Grundlæggende statistik

| Porteføljeværdi | $ 969.701.456 |

| Nuværende stillinger | 772 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

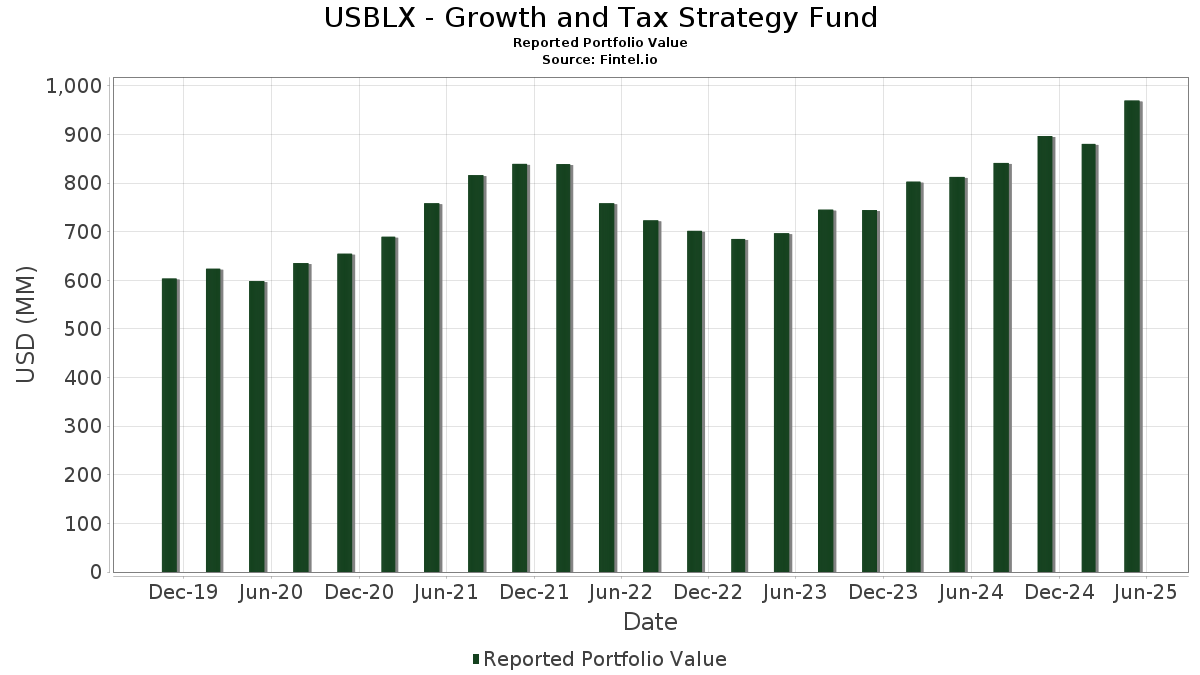

USBLX - Growth and Tax Strategy Fund har afsløret 772 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 969.701.456 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). USBLX - Growth and Tax Strategy Funds største beholdninger er NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . USBLX - Growth and Tax Strategy Funds nye stillinger omfatter University of California (US:US91412HPV95) , BURKE CNTY GA DEV AUTH POLL CONTROL REVENUE (US:US121342PQ61) , NEW YORK NY (US:US64966MU982) , APPLING COUNTY DEVELOPMENT AUTHORITY (US:US038315EV58) , and PORT OF PORT ARTHUR NAVIGATION DISTRICT (US:US735220AW56) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 10,00 | 1,2063 | 1,2063 | ||

| 6,71 | 0,8094 | 0,7054 | ||

| 0,07 | 32,92 | 3,9710 | 0,6796 | |

| 5,20 | 0,6273 | 0,6022 | ||

| 0,24 | 32,96 | 3,9759 | 0,4432 | |

| 3,09 | 0,3728 | 0,3728 | ||

| 3,09 | 0,3728 | 0,3728 | ||

| 2,62 | 0,3154 | 0,3154 | ||

| 2,62 | 0,3154 | 0,3154 | ||

| 2,38 | 0,2870 | 0,2870 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,40 | 0,1689 | -1,6427 | ||

| 5,70 | 0,6876 | -1,2678 | ||

| 0,15 | 29,38 | 3,5444 | -0,5576 | |

| 0,10 | 0,0121 | -0,5561 | ||

| 0,20 | 0,0241 | -0,3701 | ||

| 4,90 | 0,5911 | -0,2785 | ||

| 4,90 | 0,5911 | -0,2785 | ||

| 0,01 | 2,04 | 0,2456 | -0,2394 | |

| 5,30 | 0,6393 | -0,2302 | ||

| 5,30 | 0,6393 | -0,2302 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-07-25 for rapporteringsperioden 2025-05-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0,24 | 0,00 | 32,96 | 8,17 | 3,9759 | 0,4432 | |||

| MSFT / Microsoft Corporation | 0,07 | 0,00 | 32,92 | 15,97 | 3,9710 | 0,6796 | |||

| AAPL / Apple Inc. | 0,15 | 0,00 | 29,38 | -16,95 | 3,5444 | -0,5576 | |||

| AMZN / Amazon.com, Inc. | 0,08 | 0,00 | 15,67 | -3,43 | 1,8902 | 0,0090 | |||

| META / Meta Platforms, Inc. | 0,02 | 0,00 | 14,61 | -3,10 | 1,7620 | 0,0143 | |||

| US91412HPV95 / University of California | 10,00 | 1,2063 | 1,2063 | ||||||

| AVGO / Broadcom Inc. | 0,04 | 0,00 | 10,00 | 21,38 | 1,2060 | 0,2510 | |||

| GOOGL / Alphabet Inc. | 0,06 | 0,00 | 9,75 | 0,86 | 1,1763 | 0,0553 | |||

| GOOG / Alphabet Inc. | 0,05 | -0,05 | 9,17 | 0,32 | 1,1060 | 0,0463 | |||

| BRK.B / Berkshire Hathaway Inc. | 0,02 | 0,00 | 8,32 | -1,92 | 1,0034 | 0,0201 | |||

| JPM / JPMorgan Chase & Co. | 0,03 | -0,05 | 8,05 | -0,30 | 0,9710 | 0,0350 | |||

| US121342PQ61 / BURKE CNTY GA DEV AUTH POLL CONTROL REVENUE | 6,71 | 708,43 | 0,8094 | 0,7054 | |||||

| LLY / Eli Lilly and Company | 0,01 | -0,05 | 6,42 | -19,91 | 0,7749 | -0,1551 | |||

| NFLX / Netflix, Inc. | 0,01 | -0,06 | 6,16 | 23,05 | 0,7431 | 0,1626 | |||

| V / Visa Inc. | 0,02 | 0,00 | 6,03 | 0,68 | 0,7277 | 0,0330 | |||

| US64966MU982 / NEW YORK NY | 5,70 | -66,20 | 0,6876 | -1,2678 | |||||

| DEUTSCHE BANK SPEARS LIFERS TRUST / DBT (US25156SGV34) | 5,30 | -29,33 | 0,6393 | -0,2302 | |||||

| DEUTSCHE BANK SPEARS LIFERS TRUST / DBT (US25156SGV34) | 5,30 | -29,33 | 0,6393 | -0,2302 | |||||

| US038315EV58 / APPLING COUNTY DEVELOPMENT AUTHORITY | 5,20 | 2.500,00 | 0,6273 | 0,6022 | |||||

| MA / Mastercard Incorporated | 0,01 | 0,00 | 4,93 | 1,61 | 0,5949 | 0,0322 | |||

| DEUTSCHE BANK SPEARS LIFERS TRUST / DBT (US25156SGS05) | 4,90 | -34,67 | 0,5911 | -0,2785 | |||||

| DEUTSCHE BANK SPEARS LIFERS TRUST / DBT (US25156SGS05) | 4,90 | -34,67 | 0,5911 | -0,2785 | |||||

| US735220AW56 / PORT OF PORT ARTHUR NAVIGATION DISTRICT | 4,50 | 0,00 | 0,5428 | 0,0211 | |||||

| COST / Costco Wholesale Corporation | 0,00 | 0,00 | 4,28 | -0,79 | 0,5160 | 0,0160 | |||

| DEUTSCHE BANK SPEARS LIFERS TRUST / DBT (US25156SGE19) | 4,08 | -18,34 | 0,4916 | -0,0870 | |||||

| DEUTSCHE BANK SPEARS LIFERS TRUST / DBT (US25156SGE19) | 4,08 | -18,34 | 0,4916 | -0,0870 | |||||

| INDIANA FINANCE AUTHORITY / DBT (US45471CDQ87) | 3,96 | -5,81 | 0,4775 | -0,0098 | |||||

| WMT / Walmart Inc. | 0,04 | 0,00 | 3,88 | 0,10 | 0,4678 | 0,0187 | |||

| HD / The Home Depot, Inc. | 0,01 | -0,05 | 3,86 | -7,17 | 0,4653 | -0,0165 | |||

| US54660DAC39 / UOFL HEALTH INC KY 22A SF 5.0% 05-15-52 | 3,82 | -4,81 | 0,4610 | -0,0045 | |||||

| XOM / Exxon Mobil Corporation | 0,04 | -19,26 | 3,62 | -25,81 | 0,4362 | -0,1289 | |||

| BAC / Bank of America Corporation | 0,08 | -0,05 | 3,56 | -4,33 | 0,4294 | -0,0020 | |||

| ALABAMA HOUSING FINANCE AUTHORITY / DBT (US01030RMP46) | 3,29 | -3,41 | 0,3970 | 0,0020 | |||||

| ALABAMA HOUSING FINANCE AUTHORITY / DBT (US01030RMP46) | 3,29 | -3,41 | 0,3970 | 0,0020 | |||||

| US952347RY05 / WEST CONTRA COSTA UNIFIED SCHOOL DISTRICT | 3,12 | -5,97 | 0,3760 | -0,0083 | |||||

| COUNTY OF FORT BEND TX TOLL ROAD REVENUE / DBT (US346817FU82) | 3,09 | 0,3728 | 0,3728 | ||||||

| COUNTY OF FORT BEND TX TOLL ROAD REVENUE / DBT (US346817FU82) | 3,09 | 0,3728 | 0,3728 | ||||||

| ORCL / Oracle Corporation | 0,02 | -0,05 | 3,08 | -0,36 | 0,3711 | 0,0131 | |||

| ORANGE COUNTY HEALTH FACILITIES AUTHORITY / DBT (US68450LJQ95) | 3,03 | -5,01 | 0,3657 | -0,0043 | |||||

| ORANGE COUNTY HEALTH FACILITIES AUTHORITY / DBT (US68450LJQ95) | 3,03 | -5,01 | 0,3657 | -0,0043 | |||||

| KENTUCKY MUNICIPAL ENERGY AGENCY / DBT (US491499AT63) | 3,03 | -4,66 | 0,3653 | -0,0030 | |||||

| KENTUCKY MUNICIPAL ENERGY AGENCY / DBT (US491499AT63) | 3,03 | -4,66 | 0,3653 | -0,0030 | |||||

| ABBV / AbbVie Inc. | 0,02 | 0,00 | 3,01 | -10,98 | 0,3630 | -0,0289 | |||

| VILLAGE OF SYLVAN BEACH NY / DBT (US871336DY63) | 3,00 | -0,20 | 0,3619 | 0,0134 | |||||

| VILLAGE OF SYLVAN BEACH NY / DBT (US871336DY63) | 3,00 | -0,20 | 0,3619 | 0,0134 | |||||

| US167505YB63 / CHICAGO IL BOE 5% 12/1/2047 | 2,95 | -6,18 | 0,3554 | -0,0087 | |||||

| VOLUSIA COUNTY EDUCATIONAL FACILITY AUTHORITY / DBT (US928836NZ48) | 2,94 | -5,56 | 0,3544 | -0,0062 | |||||

| VOLUSIA COUNTY EDUCATIONAL FACILITY AUTHORITY / DBT (US928836NZ48) | 2,94 | -5,56 | 0,3544 | -0,0062 | |||||

| OHIO HOUSING FINANCE AGENCY / DBT (US67756UCJ51) | 2,93 | -3,30 | 0,3533 | 0,0021 | |||||

| US187145SB40 / Clifton Higher Education Finance Corp., Series 2023 | 2,92 | -9,21 | 0,3521 | -0,0207 | |||||

| ILLINOIS HOUSING DEVELOPMENT AUTHORITY / DBT (US45203MF480) | 2,92 | -0,92 | 0,3519 | 0,0105 | |||||

| ILLINOIS HOUSING DEVELOPMENT AUTHORITY / DBT (US45203MF480) | 2,92 | -0,92 | 0,3519 | 0,0105 | |||||

| MISSOURI HOUSING DEVELOPMENT COMMISSION / DBT (US60637GGR48) | 2,91 | -3,48 | 0,3510 | 0,0015 | |||||

| US87638TGQ04 / TARRANT CNTY TX CULTURAL EDU FACS FIN CORP REVENUE | 2,90 | -4,70 | 0,3498 | -0,0030 | |||||

| ALASKA HOUSING FINANCE CORP / DBT (US01170RSS21) | 2,85 | -5,06 | 0,3440 | -0,0043 | |||||

| ALASKA HOUSING FINANCE CORP / DBT (US01170RSS21) | 2,85 | -5,06 | 0,3440 | -0,0043 | |||||

| GE / General Electric Company | 0,01 | -0,05 | 2,79 | 18,76 | 0,3361 | 0,0641 | |||

| FLORIDA HOUSING FINANCE CORP / DBT (US34074NBD03) | 2,76 | -8,49 | 0,3328 | -0,0168 | |||||

| FLORIDA HOUSING FINANCE CORP / DBT (US34074NBD03) | 2,76 | -8,49 | 0,3328 | -0,0168 | |||||

| WISCONSIN HEALTH EDUCATIONAL FACILITIES AUTHORIT / DBT (US97712JMU42) | 2,75 | -4,84 | 0,3320 | -0,0033 | |||||

| WISCONSIN HEALTH EDUCATIONAL FACILITIES AUTHORIT / DBT (US97712JMU42) | 2,75 | -4,84 | 0,3320 | -0,0033 | |||||

| PG / The Procter & Gamble Company | 0,02 | -0,06 | 2,75 | -2,31 | 0,3316 | 0,0053 | |||

| US956622W345 / WEST VIRGINIA ST HOSP FIN AUTH | 2,73 | -6,95 | 0,3294 | -0,0109 | |||||

| US880397CF98 / Tennergy Corp. | 2,64 | -1,64 | 0,3187 | 0,0073 | |||||

| WFC / Wells Fargo & Company | 0,03 | -0,05 | 2,62 | -4,56 | 0,3155 | -0,0023 | |||

