Grundlæggende statistik

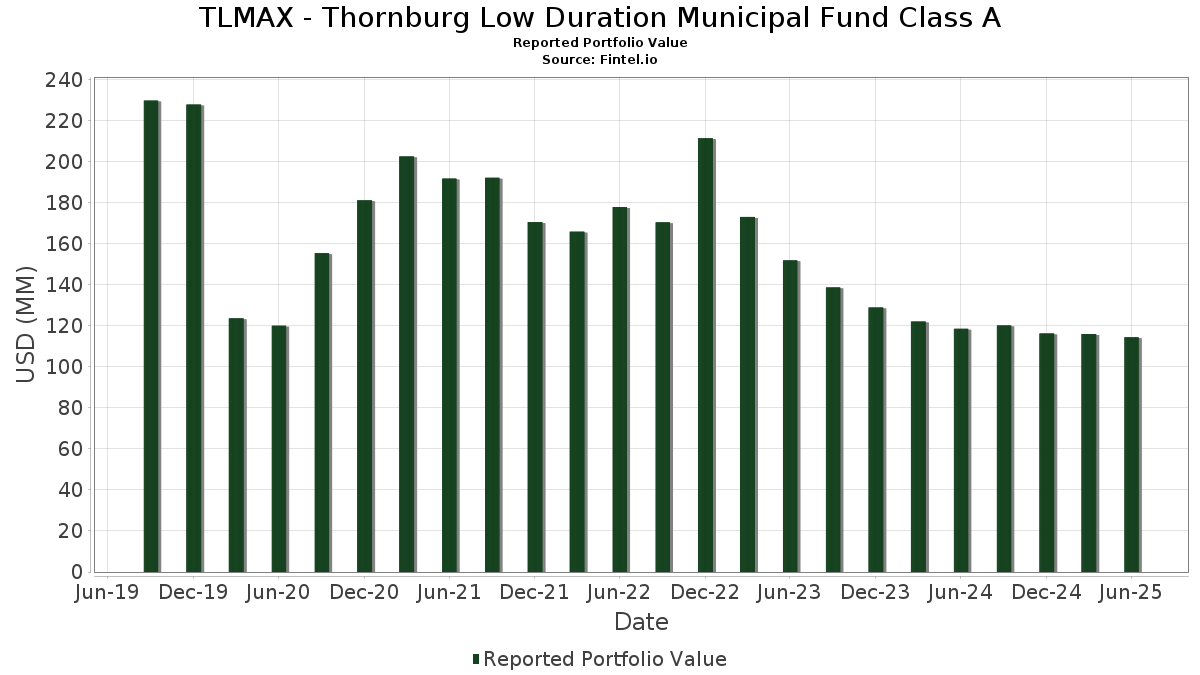

| Porteføljeværdi | $ 114.467.043 |

| Nuværende stillinger | 130 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

TLMAX - Thornburg Low Duration Municipal Fund Class A har afsløret 130 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 114.467.043 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). TLMAX - Thornburg Low Duration Municipal Fund Class As største beholdninger er INDIANA ST FIN AUTH ECON DEV R REGD V/R B/E AMT 1.40000000 (US:US45505RBN44) , PEFA INC IA GAS PROJ REVENUE (US:US70556CAB00) , Mississippi Business Finance Corp. (Chevron USA, Inc.), Series 2010 G, RB (US:US60528ABX19) , MA GENERAL BRIGHAM 19T-1 (144A/QIB) SF (MPT) FRN 07-01-49/01-29-26 (US:US57584YPF06) , and Travis County Housing Finance Corp (US:US89438UBM99) . TLMAX - Thornburg Low Duration Municipal Fund Class As nye stillinger omfatter INDIANA ST FIN AUTH ECON DEV R REGD V/R B/E AMT 1.40000000 (US:US45505RBN44) , PEFA INC IA GAS PROJ REVENUE (US:US70556CAB00) , Mississippi Business Finance Corp. (Chevron USA, Inc.), Series 2010 G, RB (US:US60528ABX19) , MA GENERAL BRIGHAM 19T-1 (144A/QIB) SF (MPT) FRN 07-01-49/01-29-26 (US:US57584YPF06) , and Travis County Housing Finance Corp (US:US89438UBM99) .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,80 | 2,4293 | 1,8327 | ||

