Grundlæggende statistik

| Porteføljeværdi | $ 13.653.918.000 |

| Nuværende stillinger | 75 |

Seneste beholdninger, ydeevne, AUM (fra 13F, 13D)

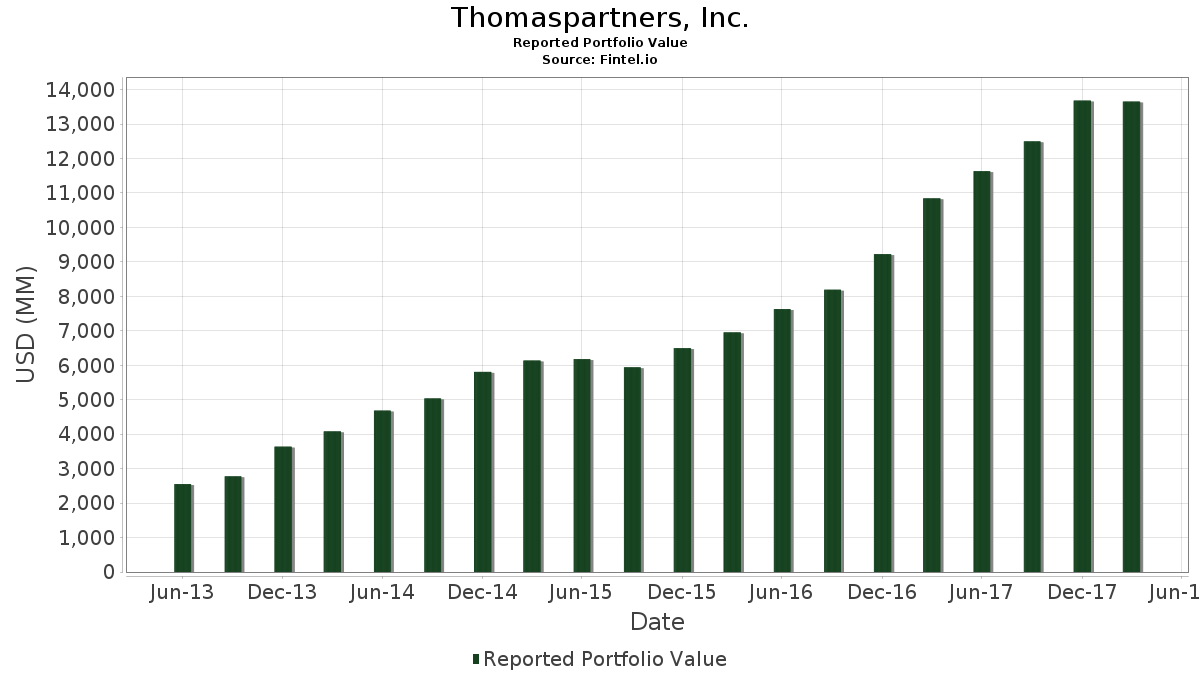

Thomaspartners, Inc. har afsløret 75 samlede besiddelser i deres seneste SEC-arkivering. Den seneste porteføljeværdi er beregnet til at være $ 13.653.918.000 USD. Faktiske aktiver under forvaltning (AUM) er denne værdi plus kontanter (som ikke er oplyst). Thomaspartners, Inc.s største beholdninger er Microsoft Corporation (US:MSFT) , Johnson & Johnson (US:JNJ) , Chevron Corporation (US:CVX) , Texas Instruments Incorporated (US:TXN) , and BB&T Corp. (US:US0549371070) . Thomaspartners, Inc.s nye stillinger omfatter SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF (US:SPIB) , .

Top øger dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 2,58 | 229,12 | 1,6780 | 1,6780 | |

| 6,80 | 227,97 | 1,6696 | 1,6696 | |

| 3,86 | 226,75 | 1,6607 | 1,6607 | |

| 2,05 | 214,33 | 1,5697 | 0,7531 | |

| 1,19 | 256,78 | 1,8806 | 0,2636 | |

| 5,88 | 306,49 | 2,2447 | 0,2635 | |

| 2,69 | 227,98 | 1,6697 | 0,2018 | |

| 6,58 | 282,26 | 2,0673 | 0,2005 | |

| 3,67 | 252,01 | 1,8457 | 0,1870 | |

| 4,37 | 398,81 | 2,9209 | 0,1863 |

Top falder i dette kvartal

Vi bruger ændringen i porteføljeallokeringen, fordi dette er den mest meningsfulde metrik. Ændringer kan skyldes handler eller ændringer i aktiekurser.