| HEALTH EDUCATIONAL FACILITIES AUTHORITY OF THE S / DBT (US60637AXL15) | 2,62 | 0,3154 | 0,3154 | ||||||

| HEALTH EDUCATIONAL FACILITIES AUTHORITY OF THE S / DBT (US60637AXL15) | 2,62 | 0,3154 | 0,3154 | ||||||

| MARYLAND HEALTH HIGHER EDUCATIONAL FACILITIES AU / DBT (US57421CGZ14) | 2,50 | -4,58 | 0,3016 | -0,0022 | |||||

| MARYLAND HEALTH HIGHER EDUCATIONAL FACILITIES AU / DBT (US57421CGZ14) | 2,50 | -4,58 | 0,3016 | -0,0022 | |||||

| US91754TQ636 / UTAH CHARTER SCHOOL FINANCE AUTHORITY | 2,46 | -6,15 | 0,2962 | -0,0071 | |||||

| US592250DM38 / Metropolitan Pier & Exposition Authority | 2,43 | -5,27 | 0,2927 | -0,0043 | |||||

| US778260FN46 / Ross County, Ohio, Hospital Facilities Revenue Bonds, Adena Health System Obligated Group Project, Refunding & Improvement Series 2019 | 2,39 | -1,97 | 0,2884 | 0,0056 | |||||

| CITY OF CHICAGO IL / DBT (US167486T254) | 2,39 | -5,77 | 0,2877 | -0,0058 | |||||

| CITY OF CHICAGO IL / DBT (US167486T254) | 2,39 | -5,77 | 0,2877 | -0,0058 | |||||

| PALM BEACH COUNTY HEALTH FACILITIES AUTHORITY / DBT (US69650MBB46) | 2,38 | 0,2870 | 0,2870 | ||||||

| PALM BEACH COUNTY HEALTH FACILITIES AUTHORITY / DBT (US69650MBB46) | 2,38 | 0,2870 | 0,2870 | ||||||

| INDIANA HOUSING COMMUNITY DEVELOPMENT AUTHORITY / DBT (US45505T6M87) | 2,38 | -5,04 | 0,2867 | -0,0035 | |||||

| INDIANA HOUSING COMMUNITY DEVELOPMENT AUTHORITY / DBT (US45505T6M87) | 2,38 | -5,04 | 0,2867 | -0,0035 | |||||

| US66353RCG74 / NORTHAMPTON CNTY PA GEN PURPOSE AUTH HOSP REVENUE | 2,36 | -6,56 | 0,2852 | -0,0082 | |||||

| BKNG / Booking Holdings Inc. | 0,00 | 0,00 | 2,30 | 10,02 | 0,2769 | 0,0350 | |||

| US4521526X47 / ILLINOIS ST | 2,30 | -2,88 | 0,2769 | 0,0028 | |||||

| MCD / McDonald's Corporation | 0,01 | 0,00 | 2,24 | 1,81 | 0,2707 | 0,0151 | |||

| EAST MONTGOMERY COUNTY IMPROVEMENT DISTRICT SALES / DBT (US273735DX52) | 2,24 | -8,67 | 0,2706 | -0,0142 | |||||

| LIN / Linde plc | 0,00 | 0,00 | 2,21 | 0,14 | 0,2666 | 0,0106 | |||

| WALKER COUNTY BOARD OF EDUCATION AL / DBT (US93154DAU46) | 2,21 | -9,83 | 0,2666 | -0,0176 | |||||

| WALKER COUNTY BOARD OF EDUCATION AL / DBT (US93154DAU46) | 2,21 | -9,83 | 0,2666 | -0,0176 | |||||

| US64577BL690 / NEW JERSEY ST ECON DEV AUTH REVENUE | 2,08 | -0,76 | 0,2515 | 0,0079 | |||||

| US56035DFT46 / MAIN STREET NATURAL GAS INC GA GAS SUPPLY REVENUE | 2,08 | -1,14 | 0,2514 | 0,0070 | |||||

| US154871CU94 / Central Plains Energy Project | 2,07 | -1,43 | 0,2502 | 0,0062 | |||||

| JNJ / Johnson & Johnson | 0,01 | -7,77 | 2,06 | -13,25 | 0,2488 | -0,0269 | |||

| UNH / UnitedHealth Group Incorporated | 0,01 | -23,44 | 2,04 | -51,34 | 0,2456 | -0,2394 | |||

| US594479JQ13 / MICHIGAN FINANCE AUTHORITY | 2,03 | -2,78 | 0,2450 | 0,0029 | |||||

| MARYLAND HEALTH HIGHER EDUCATIONAL FACILITIES AU / DBT (US57421CHU18) | 2,03 | -5,63 | 0,2449 | -0,0045 | |||||

| MARYLAND HEALTH HIGHER EDUCATIONAL FACILITIES AU / DBT (US57421CHU18) | 2,03 | -5,63 | 0,2449 | -0,0045 | |||||

| ABT / Abbott Laboratories | 0,02 | 0,00 | 2,01 | -3,23 | 0,2426 | 0,0017 | |||

| US216662AT32 / Cooper Green Mercy Health Services Authority | 2,01 | -4,65 | 0,2422 | -0,0020 | |||||

| US82652UAF93 / SIERRA VISTA INDUSTRIAL DEVELOPMENT AUTHORITY | 2,01 | -1,47 | 0,2420 | 0,0059 | |||||

| MOUNT VERNON NY CITY SCH DIST / DBT (US623606E976) | 2,00 | -0,25 | 0,2412 | 0,0088 | |||||

| MOUNT VERNON NY CITY SCH DIST / DBT (US623606E976) | 2,00 | -0,25 | 0,2412 | 0,0088 | |||||

| CSCO / Cisco Systems, Inc. | 0,03 | 0,00 | 1,99 | -1,68 | 0,2396 | 0,0054 | |||

| LEE COUNTY INDUSTRIAL DEVELOPMENT AUTHORITY FL / DBT (US52349EEQ98) | 1,96 | -5,08 | 0,2367 | -0,0030 | |||||

| LEE COUNTY INDUSTRIAL DEVELOPMENT AUTHORITY FL / DBT (US52349EEQ98) | 1,96 | -5,08 | 0,2367 | -0,0030 | |||||

| GEORGIA HOUSING FINANCE AUTHORITY / DBT (US37353PPV57) | 1,95 | -3,28 | 0,2348 | 0,0015 | |||||

| GEORGIA HOUSING FINANCE AUTHORITY / DBT (US37353PPV57) | 1,95 | -3,28 | 0,2348 | 0,0015 | |||||

| US01728A4A18 / Allegheny (County of), PA Hospital Development Authority (Allegheny Health Network Obligated Group Issue), Series 2018 A, Ref. RB | 1,94 | -4,01 | 0,2339 | -0,0003 | |||||

| PENNSYLVANIA HOUSING FINANCE AGENCY / DBT (US70879QN829) | 1,93 | 0,2333 | 0,2333 | ||||||

| PENNSYLVANIA HOUSING FINANCE AGENCY / DBT (US70879QN829) | 1,93 | 0,2333 | 0,2333 | ||||||

| INTU / Intuit Inc. | 0,00 | 0,00 | 1,92 | 22,78 | 0,2315 | 0,0502 | |||

| US130179UR39 / California Educational Facilities Authority | 1,91 | -4,30 | 0,2309 | -0,0010 | |||||

| MS / Morgan Stanley | 0,01 | -0,05 | 1,90 | -3,89 | 0,2295 | 0,0001 | |||

| US74443DHH70 / PUBLIC FIN AUTH WI EDUCTNL FAC REVENUE | 1,90 | -4,52 | 0,2293 | -0,0015 | |||||

| RHODE ISLAND HOUSING MORTGAGE FINANCE CORP / DBT (US76221SHL88) | 1,90 | -5,14 | 0,2291 | -0,0031 | |||||

| RHODE ISLAND HOUSING MORTGAGE FINANCE CORP / DBT (US76221SHL88) | 1,90 | -5,14 | 0,2291 | -0,0031 | |||||

| AXP / American Express Company | 0,01 | -0,05 | 1,88 | -2,33 | 0,2272 | 0,0036 | |||

| NORTH CAROLINA MEDICAL CARE COMMISSION / DBT (US65820YTE67) | 1,86 | -6,86 | 0,2246 | -0,0071 | |||||

| NORTH CAROLINA MEDICAL CARE COMMISSION / DBT (US65820YTE67) | 1,86 | -6,86 | 0,2246 | -0,0071 | |||||

| GS / The Goldman Sachs Group, Inc. | 0,00 | 0,00 | 1,86 | -3,53 | 0,2242 | 0,0009 | |||

| MAINE STATE HOUSING AUTHORITY / DBT (US56052FT706) | 1,85 | -7,64 | 0,2232 | -0,0091 | |||||

| MAINE STATE HOUSING AUTHORITY / DBT (US56052FT706) | 1,85 | -7,64 | 0,2232 | -0,0091 | |||||

| EP CIMARRON VENTANAS PFC / DBT (US26879QAN51) | 1,85 | -5,91 | 0,2227 | -0,0048 | |||||

| EP CIMARRON VENTANAS PFC / DBT (US26879QAN51) | 1,85 | -5,91 | 0,2227 | -0,0048 | |||||

| ADBE / Adobe Inc. | 0,00 | -2,63 | 1,84 | -7,81 | 0,2222 | -0,0095 | |||

| US167505TK28 / Chicago (City of), IL Board of Education, Series 2017 H, GO Bonds | 1,84 | -6,64 | 0,2222 | -0,0065 | |||||

| NEW MEXICO MORTGAGE FINANCE AUTHORITY / DBT (US6472012N10) | 1,83 | -6,05 | 0,2209 | -0,0051 | |||||

| NEW MEXICO MORTGAGE FINANCE AUTHORITY / DBT (US6472012N10) | 1,83 | -6,05 | 0,2209 | -0,0051 | |||||

| AMD / Advanced Micro Devices, Inc. | 0,02 | 0,00 | 1,81 | 10,90 | 0,2186 | 0,0291 | |||

| US87638RGY71 / Tarrant County Cultural Education Facilities Finance Corp | 1,81 | -4,80 | 0,2178 | -0,0021 | |||||

| CAT / Caterpillar Inc. | 0,01 | -0,06 | 1,80 | 1,18 | 0,2171 | 0,0108 | |||

| MARYLAND ECONOMIC DEVELOPMENT CORP / DBT (US57405EAL48) | 1,80 | 0,2168 | 0,2168 | ||||||

| MARYLAND ECONOMIC DEVELOPMENT CORP / DBT (US57405EAL48) | 1,80 | 0,2168 | 0,2168 | ||||||

| BARBERS HILL INDEPENDENT SCHOOL DISTRICT / DBT (US067167D941) | 1,80 | -9,52 | 0,2167 | -0,0136 | |||||

| BARBERS HILL INDEPENDENT SCHOOL DISTRICT / DBT (US067167D941) | 1,80 | -9,52 | 0,2167 | -0,0136 | |||||

| US24918TAR86 / DENVER CO HLTH & HOSP AUTH COPS | 1,79 | -5,54 | 0,2160 | -0,0038 | |||||

| PM / Philip Morris International Inc. | 0,01 | 0,00 | 1,78 | 16,31 | 0,2152 | 0,0373 | |||

| LOS ANGELES HOUSING AUTHORITY / DBT (US544562DN80) | 1,77 | -7,23 | 0,2139 | -0,0076 | |||||

| LOS ANGELES HOUSING AUTHORITY / DBT (US544562DN80) | 1,77 | -7,23 | 0,2139 | -0,0076 | |||||

| ISRG / Intuitive Surgical, Inc. | 0,00 | 0,00 | 1,74 | -3,65 | 0,2105 | 0,0006 | |||

| QCOM / QUALCOMM Incorporated | 0,01 | -0,05 | 1,74 | -7,64 | 0,2100 | -0,0086 | |||

| ACN / Accenture plc | 0,01 | 0,00 | 1,74 | -9,05 | 0,2097 | -0,0120 | |||

| NOW / ServiceNow, Inc. | 0,00 | 0,00 | 1,73 | 8,79 | 0,2091 | 0,0243 | |||

| US531127CM87 / New York Liberty Development Corp. (Goldman Sachs Headquarters), Series 2007, RB | 1,71 | -5,27 | 0,2059 | -0,0031 | |||||

| SPGI / S&P Global Inc. | 0,00 | -0,06 | 1,69 | -3,99 | 0,2035 | -0,0002 | |||

| DE / Deere & Company | 0,00 | -0,06 | 1,69 | 5,24 | 0,2034 | 0,0176 | |||

| KO / The Coca-Cola Company | 0,02 | 0,00 | 1,68 | 1,20 | 0,2030 | 0,0103 | |||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE DISTRICT / DBT (US84136HBT95) | 1,66 | -2,99 | 0,2000 | 0,0019 | |||||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE DISTRICT / DBT (US84136HBT95) | 1,66 | -2,99 | 0,2000 | 0,0019 | |||||

| CRM / Salesforce, Inc. | 0,01 | 0,00 | 1,65 | -10,90 | 0,1992 | -0,0157 | |||

| LOW / Lowe's Companies, Inc. | 0,01 | -0,06 | 1,63 | -9,25 | 0,1965 | -0,0117 | |||

| TXN / Texas Instruments Incorporated | 0,01 | 0,00 | 1,62 | -6,70 | 0,1950 | -0,0059 | |||

| US20772KGE38 / Connecticut (State of), Series 2019 A, RB | 1,58 | -2,17 | 0,1903 | 0,0033 | |||||

| AMAT / Applied Materials, Inc. | 0,01 | -0,05 | 1,57 | -0,88 | 0,1895 | 0,0057 | |||

| COF / Capital One Financial Corporation | 0,01 | 72,79 | 1,56 | 63,05 | 0,1885 | 0,0773 | |||

| NEW YORK STATE DORMITORY AUTHORITY / DBT (US65000B7Y87) | 1,56 | -4,47 | 0,1882 | -0,0011 | |||||

| NEW YORK STATE DORMITORY AUTHORITY / DBT (US65000B7Y87) | 1,56 | -4,47 | 0,1882 | -0,0011 | |||||

| COUNTY OF MIAMI DADE FL AVIATION REVENUE / DBT (US593340AD40) | 1,56 | -3,59 | 0,1881 | 0,0005 | |||||

| COUNTY OF MIAMI DADE FL AVIATION REVENUE / DBT (US593340AD40) | 1,56 | -3,59 | 0,1881 | 0,0005 | |||||

| PGR / The Progressive Corporation | 0,01 | 0,00 | 1,55 | 1,04 | 0,1868 | 0,0091 | |||

| DIS / The Walt Disney Company | 0,01 | 0,00 | 1,54 | -0,65 | 0,1857 | 0,0060 | |||

| US45204FPV12 / ILLINOIS ST FIN AUTH REVENUE | 1,54 | -7,07 | 0,1857 | -0,0064 | |||||

| US755638ZH92 / Reading School District, Series 2017, Ref. GO Bonds | 1,53 | -1,04 | 0,1844 | 0,0054 | |||||

| US396649EV32 / Greeneville Health and Educational Facilities Board, Tennessee, Hospital Revenue Bonds, Ballad Health, Series 2018A | 1,52 | -1,87 | 0,1836 | 0,0038 | |||||

