Grundlæggende statistik

| Porteføljeværdi | $ 504.931.732 |

| Nuværende stillinger | 138 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

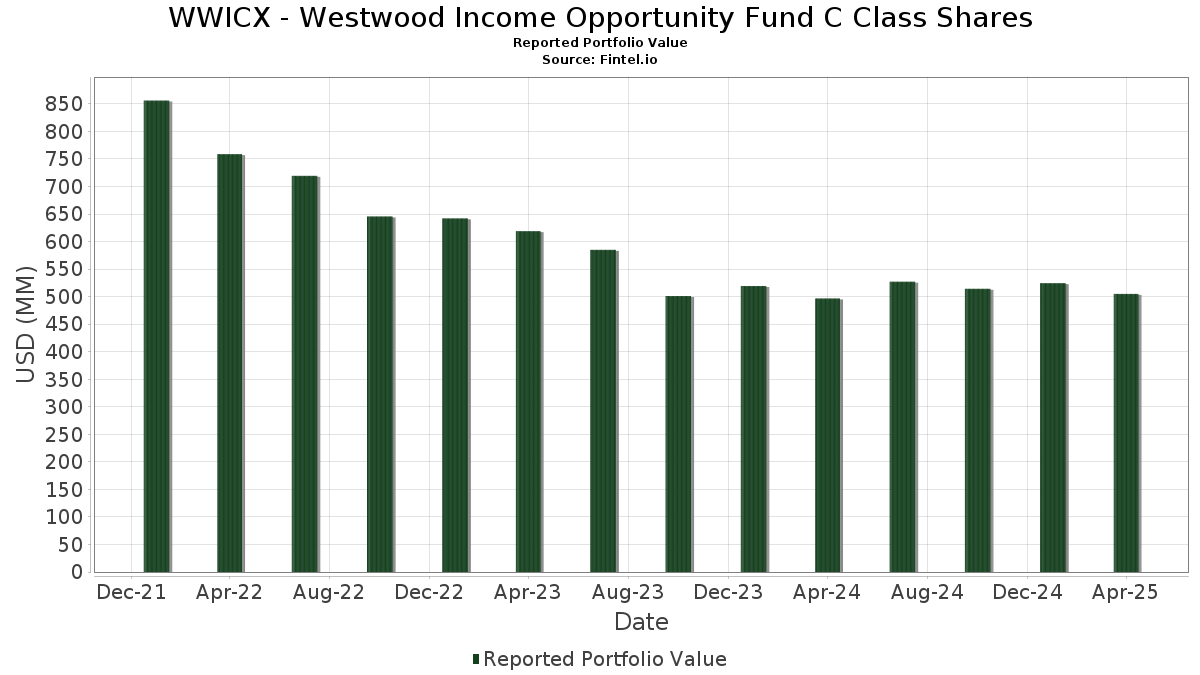

WWICX - Westwood Income Opportunity Fund C Class Shares har afsløret 138 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 504.931.732 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). WWICX - Westwood Income Opportunity Fund C Class Sharess største beholdninger er Microsoft Corporation (US:MSFT) , Gilead Sciences, Inc. (US:GILD) , The Goldman Sachs Group, Inc. (US:GS) , Energy Transfer LP - Limited Partnership (US:ET) , and Alphabet Inc. (US:GOOGL) . WWICX - Westwood Income Opportunity Fund C Class Sharess nye stillinger omfatter Berkshire Hathaway Inc. (US:BRK.A) , United States Treasury Note/Bond (US:US91282CGQ87) , Celanese US Holdings LLC (US:US15089QAW42) , SouthState Corporation (US:SSB) , and FIRST AM GOV OBLIG-U (US:US31846V2117) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 19,57 | 3,8630 | 3,8630 | ||