| 1,21 | 1,0522 | 1,0522 | ||

| 1,07 | 0,9264 | 0,9264 | ||

| 1,04 | 0,9065 | 0,9065 | ||

| 1,00 | 0,8718 | 0,8718 | ||

| 1,00 | 0,8693 | 0,8693 | ||

| 1,00 | 0,8693 | 0,8693 | ||

| 0,97 | 0,8444 | 0,8444 | ||

| 0,83 | 0,7168 | 0,7168 | ||

| 0,77 | 0,6699 | 0,6699 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,60 | 0,5219 | -0,4304 | ||

| 0,98 | 0,8468 | -0,0215 | ||

| 1,53 | 1,3312 | -0,0083 | ||

| 2,07 | 1,7921 | -0,0067 | ||

| 1,09 | 0,9464 | -0,0056 | ||

| 3,04 | 2,6414 | -0,0049 | ||

| 1,02 | 0,8818 | -0,0049 | ||

| 0,99 | 0,8582 | -0,0043 | ||

| 1,00 | 0,8658 | -0,0040 | ||

| 1,00 | 0,8700 | -0,0039 |

13F og Fondsarkivering

Denne formular blev indsendt den 2025-08-21 for rapporteringsperioden 2025-06-30. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US45505RBN44 / INDIANA ST FIN AUTH ECON DEV R REGD V/R B/E AMT 1.40000000 | 3,48 | 16,67 | 3,0184 | 0,4360 | |||||

| US70556CAB00 / PEFA INC IA GAS PROJ REVENUE | 3,04 | -0,36 | 2,6414 | -0,0049 | |||||

| US60528ABX19 / Mississippi Business Finance Corp. (Chevron USA, Inc.), Series 2010 G, RB | 2,80 | 300,00 | 2,4293 | 1,8327 | |||||

| US57584YPF06 / MA GENERAL BRIGHAM 19T-1 (144A/QIB) SF (MPT) FRN 07-01-49/01-29-26 | 2,50 | 0,00 | 2,1657 | 0,0030 | |||||

| KENTUCKY ST PUBLIC ENERGY AUTH GAS SPLY REVENUE / DBT (US74440DFN93) | 2,43 | -0,08 | 2,1075 | 0,0018 | |||||

| LOS ANGELES CA DEPT OF ARPTS ARPT REVENUE / DBT (US5444452K44) | 2,15 | 1,61 | 1,8643 | 0,0325 | |||||

| TENNERGY CORP TN GAS REVENUE / DBT (US880397CJ11) | 2,14 | 0,37 | 1,8608 | 0,0099 | |||||

| US89438UBM99 / Travis County Housing Finance Corp | 2,13 | -0,19 | 1,8449 | -0,0004 | |||||

| US414009NF36 / HARRIS CNTY TX CULTURAL EDU FACS FIN CORP REVENUE | 2,07 | -0,53 | 1,7921 | -0,0067 | |||||

| US499652AM74 / KNOX CNTY TN HLTH EDUCTNL & HS KNOX COUNTY HEALTH EDUCATIONAL & HOUSING FACILITY | 2,00 | -0,25 | 1,7371 | -0,0015 | |||||

| US13048RAF47 / California Municipal Finance Authority, Solid Waste Disposal Revenue Bonds, Waste Management Inc, Series 2004 | 2,00 | 0,05 | 1,7354 | 0,0036 | |||||

| CUMBERLAND CNTY NC INDL FACS & POLL CONTROL FING AUTH SOL WS / DBT (US230589AA18) | 2,00 | 0,05 | 1,7339 | 0,0034 | |||||