| US63608SAM44 / NATIONAL FIN AUTH NH SENIOR LIVING REVENUE | 1,52 | -6,92 | 0,1834 | -0,0060 | |||||

| US520134FU62 / Lawrence, Kansas, Hospital Revenue Bonds, Lawrence Memorial Hospital, Series 2018A | 1,50 | -1,70 | 0,1811 | 0,0040 | |||||

| NORTH CAROLINA MEDICAL CARE COMMISSION / DBT (US65820YSY31) | 1,50 | -2,15 | 0,1810 | 0,0032 | |||||

| NORTH CAROLINA MEDICAL CARE COMMISSION / DBT (US65820YSY31) | 1,50 | -2,15 | 0,1810 | 0,0032 | |||||

| US57584YQJ19 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 1,50 | -3,98 | 0,1806 | -0,0001 | |||||

| US123592DR59 / BUTLER CNTY PA HOSP AUTH | 1,50 | -5,73 | 0,1805 | -0,0036 | |||||

| US67756DZV18 / JOHN CARROLL UNIV OH SF 4.0% 10-01-52 | 1,48 | -9,15 | 0,1786 | -0,0103 | |||||

| US517732DS94 / LAS VEGAS REDEVELOPMENT AGENCY | 1,47 | -2,79 | 0,1768 | 0,0020 | |||||

| US764791BB42 / RICHMOND HOSPITAL AUTHORITY | 1,46 | -2,67 | 0,1761 | 0,0022 | |||||

| US74439YET47 / Public Finance Authority | 1,45 | -8,58 | 0,1750 | -0,0090 | |||||

| CONNECTICUT HOUSING FINANCE AUTHORITY / DBT (US20775H4T77) | 1,45 | -3,98 | 0,1744 | -0,0002 | |||||

| CONNECTICUT HOUSING FINANCE AUTHORITY / DBT (US20775H4T77) | 1,45 | -3,98 | 0,1744 | -0,0002 | |||||

| STATE OF NEW YORK MORTGAGE AGENCY HOMEOWNER MORTGA / DBT (US64988YF511) | 1,44 | -4,12 | 0,1742 | -0,0004 | |||||

| STATE OF NEW YORK MORTGAGE AGENCY HOMEOWNER MORTGA / DBT (US64988YF511) | 1,44 | -4,12 | 0,1742 | -0,0004 | |||||

| US65820YQG43 / NORTH CAROLINA MEDICAL CARE COMMISSION | 1,44 | -5,01 | 0,1738 | -0,0020 | |||||

| PENNSYLVANIA HOUSING FINANCE AGENCY / DBT (US70879QC434) | 1,44 | -4,57 | 0,1738 | -0,0012 | |||||

| PENNSYLVANIA HOUSING FINANCE AGENCY / DBT (US70879QC434) | 1,44 | -4,57 | 0,1738 | -0,0012 | |||||

| UNP / Union Pacific Corporation | 0,01 | -9,44 | 1,43 | -18,62 | 0,1724 | -0,0312 | |||

| US517704EU28 / LAS VEGAS CONVENTION & VISITORS AUTHORITY | 1,42 | -8,42 | 0,1718 | -0,0086 | |||||

| US88256HBC16 / TEXAS ST MUNI GAS ACQUISITION& SPLY CORP III GAS SPLY REVEN | 1,41 | -0,98 | 0,1702 | 0,0050 | |||||

| US592041WH69 / Nashville (City of) & Davidson (County of), TN Metropolitan Government Health & Educational Facilities Board (The) (Vanderbilt University Medical Cent | 1,41 | -4,29 | 0,1697 | -0,0007 | |||||

| LEHIGH COUNTY GENERAL PURPOSE AUTHORITY / DBT (US52480RGN44) | 1,40 | -6,35 | 0,1690 | -0,0045 | |||||

| LEHIGH COUNTY GENERAL PURPOSE AUTHORITY / DBT (US52480RGN44) | 1,40 | -6,35 | 0,1690 | -0,0045 | |||||

| US64972GZW76 / NYC WTR VAR 6/15/2033 | 1,40 | -91,04 | 0,1689 | -1,6427 | |||||

| US74443DEX57 / PUBLIC FIN AUTH WI EDUCTNL FAC REVENUE | 1,39 | -7,15 | 0,1678 | -0,0059 | |||||

| ETN / Eaton Corporation plc | 0,00 | -0,05 | 1,38 | 9,17 | 0,1666 | 0,0198 | |||

| TMO / Thermo Fisher Scientific Inc. | 0,00 | -8,77 | 1,37 | -30,53 | 0,1647 | -0,0632 | |||

| AMGN / Amgen Inc. | 0,00 | 0,00 | 1,36 | -6,42 | 0,1635 | -0,0045 | |||

| RTX / RTX Corporation | 0,01 | 0,00 | 1,35 | 2,67 | 0,1625 | 0,0103 | |||

| GEV / GE Vernova Inc. | 0,00 | 0,00 | 1,34 | 41,20 | 0,1617 | 0,0516 | |||

| US138010YP25 / CANON MCMILLAN PA SCH DIST | 1,33 | -7,72 | 0,1601 | -0,0066 | |||||

| COUNTY OF HAMILTON OH / DBT (US4072722W28) | 1,33 | 0,1599 | 0,1599 | ||||||

| COUNTY OF HAMILTON OH / DBT (US4072722W28) | 1,33 | 0,1599 | 0,1599 | ||||||

| KENTUCKY PUBLIC ENERGY AUTHORITY / DBT (US74440DFC39) | 1,32 | -2,08 | 0,1588 | 0,0029 | |||||

| KENTUCKY PUBLIC ENERGY AUTHORITY / DBT (US74440DFC39) | 1,32 | -2,08 | 0,1588 | 0,0029 | |||||

| ADP / Automatic Data Processing, Inc. | 0,00 | 0,00 | 1,32 | 3,30 | 0,1586 | 0,0110 | |||

| US71885FEJ21 / PHOENIX AZ INDL DEV AUTH EDU REVENUE | 1,30 | 2,20 | 0,1568 | 0,0093 | |||||

| BSX / Boston Scientific Corporation | 0,01 | 0,00 | 1,29 | 1,41 | 0,1562 | 0,0082 | |||

| US04184HAP73 / CITY OF ARLINGTON TX | 1,29 | -8,62 | 0,1561 | -0,0081 | |||||

| LRCX / Lam Research Corporation | 0,02 | -0,05 | 1,29 | 5,23 | 0,1553 | 0,0134 | |||

| SYK / Stryker Corporation | 0,00 | 0,00 | 1,29 | -0,85 | 0,1551 | 0,0046 | |||

| US187155BR63 / CLIFTON HIGHER EDUCATION FINANCE CORP | 1,27 | -12,40 | 0,1535 | -0,0149 | |||||

| US70917TEA51 / Pennsylvania Higher Educational Facilities Authority | 1,27 | -6,49 | 0,1529 | -0,0042 | |||||

| TJX / The TJX Companies, Inc. | 0,01 | 0,00 | 1,27 | 1,77 | 0,1529 | 0,0084 | |||

| US533883NE01 / LINCOLN CONSOLIDATED SCHOOL DISTRICT | 1,26 | -0,63 | 0,1526 | 0,0051 | |||||

| MARYLAND HEALTH HIGHER EDUCATIONAL FACILITIES AU / DBT (US57421CGJ71) | 1,26 | -4,19 | 0,1518 | -0,0006 | |||||

| MARYLAND HEALTH HIGHER EDUCATIONAL FACILITIES AU / DBT (US57421CGJ71) | 1,26 | -4,19 | 0,1518 | -0,0006 | |||||

| CITY OF DUNKIRK NY / DBT (US265543SW96) | 1,25 | -0,40 | 0,1509 | 0,0054 | |||||

| CITY OF DUNKIRK NY / DBT (US265543SW96) | 1,25 | -0,40 | 0,1509 | 0,0054 | |||||

| US57584YPF06 / MA GENERAL BRIGHAM 19T-1 (144A/QIB) SF (MPT) FRN 07-01-49/01-29-26 | 1,25 | 0,24 | 0,1505 | 0,0062 | |||||

| US57421CEV28 / Maryland Health & Higher Educational Facilities Authority | 1,24 | -5,11 | 0,1502 | -0,0019 | |||||

| US850592CF11 / SANGAMON COUNTY WATER RECLAMATION DISTRICT | 1,24 | -0,96 | 0,1490 | 0,0044 | |||||

| US982674KF96 / Wyandotte (County of) & Kansas City (City of), KS Unified Government, Series 2014 A, RB | 1,23 | -1,36 | 0,1488 | 0,0038 | |||||

| US14054CDF32 / Capital Trust Agency Inc | 1,23 | -5,91 | 0,1479 | -0,0032 | |||||

| IOWA FINANCE AUTHORITY / DBT (US46247EEP60) | 1,22 | -3,78 | 0,1475 | 0,0001 | |||||

| IOWA FINANCE AUTHORITY / DBT (US46247EEP60) | 1,22 | -3,78 | 0,1475 | 0,0001 | |||||

| TT / Trane Technologies plc | 0,00 | -0,04 | 1,21 | 21,59 | 0,1454 | 0,0305 | |||

| US34061UKP20 / FL DEV FIN CORP 22A SF 5.0% 06-15-52 | 1,20 | -4,32 | 0,1444 | -0,0007 | |||||

| TSLA / Tesla, Inc. | 0,00 | 0,00 | 1,19 | 18,25 | 0,1432 | 0,0268 | |||

| US56681NGT81 / Maricopa County Industrial Development Authority | 1,18 | -6,33 | 0,1427 | -0,0038 | |||||

| MASSACHUSETTS HOUSING FINANCE AGENCY / DBT (US57587GV696) | 1,18 | 0,1424 | 0,1424 | ||||||

| MASSACHUSETTS HOUSING FINANCE AGENCY / DBT (US57587GV696) | 1,18 | 0,1424 | 0,1424 | ||||||

| MRK / Merck & Co., Inc. | 0,02 | -10,81 | 1,18 | -25,76 | 0,1420 | -0,0417 | |||

| US791078EX24 / St. Lawrence County Industrial Development Agency, Series 2022 | 1,18 | -6,00 | 0,1419 | -0,0032 | |||||

| KLAC / KLA Corporation | 0,00 | -0,06 | 1,18 | 6,72 | 0,1419 | 0,0141 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0,01 | 0,00 | 1,18 | -1,76 | 0,1418 | 0,0031 | |||

| US57584YL648 / FX.RT. MUNI BOND | 1,18 | -3,13 | 0,1417 | 0,0010 | |||||

| US38546WDS61 / GRAND FORKS ND HLTH CARE SYS R CITY OF GRAND FORKS ND | 1,17 | -5,32 | 0,1417 | -0,0022 | |||||

| US732203BE30 / City of Pompano Beach | 1,16 | -7,26 | 0,1402 | -0,0052 | |||||

| US60637AJL70 / HEALTH & EDUCATIONAL FACILITIES AUTHORITY OF THE S | 1,15 | -6,49 | 0,1391 | -0,0039 | |||||

| SAN ANTONIO EDUCATION FACILITIES CORP / DBT (US796247EY69) | 1,15 | 0,1384 | 0,1384 | ||||||

| SAN ANTONIO EDUCATION FACILITIES CORP / DBT (US796247EY69) | 1,15 | 0,1384 | 0,1384 | ||||||

| US57584YW215 / Massachusetts Development Finance Agency | 1,14 | -8,32 | 0,1370 | -0,0066 | |||||

| US794458EY19 / Salem Hospital Facility Authority | 1,13 | -7,17 | 0,1359 | -0,0048 | |||||

| US64613CCK27 / New Jersey Transportation Trust Fund Authority, Series 2022, RB | 1,12 | -2,95 | 0,1352 | 0,0013 | |||||

| US34061UJN90 / Florida Development Finance Corp | 1,12 | -5,66 | 0,1346 | -0,0026 | |||||

| NEW HOPE CULTURAL EDUCATION FACILITIES FINANCE COR / DBT (US64542UHB35) | 1,11 | -9,31 | 0,1341 | -0,0080 | |||||

| NEW HOPE CULTURAL EDUCATION FACILITIES FINANCE COR / DBT (US64542UHB35) | 1,11 | -9,31 | 0,1341 | -0,0080 | |||||

| COP / ConocoPhillips | 0,01 | -21,91 | 1,11 | -32,77 | 0,1337 | -0,0575 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0,00 | 0,00 | 1,10 | -7,91 | 0,1322 | -0,0057 | |||

| CEG / Constellation Energy Corporation | 0,00 | -0,06 | 1,09 | 22,12 | 0,1320 | 0,0281 | |||

| BLK / BlackRock, Inc. | 0,00 | 0,00 | 1,09 | 0,18 | 0,1319 | 0,0054 | |||

| US57584YSJ90 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 1,08 | -1,28 | 0,1302 | 0,0035 | |||||

| ORLY / O'Reilly Automotive, Inc. | 0,00 | -0,13 | 1,05 | -0,57 | 0,1272 | 0,0042 | |||

| US09182TCR68 / Black Belt Energy Gas District, Series 2023 D-1 | 1,05 | -1,13 | 0,1267 | 0,0035 | |||||

| US19648FPY42 / COLORADO ST HLTH FACS AUTH HOSP REVENUE | 1,05 | -1,59 | 0,1266 | 0,0029 | |||||

| IBM / International Business Machines Corporation | 0,00 | 0,00 | 1,05 | 2,55 | 0,1264 | 0,0080 | |||

| NORTHERN ILLINOIS UNIVERSITY / DBT (US665238DA66) | 1,05 | -2,70 | 0,1261 | 0,0015 | |||||

| NORTHERN ILLINOIS UNIVERSITY / DBT (US665238DA66) | 1,05 | -2,70 | 0,1261 | 0,0015 | |||||

| HON / Honeywell International Inc. | 0,00 | 0,00 | 1,04 | 6,42 | 0,1261 | 0,0123 | |||

| MCK / McKesson Corporation | 0,00 | -0,07 | 1,04 | 12,28 | 0,1258 | 0,0181 | |||

| INDIANA FINANCE AUTHORITY / DBT (US45471FAX96) | 1,04 | -5,64 | 0,1251 | -0,0024 | |||||

| MPC / Marathon Petroleum Corporation | 0,01 | -0,05 | 1,04 | 6,92 | 0,1250 | 0,0127 | |||

