) | 1,48 | -1,59 | 1,0905 | -0,0043 | |||||

| CAFL 2024-RTL1 Issuer LLC / ABS-MBS (US12770DAB01) | 1,48 | -0,07 | 1,0888 | 0,0122 | |||||

| US35564WBE21 / FREDDIE MAC STACR TRUST 2019-FTR2 SER 2019-FTR2 CL B2 V/R REGD 144A P/P 7.49163000 | 1,48 | -0,20 | 1,0864 | 0,0110 | |||||

| HIH Trust 2024-61P / ABS-MBS (US40444VAL53) | 1,47 | -1,73 | 1,0850 | -0,0056 | |||||

| US12651QAU31 / CSMC Trust 2017-CHOP | 1,46 | -0,41 | 1,0752 | 0,0091 | |||||

| PRKCM 2024-AFC1 Trust / ABS-MBS (US69380WAF14) | 1,45 | 0,28 | 1,0681 | 0,0155 | |||||

| US924923AD75 / Verus Securitization Trust 2022-INV2 | 1,43 | -0,21 | 1,0504 | 0,0105 | |||||

| US35564KJB61 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class B2 | 1,42 | 2,38 | 1,0455 | 0,0364 | |||||

| Conseco Finance Corp / ABS-O (US393505Z544) | 1,42 | -6,40 | 1,0438 | -0,0584 | |||||

| US20754RAJ59 / Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2 | 1,38 | 0,22 | 1,0153 | 0,0146 | |||||

| US35565GAE70 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1,38 | 1,25 | 1,0149 | 0,0251 | |||||

| US43732VAL09 / HOME PARTNERS OF AMERICA 2021-2 TRUST HPA 2021-2 F | 1,38 | 0,51 | 1,0149 | 0,0178 | |||||

| US64830WCK53 / New Residential Mortgage Loan Trust, Series 2019-4A, Class B6 | 1,38 | -1,08 | 1,0138 | 0,0015 | |||||

| AGNCP / AGNC Investment Corp. - Preferred Stock | 0,05 | 0,00 | 1,38 | -0,58 | 1,0125 | 0,0063 | |||

| US26982EAG17 / Eagle RE 2023-1 Ltd | 1,37 | -0,44 | 1,0086 | 0,0074 | |||||

| US07325QAC96 / Bayview Financial Asset Trust 2007-SSR1 | 1,35 | -2,10 | 0,9958 | -0,0091 | |||||

| US35563PFX24 / Seasoned Credit Risk Transfer Trust Series 2018-2 | 1,33 | 6,06 | 0,9791 | 0,0668 | |||||

| US35563PWQ89 / Seasoned Credit Risk Transfer Trust Series 2021-1 | 1,32 | -5,12 | 0,9701 | -0,0398 | |||||

| US35565EAE23 / CORP CMO | 1,31 | 2,50 | 0,9656 | 0,0351 | |||||

| Freddie Mac Seasoned Credit Risk Transfer Trust Series 2024-1 / ABS-MBS (US35563PW214) | 1,30 | 0,54 | 0,9578 | 0,0167 | |||||

| US62954PAN06 / BF 2019-NYT Mortgage Trust | 1,29 | -2,42 | 0,9487 | -0,0112 | |||||

| GS Mortgage-Backed Securities Trust 2022-NQM1 / ABS-MBS (US36264EBG89) | 1,29 | -1,08 | 0,9481 | 0,0014 | |||||

| US04965JAJ25 / Atrium Hotel Portfolio Trust 2017-ATRM | 1,28 | 0,9448 | 0,9448 | ||||||

| US482606AS97 / KNDR 2021-KIND F 1ML+405 08/15/2026 144A | 1,28 | 1,58 | 0,9445 | 0,0255 | |||||

| US35565KBE73 / Freddie Mac STACR Remic Trust 2020-DNA2 | 1,28 | 1,18 | 0,9436 | 0,0223 | |||||

| US63875JAN81 / Natixis Commercial Mortgage Securities Trust | 1,27 | -0,78 | 0,9354 | 0,0041 | |||||

| US07290CAA53 / Bayview Financing INV Trust 2021-6F | 1,27 | -2,91 | 0,9321 | -0,0165 | |||||

| BX Commercial Mortgage Trust 2025-SPOT / ABS-MBS (US12433FAJ75) | 1,24 | -0,72 | 0,9161 | 0,0044 | |||||

| US85573MAF68 / Starwood Mortgage Residential Trust 2020-3 | 1,23 | -0,89 | 0,9061 | 0,0037 | |||||

| US35563PJ591 / Seasoned Credit Risk Transfer Trust Series 2022-2 | 1,23 | 5,06 | 0,9025 | 0,0535 | |||||

| US693984AE63 / PRKCM 2023-AFC3 Trust | 1,22 | -0,41 | 0,8975 | 0,0068 | |||||

| US924934AE22 / VERUS SECURITIZATION TRUST 2023-5 | 1,21 | -0,17 | 0,8885 | 0,0098 | |||||

| US92539GAE17 / Verus Securitization Trust 2023-3 | 1,20 | 0,00 | 0,8856 | 0,0106 | |||||

