Grundlæggende statistik

| Porteføljeværdi | $ 5.905.495.984 |

| Nuværende stillinger | 204 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

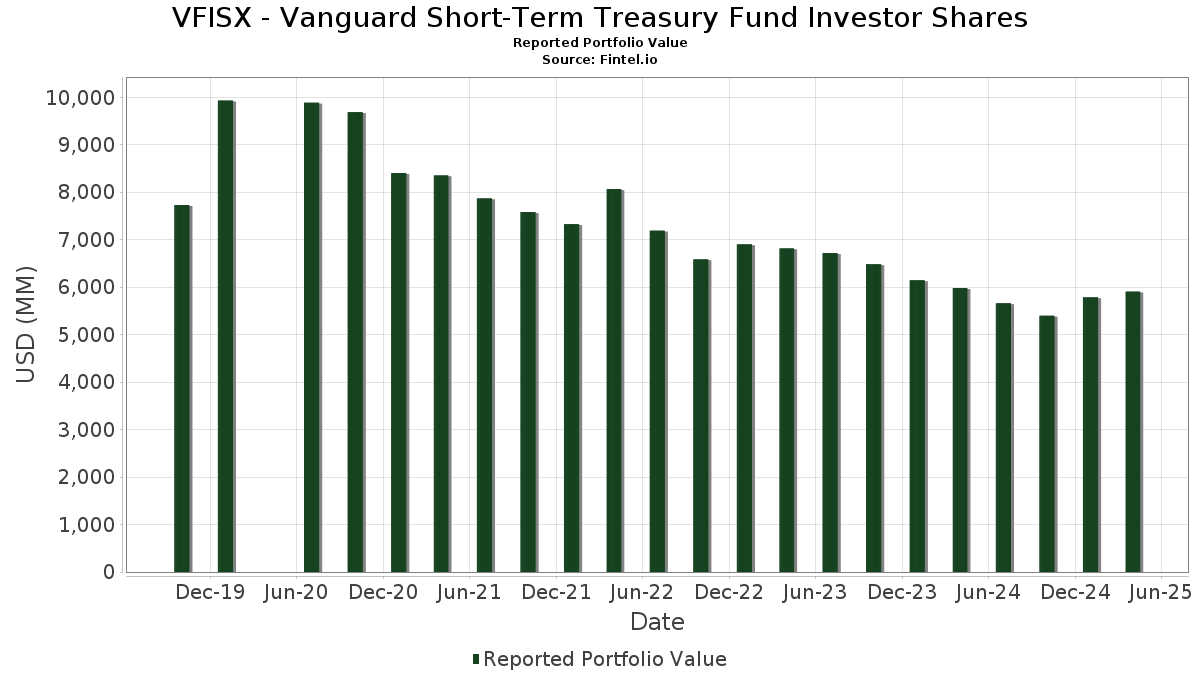

VFISX - Vanguard Short-Term Treasury Fund Investor Shares har afsløret 204 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 5.905.495.984 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). VFISX - Vanguard Short-Term Treasury Fund Investor Sharess største beholdninger er United States Treasury Note/Bond (US:US91282CHU80) , United States Treasury Note/Bond (US:US91282CFB28) , United States Treasury Note/Bond (US:US91282CAD39) , United States Treasury Note/Bond (US:US91282CBB63) , and United States Treasury Note/Bond (US:US91282CCJ80) . VFISX - Vanguard Short-Term Treasury Fund Investor Sharess nye stillinger omfatter United States Treasury Note/Bond (US:US91282CHU80) , United States Treasury Note/Bond (US:US91282CFB28) , United States Treasury Note/Bond (US:US91282CAD39) , United States Treasury Note/Bond (US:US91282CBB63) , and United States Treasury Note/Bond (US:US91282CCJ80) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 245,41 | 4,1403 | 3,5411 | ||

| 161,41 | 2,7231 | 1,9313 | ||

| 162,64 | 2,7440 | 1,8608 | ||

| 103,21 | 1,7413 | 1,7413 | ||

| 98,33 | 1,6589 | 1,6589 | ||

| 96,49 | 1,6280 | 1,3696 | ||

| 77,58 | 1,3089 | 1,3089 | ||

| 109,99 | 1,8557 | 1,2588 | ||

| 72,66 | 1,2259 | 1,2259 | ||

| 59,46 | 1,0031 | 1,0031 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 104,69 | 1,7663 | -1,7424 | ||