| US20772KBE82 / State of Connecticut | 1,03 | -1,71 | 0,1247 | 0,0027 | |||||

| US93978HRK31 / WASHINGTON HEALTH CARE FACILITIES AUTHORITY | 1,03 | -0,77 | 0,1246 | 0,0039 | |||||

| US12008EUT18 / BUILD NYC RESOURCE CORP | 1,03 | -7,16 | 0,1237 | -0,0043 | |||||

| COUNTY OF JEFFERSON AL SEWER REVENUE / DBT (US472682ZS54) | 1,03 | -4,74 | 0,1236 | -0,0012 | |||||

| COUNTY OF JEFFERSON AL SEWER REVENUE / DBT (US472682ZS54) | 1,03 | -4,74 | 0,1236 | -0,0012 | |||||

| US452153DB28 / ILLINOIS ST | 1,02 | -4,12 | 0,1236 | -0,0003 | |||||

| NEW JERSEY HEALTH CARE FACILITIES FINANCING AUTHOR / DBT (US645790UQ77) | 1,02 | -6,15 | 0,1235 | -0,0029 | |||||

| US74446AAY01 / PUBLIC FINANCE AUTHORITY | 1,02 | -2,66 | 0,1235 | 0,0016 | |||||

| US65820YLT19 / North Carolina Medical Care Commission | 1,02 | 0,39 | 0,1231 | 0,0053 | |||||

| US717883VF66 / PHILADELPHIA PA SCH DIST | 1,02 | -2,86 | 0,1231 | 0,0013 | |||||

| US79165TUA77 / ST LOUIS MUNICIPAL FINANCE CORP | 1,02 | -1,64 | 0,1231 | 0,0028 | |||||

| SOUTH CAROLINA PUBLIC SERVICE AUTHORITY / DBT (US8371515A35) | 1,02 | -5,48 | 0,1229 | -0,0021 | |||||

| SOUTH CAROLINA PUBLIC SERVICE AUTHORITY / DBT (US8371515A35) | 1,02 | -5,48 | 0,1229 | -0,0021 | |||||

| US19645R8B05 / Colorado (State of) Educational & Cultural Facilities Authority | 1,02 | -2,21 | 0,1227 | 0,0021 | |||||

| US709221VH54 / Pennsylvania Turnpike Commission Oil Franchise Tax Revenue | 1,02 | -2,96 | 0,1227 | 0,0012 | |||||

| US64580ABZ30 / NEW JERSEY ST HLTH CARE FACS FING AUTH ST CONTRACT | 1,02 | -2,68 | 0,1227 | 0,0016 | |||||

| IDAHO HEALTH FACILITIES AUTHORITY / DBT (US451295H366) | 1,02 | -4,96 | 0,1226 | -0,0014 | |||||

| IDAHO HEALTH FACILITIES AUTHORITY / DBT (US451295H366) | 1,02 | -4,96 | 0,1226 | -0,0014 | |||||

| US213248BJ58 / Cook County, Illinois, Sales Tax Revenue Bonds, Series 2017 | 1,01 | -1,93 | 0,1223 | 0,0024 | |||||

| US646066F544 / NEW JERSEY EDUCATIONAL FACILITIES AUTHORITY | 1,01 | -0,88 | 0,1223 | 0,0037 | |||||

| APH / Amphenol Corporation | 0,01 | 0,00 | 1,01 | 35,07 | 0,1222 | 0,0352 | |||

| US717883TN29 / PHILADELPHIA PA SCH DIST | 1,01 | -0,98 | 0,1222 | 0,0036 | |||||

| US468312HS52 / JACKSON MI PUBLIC SCHS | 1,01 | -2,79 | 0,1221 | 0,0013 | |||||

| US154871CP00 / CENTRAL PLAINS ENERGY PROJECT | 1,01 | -7,16 | 0,1220 | -0,0043 | |||||

| US742395UP98 / PRINCETON INDEPENDENT SCHOOL DISTRICT | 1,01 | -2,60 | 0,1220 | 0,0017 | |||||

| US45203H8Y13 / Illinois Finance Authority | 1,01 | -0,39 | 0,1220 | 0,0043 | |||||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE DISTRICT / DBT (US84136HBC60) | 1,01 | -4,72 | 0,1219 | -0,0010 | |||||

| SOUTHEAST ENERGY AUTHORITY A COOPERATIVE DISTRICT / DBT (US84136HBC60) | 1,01 | -4,72 | 0,1219 | -0,0010 | |||||

| US5462826J89 / Louisiana Local Government Environmental Facilities and Community Development Authority, Revenue Bonds, Ragin' Cajun Facilities Inc- Student Housing & | 1,01 | -1,18 | 0,1218 | 0,0034 | |||||

| WYOMING COMMUNITY DEVELOPMENT AUTHORITY / DBT (US98322QT312) | 1,01 | -1,94 | 0,1218 | 0,0025 | |||||

| WYOMING COMMUNITY DEVELOPMENT AUTHORITY / DBT (US98322QT312) | 1,01 | -1,94 | 0,1218 | 0,0025 | |||||

| CMCSA / Comcast Corporation | 0,03 | 0,00 | 1,01 | -3,63 | 0,1218 | 0,0003 | |||

| US792888KR97 / St Paul Housing and Redevelopment Authority, Minnesota, Hospital Revenue Bonds, HealthEast Inc, Series 2015A | 1,01 | -0,69 | 0,1217 | 0,0039 | |||||

| US48563UBZ30 / KAREGNONDI WTR AUTH MI | 1,01 | -2,99 | 0,1216 | 0,0012 | |||||

| US015317AN09 / Alexandria Industrial Development Authority, Virginia, Residential Care Facilities Mortgage Revenue Bonds, Goodwin House Incorporated, Series 2015 | 1,01 | -0,69 | 0,1214 | 0,0039 | |||||

| US044293BF48 / City of Ashland, Kings Daughters Medical Center, Series 2016A | 1,01 | -1,18 | 0,1213 | 0,0034 | |||||

| US709144PA12 / Pennsylvania (State of) (Municipal Real Estate Funding, LLC), Series 2018 A, Ref. COP | 1,01 | -1,37 | 0,1213 | 0,0032 | |||||

| US79165TUD17 / St Louis Municipal Finance Corp. | 1,01 | -3,27 | 0,1213 | 0,0008 | |||||

| US54628CEP32 / LOUISIANA LOCAL GOVERNMENT ENVIRONMENTAL FACILITIE | 1,00 | -1,18 | 0,1212 | 0,0033 | |||||

| US20775DVC37 / Connecticut State Health & Educational Facilities Authority | 1,00 | -5,90 | 0,1212 | -0,0026 | |||||

| NEW HAMPSHIRE BUSINESS FINANCE AUTHORITY / DBT (US63607YBX76) | 1,00 | -2,52 | 0,1211 | 0,0016 | |||||

| US167593B271 / CHICAGO O'HARE INTERNATIONAL AIRPORT | 1,00 | -1,57 | 0,1211 | 0,0028 | |||||

| US75157TAB52 / Rampart Range Metropolitan District 1, Lone Tree, Colorado, Limited Tax Supported and Special Revenue Bonds, Refunding & Improvement Series 2017 | 1,00 | -1,86 | 0,1211 | 0,0026 | |||||

| US869398BS54 / SUTTER BUTTE FLOOD AGENCY | 1,00 | -0,40 | 0,1210 | 0,0042 | |||||

| US167562QW01 / Chicago Midway International Airport | 1,00 | -0,50 | 0,1210 | 0,0041 | |||||

| US709224ZD44 / Pennsylvania Turnpike Commission | 1,00 | -1,57 | 0,1210 | 0,0028 | |||||

| US825485UR41 / Shreveport, Louisiana, Water and Sewer Revenue Bonds, Refunding Series 2015 | 1,00 | -0,79 | 0,1209 | 0,0037 | |||||

| US45203HY226 / ILLINOIS ST FIN AUTH REVENUE | 1,00 | 0,10 | 0,1209 | 0,0048 | |||||

| US762322AX31 / Rhode Island Turnpike and Bridge Authority, Motor Fuel Tax Revenue Bonds, Series 2016A | 1,00 | -1,48 | 0,1208 | 0,0030 | |||||

| US64578EMG97 / New Jersey Economic Development Authority | 1,00 | -3,19 | 0,1208 | 0,0008 | |||||

| US187145DB05 / Clifton Higher Education Finance Corp | 1,00 | 0,00 | 0,1208 | 0,0047 | |||||

| US825485TV71 / CITY OF SHREVEPORT LA WATER & SEWER REVENUE | 1,00 | 0,00 | 0,1207 | 0,0047 | |||||

| US44237NGX49 / CITY OF HOUSTON TX | 1,00 | 0,00 | 0,1207 | 0,0047 | |||||

| US44237NHW56 / Houston, Texas, Hotel Occupancy Tax and Special Revenue Bonds, Refunding Series 2015 | 1,00 | 0,00 | 0,1207 | 0,0047 | |||||

| US13063CUG31 / CALIFORNIA ST | 1,00 | -0,50 | 0,1207 | 0,0041 | |||||

| US982788FH94 / Wyandotte, Michigan, Electric Revenue Bonds, Refunding Series 2015A | 1,00 | -0,50 | 0,1207 | 0,0041 | |||||

| US45202WAH34 / ILLINOIS FINANCE AUTHORITY | 1,00 | 0,00 | 0,1207 | 0,0047 | |||||

| US04184RBT68 / City of Arlington TX Special Tax Revenue | 1,00 | -2,15 | 0,1207 | 0,0021 | |||||

| CB / Chubb Limited | 0,00 | 0,00 | 1,00 | 4,17 | 0,1206 | 0,0093 | |||

| US576528DQ33 / MATAGORDA CNTY TX NAV DIST 1 | 1,00 | 0,00 | 0,1206 | 0,0046 | |||||

| US19648A2Y04 / Colorado Health Facilities Authority, Colorado, Revenue Bonds, Evangelical Lutheran Good Samaritan Society Project, Series 2013A | 1,00 | -0,50 | 0,1206 | 0,0041 | |||||

| US5463982J61 / LOUISIANA PUBLIC FACILITIES AUTHORITY | 1,00 | -0,50 | 0,1206 | 0,0040 | |||||

| US514045F406 / Lancaster (County of), PA Hospital Authority (Masonic Villages), Series 2015, Ref. RB | 1,00 | 0,00 | 0,1206 | 0,0046 | |||||

| US192288GQ51 / COFFEYVILLE KS ELEC SYS REVENUE | 1,00 | -0,20 | 0,1206 | 0,0044 | |||||

| US71780CAK62 / Philadelphia Authority for Industrial Development | 1,00 | -5,40 | 0,1206 | -0,0019 | |||||

| ST CLAIR COUNTY COMMUNITY UNIT SCHOOL DISTRICT NO / DBT (US788550MQ18) | 1,00 | -3,39 | 0,1204 | 0,0007 | |||||

| ST CLAIR COUNTY COMMUNITY UNIT SCHOOL DISTRICT NO / DBT (US788550MQ18) | 1,00 | -3,39 | 0,1204 | 0,0007 | |||||

| US380037GR63 / Glynn-Brunswick Memorial Hospital Authority (Southeast Georgia Health System), Series 2017, RAC | 1,00 | -0,40 | 0,1202 | 0,0041 | |||||

| US709224MW61 / Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Subordinate Series 2016A-1 | 1,00 | -0,80 | 0,1200 | 0,0037 | |||||

| US49127KBV17 / Kentucky Economic Development Finance Authority | 0,99 | -2,75 | 0,1197 | 0,0014 | |||||

| NEW HAMPSHIRE BUSINESS FINANCE AUTHORITY / DBT (US63607YBU38) | 0,99 | -4,07 | 0,1196 | -0,0002 | |||||

| NEW HAMPSHIRE BUSINESS FINANCE AUTHORITY / DBT (US63607YBU38) | 0,99 | -4,07 | 0,1196 | -0,0002 | |||||

| US63607YBJ82 / New Hampshire Business Finance Authority, Series 2023 A | 0,99 | -5,08 | 0,1194 | -0,0015 | |||||

| US944514QW10 / WAYNE CNTY MI ARPT AUTH REVENUE | 0,99 | -1,20 | 0,1192 | 0,0032 | |||||

| US982674KZ50 / Wyandotte (County of) & Kansas City (City of), KS Unified Government, Series 2016 A, RB | 0,98 | -1,80 | 0,1188 | 0,0025 | |||||

| US539243UD54 / LIVONIA PUBLIC SCHOOLS SCHOOL DISTRICT | 0,98 | -2,38 | 0,1188 | 0,0018 | |||||

| US04052FDR38 / Arizona Industrial Development Authority, Series 2022 A | 0,98 | -6,11 | 0,1186 | -0,0028 | |||||

| US87972MBT80 / TEMPE INDUSTRIAL DEVELOPMENT AUTHORITY | 0,98 | -8,05 | 0,1185 | -0,0054 | |||||

| US66353RCE27 / Northampton County PA General Purpose Authority Hospital Revenue (St. Luke's Hospital Project) | 0,98 | -3,73 | 0,1183 | 0,0001 | |||||

| HCA / HCA Healthcare, Inc. | 0,00 | -0,04 | 0,98 | 24,52 | 0,1182 | 0,0269 | |||

| SOUTH CAROLINA PUBLIC SERVICE AUTHORITY / DBT (US8371515V71) | 0,98 | -6,50 | 0,1181 | -0,0033 | |||||

| SOUTH CAROLINA PUBLIC SERVICE AUTHORITY / DBT (US8371515V71) | 0,98 | -6,50 | 0,1181 | -0,0033 | |||||

| US939783Q745 / Washington State Housing Finance Commission, Series 2023 A | 0,98 | -4,21 | 0,1181 | -0,0003 | |||||

| US64578EKB29 / NEW JERSEY ST ECON DEV AUTH | 0,98 | -3,83 | 0,1180 | 0,0001 | |||||

| US45201QCZ54 / ILLINOIS EDUCATIONAL FACILITIES AUTHORITY | 0,98 | -3,07 | 0,1180 | 0,0009 | |||||

| US64578JBF21 / NEW JERSEY ST ECON DEV AUTH MTR VEHCL SURCHARGE REVENUE | 0,98 | -0,41 | 0,1180 | 0,0042 | |||||

| NEW YORK CITY HOUSING DEVELOPMENT CORP / DBT (US64972KJH95) | 0,98 | 0,1179 | 0,1179 | ||||||

| NEW YORK CITY HOUSING DEVELOPMENT CORP / DBT (US64972KJH95) | 0,98 | 0,1179 | 0,1179 | ||||||

| US57583U6R41 / Massachusetts Development Finance Agency, Revenue Bonds, Boston Medical Center Issue, Green Bonds, Series 2015D | 0,97 | -2,60 | 0,1176 | 0,0016 | |||||

| US67884XCN57 / Oklahoma (State of) Development Finance Authority (OU Medicine), Series 2018 B, RB | 0,97 | -4,70 | 0,1175 | -0,0010 | |||||

| US145810DU87 / CARSON CITY NV HOSP REVENUE | 0,97 | -3,95 | 0,1173 | -0,0001 | |||||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JH15) | 0,97 | -7,17 | 0,1172 | -0,0041 | |||||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JH15) | 0,97 | -7,17 | 0,1172 | -0,0041 | |||||

| US677510CY30 / Ohio Higher Educational Facility Commission | 0,97 | -5,54 | 0,1172 | -0,0020 | |||||

| US57584XKB63 / Massachusetts Development Finance Agency, Revenue Bonds, UMass Memorial Health Care, Series 2016I | 0,97 | -3,29 | 0,1171 | 0,0007 | |||||