| Sikkerhed | Aktier (MM) |

Værdi (MM$) |

Portefølje % | ΔPortefølje % |

|---|---|---|---|---|

| 0,00 | 0,00 | -1,8529 | ||

| 0,05 | 4,91 | 0,0360 | -1,2605 | |

| 0,08 | 8,61 | 0,0631 | -0,6779 | |

| 5,68 | 297,85 | 2,1814 | -0,2694 | |

| 1,35 | 230,53 | 1,6884 | -0,2557 | |

| 35,77 | 335,18 | 2,4548 | -0,2250 | |

| 3,11 | 398,08 | 2,9155 | -0,1870 | |

| 3,25 | 371,14 | 2,7182 | -0,1870 | |

| 4,68 | 348,97 | 2,5558 | -0,1801 | |

| 2,96 | 235,00 | 1,7211 | -0,1693 |

13F og Fondsarkivering

Denne formular blev indsendt den 2018-05-02 for rapporteringsperioden 2018-03-31. Klik på linkikonet for at se den fulde transaktionshistorik.

Opgrader for at låse op for premium-data og eksportere til Excel ![]() .

.

| Sikkerhed | Type | Gennemsnitlig aktiekurs | Aktier (MM) |

Δ Aktier (%) |

Δ Aktier (%) |

Værdi ($MM) |

Portefølje (%) |

ΔPortefølje (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 4,37 | -0,10 | 398,81 | 6,59 | 2,9209 | 0,1863 | |||

| JNJ / Johnson & Johnson | 3,11 | 2,24 | 398,08 | -6,22 | 2,9155 | -0,1870 | |||

| CVX / Chevron Corporation | 3,25 | 2,50 | 371,14 | -6,63 | 2,7182 | -0,1870 | |||

| TXN / Texas Instruments Incorporated | 3,55 | -0,85 | 368,44 | -1,37 | 2,6984 | -0,0318 | |||

| US0549371070 / BB&T Corp. | 6,83 | 1,17 | 355,42 | 5,89 | 2,6031 | 0,1500 | |||

| IBM / International Business Machines Corporation | 2,30 | 2,95 | 352,47 | 2,95 | 2,5815 | 0,0793 | |||

| XOM / Exxon Mobil Corporation | 4,68 | 4,50 | 348,97 | -6,78 | 2,5558 | -0,1801 | |||

| PPG / PPG Industries, Inc. | 3,11 | 2,33 | 346,65 | -2,24 | 2,5388 | -0,0527 | |||

| RTX / RTX Corporation | 2,70 | 1,72 | 339,34 | 0,33 | 2,4853 | 0,0133 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 35,77 | 5,27 | 335,18 | -8,59 | 2,4548 | -0,2250 | |||

| VZ / Verizon Communications Inc. | 6,85 | 4,23 | 327,69 | -5,83 | 2,4000 | -0,1433 | |||

| VFC / V.F. Corporation | 4,37 | 0,18 | 323,86 | 0,34 | 2,3719 | 0,0131 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 3,84 | 2,96 | 310,69 | -0,86 | 2,2754 | -0,0149 | |||

| INTC / Intel Corporation | 5,88 | 0,21 | 306,49 | 13,06 | 2,2447 | 0,2635 | |||

| WFC / Wells Fargo & Company | 5,68 | 2,82 | 297,85 | -11,18 | 2,1814 | -0,2694 | |||

| JPM / JPMorgan Chase & Co. | 2,69 | -0,06 | 295,56 | 2,77 | 2,1646 | 0,0627 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 2,09 | 2,44 | 282,40 | -5,00 | 2,0682 | -0,1043 | |||

| CSCO / Cisco Systems, Inc. | 6,58 | -1,32 | 282,26 | 10,51 | 2,0673 | 0,2005 | |||