| 7,84 | 1,5467 | 1,5467 | ||

| 0,01 | 6,93 | 1,3673 | 1,3673 | |

| 5,31 | 1,0483 | 1,0483 | ||

| 0,06 | 5,25 | 1,0355 | 1,0355 | |

| 5,15 | 1,0158 | 1,0158 | ||

| 0,07 | 4,38 | 0,8645 | 0,8645 | |

| 0,21 | 4,28 | 0,8440 | 0,8440 | |

| 0,07 | 4,08 | 0,8063 | 0,8063 | |

| 0,02 | 3,81 | 0,7515 | 0,7515 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,02 | 5,61 | 1,1074 | -1,2268 | |

| 0,00 | 0,00 | -0,7328 | ||

| 0,04 | 3,88 | 0,7661 | -0,6909 | |

| 0,02 | 5,34 | 1,0544 | -0,3870 | |

| 0,49 | 8,12 | 1,6025 | -0,3850 | |

| 0,00 | 0,00 | -0,2833 | ||

| 0,02 | 8,23 | 1,6237 | -0,2785 | |

| 8,76 | 1,7297 | -0,2274 | ||

| 0,02 | 4,34 | 0,8567 | -0,2239 | |

| 1,32 | 0,2607 | -0,2074 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-06-25 for rapporteringsperioden 2025-04-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Bill 0.000%, Due 06/25/2025 / DBT (US912797NW34) | 19,57 | 3,8630 | 3,8630 | ||||||

| United States Treasury Note/Bond 4.625%, Due 05/15/354 / DBT (US912810UA42) | 8,76 | -16,17 | 1,7297 | -0,2274 | |||||

| MSFT / Microsoft Corporation | 0,02 | -5,30 | 8,66 | -9,82 | 1,7103 | -0,0886 | |||

| GILD / Gilead Sciences, Inc. | 0,08 | -5,30 | 8,59 | 3,79 | 1,6965 | 0,1462 | |||

| GS / The Goldman Sachs Group, Inc. | 0,02 | -5,31 | 8,23 | -19,04 | 1,6237 | -0,2785 | |||

| ET / Energy Transfer LP - Limited Partnership | 0,49 | -5,30 | 8,12 | -23,52 | 1,6025 | -0,3850 | |||

| U.S. Treasury Notes 4.625%, Due 02/15/2035 / DBT (US91282CMM00) | 7,84 | 1,5467 | 1,5467 | ||||||

| GOOGL / Alphabet Inc. | 0,05 | 27,08 | 7,55 | -1,09 | 1,4907 | 0,0613 | |||

| BRK.A / Berkshire Hathaway Inc. | 0,01 | 6,93 | 1,3673 | 1,3673 | |||||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0,12 | -5,30 | 6,69 | -16,64 | 1,3199 | -0,1820 | |||

| JEPQ / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Nasdaq Equity Premium Income ETF | 0,13 | -5,30 | 6,49 | -15,41 | 1,2801 | -0,1552 | |||

| United States Treasury Notes 4.375%, Due 05/15/2034 / DBT (US91282CKQ32) | 6,42 | 3,16 | 1,2682 | 0,1023 | |||||

| WEC / WEC Energy Group, Inc. | 0,06 | -5,30 | 6,22 | 4,49 | 1,2274 | 0,1132 | |||

| NVDA / NVIDIA Corporation | 0,06 | 91,09 | 6,09 | 73,37 | 1,2017 | 0,5441 | |||

| DFS / Discover Financial Services | 0,03 | 20,76 | 6,06 | 9,71 | 1,1959 | 0,1619 | |||

| LOW / Lowe's Companies, Inc. | 0,03 | -5,30 | 5,81 | -18,59 | 1,1465 | -0,1893 | |||

| JPM / JPMorgan Chase & Co. | 0,02 | -50,83 | 5,61 | -55,00 | 1,1074 | -1,2268 | |||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 5,49 | -1,63 | 1,0830 | 0,0387 | |||||

| IBM / International Business Machines Corporation | 0,02 | -26,63 | 5,34 | -30,62 | 1,0544 | -0,3870 | |||

| US91282CGQ87 / United States Treasury Note/Bond | 5,31 | 1,0483 | 1,0483 | ||||||