| PUBLIC FINANCE AUTHORITY / DBT (US74442PH248) | 0,97 | -5,19 | 0,1169 | -0,0016 | |||||

| PUBLIC FINANCE AUTHORITY / DBT (US74442PH248) | 0,97 | -5,19 | 0,1169 | -0,0016 | |||||

| US700387DM25 / PARK CREEK CO MET DIST REVENUE | 0,97 | -3,69 | 0,1166 | 0,0003 | |||||

| US088354GK56 / BEXAR CNTY TX HLTH FACS DEV CO BEXMED 07/37 FIXED 5 | 0,97 | -3,88 | 0,1165 | 0,0001 | |||||

| US249189DS76 / DENVER CO CONVENTION CENTER HOTEL AUTH REVENUE | 0,97 | -4,93 | 0,1165 | -0,0012 | |||||

| GILD / Gilead Sciences, Inc. | 0,01 | 0,00 | 0,96 | -3,70 | 0,1164 | 0,0002 | |||

| NEBRASKA INVESTMENT FINANCE AUTHORITY / DBT (US63968XBJ37) | 0,96 | -3,79 | 0,1163 | 0,0001 | |||||

| GEORGIA HOUSING FINANCE AUTHORITY / DBT (US37353PPJ20) | 0,96 | -3,90 | 0,1160 | -0,0000 | |||||

| GEORGIA HOUSING FINANCE AUTHORITY / DBT (US37353PPJ20) | 0,96 | -3,90 | 0,1160 | -0,0000 | |||||

| US45203HV669 / ILLINOIS FINANCE AUTHORITY | 0,96 | -4,00 | 0,1159 | -0,0001 | |||||

| US299398CK10 / EVANSVILLE REDEVELOPMENT AUTHORITY | 0,96 | -4,19 | 0,1158 | -0,0004 | |||||

| US213187DM62 / COOK CNTY IL CMNTY CLG DIST 508 | 0,96 | -5,89 | 0,1158 | -0,0024 | |||||

| US04052BET70 / Arizona Industrial Development Authority, Arizona, Education Facility Revenue Bonds, Basis Schools, Inc Projects, Series 2017F | 0,96 | -4,77 | 0,1156 | -0,0011 | |||||

| US792909FM03 / Saint Paul Housing and Redevelopment Authority, Minnesota, Health Care Revenue Bonds, Fairview Health Services, Series 2017A | 0,96 | -4,78 | 0,1155 | -0,0011 | |||||

| US167727YK64 / Chicago (City of), IL, Series 2017 A, RB | 0,96 | -5,26 | 0,1152 | -0,0017 | |||||

| US57584XCG43 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 0,95 | -4,70 | 0,1150 | -0,0009 | |||||

| LOUISIANA HOUSING CORP / DBT (US54627DTX92) | 0,95 | -5,27 | 0,1150 | -0,0016 | |||||

| LOUISIANA HOUSING CORP / DBT (US54627DTX92) | 0,95 | -5,27 | 0,1150 | -0,0016 | |||||

| DHR / Danaher Corporation | 0,01 | -11,07 | 0,95 | -18,72 | 0,1148 | -0,0210 | |||

| MU / Micron Technology, Inc. | 0,01 | 0,00 | 0,95 | 0,85 | 0,1148 | 0,0054 | |||

| US83704EAA29 / SOUTH CAROLINA JOBS-ECON DEV AUTH | 0,95 | -6,32 | 0,1144 | -0,0030 | |||||

| US939783VV59 / WASHINGTON ST HSG FIN COMMISSION | 0,95 | -3,56 | 0,1143 | 0,0004 | |||||

| CTAS / Cintas Corporation | 0,00 | -0,05 | 0,95 | 9,12 | 0,1140 | 0,0136 | |||

| US54639TCJ97 / LOUISIANA PUBLIC FACILITIES AUTHORITY | 0,94 | -6,93 | 0,1135 | -0,0037 | |||||

| US259234CK61 / Douglas County Hospital Authority 3, Nebraska, Health Facilities Revenue Bonds, Nebraska Methodist Health System, Refunding Series 2015 | 0,93 | -6,89 | 0,1125 | -0,0036 | |||||

| NORTH DAKOTA HOUSING FINANCE AGENCY / DBT (US65889BCF94) | 0,93 | 0,1125 | 0,1125 | ||||||

| NORTH DAKOTA HOUSING FINANCE AGENCY / DBT (US65889BCF94) | 0,93 | 0,1125 | 0,1125 | ||||||

| SOUTH CAROLINA STATE HOUSING FINANCE DEVELOPMENT / DBT (US83712D7P58) | 0,93 | -7,17 | 0,1125 | -0,0040 | |||||

| SOUTH CAROLINA STATE HOUSING FINANCE DEVELOPMENT / DBT (US83712D7P58) | 0,93 | -7,17 | 0,1125 | -0,0040 | |||||

| US463805DK42 / CITY OF IRVING TX | 0,93 | -7,00 | 0,1123 | -0,0037 | |||||

| US87638RKC06 / TARRANT CNTY TX CULTURAL EDU FACS FIN CORP RETMNT FAC REVENU | 0,93 | -6,65 | 0,1119 | -0,0033 | |||||

| TRIBOROUGH BRIDGE TUNNEL AUTHORITY / DBT (US896032BC24) | 0,92 | -7,69 | 0,1115 | -0,0047 | |||||

| TRIBOROUGH BRIDGE TUNNEL AUTHORITY / DBT (US896032BC24) | 0,92 | -7,69 | 0,1115 | -0,0047 | |||||

| US592041WB99 / Metropolitan Government of Nashville-Davidson County Health and Educational Facilities Board, Tennessee, Revenue Bonds, Lipscomb University, Refunding | 0,92 | -7,06 | 0,1113 | -0,0038 | |||||

| ICE / Intercontinental Exchange, Inc. | 0,01 | 0,00 | 0,92 | 3,83 | 0,1112 | 0,0082 | |||

| US649519DH55 / New York Liberty Development Corp., Series 2019, Ref. RB | 0,92 | -0,43 | 0,1112 | 0,0038 | |||||

| US934023EU29 / Ward (County of), ND (Trinity Obligated Group), Series 2017 C, RB | 0,92 | -9,55 | 0,1109 | -0,0069 | |||||

| US517039TU76 / CITY OF LAREDO TX WATERWORKS & SEWER SYSTEM REVENU | 0,92 | -8,28 | 0,1109 | -0,0054 | |||||

| WM / Waste Management, Inc. | 0,00 | 0,00 | 0,91 | 3,51 | 0,1102 | 0,0079 | |||

| US91754TT606 / Utah Charter School Finance Authority, Series 2022, RB | 0,90 | -6,15 | 0,1088 | -0,0026 | |||||

| US924166JX03 / Vermont Educational & Health Buildings Financing Agency Revenue (Champlain College Project) | 0,90 | -3,75 | 0,1084 | 0,0002 | |||||

| US594479HL44 / MICHIGAN FINANCE AUTHORITY | 0,90 | -5,29 | 0,1081 | -0,0016 | |||||

| CAPITAL TRUST AUTHORITY / DBT (US14054UAG40) | 0,89 | -5,83 | 0,1074 | -0,0021 | |||||

| CAPITAL TRUST AUTHORITY / DBT (US14054UAG40) | 0,89 | -5,83 | 0,1074 | -0,0021 | |||||

| NEE / NextEra Energy, Inc. | 0,01 | 0,00 | 0,89 | 0,68 | 0,1070 | 0,0048 | |||

| ORANGE COUNTY HEALTH FACILITIES AUTHORITY / DBT (US68450LJR78) | 0,89 | -9,22 | 0,1069 | -0,0063 | |||||

| ORANGE COUNTY HEALTH FACILITIES AUTHORITY / DBT (US68450LJR78) | 0,89 | -9,22 | 0,1069 | -0,0063 | |||||

| US048251CC41 / Atlantic Beach (City of), FL (Fleet Landing), Series 2018 A, RB | 0,88 | -10,73 | 0,1065 | -0,0081 | |||||

| AZO / AutoZone, Inc. | 0,00 | 0,00 | 0,88 | 6,80 | 0,1063 | 0,0107 | |||

| US41415WCR16 / HARRIS COUNTY HOSPITAL DISTRICT | 0,88 | -7,77 | 0,1060 | -0,0044 | |||||

| US19645UPV07 / COLORADO EDUCATIONAL CULTURAL FACILITIES AUTHORI | 0,88 | -7,49 | 0,1059 | -0,0041 | |||||

| US57584X4P39 / Massachusetts (State of) Development Finance Agency (Newbridge Charles, Inc.), Series 2017, Ref. RB | 0,88 | -12,39 | 0,1059 | -0,0102 | |||||

| TDG / TransDigm Group Incorporated | 0,00 | 0,00 | 0,87 | 7,41 | 0,1050 | 0,0110 | |||

| US44237QAG01 / Houston Higher Education Finance Corp. | 0,87 | -3,98 | 0,1049 | -0,0000 | |||||

| US363128CY31 / CITY OF GAITHERSBURG MD | 0,87 | -1,47 | 0,1049 | 0,0026 | |||||

| WMB / The Williams Companies, Inc. | 0,01 | -0,05 | 0,87 | 3,96 | 0,1046 | 0,0079 | |||

| US93978HUA12 / WASHINGTON HEALTH CARE FACILITIES AUTHORITY | 0,86 | -7,11 | 0,1041 | -0,0035 | |||||

| ELV / Elevance Health, Inc. | 0,00 | -3,52 | 0,86 | -6,71 | 0,1041 | -0,0031 | |||

| AON / Aon plc | 0,00 | -0,04 | 0,86 | -9,08 | 0,1039 | -0,0060 | |||

| SBUX / Starbucks Corporation | 0,01 | 0,00 | 0,86 | -27,53 | 0,1039 | -0,0339 | |||

| ILLINOIS FINANCE AUTHORITY / DBT (US45204FYG44) | 0,85 | -7,11 | 0,1025 | -0,0035 | |||||

| ILLINOIS FINANCE AUTHORITY / DBT (US45204FYG44) | 0,85 | -7,11 | 0,1025 | -0,0035 | |||||

| TMUS / T-Mobile US, Inc. | 0,00 | 0,00 | 0,85 | -10,29 | 0,1022 | -0,0072 | |||

| MISSISSIPPI HOME CORP / DBT (US60535Q2A70) | 0,84 | 0,1014 | 0,1014 | ||||||

| MISSISSIPPI HOME CORP / DBT (US60535Q2A70) | 0,84 | 0,1014 | 0,1014 | ||||||

| US65000BMZ84 / NEW YORK ST DORM AUTH REVENUES NON ST SUPPORTED DEBT | 0,83 | -12,16 | 0,1003 | -0,0094 | |||||

| SHW / The Sherwin-Williams Company | 0,00 | 0,00 | 0,83 | -0,96 | 0,0997 | 0,0029 | |||

| US646136WK31 / NEW JERSEY ST TRANSPRTN TRUST FUND AUTH | 0,83 | -4,95 | 0,0997 | -0,0011 | |||||

| AJG / Arthur J. Gallagher & Co. | 0,00 | 0,00 | 0,82 | 2,88 | 0,0993 | 0,0065 | |||

| NEW HAMPSHIRE BUSINESS FINANCE AUTHORITY / DBT (US63607YCX67) | 0,82 | 0,0990 | 0,0990 | ||||||

| ANET / Arista Networks Inc | 0,01 | 0,00 | 0,82 | -6,83 | 0,0988 | -0,0032 | |||

| US19648FRW67 / FX.RT. MUNI BOND | 0,82 | -4,67 | 0,0986 | -0,0008 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0,02 | -0,05 | 0,81 | -7,30 | 0,0981 | -0,0036 | |||

| PH / Parker-Hannifin Corporation | 0,00 | 0,00 | 0,81 | -0,49 | 0,0975 | 0,0032 | |||

| US841466AK18 / Southeast Overtown/Park West Community Redevelopement Agency, Florida, Tax Increment Revenue Bonds, Series 2014A-1 | 0,80 | -20,08 | 0,0966 | -0,0195 | |||||

| US563017EB43 / MANHATTAN KS HLTH CARE FAC REVENUE | 0,80 | -3,16 | 0,0963 | 0,0007 | |||||

| US794458GK96 / Salem Hospital Facility Authority | 0,80 | -9,84 | 0,0962 | -0,0064 | |||||

| US60636SHU15 / Missouri Development Finance Board | 0,80 | -3,28 | 0,0962 | 0,0006 | |||||

| US56681NGG60 / Maricopa County Industrial Development Authority | 0,79 | -7,59 | 0,0955 | -0,0037 | |||||

| US594479FP75 / Michigan Finance Authority | 0,79 | -4,58 | 0,0955 | -0,0008 | |||||

| US45204FNP61 / ILLINOIS ST FIN AUTH REVENUE | 0,79 | -7,94 | 0,0951 | -0,0041 | |||||

| US92415TCB61 / VERMONT ECONOMIC DEVELOPMENT AUTHORITY | 0,79 | -11,59 | 0,0949 | -0,0082 | |||||

| US696506AT19 / PALM BEACH CNTY FL EDUCTNL FACS AUTH | 0,79 | -8,40 | 0,0947 | -0,0047 | |||||

| US66433RCZ91 / Northeast Ohio Medical University | 0,78 | -5,10 | 0,0943 | -0,0012 | |||||

| LMT / Lockheed Martin Corporation | 0,00 | 0,00 | 0,78 | 7,14 | 0,0941 | 0,0097 | |||

| MAR / Marriott International, Inc. | 0,00 | -0,07 | 0,78 | -6,04 | 0,0939 | -0,0021 | |||

| US49126PFG00 / KENTUCKY ST ECON DEV FIN AUTH | 0,77 | -4,44 | 0,0935 | -0,0005 | |||||

| US72177MUQ85 / Industrial Development Authority of the County of Pima (The) | 0,77 | -4,92 | 0,0933 | -0,0010 | |||||

| CLINTON COUNTY CAPITAL RESOURCE CORP / DBT (US187469AG68) | 0,77 | -5,04 | 0,0931 | -0,0012 | |||||

| CLINTON COUNTY CAPITAL RESOURCE CORP / DBT (US187469AG68) | 0,77 | -5,04 | 0,0931 | -0,0012 | |||||

| US52349EEK29 / Lee County Industrial Development Authority/FL | 0,77 | -5,30 | 0,0929 | -0,0013 | |||||

| US83703FMG45 / SOUTH CAROLINA JOBS ECONOMIC DEVELOPMENT AUTHORITY | 0,77 | -4,13 | 0,0924 | -0,0003 | |||||

| FLORIDA HOUSING FINANCE CORP / DBT (US34074NEQ88) | 0,76 | 0,0922 | 0,0922 | ||||||

| FLORIDA HOUSING FINANCE CORP / DBT (US34074NEQ88) | 0,76 | 0,0922 | 0,0922 | ||||||

| US68608JYY18 / Oregon State Facilities Authority | 0,76 | -6,39 | 0,0920 | -0,0024 | |||||