| 41,88 | 0,7066 | -1,4802 | ||

| 52,49 | 0,8855 | -0,8594 | ||

| 160,32 | 2,7048 | -0,7959 | ||

| 38,28 | 0,6458 | -0,7677 | ||

| 62,98 | 1,0626 | -0,7441 | ||

| 71,34 | 1,2035 | -0,6149 | ||

| 75,48 | 1,2735 | -0,6009 | ||

| 111,95 | 1,8887 | -0,5277 | ||

| 29,72 | 0,5014 | -0,4763 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-30 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US TREASURY N/B / DBT (US91282CKS97) | 261,16 | 25,81 | 4,4060 | 0,8320 | |||||

| US91282CHU80 / United States Treasury Note/Bond | 245,41 | 605,17 | 4,1403 | 3,5411 | |||||

| US TREASURY N/B / DBT (US91282CKY65) | 187,00 | 32,99 | 3,1548 | 0,7338 | |||||

| US91282CFB28 / United States Treasury Note/Bond | 169,63 | 55,79 | 2,8619 | 0,9871 | |||||

| US91282CAD39 / United States Treasury Note/Bond | 166,43 | 18,96 | 2,8079 | 0,3989 | |||||

| US TREASURY N/B / DBT (US91282CKR15) | 162,64 | 217,08 | 2,7440 | 1,8608 | |||||

| US91282CBB63 / United States Treasury Note/Bond | 161,41 | 250,98 | 2,7231 | 1,9313 | |||||

| US91282CCJ80 / United States Treasury Note/Bond | 160,32 | -21,15 | 2,7048 | -0,7959 | |||||

| US91282CCF68 / United States Treasury Note/Bond | 149,98 | 1,19 | 2,5303 | -0,0216 | |||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 132,48 | 64,86 | 2,2352 | 0,8515 | |||||

| US TREASURY N/B / DBT (US91282CKG59) | 121,92 | 22,97 | 2,0570 | 0,3498 | |||||

| US912828Y958 / United States Treasury Note/Bond | 111,95 | -19,50 | 1,8887 | -0,5277 | |||||

| US91282CCY57 / UNITED STATES TREASURY NOTE 1.25000000 | 111,57 | 2,96 | 1,8823 | 0,0165 | |||||

| US91282CHB00 / TREASURY NOTE | 109,99 | 181,84 | 1,8557 | 1,2588 | |||||

| US TREASURY N/B / DBT (US91282CLS88) | 104,69 | -48,62 | 1,7663 | -1,7424 | |||||

| US TREASURY N/B / DBT (US91282CKX82) | 103,21 | 1,7413 | 1,7413 | ||||||

| US91282CDP32 / United States Treasury Note/Bond - When Issued | 99,86 | 131,39 | 1,6847 | 0,9417 | |||||

| US TREASURY N/B / DBT (US91282CMP31) | 98,33 | 1,6589 | 1,6589 | ||||||

| US TREASURY N/B / DBT (US91282CLB53) | 96,66 | 42,04 | 1,6307 | 0,4591 | |||||

| US TREASURY N/B / DBT (US91282CMF58) | 96,49 | 543,12 | 1,6280 | 1,3696 | |||||

| US91282CEE75 / United States Treasury Note/Bond | 92,01 | -2,14 | 1,5524 | -0,0666 | |||||

| US91282CCV19 / UNITED STATES TREASURY NOTE 1.12500000 | 89,36 | 2,94 | 1,5076 | 0,0129 | |||||

| US91282CHM64 / U.S. Treasury Notes | 88,49 | -12,72 | 1,4930 | -0,2528 | |||||

| US91282CEV90 / United States Treasury Note/Bond | 84,80 | 2,79 | 1,4307 | 0,0103 | |||||