| Redwood Funding Trust 2025-2 / ABS-MBS (US75806EAA55) | 1,20 | 0,8852 | 0,8852 | ||||||

| US35563PGW32 / Seasoned Credit Risk Transfer Trust Series 2018-3 | 1,18 | 3,41 | 0,8705 | 0,0387 | |||||

| US92539TAE38 / Verus Securitization Trust 2023-4 | 1,18 | 0,00 | 0,8665 | 0,0101 | |||||

| BX Commercial Mortgage Trust 2024-KING / ABS-MBS (US05612RAJ86) | 1,18 | 0,34 | 0,8661 | 0,0135 | |||||

| BFLD Commercial Mortgage Trust 2024-UNIV / ABS-MBS (US08861RAJ05) | 1,17 | -0,17 | 0,8632 | 0,0089 | |||||

| US30768WAC29 / Farmer Mac Agricultural Real Estate Trust, Series 2021-1, Class B | 1,13 | -2,08 | 0,8338 | -0,0073 | |||||

| LHOME Mortgage Trust 2024-RTL1 / ABS-MBS (US50205DAB55) | 1,11 | -0,72 | 0,8178 | 0,0041 | |||||

| US74978AAF75 / RAAC 2007-SP1 M3 | 1,11 | -0,36 | 0,8171 | 0,0070 | |||||

| US14732FAC68 / CMHAT 2019-MH1 M | 1,11 | 1,10 | 0,8138 | 0,0183 | |||||

| US92922FD965 / WaMu Mortgage Pass-Through Certificates Series 2005-AR2 Trust | 1,09 | -1,89 | 0,8019 | -0,0058 | |||||

| US83438LAC54 / Lunar 2021-1 Structured Aircraft Portfolio Notes | 1,08 | -12,73 | 0,7975 | -0,1055 | |||||

| US43731BAC54 / Home RE 2023-1 Ltd | 1,07 | -1,20 | 0,7898 | -0,0002 | |||||

| SEB Funding LLC / ABS-O (US78433DAC83) | 1,04 | -0,29 | 0,7688 | 0,0070 | |||||

| US35563FAC59 / FHLMC, Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class B1 | 1,04 | -1,79 | 0,7658 | -0,0050 | |||||

| US64034YAE14 / Nelnet Student Loan Trust 2021-D | 1,03 | -0,29 | 0,7584 | 0,0071 | |||||

| US06541QAE52 / BANK 2022-BNK43 | 1,02 | -1,73 | 0,7517 | -0,0039 | |||||

| US359678AC31 / FULL HOUSE RESORTS INC REGD 144A P/P 8.25000000 | 1,02 | -1,73 | 0,7516 | -0,0037 | |||||

| Easy Street Mortgage Loan Trust 2025-RTL1 / ABS-MBS (US27786FAB58) | 1,02 | 0,7476 | 0,7476 | ||||||

| US05592AAQ31 / BPR Trust 2021-TY | 0,99 | -0,20 | 0,7298 | 0,0071 | |||||

| US39808KAB35 / BANK LOAN NOTE | 0,97 | -0,92 | 0,7162 | 0,0028 | |||||

| US08163VAL18 / Benchmark 2023-V3 Mortgage Trust | 0,97 | 0,41 | 0,7157 | 0,0115 | |||||

| US35563P6W43 / Seasoned Credit Risk Transfer Trust Series 2021-3 | 0,96 | 1,81 | 0,7059 | 0,0216 | |||||

| PRPM 2025-RCF3 LLC / ABS-MBS (US69392PAE51) | 0,93 | 0,6851 | 0,6851 | ||||||

| US22945AAH23 / CSMC 2017-RPL1 Trust | 0,91 | -1,52 | 0,6665 | -0,0023 | |||||

| Renew 2024-2 / ABS-O (US75975DAC83) | 0,90 | -5,16 | 0,6627 | -0,0274 | |||||

| FARM 2024-2 Mortgage Trust / ABS-MBS (US307910AE93) | 0,90 | -2,92 | 0,6612 | -0,0121 | |||||

| US0389238504 / ARBOR REALTY TRUST INC SER F 6.25%/VAR PFD PERP | 0,04 | 0,89 | 0,6579 | 0,6579 | |||||

| US05604FAS48 / BWAY 2013-1515 Mortgage Trust | 0,87 | -1,36 | 0,6397 | -0,0013 | |||||

| New Residential Mortgage Loan Trust 2024-RTL1 / ABS-MBS (US64831PAF27) | 0,87 | 0,58 | 0,6390 | 0,0107 | |||||

| DK 2024-SPT1 Note Backed Trust / ABS-MBS (US23292KAA25) | 0,87 | -3,03 | 0,6373 | -0,0117 | |||||

| Golub Capital Partners CLO 77 B Ltd / ABS-CBDO (US38180TAA60) | 0,85 | 0,35 | 0,6258 | 0,0093 | |||||

| DRB Prime Student Loan Trust 2017-A / ABS-O (US23342K1043) | 0,85 | -4,62 | 0,6229 | -0,0223 | |||||