| HALIFAX CNTY VA INDL DEV AUTH REVENUE / DBT (US40579PAE16) | 1,63 | 3,82 | 1,4166 | 0,0545 | |||||

| ARIZONA ST INDL DEV AUTH MF HSG REVENUE / DBT (US04062PCD15) | 1,53 | -0,78 | 1,3312 | -0,0083 | |||||

| US01728A4K99 / ALLEGHENY CNTY PA HOSP DEV AUT REGD N/C B/E 5.00000000 | 1,50 | -0,46 | 1,3023 | -0,0038 | |||||

| US162296AC15 / CHATOM AL INDL DEV BRD REVENUE | 1,50 | 0,87 | 1,3016 | 0,0131 | |||||

| CHICAGO IL O'HARE INTERNATIONAL ARPT REVENUE / DBT (US1675937F31) | 1,41 | 0,14 | 1,2248 | 0,0038 | |||||

| US069643BN34 / Bartow County Development Authority | 1,33 | 0,23 | 1,1531 | 0,0040 | |||||

| CHICAGO IL MF HSG REVENUE / DBT (US167570TV25) | 1,27 | -0,39 | 1,1034 | -0,0024 | |||||

| US61361TAA97 / Montgomery County Industrial Development Authority/PA | 1,25 | 6,41 | 1,0806 | 0,0671 | |||||

| ROCKPORT IN POLL CONTROL REVENUE / DBT (US773835BY85) | 1,21 | 1,0522 | 1,0522 | ||||||

| US607167DW00 / Industrial Development Board of the City of Mobile Alabama | 1,12 | -0,18 | 0,9710 | -0,0001 | |||||

| US478271KG34 / JOHNSON TN HOSP 5% 7/1/2025 | 1,10 | -0,36 | 0,9544 | -0,0021 | |||||

| US64972E3D99 / New York City Housing Development Corp | 1,09 | -0,82 | 0,9464 | -0,0056 | |||||

| SHELBY CNTY TN HLTH EDUCTNL &HSG FACS BRD REVENUE / DBT (US821697Y783) | 1,07 | 0,9264 | 0,9264 | ||||||

| OKLAHOMA CNTY OK FIN AUTH EDUCTNL FACS LEASE REVENUE / DBT (US67868UKE28) | 1,04 | 0,9065 | 0,9065 | ||||||

| US154871CU94 / Central Plains Energy Project | 1,04 | -0,29 | 0,9014 | -0,0009 | |||||

| US452153DG15 / ILLINOIS ST | 1,03 | -0,19 | 0,8949 | -0,0006 | |||||

| US861403AD52 / STOCKTON CA REDEV AGY SUCCESSO STOCKTON REDEVELOPMENT AGENCY SUCCESSOR AGENCY | 1,02 | -0,39 | 0,8881 | -0,0015 | |||||

| NORTH EAST TX INDEP SCH DIST / DBT (US659155QL29) | 1,02 | 0,00 | 0,8863 | 0,0015 | |||||

| US135521CM22 / Canadian County Educational Facilities Authority | 1,02 | -0,39 | 0,8854 | -0,0017 | |||||

| US93978PPU56 / WASHINGTON ST HSG FIN COMMISSI REGD V/R B/E 5.00000000 | 1,02 | -0,68 | 0,8818 | -0,0049 | |||||

| US438697BQ66 / HONOLULU HI MFR 5% 12/1/2026 MT | 1,02 | -0,59 | 0,8813 | -0,0038 | |||||

| NORTHSIDE TX INDEP SCH DIST / DBT (US66702RK922) | 1,02 | 0,10 | 0,8810 | 0,0020 | |||||

| US346668DN34 / FORSYTH MT POLL CONTROL REVENU REGD B/E 3.87500000 | 1,01 | -0,10 | 0,8785 | 0,0006 | |||||

| FARMINGTON NM POLL CONTROL REVENUE / DBT (US311450GD62) | 1,01 | 1,00 | 0,8783 | 0,0100 | |||||

| US13013JBJ43 / CALIFORNIA CMNTY CHOICE FING AUTH CLEAN ENERGY PROJ REVENUE | 1,01 | -0,20 | 0,8749 | 0,0000 | |||||

| US546510FT07 / LA OFFSHORE 4.2% 9/1/2033 | 1,01 | 0,40 | 0,8746 | 0,0042 | |||||

| US686499BQ60 / Orlando FL Tourist Development Tax Revenue | 1,01 | -0,59 | 0,8736 | -0,0032 | |||||