| BCE / BCE Inc. | 6,53 | 4,88 | 281,23 | -5,98 | 2,0597 | -0,1263 | |||

| PFE / Pfizer Inc. | 7,78 | 3,02 | 275,99 | 0,94 | 2,0213 | 0,0231 | |||

| LMT / Lockheed Martin Corporation | 0,81 | 0,43 | 272,59 | 5,71 | 1,9964 | 0,1118 | |||

| ABT / Abbott Laboratories | 4,54 | 0,71 | 271,91 | 5,74 | 1,9915 | 0,1120 | |||

| ES / Eversource Energy | 4,47 | 4,48 | 263,44 | -2,57 | 1,9294 | -0,0467 | |||

| BDX / Becton, Dickinson and Company | 1,21 | 0,73 | 263,18 | 1,97 | 1,9275 | 0,0412 | |||

| RTN / Raytheon Co. | 1,19 | 1,01 | 256,78 | 16,06 | 1,8806 | 0,2636 | |||

| PM / Philip Morris International Inc. | 2,56 | 4,19 | 254,83 | -1,97 | 1,8663 | -0,0336 | |||

| ACN / Accenture plc | 1,66 | 0,45 | 254,36 | 0,72 | 1,8629 | 0,0172 | |||

| AJG / Arthur J. Gallagher & Co. | 3,67 | 2,24 | 252,01 | 11,04 | 1,8457 | 0,1870 | |||

| T / AT&T Inc. | 7,06 | 5,80 | 251,67 | -2,99 | 1,8432 | -0,0528 | |||

| LOW / Lowe's Companies, Inc. | 2,78 | -0,15 | 244,21 | -5,73 | 1,7886 | -0,1047 | |||

| PG / The Procter & Gamble Company | 2,96 | 5,29 | 235,00 | -9,15 | 1,7211 | -0,1693 | |||

| MMM / 3M Company | 1,06 | 1,60 | 231,87 | -5,24 | 1,6982 | -0,0901 | |||

| PH / Parker-Hannifin Corporation | 1,35 | 1,13 | 230,53 | -13,34 | 1,6884 | -0,2557 | |||

| WMT / Walmart Inc. | 2,58 | 229,12 | 1,6780 | 1,6780 | |||||

| VICSX / Vanguard Scottsdale Funds - Vanguard IT Corporate Bond Index Fund Admiral | 2,69 | 16,92 | 227,98 | 13,51 | 1,6697 | 0,2018 | |||

| SPIB / SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF | 6,80 | 227,97 | 1,6696 | 1,6696 | |||||

| ITE / SPDR Barclays Capital Intermediate Term Treasury ETF | 3,86 | 14,03 | 226,75 | 12,87 | 1,6607 | 1,6607 | |||

| ORCL / Oracle Corporation | 4,85 | 2,61 | 221,86 | -0,71 | 1,6249 | -0,0083 | |||

| MBB / iShares Trust - iShares MBS ETF | 2,05 | 95,40 | 214,33 | 91,83 | 1,5697 | 0,7531 | |||

| OMC / Omnicom Group Inc. | 2,93 | 3,88 | 212,81 | 3,65 | 1,5586 | 0,0580 | |||

| KO / The Coca-Cola Company | 4,59 | 5,24 | 199,16 | -0,38 | 1,4586 | -0,0025 | |||

| GPC / Genuine Parts Company | 2,20 | 3,13 | 197,25 | -2,48 | 1,4446 | -0,0336 | |||

| OXY / Occidental Petroleum Corporation | 2,87 | 3,40 | 186,50 | -8,82 | 1,3659 | -0,1289 | |||

| CL / Colgate-Palmolive Company | 2,60 | 3,97 | 186,05 | -1,23 | 1,3626 | -0,0141 | |||

| MO / Altria Group, Inc. | 2,97 | 4,51 | 185,29 | -8,79 | 1,3571 | -0,1277 | |||

| CVS / CVS Health Corporation | 2,82 | 6,42 | 175,35 | -8,69 | 1,2842 | -0,1192 | |||

| AAPL / Apple Inc. | 1,04 | 1,05 | 174,16 | 0,18 | 1,2755 | 0,0050 | |||

| SPSB / SPDR Series Trust - SPDR Portfolio Short Term Corporate Bond ETF | 5,27 | 16,18 | 159,17 | 15,34 | 1,1658 | 0,1571 | |||