| US74333EAG70 / PROGRESS RESIDENTIAL 2021-SFR4 PROG 2021-SFR4 F | 0,82 | 1,49 | 0,6026 | 0,0160 | |||||

| Bayview Opportunity Master Fund VII 2024-CAR1 LLC / ABS-O (US07336QAE26) | 0,82 | -13,92 | 0,6007 | -0,0887 | |||||

| US36264DAX49 / GS Mortgage-Backed Securities Trust 2021-PJ2 | 0,82 | -1,93 | 0,6001 | -0,0045 | |||||

| Toorak Mortgage Trust 2024-RRTL1 / ABS-MBS (US89054YAE32) | 0,81 | -0,98 | 0,5954 | 0,0015 | |||||

| US05610HAN35 / BX Commercial Mortgage Trust 2022-LP2 | 0,80 | 0,00 | 0,5922 | 0,0073 | |||||

| NRM FNT1 Excess LLC / ABS-O (US62956YAA73) | 0,79 | -5,14 | 0,5839 | -0,0245 | |||||

| US53944YAV56 / Lloyds Banking Group PLC | 0,79 | 1,54 | 0,5836 | 0,0163 | |||||

| LHOME Mortgage Trust 2024-RTL2 / ABS-MBS (US50205JAB26) | 0,77 | -0,65 | 0,5652 | 0,0032 | |||||

| GS Mortgage-Backed Securities Trust 2021-GR2 / ABS-MBS (US36262JBR59) | 0,76 | -2,20 | 0,5577 | -0,0057 | |||||

| US12659TBW45 / Credit Suisse Mortgage Capital Certificates | 0,73 | -4,81 | 0,5395 | -0,0203 | |||||

| US06540KBQ13 / BANK 2022-BNK44 | 0,73 | -70,24 | 0,5362 | -1,2427 | |||||

| Clover CLO 2021-3 LLC / ABS-CBDO (US18915FAJ12) | 0,72 | 0,00 | 0,5317 | 0,0062 | |||||

| US7609853J89 / RAMP Series 2004-RS4 Trust | 0,72 | -2,83 | 0,5312 | -0,0086 | |||||

| CIM.PRA / Chimera Investment Corporation - Preferred Stock | 0,03 | 0,00 | 0,71 | 1,15 | 0,5200 | 0,0123 | |||

| CIM.PRC / Chimera Investment Corporation - Preferred Stock | 0,03 | 29,92 | 0,71 | 30,07 | 0,5196 | 0,1254 | |||

| BANK 2021-BNK35 / ABS-MBS (US06540CAQ06) | 0,70 | 4,46 | 0,5177 | 0,0280 | |||||

| US018820AB64 / Allianz SE | 0,70 | 0,57 | 0,5173 | 0,0090 | |||||

| Whitebox Clo V Ltd / ABS-CBDO (US96467NAA19) | 0,69 | 0,5105 | 0,5105 | ||||||

| US05591UAQ04 / BSREP Commercial Mortgage Trust 2021-DC | 0,69 | -6,76 | 0,5082 | -0,0299 | |||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RJU95) | 0,67 | 0,4967 | 0,4967 | ||||||

| US86745JAB35 / SUNNOVA HELIOS II ISSUER LLC 2018-1 | 0,67 | 3,38 | 0,4949 | 0,0215 | |||||

| US35563PKR90 / CORP CMO | 0,66 | 0,61 | 0,4863 | 0,0086 | |||||

| US95001GAU76 / Wells Fargo Commercial Mortgage Trust, Series 2017-C42, Class D | 0,66 | -3,23 | 0,4854 | -0,0105 | |||||

| US36250PAM77 / GS Mortgage Securities Trust 2015-GC32 | 0,65 | 0,00 | 0,4816 | 0,0059 | |||||

| Toorak Mortgage Trust 2024-RRTL1 / ABS-MBS (US890938AE39) | 0,65 | 0,00 | 0,4781 | 0,0058 | |||||

| US05549GAS03 / BHMS 2018-MZB | 0,65 | -11,96 | 0,4771 | -0,0587 | |||||

| Balboa Bay Loan Funding 2023-1 Ltd / ABS-CBDO (US05766HAF29) | 0,64 | 0,4735 | 0,4735 | ||||||

| US30296RAJ95 / FRESB 2018-SB48 Mortgage Trust | 0,64 | -2,30 | 0,4694 | -0,0054 | |||||

| US45660LVZ92 / IndyMac INDX Mortgage Loan Trust 2005-AR18 | 0,63 | -1,72 | 0,4637 | -0,0024 | |||||

| US83410JAJ79 / SOHO CHINA ABS 2021-SOHO D 2.78648% 08/10/2028 144A | 0,62 | -0,32 | 0,4566 | 0,0038 | |||||

| US07325QAD79 / Bayview Financial Asset Trust 2007-SSR1 | 0,62 | -2,22 | 0,4548 | -0,0043 | |||||

| Five Point Operating Co LP / Five Point Capital Corp / DBT (US33834YAB48) | 0,61 | -0,16 | 0,4496 | 0,0048 | |||||

| Ocean Trails CLO XIV Ltd / ABS-CBDO (US67515MAG33) | 0,61 | 0,66 | 0,4489 | 0,0089 | |||||