| US121342QG70 / BURKE GA PCR 3.8% MT | 1,01 | -0,10 | 0,8725 | 0,0003 | |||||

| MOBILE AL INDL DEV BRD POLL CONTROL REVENUE / DBT (US607167EA70) | 1,00 | 0,8718 | 0,8718 | ||||||

| US56031AAA07 / MAIKER HSG PARTNERS CO MF HSG REV | 1,00 | -0,59 | 0,8709 | -0,0034 | |||||

| HOUSTON TX HSG FIN CORP MF HSG REVENUE / DBT (US442396EN39) | 1,00 | -0,30 | 0,8708 | -0,0006 | |||||

| US88271FFQ19 / Texas State Affordable Housing Corp | 1,00 | -0,60 | 0,8700 | -0,0039 | |||||

| US88271FFR91 / TEXAS ST AFFORDABLE HSG CORP M REGD V/R B/E 3.62500000 | 1,00 | -0,40 | 0,8698 | -0,0021 | |||||

| US181008BE29 / County of Clark NV | 1,00 | 0,10 | 0,8694 | 0,0020 | |||||

| US26118RAK05 / DOWNTOWN REDEV AUTH TX (MROW) BAM 5.0% 09-01-30 | 1,00 | 0,8693 | 0,8693 | ||||||

| US83703DAA54 / SOUTH CAROLINA JOBS-ECON DEV AUTH ENVRNMNTL IMPT REVENUE | 1,00 | 0,8693 | 0,8693 | ||||||

| US9769044P40 / WISCONSIN ST HSG & ECON DEV AUTH HSG REVENUE | 1,00 | -0,30 | 0,8692 | -0,0006 | |||||

| US607167DX82 / Mobile Industrial Development Board, Alabama, Pollution Control Revenue Refunding Bonds, Alabama Power Company Barry Plan, Series 2008 | 1,00 | 0,10 | 0,8685 | 0,0019 | |||||

| US593344BS22 / Miami-Dade County Housing Finance Authority | 1,00 | -0,30 | 0,8684 | -0,0012 | |||||

| US253363UD56 / DICKINSON TX INDEP SCH DIST DICKINSON INDEPENDENT SCHOOL DISTRICT | 1,00 | -0,20 | 0,8680 | 0,0001 | |||||

| US154872AT23 / Central Plains Energy Project | 1,00 | -0,10 | 0,8678 | 0,0005 | |||||