| US TREASURY N/B / DBT (US91282CLQ23) | 80,53 | 1,58 | 1,3587 | -0,0063 | |||||

| US TREASURY N/B / DBT (US91282CKK61) | 79,13 | 117,80 | 1,3350 | 0,7037 | |||||

| US91282CHA27 / United States Treasury Note/Bond | 77,58 | 1,3089 | 1,3089 | ||||||

| US91282CCE93 / United States Treasury Note/Bond | 75,48 | -30,66 | 1,2735 | -0,6009 | |||||

| US TREASURY N/B / DBT (US91282CMH15) | 72,66 | 1,2259 | 1,2259 | ||||||

| US91282CCH25 / United States Treasury Note/Bond | 71,34 | -32,46 | 1,2035 | -0,6149 | |||||

| US91282CJA09 / United States Treasury Note/Bond | 67,08 | 2,07 | 1,1318 | 0,0002 | |||||

| US9128284V99 / U.S. Treasury Notes 2.875%, due 08/15/2028 | 66,64 | 283,83 | 1,1244 | 0,8254 | |||||

| US91282CEC10 / United States Treasury Note/Bond | 62,98 | -39,98 | 1,0626 | -0,7441 | |||||

| US TREASURY N/B / DBT (US91282CJW29) | 60,73 | 2,37 | 1,0246 | 0,0032 | |||||

| US TREASURY N/B / DBT (US91282CKA89) | 60,07 | 9,56 | 1,0135 | 0,0694 | |||||

| US76116FAB31 / Resol Fnd Ser A 2030 Bonds Prin Comp 01/15/30 | 59,46 | 1,0031 | 1,0031 | ||||||

| US TREASURY N/B / DBT (US91282CLG41) | 59,40 | 500,92 | 1,0022 | 0,8320 | |||||

| US9128282R06 / United States Treasury Note/Bond | 54,36 | 185,95 | 0,9171 | 0,5868 | |||||

| US91282CBS98 / United States Treasury Note/Bond | 52,49 | -48,21 | 0,8855 | -0,8594 | |||||

| US91282CJK80 / US TREASURY N/B 4.625% 11-15-26 | 52,19 | 0,66 | 0,8805 | -0,0122 | |||||

| US TREASURY N/B / DBT (US91282CJT99) | 51,68 | 0,8719 | 0,8719 | ||||||

| US01F0606594 / Uniform Mortgage-Backed Security, TBA | 50,46 | 0,8512 | 0,8512 | ||||||

| US TREASURY N/B / DBT (US91282CKZ31) | 50,41 | 1,28 | 0,8504 | -0,0065 | |||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 50,30 | 0,8486 | 0,8486 | ||||||

| US91282CET45 / U.S. Treasury Notes | 49,31 | -24,78 | 0,8319 | -0,3057 | |||||

| US912828ZN34 / United States Treasury Note/Bond | 47,02 | 2,09 | 0,7933 | 0,0002 | |||||

| US9128284N73 / United States Treasury Note/Bond | 44,05 | -21,18 | 0,7432 | -0,2400 | |||||

| US TREASURY N/B / DBT (US91282CMG32) | 43,19 | 0,7286 | 0,7286 | ||||||

| FHMS K539 A2 / ABS-MBS (US3137HKXJ82) | 43,05 | 0,7263 | 0,7263 | ||||||

| FNA 2024-M6 A2 / ABS-MBS (US3136BTGM94) | 41,88 | -67,02 | 0,7066 | -1,4802 | |||||

| FN BS1548 / ABS-MBS (US3140LBWJ83) | 40,92 | 0,6904 | 0,6904 | ||||||

| US9128286X38 / United States Treasury Note/Bond | 38,28 | -52,95 | 0,6458 | -0,7677 | |||||

| US91282CBZ32 / United States Treasury Note/Bond | 37,72 | 2,64 | 0,6364 | 0,0036 | |||||

| US912828ZV59 / United States Treasury Note/Bond | 37,43 | 2,20 | 0,6315 | 0,0009 | |||||

| US31418D2X92 / Fannie Mae Pool | 34,55 | -4,20 | 0,5829 | -0,0380 | |||||

| US91282CJM47 / United States Treasury Note/Bond | 30,34 | 0,5119 | 0,5119 | ||||||