| Greystone CRE Notes 2024-HC3 / ABS-CBDO (US39808MAJ27) | 0,61 | 0,00 | 0,4474 | 0,0056 | |||||

| MIDOCEAN CREDIT CLO XVIII LLC / ABS-CBDO (US59803MAA45) | 0,60 | 0,4439 | 0,4439 | ||||||

| US3137G1CG08 / Freddie Mac Structured Agency Credit Risk Debt Notes | 0,59 | 7,26 | 0,4356 | 0,0344 | |||||

| US63546VAA89 / National Collegiate VI 2007-4 Class A-3L Commutation Trust | 0,59 | -7,09 | 0,4350 | -0,0273 | |||||

| US61690HAE99 / Morgan Stanley Resecuritization Trust 2015-R2 | 0,59 | -2,16 | 0,4332 | -0,0041 | |||||

| US75971FAF09 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 3 AF3 | 0,58 | -1,88 | 0,4235 | -0,0031 | |||||

| Apex Credit CLO 2019-II Ltd / ABS-CBDO (US03755CBJ27) | 0,56 | 2,97 | 0,4091 | 0,0167 | |||||

| US78433XAC48 / Stonepeak 2021-1 ABS | 0,55 | -9,56 | 0,4043 | -0,0373 | |||||

| US16165TBD46 / ChaseFlex Trust Series 2005-2 | 0,54 | 5,94 | 0,3942 | 0,0269 | |||||

| US30320YAE59 / FREMF 2021-KF100 Mortgage Trust | 0,51 | 0,20 | 0,3779 | 0,0052 | |||||

| Bear Mountain Park CLO Ltd / ABS-CBDO (US07403KAE38) | 0,51 | 0,40 | 0,3746 | 0,0065 | |||||

| US02148GAA13 / Alternative Loan Trust 2007-OA8 | 0,50 | -2,33 | 0,3711 | -0,0044 | |||||

| Columbia Cent CLO 35 Ltd / ABS-CBDO (US19739RAJ77) | 0,50 | 0,3694 | 0,3694 | ||||||

| US35563PAH29 / Seasoned Credit Risk Transfer Trust Series 2016-1 | 0,50 | -1,96 | 0,3687 | -0,0029 | |||||

| Elevation CLO 2016-5 Ltd / ABS-CBDO (US28623BAC72) | 0,49 | 2,92 | 0,3636 | 0,0147 | |||||

| US63873VAN38 / Natixis Commercial Mortgage Securities Trust 2019-FAME | 0,49 | 4,26 | 0,3610 | 0,0187 | |||||

| CUSHMAN & WAKEFIELD US / LON (US23340DAU63) | 0,49 | -1,81 | 0,3603 | -0,0025 | |||||

| US38380PTL84 / GNMA, Series 2020-89, Class IA | 0,46 | -0,86 | 0,3404 | 0,0012 | |||||

| US53948PAC23 / Loanpal Solar Loan 2021-1 Ltd | 0,46 | -6,13 | 0,3383 | -0,0175 | |||||

| CIM Trust 2021-INV1 / ABS-MBS (US12566PCU75) | 0,43 | 0,00 | 0,3198 | 0,0038 | |||||

| US52521RAS04 / Lehman Mortgage Trust 2007-5 | 0,43 | -0,46 | 0,3191 | 0,0024 | |||||

| JP Morgan Mortgage Trust Series 2024-3 / ABS-MBS (US46657QBB68) | 0,42 | 1,68 | 0,3121 | 0,0091 | |||||

| US743844DA75 / Provident Home Equity Loan Trust 2000-2 | 0,41 | -2,14 | 0,3028 | -0,0032 | |||||

| US53948NAC74 / Loanpal Solar Loan Ltd. | 0,40 | -12,94 | 0,2929 | -0,0392 | |||||

| Sierra Timeshare 2024-1 Receivables Funding LLC / ABS-O (US826935AD03) | 0,40 | -12,80 | 0,2908 | -0,0390 | |||||

| US61756XBK00 / Morgan Stanley Mortgage Loan Trust 2007-15AR | 0,39 | -2,28 | 0,2842 | -0,0034 | |||||

| New Residential Mortgage Loan Trust 2024-RTL1 / ABS-MBS (US64831PAC95) | 0,38 | 0,00 | 0,2823 | 0,0034 | |||||

| Hartwick Park CLO Ltd / ABS-CBDO (US417402AE46) | 0,37 | -1,59 | 0,2745 | -0,0010 | |||||

| US52520CAK18 / Lehman Mortgage Trust 2006-3 | 0,37 | 1,65 | 0,2719 | 0,0078 | |||||

| US026933AA96 / American Home Mortgage Investment Trust 2007-A | 0,36 | -3,00 | 0,2624 | -0,0045 | |||||

| US63873VAL71 / Natixis Commercial Mortgage Securities Trust 2019-FAME | 0,35 | -47,27 | 0,2562 | -0,2240 | |||||

| US02660VBH06 / American Home Mortgage Assets Trust 2005-2 | 0,34 | -0,59 | 0,2478 | 0,0013 | |||||