| WATERTOWN WI / DBT (US942214E528) | 1,00 | 0,00 | 0,8678 | 0,0009 | |||||

| CAPITAL AREA HSG FIN CORP TX / DBT (US139726CX99) | 1,00 | -0,10 | 0,8677 | 0,0004 | |||||

| US708692BP27 / MUNI PUT BOND ACT | 1,00 | -0,20 | 0,8677 | -0,0006 | |||||

| MIAMI-DADE CNTY FL HSG FIN AUTH MF HSG REVENUE / DBT (US593344BU77) | 1,00 | -0,10 | 0,8676 | 0,0014 | |||||

| FLORIDA ST HSG FIN CORP MF MTGE REVENUE / DBT (US34074HHA32) | 1,00 | -0,30 | 0,8673 | -0,0009 | |||||

| US167403AC89 / CHICA IL 2.875% 8/1/27 MT | 1,00 | 0,00 | 0,8660 | 0,0009 | |||||

| US098792AQ71 / BOONE CNTY KY POLL CONTROL REVENUE | 1,00 | -0,70 | 0,8658 | -0,0040 | |||||

| US130536RN77 / CA ST POLL CNTR 4.25 7/43 | 1,00 | -0,20 | 0,8637 | -0,0006 | |||||

| OHIO ST AIR QUALITY DEV AUTH / DBT (US677525WZ61) | 0,99 | -0,60 | 0,8582 | -0,0043 | |||||

| US097067NL22 / BOERNE TX INDEP SCH DIST | 0,99 | 0,10 | 0,8561 | 0,0024 | |||||

| PESHTIGO WI SCH DIST / DBT (US715777FE37) | 0,98 | -2,69 | 0,8468 | -0,0215 | |||||

| CENTRL PLAINS ENERGY PROJ NE GAS SPLY REVENUE / DBT (US154872AY18) | 0,97 | 0,8444 | 0,8444 | ||||||

| US546475VU56 / LOUISIANA ST GAS & FUELS TAX REVENUE | 0,96 | 0,52 | 0,8364 | 0,0063 | |||||

| HARRISONBURG VA REDEV & HSG AUTH MF HSG REVENUE / DBT (US415690NX01) | 0,91 | -0,44 | 0,7917 | -0,0025 | |||||

| US167615WS89 / Chicago Park District | 0,83 | -0,60 | 0,7217 | -0,0030 | |||||

| US547804AM69 / LOWER ALA GAS D 4% MT | 0,83 | 0,7168 | 0,7168 | ||||||

| ARIZONA ST HLTH FACS AUTH / DBT (US040507QT52) | 0,81 | 0,00 | 0,7016 | 0,0016 | |||||

| FORT BEND TX INDEP SCH DIST / DBT (US346843WS00) | 0,77 | 0,6699 | 0,6699 | ||||||

| US708692BF45 / Pa Ecodev Fa Ws Bond DBT | 0,75 | -0,40 | 0,6501 | -0,0013 | |||||

| WESTFIELD-WASHINGTON IN SCHS / DBT (US960242DG77) | 0,67 | -0,74 | 0,5819 | -0,0031 | |||||

| US88256HBB33 / TEXAS ST MUNI GAS ACQUISITION& SPLY CORP III GAS SPLY REVEN | 0,64 | -0,31 | 0,5527 | -0,0010 | |||||

| US121342NR62 / Burke (County of), GA Development Authority (Oglethorpe Power Vogtle), Series 2013 A, PCR | 0,62 | -0,32 | 0,5409 | -0,0005 | |||||

| MICHIGAN ST STRATEGIC FUND LTD OBLG REVENUE / DBT (US594698TK87) | 0,60 | -45,31 | 0,5219 | -0,4304 | |||||

| US167736F772 / CHICAGO IL WTRWKS REVENUE | 0,57 | -0,35 | 0,4965 | -0,0008 | |||||

| VENICE FL / DBT (US922687AG31) | 0,57 | 0,4912 | 0,4912 | ||||||

| US899111CQ90 / Tulare Public Financing Authority | 0,56 | -0,71 | 0,4839 | -0,0028 | |||||

| US647370KF19 / NEW MEXICO HOSPITAL EQUIPMENT LOAN COUNCIL | 0,54 | 0,4703 | 0,4703 | ||||||

| US231634AG15 / Cushing Educational Facilities Authority, Oklahoma, Educational Facilities Lease Revenue Bonds, Cushing Public Schools Project, Series 2022 | 0,53 | 0,00 | 0,4598 | 0,0009 | |||||

| RENO-TAHOE NV ARPT AUTH ARPT REVENUE / DBT (US759874BT67) | 0,53 | 0,19 | 0,4567 | 0,0018 | |||||

| US373064Q727 / City of Georgetown | 0,52 | -0,38 | 0,4523 | -0,0010 | |||||

| US4521524T52 / ILLINOIS ST GO 19B 5.0% 09-01-27 | 0,51 | -0,19 | 0,4468 | 0,0005 | |||||

| US899111CR73 / Tulare Public Financing Authority | 0,51 | -0,78 | 0,4442 | -0,0024 | |||||