| DE / Deere & Company | 0,98 | -0,80 | 152,77 | -1,56 | 1,1189 | -0,0153 | |||

| SBUX / Starbucks Corporation | 2,12 | 4,31 | 122,57 | 5,15 | 0,8977 | 0,0457 | |||

| WSO / Watsco, Inc. | 0,63 | 0,74 | 113,97 | 7,21 | 0,8347 | 0,0578 | |||

| LEG / Leggett & Platt, Incorporated | 2,56 | 6,38 | 113,43 | -1,13 | 0,8308 | -0,0077 | |||

| TJX / The TJX Companies, Inc. | 1,28 | 2,95 | 104,40 | 9,82 | 0,7646 | 0,0698 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 1,21 | -0,69 | 29,58 | -8,29 | 0,2166 | -0,0191 | |||

| KMB / Kimberly-Clark Corporation | 0,21 | -7,05 | 22,58 | -15,16 | 0,1654 | -0,0291 | |||

| MMP / Magellan Midstream Partners L.P. | 0,30 | -1,99 | 17,23 | -19,39 | 0,1262 | -0,0300 | |||

| PAA / Plains All American Pipeline, L.P. - Limited Partnership | 0,73 | 1,36 | 16,07 | 8,18 | 0,1177 | 0,0091 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0,20 | -3,83 | 11,53 | -17,18 | 0,0845 | -0,0173 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0,08 | -91,44 | 8,61 | -91,50 | 0,0631 | -0,6779 | |||

| / Energy Transfer Operating, L.P. Series E Fixed-to-Floating Rate Cumulative Redeemable Perpetual Pref | 0,33 | -1,08 | 5,43 | -10,46 | 0,0397 | -0,0046 | |||

| IGIB / iShares Trust - iShares 5-10 Year Investment Grade Corporate Bond ETF | 0,05 | -97,18 | 4,91 | -97,23 | 0,0360 | -1,2605 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0,05 | 525,25 | 4,53 | 503,20 | 0,0332 | 0,0277 | |||

| PEP / PepsiCo, Inc. | 0,03 | -0,69 | 3,31 | -9,61 | 0,0242 | -0,0025 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0,03 | -7,65 | 3,07 | -8,52 | 0,0225 | -0,0020 | |||

| GVI / iShares Trust - iShares Intermediate Government/Credit Bond ETF | 0,03 | -2,05 | 3,02 | -3,39 | 0,0221 | -0,0007 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0,02 | -1,17 | 2,68 | -2,05 | 0,0196 | -0,0004 | |||

| PFM / Invesco Exchange-Traded Fund Trust - Invesco Dividend Achievers ETF | 0,08 | -12,23 | 2,02 | -15,76 | 0,0148 | 0,0148 | |||

| VIGI / Vanguard Whitehall Funds - Vanguard International Dividend Appreciation ETF | 0,03 | -0,87 | 1,75 | -3,73 | 0,0129 | 0,0129 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0,01 | -1,05 | 1,57 | -2,96 | 0,0115 | -0,0003 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0,01 | 0,48 | 1,18 | -1,34 | 0,0086 | -0,0001 | |||

| EMLP / First Trust Exchange-Traded Fund IV - First Trust North American Energy Infrastructure Fund | 0,04 | 2,06 | 0,82 | -8,95 | 0,0060 | 0,0060 | |||

| WM / Waste Management, Inc. | 0,01 | 0,53 | 0,67 | -2,04 | 0,0049 | -0,0001 | |||

| EMB / iShares Trust - iShares J.P. Morgan USD Emerging Markets Bond ETF | 0,01 | -1,81 | 0,62 | -4,63 | 0,0045 | -0,0002 | |||

| SPY / SPDR S&P 500 ETF | 0,00 | 72,80 | 0,54 | 70,44 | 0,0040 | 0,0016 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0,00 | -10,90 | 0,40 | -14,35 | 0,0029 | 0,0029 | |||

| ITW / Illinois Tool Works Inc. | 0,00 | -100,00 | 0,00 | -100,00 | -0,0163 | ||||

| SBI / Western Asset Intermediate Muni Fund Inc. | 0,00 | -100,00 | 0,00 | -100,00 | 0,0000 | 0,0000 | |||

| TROW / T. Rowe Price Group, Inc. | 0,00 | -100,00 | 0,00 | -100,00 | -1,8529 |