| FN FM6612 / ABS-MBS (US3140XAK270) | 30,27 | -4,71 | 0,5108 | -0,0363 | |||||

| FR RD5049 / ABS-MBS (US3133LPTE78) | 30,22 | -4,52 | 0,5098 | -0,0351 | |||||

| US91282CJQ50 / United States Treasury Note/Bond - When Issued | 29,90 | 0,5044 | 0,5044 | ||||||

| US91282CFC01 / U.S. Treasury Notes | 29,72 | -47,66 | 0,5014 | -0,4763 | |||||

| US76116FAC14 / Resol Fnd Ser B 2030 Bonds Prin Comp 04/15/30 | 28,72 | 0,4846 | 0,4846 | ||||||

| FR WG9005 / ABS-MBS (US31425SAE00) | 27,16 | 2,44 | 0,4582 | 0,0017 | |||||

| FN MA4225 / ABS-MBS (US31418DVT61) | 26,31 | -4,89 | 0,4439 | -0,0324 | |||||

| US31418D5J71 / Fannie Mae Pool | 23,80 | -3,62 | 0,4015 | -0,0236 | |||||

| FR WN3238 / ABS-MBS (US3132XHS473) | 23,23 | 0,3919 | 0,3919 | ||||||

| US31418D2A99 / Fannie Mae Pool | 22,21 | -4,63 | 0,3747 | -0,0262 | |||||

| US31418DW245 / FN MA4264 | 21,37 | -4,93 | 0,3605 | -0,0265 | |||||

| FR WN5225 / ABS-MBS (US3132XKYX96) | 20,96 | 0,3535 | 0,3535 | ||||||

| US31418D2Y75 / Fannie Mae Pool | 20,84 | -4,32 | 0,3516 | -0,0234 | |||||

| US TREASURY N/B / DBT (US91282CMD01) | 20,57 | 2,66 | 0,3470 | 0,0020 | |||||

| FN AN1371 / ABS-MBS (US3138LDQZ91) | 18,82 | 2,03 | 0,3175 | -0,0001 | |||||

| Vanguard Market Liquidity Fund / STIV (N/A) | 17,97 | 17,96 | 0,3031 | 0,3031 | |||||

| FN BZ0160 / ABS-MBS (US3140NUFA21) | 17,83 | 2,14 | 0,3008 | 0,0003 | |||||

| FR WN5227 / ABS-MBS (US3132XKYZ45) | 15,20 | 0,2564 | 0,2564 | ||||||

| FN BL9595 / ABS-MBS (US3140J2UV61) | 13,86 | 2,45 | 0,2338 | 0,0009 | |||||

| US31418DZ966 / Fannie Mae Pool | 13,81 | -4,29 | 0,2330 | -0,0155 | |||||

| US91282CAY75 / UST NOTES 0.625% 11/30/2027 | 13,35 | 2,49 | 0,2253 | 0,0010 | |||||

| US31418DYE65 / Fannie Mae Pool | 13,21 | -3,94 | 0,2228 | -0,0139 | |||||

| FR RD5046 / ABS-MBS (US3133LPTB30) | 13,16 | -3,98 | 0,2221 | -0,0140 | |||||

| US9128287B09 / United States Treasury Note/Bond | 12,91 | -53,14 | 0,2177 | -0,2608 | |||||

| FR RD5072 / ABS-MBS (US3133LPT568) | 12,70 | -3,32 | 0,2143 | -0,0119 | |||||

| FR RD5071 / ABS-MBS (US3133LPT493) | 12,27 | -3,94 | 0,2069 | -0,0129 | |||||

| FR RD5044 / ABS-MBS (US3133LPS990) | 12,23 | -4,34 | 0,2064 | -0,0138 | |||||

| US91282CFJ53 / United States Treasury Note/Bond | 12,22 | 2,93 | 0,2062 | 0,0018 | |||||