| US17329MBF59 / Citigroup Mortgage Loan Trust 2021-J2 | 0,32 | -1,82 | 0,2385 | -0,0016 | |||||

| US76110H2N86 / RALI Series 2005-QA3 Trust | 0,32 | 0,00 | 0,2364 | 0,0025 | |||||

| US02151EAS19 / Alternative Loan Trust 2007-23CB | 0,31 | -0,32 | 0,2281 | 0,0024 | |||||

| US90205FAQ37 / 280 PK AVE 2017-280P MTG TR 1ML+315 09/15/2034 144A | 0,31 | 0,00 | 0,2264 | 0,0030 | |||||

| UWM Mortgage Trust 2021-1 / ABS-MBS (US91824NAY85) | 0,30 | 0,33 | 0,2240 | 0,0036 | |||||

| Balboa Bay Loan Funding 2024-2 Ltd / ABS-CBDO (US05765BAA70) | 0,29 | 0,00 | 0,2163 | 0,0027 | |||||

| US17329MDX48 / Citigroup Mortgage Loan Trust 2021-J2 | 0,29 | -6,51 | 0,2115 | -0,0123 | |||||

| Jamestown CLO XVII Ltd / ABS-CBDO (US47048UAS78) | 0,28 | 0,2069 | 0,2069 | ||||||

| US83401B1061 / SOFI PROFESSIONAL LOAN PROGRAM 2017-F LLC | 0,28 | 8,59 | 0,2049 | 0,0184 | |||||

| Magnetite XXXIX Ltd / ABS-CBDO (US559923AE78) | 0,28 | -1,08 | 0,2038 | 0,0003 | |||||

| US46654GAA40 / JP Morgan Chase Commercial Mortgage Securities Trust 2021-NYMZ | 0,27 | 5,02 | 0,2003 | 0,0120 | |||||

| US52523YAD67 / Lehman XS Trust 2006-19 | 0,27 | -6,69 | 0,1958 | -0,0109 | |||||

| US61751GAD97 / Morgan Stanley Mortgage Loan Trust 2007-5AX | 0,26 | -4,12 | 0,1885 | -0,0060 | |||||

| US759950GX06 / Renaissance Home Equity Loan Trust 2006-1 | 0,25 | -2,38 | 0,1813 | -0,0023 | |||||

| US86358EMH61 / Structured Asset Investment Loan Trust 2004-8 | 0,23 | 0,45 | 0,1662 | 0,0029 | |||||

| US64828GAH39 / New Residential Mortgage Loan Trust 2019-6 | 0,22 | -5,63 | 0,1608 | -0,0075 | |||||

| US12667G4G57 / Alternative Loan Trust 2005-J10 | 0,21 | -7,14 | 0,1535 | -0,0097 | |||||

| US7844561057 / SMB Private Education Loan Trust 2014-A | 0,21 | -37,76 | 0,1518 | -0,0889 | |||||

| US3623413E74 / GSMPS Mortgage Loan Trust 2006-RP1 | 0,19 | -1,06 | 0,1382 | 0,0002 | |||||

| US23248AAA97 / Countrywide Asset-Backed Certificates | 0,19 | 0,54 | 0,1376 | 0,0029 | |||||

| US45661EGK47 / IndyMac INDX Mortgage Loan Trust 2006-AR9 | 0,17 | -0,58 | 0,1263 | 0,0012 | |||||

| US45661KAA88 / IndyMac INDX Mortgage Loan Trust 2006-AR11 | 0,15 | -1,31 | 0,1112 | -0,0002 | |||||

| US59020U5W12 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 A1 2A1 | 0,15 | 0,68 | 0,1104 | 0,0025 | |||||

| US32051GQA66 / First Horizon Alternative Mortgage Securities Trust 2005-AA6 | 0,15 | -0,68 | 0,1073 | 0,0008 | |||||

| US23166MAC73 / Cushman & Wakefield US Borrower LLC | 0,14 | -12,58 | 0,1028 | -0,0131 | |||||

| US466287AR06 / J.P. MORGAN ALTERNATIVE LOAN T JPALT 2007 A1 3A1 | 0,14 | 0,00 | 0,1022 | 0,0012 | |||||

| US761118SZ21 / RALI Series 2006-QA1 Trust | 0,14 | -14,47 | 0,1008 | -0,0149 | |||||

| US12638FAB76 / CSMC Resecuritization Trust 2006-1R | 0,12 | -8,33 | 0,0894 | -0,0073 | |||||

| US14983AAC36 / Credit-Based Asset Servicing & Securitization LLC | 0,12 | -2,52 | 0,0858 | -0,0013 | |||||

| US74957XAM74 / RFMSI Series 2006-S8 Trust | 0,11 | 5,77 | 0,0816 | 0,0053 | |||||

| US93935YAA82 / Washington Mutual Mortgage Pass-Through Certificates WMALT Ser 2006-AR10 Trust | 0,11 | 0,92 | 0,0810 | 0,0015 | |||||

| US3136AATJ47 / Fannie Mae REMICS | 0,11 | 8,16 | 0,0782 | 0,0065 | |||||

| US863579FR48 / Structured Adjustable Rate Mortgage Loan Trust Series 2004-18 | 0,11 | -1,87 | 0,0775 | -0,0005 | |||||

