Grundlæggende statistik

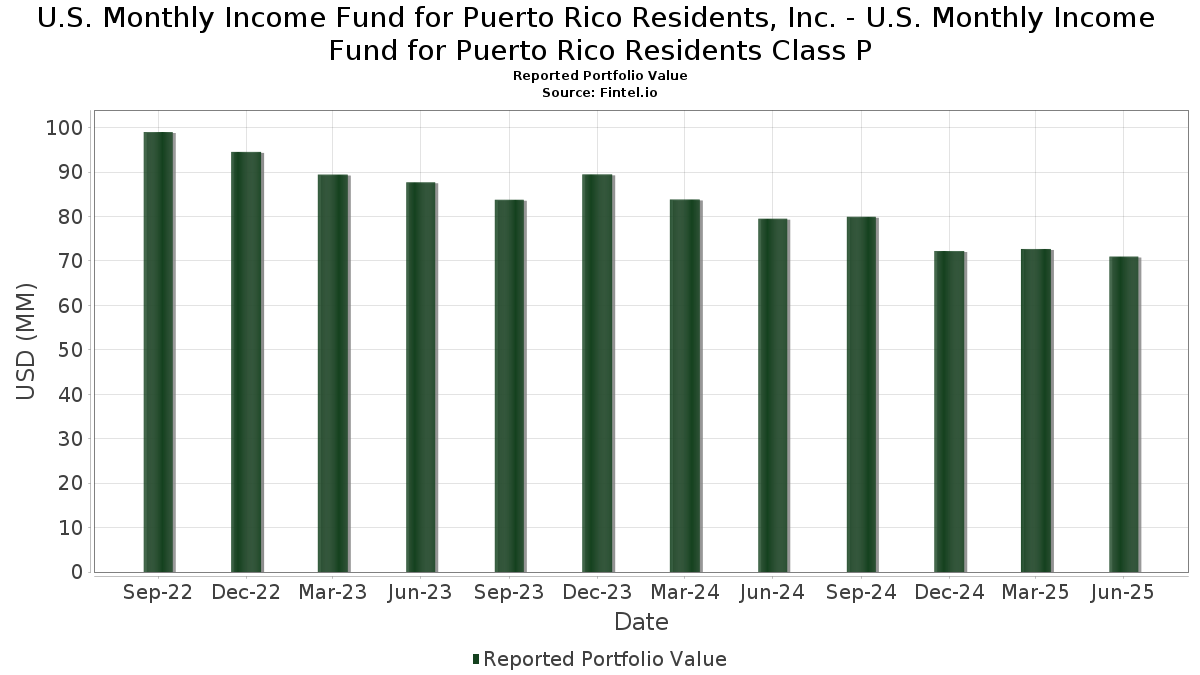

| Porteføljeværdi | $ 70.989.081 |

| Nuværende stillinger | 63 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

U.S. Monthly Income Fund for Puerto Rico Residents, Inc. - U.S. Monthly Income Fund for Puerto Rico Residents Class P har afsløret 63 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 70.989.081 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). U.S. Monthly Income Fund for Puerto Rico Residents, Inc. - U.S. Monthly Income Fund for Puerto Rico Residents Class Ps største beholdninger er Autopistas Metropolitanas de Puerto Rico LLC (PR:US05330KAA34) , MUNI ELEC AUTH OF GEORGIA (US:US626207YS78) , Fannie Mae Pool (US:US3138W2WY71) , MET TRANSPRTN AUTH NY DEDICATED TAX FUND (US:US59259NZH96) , and Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage System Revenue Bonds, Build America Taxable Bonds Series 201 (US:US546589QY11) . U.S. Monthly Income Fund for Puerto Rico Residents, Inc. - U.S. Monthly Income Fund for Puerto Rico Residents Class Ps nye stillinger omfatter Autopistas Metropolitanas de Puerto Rico LLC (PR:US05330KAA34) , MUNI ELEC AUTH OF GEORGIA (US:US626207YS78) , Fannie Mae Pool (US:US3138W2WY71) , MET TRANSPRTN AUTH NY DEDICATED TAX FUND (US:US59259NZH96) , and Louisville and Jefferson County Metropolitan Sewer District, Kentucky, Sewer and Drainage System Revenue Bonds, Build America Taxable Bonds Series 201 (US:US546589QY11) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 1,12 | 1,7606 | 1,7606 | ||

| 0,74 | 1,1702 | 1,1702 | ||

| 8,43 | 13,2996 | 0,1634 | ||

| 1,88 | 2,9658 | 0,1374 | ||

| 2,07 | 3,2674 | 0,1078 | ||

| 1,51 | 2,3789 | 0,1022 | ||

| 2,11 | 3,3361 | 0,0936 | ||

| 1,71 | 2,6928 | 0,0911 | ||

| 1,31 | 2,0676 | 0,0902 | ||

| 1,80 | 2,8349 | 0,0741 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,77 | 1,2151 | -0,6600 | ||

| 0,84 | 1,3278 | -0,0159 | ||

| 0,93 | 1,4649 | -0,0098 | ||

| 0,24 | 0,3863 | -0,0026 | ||

| 0,89 | 1,4088 | -0,0015 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-04 for rapporteringsperioden 2025-06-30. Denne investor har ikke oplyst værdipapirer, der tælles i aktier, så de aktierelaterede kolonner i nedenstående tabel er udeladt. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.