| US3133LPTA56 / Freddie Mac Pool | 11,67 | -4,81 | 0,1968 | -0,0142 | |||||

| FR WN1065 / ABS-MBS (US3132XFFF07) | 11,20 | 2,33 | 0,1890 | 0,0005 | |||||

| FN BL0863 / ABS-MBS (US3140HR5Z26) | 11,01 | 0,1857 | 0,1857 | ||||||

| US31418DXN73 / FN MA4284 | 10,96 | -4,51 | 0,1849 | -0,0127 | |||||

| FN BZ0750 / ABS-MBS (US3140NUZQ52) | 10,81 | 0,1823 | 0,1823 | ||||||

| FN BS3631 / ABS-MBS (US3140LEA989) | 10,81 | 0,1823 | 0,1823 | ||||||

| FN MA4285 / ABS-MBS (US31418DXP22) | 10,75 | -4,92 | 0,1814 | -0,0133 | |||||

| FN BZ2590 / ABS-MBS (US3140NW2Y02) | 10,51 | 2,72 | 0,1773 | 0,0011 | |||||

| US TREASURY N/B / DBT (US91282CKE02) | 10,11 | 0,1706 | 0,1706 | ||||||

| FR RD5070 / ABS-MBS (US3133LPT311) | 9,96 | -3,54 | 0,1681 | -0,0098 | |||||

| FR WN5229 / ABS-MBS (US3132XKY350) | 9,78 | 0,1650 | 0,1650 | ||||||

| FR WN5117 / ABS-MBS (US3132XKVK03) | 9,76 | 2,54 | 0,1647 | 0,0008 | |||||

| FR RD5055 / ABS-MBS (US3133LPTL12) | 9,41 | -4,51 | 0,1588 | -0,0109 | |||||

| FN MA4522 / ABS-MBS (US31418EAY68) | 8,77 | -3,65 | 0,1480 | -0,0088 | |||||

| FN AN6586 / ABS-MBS (US3138LKJ817) | 8,59 | 0,93 | 0,1448 | -0,0016 | |||||

| FN MA4200 / ABS-MBS (US31418DU264) | 8,28 | -4,72 | 0,1397 | -0,0099 | |||||

| FR RD5042 / ABS-MBS (US3133LPS735) | 7,98 | -4,26 | 0,1346 | -0,0089 | |||||

| FR WG0001 / ABS-MBS (US31425GAA40) | 7,94 | 2,35 | 0,1339 | 0,0004 | |||||

| FR WN5140 / ABS-MBS (US3132XKWA12) | 7,85 | 2,39 | 0,1325 | 0,0004 | |||||

| FN BS9882 / ABS-MBS (US3140LL6U09) | 6,85 | 2,06 | 0,1156 | 0,0000 | |||||

| US3133LPTH00 / FED HM LN PC POOL RD5052 FR 03/31 FIXED 1.5 | 6,84 | -4,28 | 0,1155 | -0,0076 | |||||

| FN BL5705 / ABS-MBS (US3140HXKT69) | 6,76 | 1,41 | 0,1141 | -0,0007 | |||||

| US3140HSM248 / Fannie Mae Pool | 6,72 | 2,33 | 0,1133 | 0,0003 | |||||

| FN FM5328 / ABS-MBS (US3140X84N42) | 5,98 | -4,76 | 0,1009 | -0,0072 | |||||

| US3133LPS818 / Freddie Mac Pool | 5,95 | -4,36 | 0,1004 | -0,0067 | |||||

| FN AM8441 / ABS-MBS (US3138L9LX89) | 5,85 | 0,33 | 0,0986 | -0,0017 | |||||

| FNA 2021-M7 A2 / ABS-MBS (US3136BFQZ93) | 5,77 | 0,0974 | 0,0974 | ||||||

| US3128MMWQ29 / Freddie Mac Gold Pool | 5,72 | -3,36 | 0,0965 | -0,0054 | |||||

| FN MA4201 / ABS-MBS (US31418DU348) | 5,69 | -4,63 | 0,0960 | -0,0067 | |||||

| FN AN4354 / ABS-MBS (US3138LGZU35) | 5,41 | 0,0912 | 0,0912 | ||||||

| FN BL6627 / ABS-MBS (US3140HYLH95) | 5,40 | 1,29 | 0,0912 | -0,0007 | |||||