| United States Treasury Note/Bond 4.5%, Due 11/15/2054 / DBT (US912810UE63) | 5,27 | 2,00 | 1,0393 | 0,0727 | |||||

| US15089QAW42 / Celanese US Holdings LLC | 5,27 | -1,46 | 1,0393 | 0,0388 | |||||

| SSB / SouthState Corporation | 0,06 | 5,25 | 1,0355 | 1,0355 | |||||

| HON / Honeywell International Inc. | 0,02 | -5,30 | 5,22 | -10,90 | 1,0298 | -0,0665 | |||

| JEPI / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Equity Premium Income ETF | 0,09 | -5,31 | 5,21 | -10,74 | 1,0291 | -0,0644 | |||

| United States Treasury Note/Bond 4.0% Due 03/31/2030 / DBT (US91282CMU26) | 5,15 | 1,0158 | 1,0158 | ||||||

| US31846V2117 / FIRST AM GOV OBLIG-U | 5,07 | -2,70 | 1,0015 | 0,0251 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 5,07 | 2,08 | 1,0001 | 0,0707 | |||||

| US912810TU25 / United States Treasury Note/Bond | 5,06 | 2,28 | 0,9991 | 0,0726 | |||||

| VTR / Ventas, Inc. | 0,07 | -5,30 | 4,91 | 9,82 | 0,9692 | 0,1322 | |||

| GD / General Dynamics Corporation | 0,02 | 38,21 | 4,84 | 46,35 | 0,9549 | 0,3360 | |||

| WFC / Wells Fargo & Company | 0,07 | -5,30 | 4,72 | -14,68 | 0,9308 | -0,1038 | |||

| US161175BA14 / Charter Communications Operating LLC / Charter Communications Operating Capital | 4,61 | -2,02 | 0,9095 | 0,0291 | |||||

| MU / Micron Technology, Inc. | 0,06 | 132,81 | 4,53 | 96,36 | 0,8935 | 0,4619 | |||

| US29273VAM28 / Energy Transfer LP | 4,38 | -3,07 | 0,8653 | 0,0185 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0,07 | 4,38 | 0,8645 | 0,8645 | |||||

| FDX / FedEx Corporation | 0,02 | -5,30 | 4,34 | -24,80 | 0,8567 | -0,2239 | |||

| US04010LBE20 / Ares Capital Corp. | 4,32 | -0,67 | 0,8536 | 0,0385 | |||||

| INTC / Intel Corporation | 0,21 | 4,28 | 0,8440 | 0,8440 | |||||

| ABT / Abbott Laboratories | 0,03 | -5,30 | 4,20 | -3,23 | 0,8282 | 0,0165 | |||

| MCY / Mercury General Corporation | 0,07 | 4,08 | 0,8063 | 0,8063 | |||||

| US05526DBX21 / BATSLN 7 3/4 10/19/32 | 4,08 | 0,64 | 0,8061 | 0,0465 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 4,08 | 9,45 | 0,8049 | 0,1074 | |||||

| US816851BR98 / Sempra Energy | 4,06 | 1,12 | 0,8018 | 0,0498 | |||||

| GOLD / Barrick Mining Corporation | 0,21 | 78,91 | 3,97 | 108,13 | 0,7832 | 0,4262 | |||

| Integer Holdings Corp 2.125%, Due 02/15/28 / DBT (US45826HAB50) | 3,96 | -9,66 | 0,7812 | -0,0389 | |||||

| FCT / Fincantieri S.p.A. | 3,94 | -1,89 | 0,7775 | 0,0259 | |||||

| CSCO / Cisco Systems, Inc. | 0,07 | -5,30 | 3,91 | -9,79 | 0,7711 | -0,0397 | |||

| WMT / Walmart Inc. | 0,04 | -49,66 | 3,88 | -50,13 | 0,7661 | -0,6909 | |||

| US72147KAK43 / Pilgrim's Pride Corp 6.250%, Due 07/01/33 | 3,88 | 1,52 | 0,7653 | 0,0503 | |||||