| US45454RBA32 / INDIAN WELLS CA REDEV AGY SUCCESSOR AGY TAX ALLOCATION | 0,51 | -0,59 | 0,4416 | -0,0022 | |||||

| US74265LW464 / PRIV CLGS & UNIVS AUTH GA | 0,51 | 0,00 | 0,4414 | 0,0007 | |||||

| US89602HAV96 / TRIBOROUGH NY BRIDGE & TUNNEL AUTH PAYROLL MOBILITY TAX | 0,51 | -0,39 | 0,4409 | -0,0009 | |||||

| US8254345K52 / SHREVEPORT LA | 0,51 | -0,39 | 0,4390 | -0,0011 | |||||

| US803770XB70 / GO Bonds Series 2022B | 0,50 | -0,40 | 0,4375 | -0,0014 | |||||

| US235298BS42 / DALLAS TX HSG FIN CORP | 0,50 | -0,59 | 0,4369 | -0,0021 | |||||

| US88256HBA59 / TEXAS ST MUNI GAS ACQUISITION& SPLY CORP III GAS SPLY REVEN | 0,50 | -0,59 | 0,4364 | -0,0011 | |||||

| US708797BC83 / Pennsylvania Housing Finance Agency, Series 2023 B | 0,50 | -0,79 | 0,4362 | -0,0021 | |||||

| US115027RA46 / MUNI PUT BOND ACT | 0,50 | -0,40 | 0,4358 | -0,0011 | |||||

| NORTH CAROLINA ST MED CARE COMMISSION RETMNT FACS REVENUE / DBT (US65820YTA46) | 0,50 | 0,60 | 0,4341 | 0,0030 | |||||

| US62813NAX49 / MUSKOGEE OK INDL TRUST EDUCTNL FACS LEASE REVENUE | 0,49 | 0,00 | 0,4250 | 0,0011 | |||||

| US664551DD73 / N ESTRN PA HOSP & EDU AUTH | 0,49 | 0,20 | 0,4244 | 0,0012 | |||||

| US592250FH25 / Metropolitan Pier & Exposition Authority | 0,46 | 0,00 | 0,3974 | 0,0003 | |||||

| US928104MM72 / FX.RT. MUNI BOND | 0,41 | -0,24 | 0,3567 | -0,0002 | |||||

| US373064Q800 / GEORGETOWN TX UTILITY SYS REVENUE | 0,41 | 0,00 | 0,3556 | 0,0008 | |||||

| US64987JA432 / New York State Housing Finance Agency | 0,40 | 0,00 | 0,3464 | 0,0002 | |||||

| US421110W868 / Hays Consolidated Independent School District | 0,39 | -0,25 | 0,3427 | 0,0001 | |||||

| US167736E379 / CHICAGO WTRWKS REV 2ND LIEN 5.0% 11-01-29 | 0,39 | 0,00 | 0,3411 | 0,0006 | |||||

| US13032UVY18 / CALIFORNIA ST HLTH FACS FING A CASMED 06/27 FIXED 5 | 0,38 | -0,53 | 0,3282 | -0,0011 | |||||

| GREENE JERSEY & MACOUPIN CNTYS IL CMNTY UNITED SCH DIST #9 / DBT (US394700CW67) | 0,37 | 0,00 | 0,3238 | 0,0006 | |||||

| US561851HP47 / County of Manatee FL Public Utilities Revenue | 0,37 | 0,00 | 0,3215 | 0,0005 | |||||