| CSX / CSX Corporation | 0,02 | -0,05 | 0,76 | -1,30 | 0,0916 | 0,0023 | |||

| US592029AR36 / Metropolitan Government Nashville & Davidson County Health & Educational Facs Bd | 0,76 | -11,87 | 0,0914 | -0,0083 | |||||

| US97712JEE91 / Wisconsin Health & Educational Facilities Authority | 0,76 | -6,90 | 0,0913 | -0,0030 | |||||

| ZTS / Zoetis Inc. | 0,00 | 0,00 | 0,76 | 0,80 | 0,0912 | 0,0043 | |||

| US87638TGW71 / Tarrant County Cultural Education Facilities Finance Corp | 0,75 | -4,32 | 0,0909 | -0,0004 | |||||

| US899530AY53 / Tulsa County Industrial Authority, Oklahoma, Senior Living Community Revenue Bonds, Montereau, Inc Project, Refunding Series 2017 | 0,75 | -2,34 | 0,0907 | 0,0015 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0,00 | -0,07 | 0,75 | -6,28 | 0,0900 | -0,0023 | |||

| US796247DL57 / San Antonio Education Facilities Corp. | 0,74 | -5,23 | 0,0897 | -0,0012 | |||||

| FTNT / Fortinet, Inc. | 0,01 | -0,05 | 0,74 | -5,72 | 0,0895 | -0,0018 | |||

| CDNS / Cadence Design Systems, Inc. | 0,00 | 0,00 | 0,74 | 14,53 | 0,0894 | 0,0144 | |||

| US363433BB88 / CITY OF GALESBURG IL | 0,74 | -16,52 | 0,0891 | -0,0134 | |||||

| MCO / Moody's Corporation | 0,00 | 0,00 | 0,73 | -4,92 | 0,0886 | -0,0009 | |||

| SCHW / The Charles Schwab Corporation | 0,01 | 0,00 | 0,73 | 11,06 | 0,0885 | 0,0119 | |||

| BA / The Boeing Company | 0,00 | 0,00 | 0,73 | 18,86 | 0,0882 | 0,0168 | |||

| US528819AF20 / CITY OF LEWISVILLE TX | 0,73 | -0,68 | 0,0880 | 0,0028 | |||||

| US56042RFG20 / Maine Health and Higher Educational Facilities Authority Revenue Bonds, Eastern Maine Medical Center Obligated Group Issue, Series 2016A | 0,73 | -11,31 | 0,0880 | -0,0073 | |||||

| US57584YX874 / MASSACHUSETTS ST DEV FIN AGY REVENUE | 0,72 | -4,12 | 0,0870 | -0,0002 | |||||

| MARICOPA COUNTY PHOENIX INDUSTRIAL DEVELOPMENT A / DBT (US566736JW53) | 0,72 | -4,92 | 0,0863 | -0,0009 | |||||

| MARICOPA COUNTY PHOENIX INDUSTRIAL DEVELOPMENT A / DBT (US566736JW53) | 0,72 | -4,92 | 0,0863 | -0,0009 | |||||

| MO / Altria Group, Inc. | 0,01 | 0,00 | 0,71 | 8,55 | 0,0858 | 0,0098 | |||

| WELL / Welltower Inc. | 0,00 | 0,00 | 0,70 | 0,43 | 0,0850 | 0,0037 | |||

| US531127AC24 / New York Liberty Development Corp. (Goldman Sachs Headquarters), Series 2005, Ref. RB | 0,70 | -3,83 | 0,0848 | -0,0000 | |||||

| US74442CDS08 / PUBLIC FINANCE AUTHORITY | 0,70 | -10,37 | 0,0845 | -0,0062 | |||||

| US80329UBJ79 / Sarasota County Health Facilities Authority, Sunnyside Village Project | 0,69 | -3,35 | 0,0836 | 0,0005 | |||||

| US74442EGU82 / Public Finance Authority | 0,69 | -5,59 | 0,0836 | -0,0014 | |||||

| US19645UNQ30 / Colorado Educational & Cultural Facilities Authority, Series 2022 | 0,69 | -7,01 | 0,0833 | -0,0027 | |||||

| MDLZ / Mondelez International, Inc. | 0,01 | 0,00 | 0,69 | 5,05 | 0,0830 | 0,0071 | |||

| US19645R7B14 / COLORADO EDUCATIONAL & CULTURAL FACILITIES AUTHORI | 0,69 | -4,33 | 0,0827 | -0,0004 | |||||

| ILLINOIS FINANCE AUTHORITY / DBT (US45204FYV11) | 0,68 | -7,57 | 0,0826 | -0,0032 | |||||

| ILLINOIS FINANCE AUTHORITY / DBT (US45204FYV11) | 0,68 | -7,57 | 0,0826 | -0,0032 | |||||

| US57584YN701 / Massachusetts Development Finance Agency | 0,68 | -7,51 | 0,0817 | -0,0032 | |||||

| JCI / Johnson Controls International plc | 0,01 | 0,00 | 0,68 | 18,39 | 0,0816 | 0,0153 | |||

| AFL / Aflac Incorporated | 0,01 | -0,05 | 0,68 | -5,46 | 0,0815 | -0,0014 | |||

| US16772PDM59 / CHICAGO IL TRANSIT AUTH SALES TAX RECPTS REVENUE | 0,67 | -5,61 | 0,0813 | -0,0014 | |||||

| US841895AV73 / S ESTRN OH PORT AUTH HOSP FACS REVENUE | 0,67 | -4,45 | 0,0804 | -0,0004 | |||||

| US613609L464 / Montgomery County Industrial Development Authority/PA | 0,66 | -4,20 | 0,0798 | -0,0003 | |||||

| US04052BNW09 / ARIZONA ST INDL DEV A | 0,65 | -8,42 | 0,0789 | -0,0039 | |||||

| NOC / Northrop Grumman Corporation | 0,00 | 0,00 | 0,65 | 4,99 | 0,0787 | 0,0067 | |||

| CI / The Cigna Group | 0,00 | 0,00 | 0,65 | 2,53 | 0,0784 | 0,0049 | |||

| SNPS / Synopsys, Inc. | 0,00 | 0,00 | 0,65 | 1,41 | 0,0782 | 0,0041 | |||

| TRV / The Travelers Companies, Inc. | 0,00 | 0,00 | 0,65 | 6,59 | 0,0782 | 0,0077 | |||

| US816686AL39 / SEMINOLE CNTY FL INDL DEV AUTH EDUCTNL FACS REVENUE | 0,64 | -6,27 | 0,0776 | -0,0020 | |||||

| ALL / The Allstate Corporation | 0,00 | -0,07 | 0,64 | 5,29 | 0,0769 | 0,0067 | |||

| US64577XEH52 / New Jersey Economic Development Auth. Rev. | 0,63 | -3,22 | 0,0762 | 0,0006 | |||||

| HWM / Howmet Aerospace Inc. | 0,00 | 0,00 | 0,63 | 24,26 | 0,0761 | 0,0173 | |||

| FI / Fiserv, Inc. | 0,00 | 0,00 | 0,63 | -30,94 | 0,0754 | -0,0295 | |||

| US56681NGF87 / Maricopa County Industrial Development Authority | 0,62 | -7,00 | 0,0753 | -0,0025 | |||||

| MSI / Motorola Solutions, Inc. | 0,00 | 0,00 | 0,62 | -5,67 | 0,0744 | -0,0014 | |||

| FCX / Freeport-McMoRan Inc. | 0,02 | -0,05 | 0,61 | 4,27 | 0,0737 | 0,0057 | |||

| COLUMBUS REGIONAL AIRPORT AUTHORITY / DBT (US199546DX74) | 0,61 | -3,50 | 0,0732 | 0,0002 | |||||

| COLUMBUS REGIONAL AIRPORT AUTHORITY / DBT (US199546DX74) | 0,61 | -3,50 | 0,0732 | 0,0002 | |||||

| US74439YBV20 / Public Finance Authority | 0,60 | -1,79 | 0,0728 | 0,0015 | |||||

| US14054CDE66 / Capital Trust Agency Inc | 0,60 | -2,60 | 0,0724 | 0,0009 | |||||

| US42934ABU34 / HIDALGO CNTY TX REGL MOBILITY AUTH TOLL & VEHICLE REGISTRATI | 0,60 | -3,40 | 0,0721 | 0,0004 | |||||

| US518324AV03 / LATROBE PA INDL DEV AUTH UNIV REVENUE | 0,59 | -10,27 | 0,0717 | -0,0052 | |||||

| US19645UKU78 / Colorado Educational & Cultural Facilities Authority | 0,59 | -7,08 | 0,0713 | -0,0025 | |||||

| AMP / Ameriprise Financial, Inc. | 0,00 | -0,09 | 0,59 | -5,33 | 0,0708 | -0,0011 | |||

| US67756DB546 / Ohio Higher Educational Facility Commission | 0,58 | -9,03 | 0,0705 | -0,0040 | |||||

| US594479HP57 / FX.RT. MUNI BOND | 0,58 | -8,82 | 0,0699 | -0,0038 | |||||

| CARR / Carrier Global Corporation | 0,01 | 0,00 | 0,57 | 9,86 | 0,0686 | 0,0086 | |||

| ADI / Analog Devices, Inc. | 0,00 | 0,00 | 0,57 | -6,91 | 0,0683 | -0,0023 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0,00 | 0,00 | 0,56 | 4,44 | 0,0681 | 0,0054 | |||

| EMR / Emerson Electric Co. | 0,00 | 0,00 | 0,56 | -1,92 | 0,0680 | 0,0014 | |||

| MSCI / MSCI Inc. | 0,00 | -0,10 | 0,56 | -4,62 | 0,0674 | -0,0005 | |||

| AIG / American International Group, Inc. | 0,01 | -0,05 | 0,55 | 2,05 | 0,0660 | 0,0038 | |||

| NKE / NIKE, Inc. | 0,01 | 0,00 | 0,55 | -23,67 | 0,0658 | -0,0171 | |||

| RSG / Republic Services, Inc. | 0,00 | 0,00 | 0,54 | 8,50 | 0,0647 | 0,0074 | |||

| NSC / Norfolk Southern Corporation | 0,00 | 0,00 | 0,54 | 0,56 | 0,0646 | 0,0029 | |||

| US74442EHZ60 / Public Finance Authority | 0,53 | -1,66 | 0,0644 | 0,0014 | |||||

| KR / The Kroger Co. | 0,01 | -0,05 | 0,53 | 5,13 | 0,0644 | 0,0056 | |||

| URI / United Rentals, Inc. | 0,00 | 0,00 | 0,53 | 10,40 | 0,0641 | 0,0082 | |||

| US19645UKT06 / Colorado Educational & Cultural Facilities Authority | 0,53 | -6,53 | 0,0640 | -0,0018 | |||||

| US613609L381 / Montgomery County Industrial Development Authority | 0,53 | -3,67 | 0,0634 | 0,0002 | |||||

| NEW YORK STATE DORMITORY AUTHORITY / DBT (US64985SBV43) | 0,52 | 0,0629 | 0,0629 | ||||||

| GWW / W.W. Grainger, Inc. | 0,00 | 0,00 | 0,52 | 6,35 | 0,0627 | 0,0061 | |||

| ADSK / Autodesk, Inc. | 0,00 | 0,00 | 0,51 | 8,00 | 0,0619 | 0,0068 | |||

| US838536MQ02 / S JERSEY NJ TRANSPRTN AUTH TRA REGD B/E BAM 5.25000000 | 0,51 | -5,03 | 0,0616 | -0,0008 | |||||

| EQIX / Equinix, Inc. | 0,00 | 0,00 | 0,51 | -1,74 | 0,0612 | 0,0013 | |||

| US414009FB14 / Harris County Cultural Education Facilities Finance Corporation, Texas, Revenue Refunding Bonds, Young Men's Christian Association of the Greater Hous | 0,51 | -46,91 | 0,0612 | -0,0496 | |||||

| US64577B4K76 / NEW JERSEY ST ECON DEV AUTH REVENUE | 0,51 | -1,17 | 0,0609 | 0,0016 | |||||

| US70275QAC78 / Passaic County Improvement Authority (The) | 0,50 | -2,52 | 0,0608 | 0,0009 | |||||

| US60637AWL24 / Health & Educational Facilities Authority of the State of Missouri, Series 2023 | 0,50 | -4,20 | 0,0607 | -0,0001 | |||||

| US56678PAT49 / MARICOPA CNTY AZ INDL DEV AUTH HOSP REVENUE | 0,50 | -2,34 | 0,0606 | 0,0010 | |||||

| US888808HR61 / Tobacco Settlement Financing Corp., Series 2018 A, Ref. RB | 0,50 | -1,77 | 0,0604 | 0,0014 | |||||

| CL / Colgate-Palmolive Company | 0,01 | 0,00 | 0,50 | 1,84 | 0,0603 | 0,0034 | |||

| US371669AW25 / Genesee County Funding Corp. (The) | 0,50 | -4,24 | 0,0601 | -0,0002 | |||||

| US40727RCL06 / County of Hamilton, Series 2023A | 0,50 | -3,68 | 0,0601 | 0,0002 | |||||

| AME / AMETEK, Inc. | 0,00 | -0,04 | 0,50 | -5,52 | 0,0598 | -0,0011 | |||

| EBAY / eBay Inc. | 0,01 | -0,04 | 0,50 | 13,01 | 0,0598 | 0,0089 | |||

| PWR / Quanta Services, Inc. | 0,00 | 0,00 | 0,49 | 32,09 | 0,0597 | 0,0162 | |||

| CME / CME Group Inc. | 0,00 | 0,00 | 0,49 | 13,92 | 0,0593 | 0,0092 | |||

| US97712JED19 / Wisconsin Health & Educational Facilities Authority | 0,49 | -5,59 | 0,0591 | -0,0011 | |||||

| AMT / American Tower Corporation | 0,00 | 0,00 | 0,49 | 4,48 | 0,0591 | 0,0047 | |||

| BK / The Bank of New York Mellon Corporation | 0,01 | 0,00 | 0,49 | -0,41 | 0,0591 | 0,0021 | |||

| PYPL / PayPal Holdings, Inc. | 0,01 | 0,00 | 0,49 | -1,01 | 0,0590 | 0,0017 | |||

| PUBLIC FINANCE AUTHORITY / DBT (US74439YFV83) | 0,48 | 0,0582 | 0,0582 | ||||||

| PUBLIC FINANCE AUTHORITY / DBT (US74439YFV83) | 0,48 | 0,0582 | 0,0582 | ||||||

| GD / General Dynamics Corporation | 0,00 | 0,00 | 0,48 | 10,34 | 0,0580 | 0,0074 | |||

| ITW / Illinois Tool Works Inc. | 0,00 | -21,53 | 0,48 | -27,22 | 0,0575 | -0,0184 | |||