| AAPL / Apple Inc. | 0,02 | 30,20 | 3,88 | 17,24 | 0,7651 | 0,1461 | |||

| US309588AC50 / Farmers Exchange Capital | 3,86 | 1,21 | 0,7616 | 0,0477 | |||||

| PM / Philip Morris International Inc. | 0,02 | 3,81 | 0,7515 | 0,7515 | |||||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0,08 | 36,82 | 3,81 | 53,80 | 0,7511 | 0,2879 | |||

| UNITED STATES TREAS BDS 4.25% 02/15/54 / DBT (US912810TX63) | 3,79 | 415,67 | 0,7473 | 0,6083 | |||||

| US19828TAC09 / CORPORATE BONDS | 3,78 | -2,53 | 0,7458 | 0,0200 | |||||

| TSN / Tyson Foods, Inc. | 0,06 | 3,77 | 0,7432 | 0,7432 | |||||

| US902973BC96 / US Bancorp | 3,76 | -1,47 | 0,7424 | 0,0277 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0,12 | -5,30 | 3,71 | -13,28 | 0,7325 | -0,0687 | |||

| KMI / Kinder Morgan, Inc. | 0,14 | 3,71 | 0,7323 | 0,7323 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 3,66 | 1,41 | 0,7232 | 0,0468 | |||||

| MDT / Medtronic plc | 0,04 | -5,31 | 3,64 | -11,62 | 0,7192 | -0,0527 | |||

| US404280DT33 / HSBC Holdings PLC | 3,59 | -1,35 | 0,7083 | 0,0273 | |||||

| Golub Capital Private Credit Fund 5.875% Due 05/01/2030 / DBT (US38179RAC97) | 3,56 | 0,7031 | 0,7031 | ||||||

| ESS / Essex Property Trust, Inc. | 0,01 | -5,30 | 3,54 | -7,11 | 0,6995 | -0,0148 | |||

| US46647PDU75 / JPMorgan Chase & Co. | 3,48 | 1,22 | 0,6864 | 0,0432 | |||||

| US0641598S88 / Bank of Nova Scotia/The | 3,38 | -1,91 | 0,6675 | 0,0220 | |||||

| SBL Holdings Inc 7.2%, Due 10/30/2034 / DBT (US78397DAD03) | 3,37 | 22,54 | 0,6655 | 0,1503 | |||||

| PEP / PepsiCo, Inc. | 0,02 | 3,35 | 0,6615 | 0,6615 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 3,31 | -4,59 | 0,6528 | 0,0037 | |||||

| US02005NBT63 / Ally Financial Inc | 3,30 | -0,96 | 0,6504 | 0,0275 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 3,27 | 0,6447 | 0,6447 | ||||||

| US06738EBX22 / Barclays PLC | 3,25 | -1,13 | 0,6407 | 0,0260 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 3,12 | -1,14 | 0,6167 | 0,0249 | |||||

| Bank of America Corp 5.518% Due 10/25/2035 / DBT (US06051GMD87) | 3,07 | 0,6067 | 0,6067 | ||||||

| PSA / Public Storage | 0,01 | -5,31 | 3,06 | -4,70 | 0,6047 | 0,0029 | |||

| US06738ECD58 / Barclays PLC | 3,02 | 0,20 | 0,5955 | 0,0317 | |||||

| US632525BC43 / National Australia Bank Ltd. | 3,01 | 0,43 | 0,5945 | 0,0330 | |||||

| US709599BV54 / PENSKE TRUCK LEASING CO LP/PTL | 2,97 | 0,99 | 0,5868 | 0,0356 | |||||

| DPZ / Domino's Pizza, Inc. | 0,01 | 1,93 | 2,95 | 11,27 | 0,5826 | 0,0861 | |||

| US03217KAB44 / America Movil SAB de CV | 2,91 | 1,43 | 0,5738 | 0,0374 | |||||

| BDX / Becton, Dickinson and Company | 0,01 | -5,30 | 2,88 | -20,80 | 0,5683 | -0,1123 | |||