| US05946XLZ41 / Banc of America Funding 2004-C Trust | 0,10 | -2,80 | 0,0771 | -0,0012 | |||||

| US12667GA298 / Alternative Loan Trust 2005-36 | 0,10 | 0,00 | 0,0715 | 0,0010 | |||||

| US225470DY68 / CSFB Mortgage-Backed Pass-Through Certificates Series 2005-10 | 0,10 | -2,04 | 0,0707 | -0,0013 | |||||

| US748939AA32 / RALI Series 2006-QA4 Trust | 0,10 | -2,06 | 0,0700 | -0,0011 | |||||

| US12668BUF83 / Alternative Loan Trust 2006-HY10 | 0,09 | 0,00 | 0,0686 | 0,0003 | |||||

| US17309FAS74 / Citigroup Mortgage Loan Trust 2006-AR5 | 0,09 | 0,00 | 0,0671 | 0,0003 | |||||

| US761120AA26 / Residential Asset Securitization Trust 2007-A2 | 0,09 | 0,00 | 0,0653 | 0,0011 | |||||

| US45661EDE14 / IndyMac INDX Mortgage Loan Trust 2006-AR7 | 0,09 | 0,00 | 0,0634 | 0,0005 | |||||

| US007036MT06 / Adjustable Rate Mortgage Trust 2005-7 | 0,08 | -9,68 | 0,0624 | -0,0056 | |||||

| US02660CAH34 / American Home Mortgage Investment Trust 2007-2 | 0,08 | 1,23 | 0,0606 | 0,0012 | |||||

| US93934FCK66 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2005-8 Trust | 0,08 | 1,30 | 0,0580 | 0,0019 | |||||

| US576433G423 / MASTR Adjustable Rate Mortgages Trust 2006-OA1 | 0,08 | 1,32 | 0,0568 | 0,0012 | |||||

| US07386HYF27 / BEAR STEARNS ALT A TRUST BALTA 2005 9 25A1 | 0,07 | -6,41 | 0,0541 | -0,0034 | |||||

| US863579MP09 / Structured Adjustable Rate Mortgage Loan Trust Series 2005-4 | 0,07 | 0,00 | 0,0518 | 0,0002 | |||||

| US12667GCF81 / Alternative Loan Trust 2005-14 | 0,07 | -1,43 | 0,0514 | -0,0002 | |||||

| US007036LG93 / Adjustable Rate Mortgage Trust 2005-5 | 0,06 | -1,64 | 0,0448 | 0,0002 | |||||

| US92922F4V78 / CORP CMO | 0,06 | -4,92 | 0,0431 | -0,0013 | |||||

| US126670JP46 / CHL Mortgage Pass-Through Trust 2005-HYB9 | 0,05 | -1,82 | 0,0404 | 0,0001 | |||||

| US93934FGB22 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2005-10 Trust | 0,05 | 0,00 | 0,0393 | 0,0003 | |||||

| US2254W0MM42 / Adjustable Rate Mortgage Trust 2005-12 | 0,05 | -2,00 | 0,0364 | -0,0001 | |||||

| US45660LY609 / IndyMac INDA Mortgage Loan Trust 2005-AR2 | 0,04 | 0,00 | 0,0326 | 0,0003 | |||||

| US12667GJT13 / Alternative Loan Trust 2005-11CB | 0,04 | 7,69 | 0,0312 | 0,0028 | |||||

| US05950HAA95 / Banc of America Funding 2006-F Trust | 0,04 | 0,00 | 0,0303 | -0,0000 | |||||

| US40431LAF58 / HSI Asset Loan Obligation Trust 2007-AR1 | 0,04 | 0,00 | 0,0303 | 0,0002 | |||||

| US16162XAH08 / Chase Mortgage Finance Trust Series 2006-S3 | 0,04 | -2,44 | 0,0300 | 0,0001 | |||||

| US16678WAA45 / Chevy Chase Funding LLC Mortgage-Backed Certificates Series 2006-2 | 0,04 | -4,88 | 0,0291 | -0,0010 | |||||

| US17307GXX14 / Citigroup Mortgage Loan Trust Inc | 0,04 | 0,00 | 0,0290 | 0,0001 | |||||

| US61749LAB71 / Morgan Stanley Mortgage Loan Trust 2006-8AR | 0,04 | 0,00 | 0,0266 | 0,0002 | |||||

| US45254NKQ96 / Impac CMB Trust Series 2004-8 | 0,04 | -5,41 | 0,0264 | -0,0009 | |||||

| US93934FFE79 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2005-9 Trust | 0,03 | 6,45 | 0,0244 | 0,0013 | |||||

| US761118VY19 / RALI Series 2006-QO2 Trust | 0,03 | -3,45 | 0,0208 | -0,0003 | |||||

| US23245LAE02 / Alternative Loan Trust 2006-J8 | 0,03 | -3,45 | 0,0207 | -0,0009 | |||||