| US74442CCM47 / PUBLIC FIN AUTH WI HOSP REVENUE | 0,36 | -0,28 | 0,3134 | -0,0003 | |||||

| WISCONSIN ST HSG & ECON DEV AUTH MF HSG / DBT (US97689RFC34) | 0,36 | -0,56 | 0,3110 | -0,0010 | |||||

| US249189DJ77 / Denver Convention Center Hotel Authority, Colorado, Revenue Bonds, Convention Center Hotel, Refunding Senior Lien Series 2016 | 0,35 | 0,3080 | 0,3080 | ||||||

| WESTFIELD-WASHINGTON IN SCHS / DBT (US960242DH50) | 0,35 | -0,58 | 0,2996 | -0,0017 | |||||

| US009730PK23 / AKRON BATH COPLEY JT TWP OH HOSP DIST | 0,35 | 0,2995 | 0,2995 | ||||||

| US41401PCL58 / HARRIS CNTY TX CULTURAL EDU FACS FIN CORP THERMAL UTILITY RE | 0,34 | 0,2929 | 0,2929 | ||||||

| US16080TAC99 / CHARLOTTE CNTY FL INDL DEV AUTH UTILITY SYS REVENUE | 0,33 | 0,2883 | 0,2883 | ||||||

| TAMPA FL CAPITAL IMPT CIGARETTE TAX ALLOCATION / DBT (US875146AK89) | 0,31 | -0,32 | 0,2670 | -0,0003 | |||||

| US74444VBG41 / Public Finance Authority | 0,30 | -0,33 | 0,2619 | 0,0003 | |||||

| US74444VBF67 / Public Finance Authority | 0,29 | 0,00 | 0,2518 | 0,0000 | |||||

| US45204EEV65 / ILLINOIS ST FIN AUTH REVENUE | 0,28 | -0,35 | 0,2448 | -0,0004 | |||||

| US66433RCL06 / N E OHIO MED UNIV GEN RECPTS | 0,28 | 0,36 | 0,2400 | 0,0009 | |||||

| US95737TEE29 / Westchester County NY Local Development Corp. Revenue (Miriam Osborn Memorial Home) | 0,28 | 0,00 | 0,2389 | 0,0002 | |||||

| US20775HD838 / Connecticut Housing Finance Authority, Series 2023 C SUB C-2 | 0,25 | 0,00 | 0,2171 | 0,0002 | |||||

| US70869PLG09 / PENNSYLVANIA ST ECON DEV FINGA PENNSYLVANIA ECONOMIC DEVELOPMENT FINANCING AUTHOR | 0,22 | -0,89 | 0,1934 | -0,0007 | |||||

| AUBREY TX SPL ASSMNT / DBT (US050197AT96) | 0,20 | -0,50 | 0,1740 | -0,0003 | |||||

| US009730PJ59 / AKRON BATH HSP 5% 11/15/2027 | 0,19 | -0,53 | 0,1617 | -0,0004 | |||||

| US040507QQ14 / Arizona Health Facilities Authority | 0,15 | 0,00 | 0,1343 | 0,0003 | |||||

| NORTH CAROLINA ST MED CARE COMMISSION RETMNT FACS REVENUE / DBT (US65820YSZ06) | 0,15 | 0,00 | 0,1304 | 0,0001 | |||||

| US49126VCG05 / Kentucky Economic Development Finance Authority Health System Revenue (Norton Healthcare Inc. & Affiliates) | 0,12 | 0,81 | 0,1076 | 0,0009 | |||||

| TEXAS ST TRANSPRTN COMMISSION CENTRAL TX TURNPIKE SYS REVENU / DBT (US88283KBQ04) | 0,11 | 0,0974 | 0,0974 | ||||||

| ARIZONA ST HLTH FACS AUTH / DBT (US040507QS79) | 0,03 | 0,00 | 0,0301 | 0,0002 | |||||

| US8574928888 / State Street Institutional Treasury Money Market Fund | 0,03 | 1.349,41 | 0,03 | 2.700,00 | 0,0246 | 0,0229 | |||

| TRISTATE INSURED CASH SWEEP / STIV (000000000) | 0,00 | 0,00 | 0,0004 | 0,0004 |