| US842587DT18 / Southern Co. (The) | 2,86 | 1,56 | 0,5649 | 0,0373 | |||||

| CRM / Salesforce, Inc. | 0,01 | 1,93 | 2,86 | -19,84 | 0,5648 | -0,1035 | |||

| US14040HDC60 / Capital One Financial Corp | 2,85 | 0,67 | 0,5623 | 0,0325 | |||||

| US31418EXW55 / FNMA, 30 Year | 2,85 | -4,37 | 0,5623 | 0,0046 | |||||

| PCH / PotlatchDeltic Corporation | 0,07 | -5,30 | 2,83 | -18,72 | 0,5588 | -0,0934 | |||

| LNT / Alliant Energy Corporation | 0,05 | -5,30 | 2,82 | -1,81 | 0,5573 | 0,0188 | |||

| US33938XAE58 / Flex Ltd | 2,79 | -0,14 | 0,5516 | 0,0276 | |||||

| US12543DBN93 / CHS/Community Health Systems Inc | 2,76 | 0,25 | 0,5448 | 0,0292 | |||||

| NNN / NNN REIT, Inc. | 0,07 | -5,30 | 2,74 | -1,19 | 0,5404 | 0,0218 | |||

| US20451RAB87 / Compass Group Diversified Holdings LLC | 2,74 | -4,84 | 0,5399 | 0,0482 | |||||

| US89356BAG32 / Transcanada Trust | 2,69 | -3,06 | 0,5315 | 0,0115 | |||||

| US589889AA22 / Merit Medical Systems Inc | 2,67 | -8,02 | 0,5277 | -0,0165 | |||||

| DLX / Deluxe Corporation | 2,60 | -2,66 | 0,5138 | 0,0131 | |||||

| MTH / Meritage Homes Corporation | 2,60 | -3,09 | 0,5137 | 0,0109 | |||||

| Sinclair Television Group Inc 8.125% Due 2/15/2033 / DBT (US829259BH26) | 2,54 | -1,93 | 0,5005 | 0,0164 | |||||

| US3140XJXY40 / UMBS | 2,52 | 0,84 | 0,4972 | 0,0295 | |||||

| US75968NAE13 / RenaissanceRe Holdings Ltd | 2,49 | 1,76 | 0,4911 | 0,0334 | |||||

| US61747YEV39 / Morgan Stanley | 2,48 | 0,53 | 0,4902 | 0,0277 | |||||

| US3132DP3N63 / Freddie Mac Pool | 2,48 | -2,36 | 0,4897 | 0,0138 | |||||

| US161175AZ73 / Charter Communications Operating LLC / Charter Communications Operating Capital | 2,46 | 0,74 | 0,4848 | 0,0284 | |||||

| US3132DWFQ15 / FHLG 30YR 4.5% 12/01/2052# | 2,45 | -0,28 | 0,4841 | 0,0237 | |||||

| US3132DWF570 / FNCL UMBS 5.0 SD8288 01-01-53 | 2,45 | -0,24 | 0,4832 | 0,0237 | |||||

| K1IM34 / Kimco Realty Corporation - Depositary Receipt (Common Stock) | 2,44 | 0,83 | 0,4807 | 0,0285 | |||||

| XAL2000DAC82 / Connect Finco Sarl Term Loan B | 2,42 | 4,32 | 0,4772 | 0,0434 | |||||

| US46115HCB15 / Intesa Sanpaolo SpA | 2,31 | -1,45 | 0,4567 | 0,0172 | |||||

| US55342UAJ34 / MPT Operating Partnership LP | 2,28 | -0,65 | 0,4501 | 0,0204 | |||||

| US22003BAQ95 / Corporate Office Properties, LP, Convertible | 2,24 | -2,56 | 0,4426 | 0,0117 | |||||

| US68389XCK90 / ORACLE CORPORATION | 2,24 | -2,52 | 0,4424 | 0,0119 | |||||

| S1RE34 / Sempra - Depositary Receipt (Common Stock) | 2,22 | -5,54 | 0,4373 | -0,0019 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 2,21 | -5,10 | 0,4372 | 0,0002 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 2,19 | 0,4326 | 0,4326 | ||||||