| US09774XAJ19 / BCMSC Trust 1998-B | 0,03 | -41,30 | 0,0205 | -0,0132 | |||||

| US576436AU31 / MASTR Reperforming Loan Trust 2005-1 | 0,03 | -7,14 | 0,0198 | -0,0007 | |||||

| US863579PF99 / Structured Adjustable Rate Mortgage Loan Trust | 0,03 | -3,70 | 0,0194 | -0,0004 | |||||

| US45660LVM89 / IndyMac INDX Mortgage Loan Trust 2005-AR15 | 0,03 | 0,00 | 0,0186 | -0,0000 | |||||

| US058933AE20 / Banc of America Funding 2006-D Trust | 0,02 | 0,00 | 0,0180 | -0,0000 | |||||

| US46630WBB54 / JP Morgan Mortgage Trust 2007-S2 | 0,02 | 0,00 | 0,0140 | -0,0005 | |||||

| US45660N7J87 / IndyMac INDX Mortgage Loan Trust 2004-AR13 | 0,02 | 0,00 | 0,0140 | -0,0005 | |||||

| US25157GCA85 / Deutsche Mortgage Securities Inc Mortgage Loan Trust Series 2006-PR1 | 0,02 | 6,25 | 0,0132 | 0,0012 | |||||

| US32052FAH91 / First Horizon Alternative Mortgage Securities Trust 2006-FA6 | 0,02 | -5,88 | 0,0123 | -0,0001 | |||||

| US02149VAU35 / Alternative Loan Trust 2007-3T1 | 0,01 | -6,67 | 0,0106 | -0,0003 | |||||

| US073879U970 / Bear Stearns Asset Backed Securities I Trust 2005-CL1 | 0,01 | -9,09 | 0,0078 | -0,0006 | |||||

| US126673KQ49 / CWABS Revolving Home Equity Loan Trust Series 2004-L | 0,01 | -10,00 | 0,0067 | -0,0006 | |||||

| US126694VH83 / CHL Mortgage Pass-Through Trust 2005-HY10 | 0,01 | 0,00 | 0,0050 | -0,0000 | |||||

| US25157GBJ04 / Deutsche Mortgage Securities Inc Mortgage Loan Trust Series 2006-PR1 | 0,01 | 25,00 | 0,0041 | 0,0005 | |||||

| US126694EP92 / CHL Mortgage Pass-Through Trust 2005-18 | 0,01 | 0,00 | 0,0038 | -0,0001 | |||||

| US46630WBC38 / JP Morgan Mortgage Trust 2007-S2 | 0,00 | -20,00 | 0,0036 | -0,0002 | |||||

| US17307GKZ09 / Citigroup Mortgage Loan Trust Inc | 0,00 | 0,00 | 0,0035 | -0,0000 | |||||

| US25157GAE26 / Deutsche Mortgage Securities Inc Mortgage Loan Trust Series 2006-PR1 | 0,00 | 0,00 | 0,0034 | -0,0000 | |||||

| US25157GAW24 / Deutsche Mortgage Securities Inc Mortgage Loan Trust Series 2006-PR1 | 0,00 | 0,00 | 0,0030 | -0,0002 | |||||

| US92977YBU47 / Wachovia Mortgage Loan Trust LLC Series 2005-B Trust | 0,00 | -25,00 | 0,0028 | -0,0005 | |||||

| US25157GAT94 / Deutsche Mortgage Securities Inc Mortgage Loan Trust Series 2006-PR1 | 0,00 | 0,00 | 0,0020 | -0,0002 | |||||

| US576433UC81 / MASTR Adjustable Rate Mortgages Trust 2004-12 | 0,00 | 0,00 | 0,0018 | -0,0000 | |||||

| US12660WAS44 / CSMC 2021-ADV | 0,00 | -90,91 | 0,0013 | -0,0069 | |||||

| US46652DAN57 / JP Morgan Chase Commercial Mortgage Securities Corp | 0,00 | 0,0007 | -0,0000 | ||||||

| US36228FCU84 / GS Mortgage Securities Corp II | 0,00 | 0,0005 | 0,0000 | ||||||

| US46652DAQ88 / JP Morgan Chase Commercial Mortgage Securities Corp | 0,00 | 0,0000 | -0,0000 | ||||||

| US396782EG53 / RBS Acceptance Inc | 0,00 | 0,0000 | 0,0000 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,02 | -0,0147 | -0,0147 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,03 | -0,0184 | -0,0184 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,03 | -0,0213 | -0,0213 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,04 | -0,0331 | -0,0331 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,05 | -0,0353 | -0,0353 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,08 | -0,0589 | -0,0589 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,08 | -0,0604 | -0,0604 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,10 | -0,0714 | -0,0714 | ||||||

| US ULTRA BOND CBT / DIR (000000000) | -0,10 | -0,0719 | -0,0719 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | -0,15 | -0,1070 | -0,1070 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,15 | -0,1075 | -0,1075 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,17 | -0,1266 | -0,1266 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,20 | -0,1509 | -0,1509 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,21 | -0,1546 | -0,1546 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,23 | -0,1693 | -0,1693 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,23 | -0,1693 | -0,1693 | ||||||