| FN AN4860 / ABS-MBS (US3138LHMJ00) | 5,40 | 0,0911 | 0,0911 | ||||||

| FN AN2417 / ABS-MBS (US3138LEVK41) | 5,34 | 0,0901 | 0,0901 | ||||||

| US3136AY6X67 / FNA 17-M15 A2 (MF) FRN 09-25-27 | 5,23 | 0,0882 | 0,0882 | ||||||

| FN AN8051 / ABS-MBS (US3138LL5M38) | 5,19 | 0,0875 | 0,0875 | ||||||

| FN AN3933 / ABS-MBS (US3138LGLP95) | 5,12 | 0,0865 | 0,0865 | ||||||

| FN BZ2941 / ABS-MBS (US3140NXHT33) | 5,11 | 2,65 | 0,0862 | 0,0005 | |||||

| FN BK8111 / ABS-MBS (US3140HNAM45) | 4,93 | -5,06 | 0,0832 | -0,0062 | |||||

| FR WN5041 / ABS-MBS (US3132XKS733) | 4,92 | 2,37 | 0,0830 | 0,0003 | |||||

| FR WN5195 / ABS-MBS (US3132XKXZ53) | 4,76 | 0,0804 | 0,0804 | ||||||

| FHMR 2021-P007 A1 / ABS-MBS (US3137F92D25) | 4,43 | 2,14 | 0,0748 | 0,0001 | |||||

| FN BS9079 / ABS-MBS (US3140LLCR02) | 4,38 | 1,98 | 0,0739 | -0,0000 | |||||

| FN BZ3037 / ABS-MBS (US3140NXLT86) | 4,19 | 0,0707 | 0,0707 | ||||||

| FR WN5138 / ABS-MBS (US3132XKV877) | 4,07 | 2,57 | 0,0687 | 0,0003 | |||||

| FN BZ2911 / ABS-MBS (US3140NXGV97) | 4,06 | 0,0685 | 0,0685 | ||||||

| US3140HV4J03 / Federal National Mortgage Association, Inc. | 4,02 | 2,21 | 0,0677 | 0,0001 | |||||

| FN BL5369 / ABS-MBS (US3140HW6F45) | 3,65 | 0,77 | 0,0616 | -0,0008 | |||||

| FR WN2058 / ABS-MBS (US3132XGJC13) | 3,31 | 2,00 | 0,0559 | -0,0000 | |||||

| FR WN5153 / ABS-MBS (US3132XKWP80) | 3,28 | 0,0553 | 0,0553 | ||||||

| FN BL5364 / ABS-MBS (US3140HW6A57) | 3,13 | 0,81 | 0,0528 | -0,0007 | |||||

| FN BZ1030 / ABS-MBS (US3140NVEC78) | 3,09 | 0,0521 | 0,0521 | ||||||

| FR RD5077 / ABS-MBS (US3133LPUA38) | 3,02 | -3,39 | 0,0510 | -0,0029 | |||||

| FR RD5075 / ABS-MBS (US3133LPT808) | 2,95 | -3,41 | 0,0497 | -0,0028 | |||||

| US3128MMW740 / Freddie Mac Gold Pool | 2,94 | -3,61 | 0,0496 | -0,0029 | |||||

| US3138LFV622 / Fannie Mae Pool | 2,91 | 0,07 | 0,0490 | -0,0010 | |||||

| FN MA4476 / ABS-MBS (US31418D6N74) | 2,88 | -3,74 | 0,0486 | -0,0029 | |||||

| FN AN1613 / ABS-MBS (US3138LDYK31) | 2,87 | 0,0484 | 0,0484 | ||||||

| US 2YR NOTE (CBT) Jun25 / DIR (N/A) | 2,47 | 0,0416 | 0,0416 | ||||||

| US3128MFTS70 / Freddie Mac Gold Pool | 2,45 | -3,46 | 0,0414 | -0,0024 | |||||

| FN AN3270 / ABS-MBS (US3138LFT402) | 2,41 | 0,75 | 0,0407 | -0,0005 | |||||

| FR WA4438 / ABS-MBS (US3132XDBG77) | 2,16 | 2,13 | 0,0364 | 0,0000 | |||||

| US3137FKSH00 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K086, Class A2 | 2,09 | 1,96 | 0,0352 | -0,0000 | |||||