| US534187BR92 / Lincoln National Corp | 2,18 | -2,24 | 0,4312 | 0,0128 | |||||

| US30063PAB13 / Exas 3/8 3/15/27 Bond | 2,12 | -0,66 | 0,4177 | 0,0187 | |||||

| US17327CAR43 / Citigroup Inc | 2,11 | 0,43 | 0,4168 | 0,0231 | |||||

| B2LN34 / BlackLine, Inc. - Depositary Receipt (Common Stock) | 2,08 | 0,4098 | 0,4098 | ||||||

| Sixth Street Lending Partners 5.75%, Due 01/15/2030 / DBT (US829932AD42) | 2,06 | -0,05 | 0,4065 | 0,0207 | |||||

| US628530BJ54 / Mylan Inc. | 1,97 | -10,24 | 0,3893 | -0,0221 | |||||

| US33835PAA49 / Five Corners Funding Trust IV | 1,95 | 0,41 | 0,3843 | 0,0213 | |||||

| HES / Hess Corporation | 0,01 | -5,30 | 1,93 | -12,07 | 0,3812 | -0,0302 | |||

| US720186AP00 / PIEDMONT NATURAL GAS CO REGD 5.05000000 | 1,90 | 0,37 | 0,3741 | 0,0204 | |||||

| US665531AJ80 / CONV. NOTE | 1,87 | -16,65 | 0,3687 | -0,0508 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,84 | -0,05 | 0,3631 | 0,0184 | |||||

| Aptiv PLC / Aptiv Global Financing DAC 6.875%, Due 12/15/2054 / DBT (US03837AAD28) | 1,70 | -6,04 | 0,3347 | -0,0033 | |||||

| Mars Inc 5.7% Due 11/1/2025 / DBT (US571676BC81) | 1,60 | 0,3156 | 0,3156 | ||||||

| US24703TAK25 / CORPORATE BONDS | 1,60 | -3,91 | 0,3150 | 0,0039 | |||||

| HPQ / HP Inc. - Depositary Receipt (Common Stock) | 1,45 | 0,2860 | 0,2860 | ||||||

| US91282CFV81 / United States Treasury Note/Bond | 1,32 | -47,18 | 0,2607 | -0,2074 | |||||

| MORGAN STANLEY & COMPANY MARGIN DEPOSIT ACCOUNT / STIV (N/A) | 0,77 | 0,1516 | 0,1516 | ||||||

| UXYM5 US 10YR ULTRA JUN 2025 / DE (N/A) | 0,00 | 0,26 | 0,0506 | 0,0506 | |||||

| 5-YEAR U.S. TREASURY NOTE FUTURE 6/30/2025 / DE (N/A) | 0,00 | 0,17 | 0,0342 | 0,0342 | |||||

| EURO FX CURR FUT Jun25 6/16/2025 / DE (N/A) | 0,00 | 0,14 | 0,0285 | 0,0285 | |||||

| 2-Year U.S. Treasury Note Future 6/30/2025 / DE (N/A) | 0,00 | 0,07 | 0,0133 | 0,0133 | |||||

| WNM5 US ULTRA BOND CBT / DE (N/A) | 0,00 | 0,03 | 0,0067 | 0,0067 | |||||

| VNOM / Viper Energy, Inc. | 0,00 | -100,00 | 0,00 | -100,00 | -0,2833 | ||||

| CCI / Crown Castle Inc. | 0,00 | -100,00 | 0,00 | -100,00 | -0,7328 | ||||

| Intel Corp Call @ $25, Expiring July 2025 / DE (N/A) | Short | -0,00 | -0,10 | -0,0188 | -0,0188 | ||||

| NVIDIA Corp Call @ $130, Expiring July 2025 / DE (N/A) | Short | -0,00 | -0,17 | -0,0336 | -0,0336 | ||||

| Micron Technology Inc Call @ $90, Expiring July 2025 / DE (N/A) | Short | -0,00 | -0,21 | -0,0406 | -0,0406 |