| US 10YR ULTRA / DIR (000000000) | -0,23 | -0,1730 | -0,1730 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,25 | -0,1833 | -0,1833 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,31 | -0,2275 | -0,2275 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,33 | -0,2407 | -0,2407 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,35 | -0,2576 | -0,2576 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,37 | -0,2702 | -0,2702 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,41 | -0,3025 | -0,3025 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,42 | -0,3106 | -0,3106 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,42 | -0,3114 | -0,3114 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,42 | -0,3128 | -0,3128 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,45 | -0,3312 | -0,3312 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,47 | -0,3438 | -0,3438 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,49 | -0,3600 | -0,3600 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,50 | -0,3710 | -0,3710 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,54 | -0,3938 | -0,3938 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,54 | -0,3997 | -0,3997 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,55 | -0,4071 | -0,4071 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,56 | -0,4144 | -0,4144 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,59 | -0,4336 | -0,4336 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,60 | -0,4387 | -0,4387 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,60 | -0,4409 | -0,4409 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,64 | -0,4682 | -0,4682 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,65 | -0,4755 | -0,4755 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,67 | -0,4954 | -0,4954 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,68 | -0,4983 | -0,4983 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,70 | -0,5175 | -0,5175 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,71 | -0,5219 | -0,5219 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,71 | -0,5241 | -0,5241 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,72 | -0,5307 | -0,5307 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,74 | -0,5418 | -0,5418 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,87 | -0,6434 | -0,6434 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,89 | -0,6515 | -0,6515 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,89 | -0,6522 | -0,6522 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,93 | -0,6838 | -0,6838 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,94 | -0,6890 | -0,6890 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,96 | -0,7059 | -0,7059 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,97 | -0,7170 | -0,7170 | ||||||

| Nomura Securities Inc / RA (000000000) | -0,99 | -0,7302 | -0,7302 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,01 | -0,7420 | -0,7420 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,02 | -0,7516 | -0,7516 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,03 | -0,7575 | -0,7575 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,05 | -0,7744 | -0,7744 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,06 | -0,7773 | -0,7773 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,07 | -0,7876 | -0,7876 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,08 | -0,7921 | -0,7921 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,09 | -0,8053 | -0,8053 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,10 | -0,8090 | -0,8090 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,10 | -0,8105 | -0,8105 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,11 | -0,8200 | -0,8200 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,14 | -0,8362 | -0,8362 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,15 | -0,8443 | -0,8443 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,17 | -0,8642 | -0,8642 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,18 | -0,8693 | -0,8693 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,19 | -0,8760 | -0,8760 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,20 | -0,8804 | -0,8804 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,20 | -0,8819 | -0,8819 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,22 | -0,8966 | -0,8966 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,22 | -0,8988 | -0,8988 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,25 | -0,9179 | -0,9179 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,25 | -0,9187 | -0,9187 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,25 | -0,9201 | -0,9201 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,25 | -0,9223 | -0,9223 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,26 | -0,9282 | -0,9282 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,29 | -0,9503 | -0,9503 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,30 | -0,9577 | -0,9577 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,33 | -0,9798 | -0,9798 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,34 | -0,9879 | -0,9879 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,35 | -0,9915 | -0,9915 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,35 | -0,9974 | -0,9974 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,36 | -0,9996 | -0,9996 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,37 | -1,0077 | -1,0077 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,40 | -1,0276 | -1,0276 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,42 | -1,0416 | -1,0416 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,50 | -1,1027 | -1,1027 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,51 | -1,1108 | -1,1108 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,52 | -1,1218 | -1,1218 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,53 | -1,1233 | -1,1233 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,53 | -1,1270 | -1,1270 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,53 | -1,1277 | -1,1277 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,59 | -1,1697 | -1,1697 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,60 | -1,1807 | -1,1807 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,66 | -1,2190 | -1,2190 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,72 | -1,2668 | -1,2668 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,78 | -1,3081 | -1,3081 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,88 | -1,3854 | -1,3854 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,91 | -1,4038 | -1,4038 | ||||||

| Nomura Securities Inc / RA (000000000) | -1,94 | -1,4273 | -1,4273 | ||||||

| Nomura Securities Inc / RA (000000000) | -2,00 | -1,4759 | -1,4759 | ||||||

| Nomura Securities Inc / RA (000000000) | -2,01 | -1,4781 | -1,4781 | ||||||

| Nomura Securities Inc / RA (000000000) | -2,09 | -1,5399 | -1,5399 | ||||||

| Nomura Securities Inc / RA (000000000) | -2,12 | -1,5635 | -1,5635 | ||||||

| Nomura Securities Inc / RA (000000000) | -2,27 | -1,6739 | -1,6739 | ||||||

| Nomura Securities Inc / RA (000000000) | -2,36 | -1,7380 | -1,7380 | ||||||

| Nomura Securities Inc / RA (000000000) | -2,51 | -1,8469 | -1,8469 | ||||||

| Nomura Securities Inc / RA (000000000) | -3,36 | -2,4741 | -2,4741 | ||||||

| Nomura Securities Inc / RA (000000000) | -3,83 | -2,8156 | -2,8156 | ||||||

| Nomura Securities Inc / RA (000000000) | -5,66 | -4,1642 | -4,1642 |