| FN BL5367 / ABS-MBS (US3140HW6D96) | 2,00 | 0,81 | 0,0337 | -0,0004 | |||||

| FN BZ2443 / ABS-MBS (US3140NWWD33) | 1,93 | 0,0326 | 0,0326 | ||||||

| FR WA4440 / ABS-MBS (US3132XDBJ17) | 1,77 | 2,14 | 0,0298 | 0,0000 | |||||

| US3136AX7E95 / FNA 17-M12 A2 (MF) FRN 06-25-27 | 1,62 | 0,0273 | 0,0273 | ||||||

| FR RD5081 / ABS-MBS (US3133LPUE59) | 1,56 | -3,10 | 0,0264 | -0,0014 | |||||

| FR RD5079 / ABS-MBS (US3133LPUC93) | 1,54 | -3,63 | 0,0260 | -0,0015 | |||||

| FN MA4530 / ABS-MBS (US31418EA835) | 1,53 | -2,92 | 0,0259 | -0,0013 | |||||

| FR WA4439 / ABS-MBS (US3132XDBH50) | 1,47 | 2,15 | 0,0248 | 0,0000 | |||||

| FN AN6611 / ABS-MBS (US3138LKKZ98) | 1,41 | 1,00 | 0,0238 | -0,0002 | |||||

| FR RD5067 / ABS-MBS (US3133LPTY33) | 1,36 | -4,02 | 0,0230 | -0,0015 | |||||

| US31418D4J80 / FANNIE MAE 1.5% due 09/01/2031 | 1,36 | -3,90 | 0,0229 | -0,0014 | |||||

| FR RD5065 / ABS-MBS (US3133LPTW76) | 1,34 | -3,82 | 0,0225 | -0,0014 | |||||

| US31418D3T71 / FNMA 10YR 1.5% 08/01/2031#MA4409 | 1,32 | -3,99 | 0,0223 | -0,0014 | |||||

| FR RD5062 / ABS-MBS (US3133LPTT48) | 1,31 | -3,89 | 0,0221 | -0,0014 | |||||

| US3133LPTQ09 / FEDERAL HOME LOAN MORTGAGE CORP | 1,26 | -3,81 | 0,0213 | -0,0013 | |||||

| FN MA4331 / ABS-MBS (US31418DY555) | 1,24 | -4,17 | 0,0210 | -0,0014 | |||||

| US3133LPTN77 / Freddie Mac Pool | 1,23 | -4,52 | 0,0207 | -0,0014 | |||||

| FN BS5957 / ABS-MBS (US3140LGTP77) | 1,16 | 2,65 | 0,0196 | 0,0001 | |||||

| FN AN1760 / ABS-MBS (US3138LD5W90) | 0,98 | 0,0166 | 0,0166 | ||||||

| FN MA4172 / ABS-MBS (US31418DT696) | 0,94 | -4,67 | 0,0158 | -0,0011 | |||||

| US3136AUG215 / FNMA ACES, Series 2017-M1, Class A2 | 0,74 | 0,0125 | 0,0125 | ||||||