| PNC / The PNC Financial Services Group, Inc. | 0,00 | 0,00 | 0,47 | -9,40 | 0,0569 | -0,0035 | |||

| CPRT / Copart, Inc. | 0,01 | -0,05 | 0,47 | -6,19 | 0,0568 | -0,0013 | |||

| TEL / TE Connectivity plc | 0,00 | 0,00 | 0,47 | 3,99 | 0,0566 | 0,0043 | |||

| US57583UJ667 / Massachusetts Development Finance Agency Revenue Bonds, Lawrence General Hospital Issue, Series 2014A | 0,47 | -4,89 | 0,0564 | -0,0006 | |||||

| PAYX / Paychex, Inc. | 0,00 | 0,00 | 0,47 | 4,02 | 0,0563 | 0,0043 | |||

| VRSK / Verisk Analytics, Inc. | 0,00 | 0,00 | 0,46 | 5,81 | 0,0549 | 0,0050 | |||

| ROP / Roper Technologies, Inc. | 0,00 | 0,00 | 0,46 | -2,36 | 0,0549 | 0,0008 | |||

| US592029AE23 / METROPOLITAN GOVERNMENT NASHVILLE & DAVIDSON COUNT | 0,45 | -9,56 | 0,0548 | -0,0034 | |||||

| EW / Edwards Lifesciences Corporation | 0,01 | 0,00 | 0,45 | 9,22 | 0,0543 | 0,0065 | |||

| OKE / ONEOK, Inc. | 0,01 | 0,00 | 0,45 | -19,53 | 0,0538 | -0,0104 | |||

| FAST / Fastenal Company | 0,01 | 100,00 | 0,44 | 9,09 | 0,0537 | 0,0064 | |||

| UNIVERSITY OF WISCONSIN HOSPITALS CLINICS / DBT (US915260FT55) | 0,44 | -8,73 | 0,0530 | -0,0028 | |||||

| UNIVERSITY OF WISCONSIN HOSPITALS CLINICS / DBT (US915260FT55) | 0,44 | -8,73 | 0,0530 | -0,0028 | |||||

| NRG / NRG Energy, Inc. | 0,00 | -0,04 | 0,43 | 47,62 | 0,0524 | 0,0182 | |||

| US599772AB61 / Military Installation Development Authority | 0,43 | -4,85 | 0,0521 | -0,0006 | |||||

| US825485XP57 / CITY OF SHREVEPORT LA WATER & SEWER REVENUE | 0,43 | -8,49 | 0,0520 | -0,0026 | |||||

| CVS / CVS Health Corporation | 0,01 | 0,00 | 0,42 | -2,54 | 0,0510 | 0,0007 | |||

| CMI / Cummins Inc. | 0,00 | 0,00 | 0,42 | -12,76 | 0,0504 | -0,0051 | |||

| IDXX / IDEXX Laboratories, Inc. | 0,00 | 0,00 | 0,41 | 17,28 | 0,0500 | 0,0091 | |||

| PLD / Prologis, Inc. | 0,00 | -7,65 | 0,41 | -19,02 | 0,0498 | -0,0093 | |||

| COR / Cencora, Inc. | 0,00 | 0,00 | 0,41 | 14,85 | 0,0495 | 0,0081 | |||

| US491740EZ50 / Kentwood Economic Development Corp. | 0,41 | -9,80 | 0,0489 | -0,0032 | |||||

| EOG / EOG Resources, Inc. | 0,00 | -22,61 | 0,40 | -33,94 | 0,0482 | -0,0218 | |||

| US64577XEG79 / New Jersey Economic Development Auth. Rev. | 0,40 | -1,00 | 0,0478 | 0,0014 | |||||

| CBRE / CBRE Group, Inc. | 0,00 | -0,06 | 0,40 | -12,03 | 0,0477 | -0,0044 | |||

| MLM / Martin Marietta Materials, Inc. | 0,00 | 0,00 | 0,39 | 13,22 | 0,0476 | 0,0072 | |||

| ROST / Ross Stores, Inc. | 0,00 | 0,00 | 0,39 | -0,25 | 0,0475 | 0,0018 | |||

| MET / MetLife, Inc. | 0,00 | -3,85 | 0,39 | -12,30 | 0,0473 | -0,0046 | |||

| US51434NAS71 / LANCASTER INDUSTRIAL DEVELOPMENT AUTHORITY | 0,39 | -8,41 | 0,0473 | -0,0024 | |||||

| APD / Air Products and Chemicals, Inc. | 0,00 | 0,00 | 0,39 | -11,79 | 0,0470 | -0,0042 | |||

| US732203BH60 / City of Pompano Beach | 0,38 | -8,15 | 0,0462 | -0,0021 | |||||

| ECL / Ecolab Inc. | 0,00 | 0,00 | 0,38 | -1,30 | 0,0459 | 0,0012 | |||

| GLW / Corning Incorporated | 0,01 | 0,00 | 0,38 | -1,04 | 0,0459 | 0,0013 | |||

| US60637AUZ38 / MISSOURI ST HLTH & EDUCTNL FACS AUTH HLTH FACS REVENUE | 0,38 | -9,33 | 0,0457 | -0,0028 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0,00 | 0,00 | 0,38 | 9,62 | 0,0454 | 0,0057 | |||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JK44) | 0,37 | -4,11 | 0,0451 | -0,0000 | |||||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JK44) | 0,37 | -4,11 | 0,0451 | -0,0000 | |||||

| FDX / FedEx Corporation | 0,00 | 0,00 | 0,37 | -17,12 | 0,0445 | -0,0071 | |||

| PUBLIC FINANCE AUTHORITY / DBT (US74439YFZ97) | 0,37 | 0,0444 | 0,0444 | ||||||

| PUBLIC FINANCE AUTHORITY / DBT (US74439YFZ97) | 0,37 | 0,0444 | 0,0444 | ||||||

| US6262077H15 / FX.RT. MUNI BOND | 0,36 | -6,46 | 0,0437 | -0,0012 | |||||

| PCAR / PACCAR Inc | 0,00 | 0,00 | 0,36 | -12,62 | 0,0435 | -0,0043 | |||

| DHI / D.R. Horton, Inc. | 0,00 | -0,07 | 0,36 | -7,03 | 0,0431 | -0,0014 | |||

| US50376FBQ90 / La Paz County Industrial Development Authority | 0,36 | -6,32 | 0,0431 | -0,0010 | |||||

| CAH / Cardinal Health, Inc. | 0,00 | 0,00 | 0,36 | 19,06 | 0,0430 | 0,0084 | |||

| HES / Hess Corporation | 0,00 | 0,00 | 0,35 | -11,28 | 0,0428 | -0,0035 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0,00 | 0,00 | 0,35 | 9,29 | 0,0426 | 0,0051 | |||

| US57325VAV18 / MARTIN COUNTY HOSPITAL DISTRICT | 0,35 | -2,22 | 0,0425 | 0,0007 | |||||

| IRM / Iron Mountain Incorporated | 0,00 | -0,06 | 0,35 | 5,72 | 0,0425 | 0,0039 | |||

| SYF / Synchrony Financial | 0,01 | -0,05 | 0,35 | -5,14 | 0,0424 | -0,0005 | |||

| US04052BNV26 / ARIZONA ST INDL DEV AUTH EDU REVENUE | 0,35 | -7,67 | 0,0421 | -0,0018 | |||||

| IR / Ingersoll Rand Inc. | 0,00 | 0,00 | 0,34 | -3,68 | 0,0410 | 0,0001 | |||

| TSCO / Tractor Supply Company | 0,01 | -0,04 | 0,33 | -12,57 | 0,0403 | -0,0040 | |||

| VLO / Valero Energy Corporation | 0,00 | -16,81 | 0,33 | -17,87 | 0,0400 | -0,0068 | |||

| SPG / Simon Property Group, Inc. | 0,00 | -47,21 | 0,33 | -53,82 | 0,0394 | -0,0425 | |||

| RMD / ResMed Inc. | 0,00 | 0,00 | 0,32 | 4,56 | 0,0388 | 0,0032 | |||

| YUM / Yum! Brands, Inc. | 0,00 | -23,18 | 0,32 | -29,27 | 0,0385 | -0,0138 | |||

| PSX / Phillips 66 | 0,00 | 0,00 | 0,32 | -12,36 | 0,0385 | -0,0038 | |||

| DRI / Darden Restaurants, Inc. | 0,00 | -0,07 | 0,32 | 6,78 | 0,0381 | 0,0038 | |||

| BKR / Baker Hughes Company | 0,01 | 0,00 | 0,32 | -16,89 | 0,0380 | -0,0060 | |||

| ROK / Rockwell Automation, Inc. | 0,00 | 0,00 | 0,31 | 9,96 | 0,0373 | 0,0047 | |||

| A / Agilent Technologies, Inc. | 0,00 | 0,00 | 0,31 | -12,46 | 0,0373 | -0,0037 | |||

| CTVA / Corteva, Inc. | 0,00 | 0,00 | 0,31 | 12,41 | 0,0372 | 0,0054 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0,00 | 0,00 | 0,30 | -2,88 | 0,0367 | 0,0004 | |||

| WRB / W. R. Berkley Corporation | 0,00 | -0,05 | 0,30 | 18,18 | 0,0361 | 0,0068 | |||

| VMC / Vulcan Materials Company | 0,00 | 0,00 | 0,29 | 7,30 | 0,0355 | 0,0037 | |||

| KEYS / Keysight Technologies, Inc. | 0,00 | -0,05 | 0,29 | -1,68 | 0,0353 | 0,0008 | |||

| RJF / Raymond James Financial, Inc. | 0,00 | -0,05 | 0,29 | -4,89 | 0,0352 | -0,0004 | |||

| AEP / American Electric Power Company, Inc. | 0,00 | 0,00 | 0,29 | -2,68 | 0,0352 | 0,0005 | |||

| NDAQ / Nasdaq, Inc. | 0,00 | 0,00 | 0,29 | 1,05 | 0,0350 | 0,0017 | |||

| MTD / Mettler-Toledo International Inc. | 0,00 | 0,00 | 0,29 | -9,43 | 0,0348 | -0,0020 | |||

| NUE / Nucor Corporation | 0,00 | -0,04 | 0,29 | -20,66 | 0,0348 | -0,0073 | |||

| EA / Electronic Arts Inc. | 0,00 | 0,00 | 0,29 | 11,72 | 0,0345 | 0,0047 | |||

| FANG / Diamondback Energy, Inc. | 0,00 | -0,05 | 0,28 | -15,52 | 0,0342 | -0,0047 | |||

| KMB / Kimberly-Clark Corporation | 0,00 | 0,00 | 0,28 | 1,43 | 0,0342 | 0,0017 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0,00 | 0,00 | 0,28 | -9,32 | 0,0341 | -0,0020 | |||

| PEP / PepsiCo, Inc. | 0,00 | -68,95 | 0,28 | -73,38 | 0,0333 | -0,0870 | |||

| STX / Seagate Technology Holdings plc | 0,00 | -0,04 | 0,27 | 15,61 | 0,0331 | 0,0056 | |||

| US50376FBR73 / La Paz County Industrial Development Authority | 0,27 | -6,57 | 0,0326 | -0,0009 | |||||

| EFX / Equifax Inc. | 0,00 | 0,00 | 0,27 | 8,00 | 0,0326 | 0,0035 | |||

| ANSS / ANSYS, Inc. | 0,00 | 0,00 | 0,26 | -0,75 | 0,0318 | 0,0010 | |||

| US93978TS593 / WASHINGTON ST HSG FIN COMMISSION | 0,26 | -2,97 | 0,0316 | 0,0003 | |||||

| WEC / WEC Energy Group, Inc. | 0,00 | 0,00 | 0,26 | 0,78 | 0,0313 | 0,0014 | |||

| OTIS / Otis Worldwide Corporation | 0,00 | 0,00 | 0,26 | -4,46 | 0,0311 | -0,0002 | |||

| SALEM ECONOMIC DEVELOPMENT AUTHORITY / DBT (US794565BL41) | 0,26 | 0,0308 | 0,0308 | ||||||

| SALEM ECONOMIC DEVELOPMENT AUTHORITY / DBT (US794565BL41) | 0,26 | 0,0308 | 0,0308 | ||||||

| WTW / Willis Towers Watson Public Limited Company | 0,00 | 0,00 | 0,25 | -6,99 | 0,0306 | -0,0010 | |||

| US700387EV15 / PARK CREEK METROPOLITAN DISTRICT | 0,25 | -0,80 | 0,0301 | 0,0009 | |||||

| PEG / Public Service Enterprise Group Incorporated | 0,00 | 0,00 | 0,25 | 0,00 | 0,0297 | 0,0011 | |||

| NTAP / NetApp, Inc. | 0,00 | -0,04 | 0,24 | -0,81 | 0,0295 | 0,0009 | |||

| MONTANA BOARD OF HOUSING / DBT (US61212WZZ12) | 0,24 | 0,0295 | 0,0295 | ||||||

| MONTANA BOARD OF HOUSING / DBT (US61212WZZ12) | 0,24 | 0,0295 | 0,0295 | ||||||

| WAT / Waters Corporation | 0,00 | 0,00 | 0,24 | -7,69 | 0,0291 | -0,0011 | |||

| SYY / Sysco Corporation | 0,00 | 0,00 | 0,24 | -3,23 | 0,0290 | 0,0002 | |||

| MNST / Monster Beverage Corporation | 0,00 | 0,00 | 0,24 | 17,24 | 0,0287 | 0,0051 | |||

| TPR / Tapestry, Inc. | 0,00 | -0,07 | 0,24 | -8,14 | 0,0286 | -0,0013 | |||

| US4521526L09 / ILLINOIS ST | 0,24 | -3,69 | 0,0285 | 0,0001 | |||||

| DELAWARE STATE HOUSING AUTHORITY / DBT (US246395N529) | 0,24 | -6,00 | 0,0284 | -0,0006 | |||||

| DELAWARE STATE HOUSING AUTHORITY / DBT (US246395N529) | 0,24 | -6,00 | 0,0284 | -0,0006 | |||||

| 0L8A / The Southern Company | 0,00 | 0,00 | 0,23 | 0,43 | 0,0281 | 0,0012 | |||

| LYV / Live Nation Entertainment, Inc. | 0,00 | -0,06 | 0,23 | -4,55 | 0,0280 | -0,0001 | |||

| PHM / PulteGroup, Inc. | 0,00 | -0,04 | 0,23 | -4,94 | 0,0279 | -0,0004 | |||

| CF / CF Industries Holdings, Inc. | 0,00 | -0,04 | 0,23 | 12,20 | 0,0278 | 0,0039 | |||

| HPQ / HP Inc. | 0,01 | -9,40 | 0,23 | -27,07 | 0,0277 | -0,0087 | |||

| US64542YAJ55 / NEW HOPE CULTURAL EDU FACS FIN CORP TX CAPITAL IMPT REVENUE | 0,23 | -0,43 | 0,0277 | 0,0009 | |||||

| BDX / Becton, Dickinson and Company | 0,00 | 0,00 | 0,23 | -23,39 | 0,0273 | -0,0070 | |||

| STT / State Street Corporation | 0,00 | 0,00 | 0,22 | -3,04 | 0,0270 | 0,0003 | |||

| US50376FBS56 / La Paz County Industrial Development Authority | 0,22 | -5,91 | 0,0269 | -0,0006 | |||||

| FITB / Fifth Third Bancorp | 0,01 | -30,02 | 0,22 | -38,61 | 0,0268 | -0,0151 | |||

| SRE / Sempra | 0,00 | 0,00 | 0,22 | 9,95 | 0,0267 | 0,0033 | |||

| PRU / Prudential Financial, Inc. | 0,00 | -11,92 | 0,22 | -20,58 | 0,0266 | -0,0056 | |||

| US60637APW61 / Missouri Health and Educational Facilities Authority, Health Facilities Revenue Bonds, Mosaic Health System, Series 2019A | 0,21 | -7,79 | 0,0258 | -0,0011 | |||||

| DUK / Duke Energy Corporation | 0,00 | 0,00 | 0,21 | 0,47 | 0,0257 | 0,0010 | |||

| RF / Regions Financial Corporation | 0,01 | -0,05 | 0,21 | -9,91 | 0,0253 | -0,0016 | |||

| GRMN / Garmin Ltd. | 0,00 | 0,00 | 0,21 | -11,49 | 0,0252 | -0,0021 | |||

| VLTO / Veralto Corporation | 0,00 | 0,00 | 0,21 | 0,98 | 0,0249 | 0,0013 | |||

| HUM / Humana Inc. | 0,00 | 0,00 | 0,21 | -13,81 | 0,0249 | -0,0029 | |||

| US422230BS05 / HEARD CNTY GA DEV AUTH | 0,20 | -94,12 | 0,0241 | -0,3701 | |||||

| CNP / CenterPoint Energy, Inc. | 0,01 | 0,00 | 0,20 | 8,20 | 0,0239 | 0,0027 | |||

| DD / DuPont de Nemours, Inc. | 0,00 | -13,55 | 0,20 | -29,29 | 0,0239 | -0,0086 | |||

| LHX / L3Harris Technologies, Inc. | 0,00 | 0,00 | 0,20 | 18,67 | 0,0238 | 0,0045 | |||

| XYL / Xylem Inc. | 0,00 | 0,00 | 0,20 | -3,47 | 0,0235 | 0,0000 | |||

| PFG / Principal Financial Group, Inc. | 0,00 | -0,04 | 0,19 | -12,73 | 0,0233 | -0,0023 | |||

| VRSN / VeriSign, Inc. | 0,00 | 0,00 | 0,19 | 14,63 | 0,0227 | 0,0036 | |||

| L / Loews Corporation | 0,00 | -0,05 | 0,19 | 2,76 | 0,0225 | 0,0015 | |||

| TROW / T. Rowe Price Group, Inc. | 0,00 | 0,00 | 0,18 | -11,54 | 0,0222 | -0,0019 | |||

| PPG / PPG Industries, Inc. | 0,00 | 0,00 | 0,18 | -2,16 | 0,0219 | 0,0004 | |||

| AEE / Ameren Corporation | 0,00 | 0,00 | 0,18 | -4,30 | 0,0215 | -0,0002 | |||

| EXPD / Expeditors International of Washington, Inc. | 0,00 | -0,06 | 0,18 | -4,32 | 0,0214 | -0,0000 | |||

| STZ / Constellation Brands, Inc. | 0,00 | 0,00 | 0,17 | 1,75 | 0,0211 | 0,0011 | |||

| IT / Gartner, Inc. | 0,00 | 0,00 | 0,17 | -12,50 | 0,0204 | -0,0020 | |||

| DOV / Dover Corporation | 0,00 | -34,73 | 0,17 | -41,75 | 0,0201 | -0,0130 | |||

| MOS / The Mosaic Company | 0,00 | -0,05 | 0,16 | 51,43 | 0,0193 | 0,0070 | |||

| MCHP / Microchip Technology Incorporated | 0,00 | 0,00 | 0,16 | -1,24 | 0,0192 | 0,0005 | |||

| LEN / Lennar Corporation | 0,00 | -44,14 | 0,16 | -50,47 | 0,0191 | -0,0179 | |||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JD01) | 0,16 | -1,90 | 0,0188 | 0,0004 | |||||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JD01) | 0,16 | -1,90 | 0,0188 | 0,0004 | |||||

| EQR / Equity Residential | 0,00 | 0,00 | 0,16 | -5,49 | 0,0187 | -0,0003 | |||

| F / Ford Motor Company | 0,01 | 0,00 | 0,16 | 9,15 | 0,0187 | 0,0022 | |||

| ED / Consolidated Edison, Inc. | 0,00 | 0,00 | 0,15 | 2,67 | 0,0187 | 0,0012 | |||

| TXT / Textron Inc. | 0,00 | -0,05 | 0,15 | -0,65 | 0,0185 | 0,0005 | |||

| PSA / Public Storage | 0,00 | 0,00 | 0,15 | 1,33 | 0,0184 | 0,0010 | |||

| XEL / Xcel Energy Inc. | 0,00 | 0,00 | 0,15 | -2,67 | 0,0177 | 0,0002 | |||

| BALL / Ball Corporation | 0,00 | 0,00 | 0,15 | 2,10 | 0,0177 | 0,0010 | |||

| CINF / Cincinnati Financial Corporation | 0,00 | 0,00 | 0,15 | 2,10 | 0,0176 | 0,0010 | |||

| HSY / The Hershey Company | 0,00 | 0,00 | 0,15 | -7,01 | 0,0176 | -0,0006 | |||

| US45203H7B29 / Illinois Finance Authority | 0,15 | -81,97 | 0,0176 | -0,0757 | |||||

| DVN / Devon Energy Corporation | 0,00 | 0,00 | 0,14 | -16,86 | 0,0173 | -0,0026 | |||

| GPC / Genuine Parts Company | 0,00 | 0,00 | 0,14 | 1,45 | 0,0169 | 0,0009 | |||

| MAS / Masco Corporation | 0,00 | -21,53 | 0,14 | -34,74 | 0,0168 | -0,0080 | |||

| LUV / Southwest Airlines Co. | 0,00 | 0,00 | 0,14 | 8,00 | 0,0163 | 0,0017 | |||

| IP / International Paper Company | 0,00 | 0,00 | 0,13 | -15,38 | 0,0160 | -0,0021 | |||

| LH / Labcorp Holdings Inc. | 0,00 | 0,00 | 0,13 | -1,53 | 0,0157 | 0,0005 | |||

| OMC / Omnicom Group Inc. | 0,00 | 0,00 | 0,13 | -11,03 | 0,0156 | -0,0013 | |||

| FTV / Fortive Corporation | 0,00 | 0,00 | 0,13 | -11,72 | 0,0155 | -0,0014 | |||

| DTE / DTE Energy Company | 0,00 | 0,00 | 0,13 | 2,46 | 0,0151 | 0,0009 | |||

| J / Jacobs Solutions Inc. | 0,00 | 0,00 | 0,12 | -1,63 | 0,0147 | 0,0004 | |||

| MTB / M&T Bank Corporation | 0,00 | 0,00 | 0,12 | -4,76 | 0,0145 | -0,0001 | |||

| AVY / Avery Dennison Corporation | 0,00 | 0,00 | 0,12 | -5,65 | 0,0141 | -0,0002 | |||

| RL / Ralph Lauren Corporation | 0,00 | 0,00 | 0,12 | 2,65 | 0,0140 | 0,0008 | |||

| CMS / CMS Energy Corporation | 0,00 | 0,00 | 0,11 | -3,54 | 0,0132 | 0,0000 | |||

| TFC / Truist Financial Corporation | 0,00 | 0,00 | 0,11 | -14,96 | 0,0131 | -0,0017 | |||

| BIIB / Biogen Inc. | 0,00 | 0,00 | 0,11 | -7,89 | 0,0128 | -0,0005 | |||

| AVB / AvalonBay Communities, Inc. | 0,00 | 0,00 | 0,11 | -8,70 | 0,0127 | -0,0007 | |||

| HPE / Hewlett Packard Enterprise Company | 0,01 | -23,69 | 0,10 | -33,76 | 0,0126 | -0,0056 | |||

| DGX / Quest Diagnostics Incorporated | 0,00 | 0,00 | 0,10 | 0,97 | 0,0125 | 0,0005 | |||

| DVA / DaVita Inc. | 0,00 | 0,00 | 0,10 | -8,18 | 0,0123 | -0,0005 | |||

| US038315EF09 / APPLING CNTY GA DEV AUTH | 0,10 | -97,96 | 0,0121 | -0,5561 | |||||

| EL / The Estée Lauder Companies Inc. | 0,00 | 0,00 | 0,10 | -6,60 | 0,0120 | -0,0004 | |||

| CVX / Chevron Corporation | 0,00 | -94,26 | 0,10 | -95,09 | 0,0118 | -0,2175 | |||

| TSN / Tyson Foods, Inc. | 0,00 | 0,00 | 0,10 | -8,49 | 0,0118 | -0,0006 | |||

| EXPE / Expedia Group, Inc. | 0,00 | 0,00 | 0,10 | -15,93 | 0,0116 | -0,0016 | |||

| AKAM / Akamai Technologies, Inc. | 0,00 | 0,00 | 0,09 | -6,00 | 0,0114 | -0,0002 | |||

| FIS / Fidelity National Information Services, Inc. | 0,00 | 0,00 | 0,09 | 12,05 | 0,0113 | 0,0016 | |||

| USB / U.S. Bancorp | 0,00 | -78,78 | 0,09 | -80,42 | 0,0113 | -0,0438 | |||

| MMM / 3M Company | 0,00 | 0,00 | 0,09 | -4,26 | 0,0109 | -0,0001 | |||

| ES / Eversource Energy | 0,00 | 0,00 | 0,09 | 3,49 | 0,0108 | 0,0007 | |||

| SJM / The J. M. Smucker Company | 0,00 | 0,00 | 0,09 | 2,33 | 0,0107 | 0,0006 | |||

| ALLE / Allegion plc | 0,00 | 0,00 | 0,09 | 11,54 | 0,0106 | 0,0014 | |||

| PNR / Pentair plc | 0,00 | 0,00 | 0,09 | 6,17 | 0,0104 | 0,0009 | |||

| BBY / Best Buy Co., Inc. | 0,00 | 0,00 | 0,08 | -26,79 | 0,0100 | -0,0030 | |||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JF58) | 0,08 | -2,38 | 0,0099 | 0,0001 | |||||

| BERKS COUNTY MUNICIPAL AUTHORITY THE / DBT (US084538JF58) | 0,08 | -2,38 | 0,0099 | 0,0001 | |||||

| VTR / Ventas, Inc. | 0,00 | 0,00 | 0,08 | -7,06 | 0,0095 | -0,0003 | |||

| T / AT&T Inc. | 0,00 | 0,00 | 0,08 | 1,32 | 0,0093 | 0,0005 | |||

| NWSA / News Corporation | 0,00 | 0,00 | 0,08 | -1,30 | 0,0093 | 0,0002 | |||

| CHTR / Charter Communications, Inc. | 0,00 | 0,00 | 0,07 | 8,82 | 0,0090 | 0,0011 | |||

| CMA / Comerica Incorporated | 0,00 | -0,08 | 0,07 | -10,84 | 0,0089 | -0,0008 | |||

| EMN / Eastman Chemical Company | 0,00 | 0,00 | 0,07 | -19,78 | 0,0089 | -0,0018 | |||

| ETR / Entergy Corporation | 0,00 | 0,00 | 0,07 | -3,95 | 0,0088 | -0,0001 | |||

| KMX / CarMax, Inc. | 0,00 | -18,71 | 0,07 | -37,39 | 0,0088 | -0,0046 | |||

| HAS / Hasbro, Inc. | 0,00 | 0,00 | 0,07 | 1,54 | 0,0081 | 0,0005 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0,00 | 0,00 | 0,07 | -12,00 | 0,0080 | -0,0008 | |||

| CCL / Carnival Corporation & plc | 0,00 | 0,00 | 0,06 | -3,03 | 0,0078 | 0,0001 | |||

| C / Citigroup Inc. - Corporate Bond/Note | 0,00 | 0,00 | 0,06 | -4,55 | 0,0076 | -0,0002 | |||

| ZION / Zions Bancorporation, National Association | 0,00 | -0,08 | 0,06 | -12,86 | 0,0075 | -0,0007 | |||

| PKI / Revvity Inc. | 0,00 | 0,00 | 0,06 | -19,74 | 0,0074 | -0,0014 | |||

| GPN / Global Payments Inc. | 0,00 | 0,00 | 0,06 | -28,05 | 0,0071 | -0,0024 | |||

| OXY / Occidental Petroleum Corporation | 0,00 | -77,16 | 0,06 | -80,92 | 0,0070 | -0,0283 | |||

| LNC / Lincoln National Corporation | 0,00 | -0,06 | 0,06 | -14,93 | 0,0069 | -0,0009 | |||

| CTRA / Coterra Energy Inc. | 0,00 | 0,00 | 0,05 | -10,53 | 0,0062 | -0,0004 | |||

| WDC / Western Digital Corporation | 0,00 | 0,00 | 0,05 | 4,44 | 0,0057 | 0,0005 | |||

| US45204E6G87 / ILLINOIS FIN AT 4% 2/15/2041 PRE | 0,05 | -2,17 | 0,0055 | 0,0002 | |||||

| SWK / Stanley Black & Decker, Inc. | 0,00 | 0,00 | 0,04 | -24,56 | 0,0052 | -0,0014 | |||

| KEY / KeyCorp | 0,00 | 0,00 | 0,04 | -8,89 | 0,0051 | -0,0003 | |||

| BBWI / Bath & Body Works, Inc. | 0,00 | -0,07 | 0,04 | -23,08 | 0,0049 | -0,0012 | |||

| MRP / Millrose Properties, Inc. | 0,00 | -0,07 | 0,04 | 23,33 | 0,0045 | 0,0009 | |||

| DOW / Dow Inc. | 0,00 | -21,48 | 0,04 | -43,75 | 0,0044 | -0,0030 | |||

| RHI / Robert Half Inc. | 0,00 | -1,33 | 0,03 | -25,00 | 0,0041 | -0,0011 | |||

| ILLINOIS FINANCE AUTHORITY / DBT (US45204FYF60) | 0,03 | 0,00 | 0,0031 | 0,0001 | |||||

| ILLINOIS FINANCE AUTHORITY / DBT (US45204FYF60) | 0,03 | 0,00 | 0,0031 | 0,0001 | |||||

| HBAN / Huntington Bancshares Incorporated | 0,00 | 0,00 | 0,03 | -3,85 | 0,0031 | -0,0000 | |||

| AMTM / Amentum Holdings, Inc. | 0,00 | 5,92 | 0,02 | 16,67 | 0,0025 | 0,0004 | |||