| FN BJ3746 / ABS-MBS (US3140H5EU14) | 0,65 | -4,84 | 0,0110 | -0,0008 | |||||

| US31418CTC81 / Fannie Mae Pool | 0,21 | -2,84 | 0,0035 | -0,0002 | |||||

| US31418CRH96 / Fannie Mae Pool | 0,13 | -3,01 | 0,0022 | -0,0001 | |||||

| US3128MMW336 / Freddie Mac Gold Pool | 0,11 | -3,45 | 0,0019 | -0,0001 | |||||

| US3140H4J968 / FNMA 15YR 2.5% 12/01/2032#BJ2987 | 0,07 | -1,49 | 0,0011 | -0,0000 | |||||

| FSWP: OIS 3.206440 31-AUG-2029 SOF / DIR (N/A) | 0,07 | 0,0011 | 0,0011 | ||||||

| US3140H4N341 / FNMA 15YR 2.5% 11/01/2032#BJ3109 | 0,06 | 0,00 | 0,0010 | -0,0000 | |||||

| US3131XC3R67 / FHLG 15YR 2.5% 09/01/2032#ZK8908 | 0,04 | 0,00 | 0,0006 | -0,0000 | |||||

| US3140GYHU61 / FNMA 15YR 2.5% 01/01/2033#BH9242 | 0,02 | -6,25 | 0,0003 | -0,0000 | |||||

| US3140QBEW42 / FNMA 15YR 2.5% 12/32#CA3748 | 0,01 | 0,00 | 0,0002 | -0,0000 | |||||

| US3140H2B498 / FNMA 15YR 2.5% 11/01/2032#BJ0958 | 0,01 | 0,00 | 0,0002 | -0,0000 | |||||

| US3140FPMM82 / Fannie Mae Pool | 0,01 | 0,00 | 0,0001 | -0,0000 | |||||

| US3140FPM305 / FNMA 15YR 2.5% 02/01/2032#BE3977 | 0,01 | 0,00 | 0,0001 | -0,0000 | |||||

| US31307TT689 / FHLG 15YR 2.5% 04/32#J36873 | 0,01 | 0,00 | 0,0001 | -0,0000 | |||||

| US3138WJVE58 / FNMA 15YR 2.5% 02/01/2032#AS8712 | 0,01 | 0,00 | 0,0001 | -0,0000 | |||||

| US3140GNF575 / FANNIE MAE POOL UMBS P#BH0187 2.50000000 | 0,01 | 0,00 | 0,0001 | -0,0000 | |||||

| US31418CG737 / Fannie Mae Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US3138WJW207 / Fannie Mae Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US31307T3V11 / FHLG 15YR 2.5% 06/01/2032#J37112 | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US31418CGG33 / Fannie Mae Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US31307UP446 / FHLG 15YR 2.5% 09/01/2032#J37643 | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US3138WK6Q32 / FNMA 15YR 2.5% 06/01/2032#AS9878 | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US3128MMWU31 / Freddie Mac Gold Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US3140GV2P90 / UMBS, 15 Year | 0,00 | 0,00 | 0,0000 | -0,0000 | |||||

| US3140XKJM31 / FNMA 15YR 2.5% 01/01/2028#FS3867 | 0,00 | -100,00 | 0,0000 | -0,3411 | |||||

| FSWP: OIS 3.343380 31-MAR-2027 SOF / DIR (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| US LONG BOND(CBT) Jun25 / DIR (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| FSWP: OIS 3.433120 31-MAR-2027 SOF / DIR (N/A) | -0,08 | -0,0014 | -0,0014 | ||||||

| FSWP: OIS 3.622660 31-AUG-2029 SOF / DIR (N/A) | -0,09 | -0,0016 | -0,0016 | ||||||

| FSWP: OIS 3.494960 31-AUG-2029 SOF / DIR (N/A) | -0,10 | -0,0017 | -0,0017 | ||||||

| FSWP: OIS 3.38522 31-AUG-2029 SOF / DIR (N/A) | -0,13 | -0,0022 | -0,0022 | ||||||

| FSWP: OIS 3.799350 31-AUG-2029 SOF / DIR (N/A) | -0,14 | -0,0024 | -0,0024 | ||||||

| FSWP: OIS 3.533440 31-MAR-2027 SOF / DIR (N/A) | -0,18 | -0,0031 | -0,0031 | ||||||

| FSWP: OIS 3.925610 31-AUG-2029 SOF / DIR (N/A) | -0,37 | -0,0062 | -0,0062 | ||||||

| FSWP: OIS 4.087570 31-AUG-2029 SOF / DIR (N/A) | -0,46 | -0,0078 | -0,0078 | ||||||

| US 10YR NOTE (CBT)Jun25 / DIR (N/A) | -0,57 | -0,0096 | -0,0096 | ||||||

| FSWP: OIS 3.638830 31-AUG-2029 SOF / DIR (N/A) | -0,87 | -0,0147 | -0,0147 | ||||||

| US 5YR NOTE (CBT) Jun25 / DIR (N/A) | -1,14 | -0,0193 | -0,0193 |